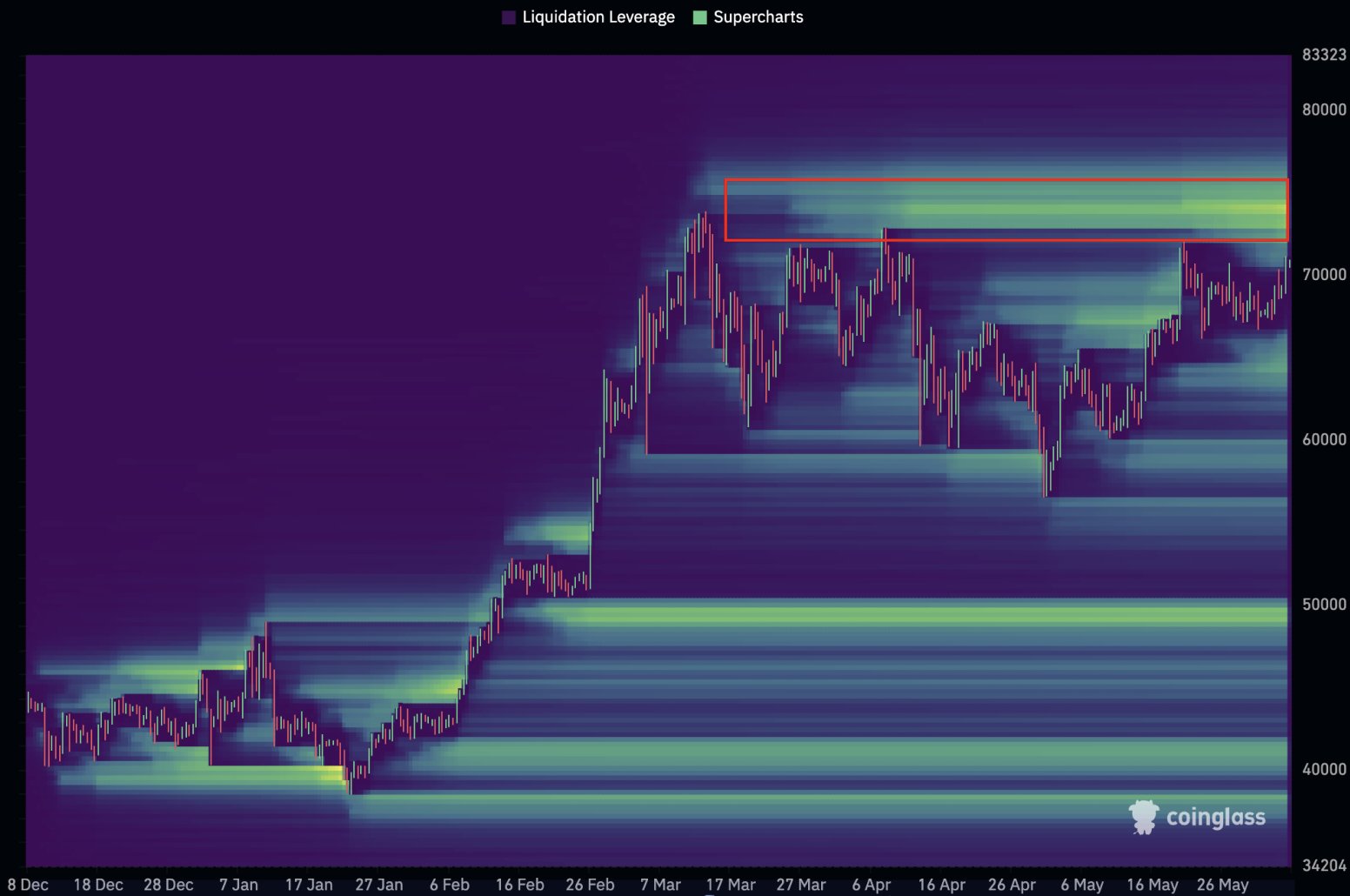

On-chain analyst Willy Woo says there’s a “cascade” of liquidation that’s primed to begin when Bitcoin (BTC) hits $72,000.

Woon tells his 1.1 million followers on the social media platform X that $1.5 billion worth of short positions are “ready to be liquidated all the way up to $75,000 and a new all-time high.”

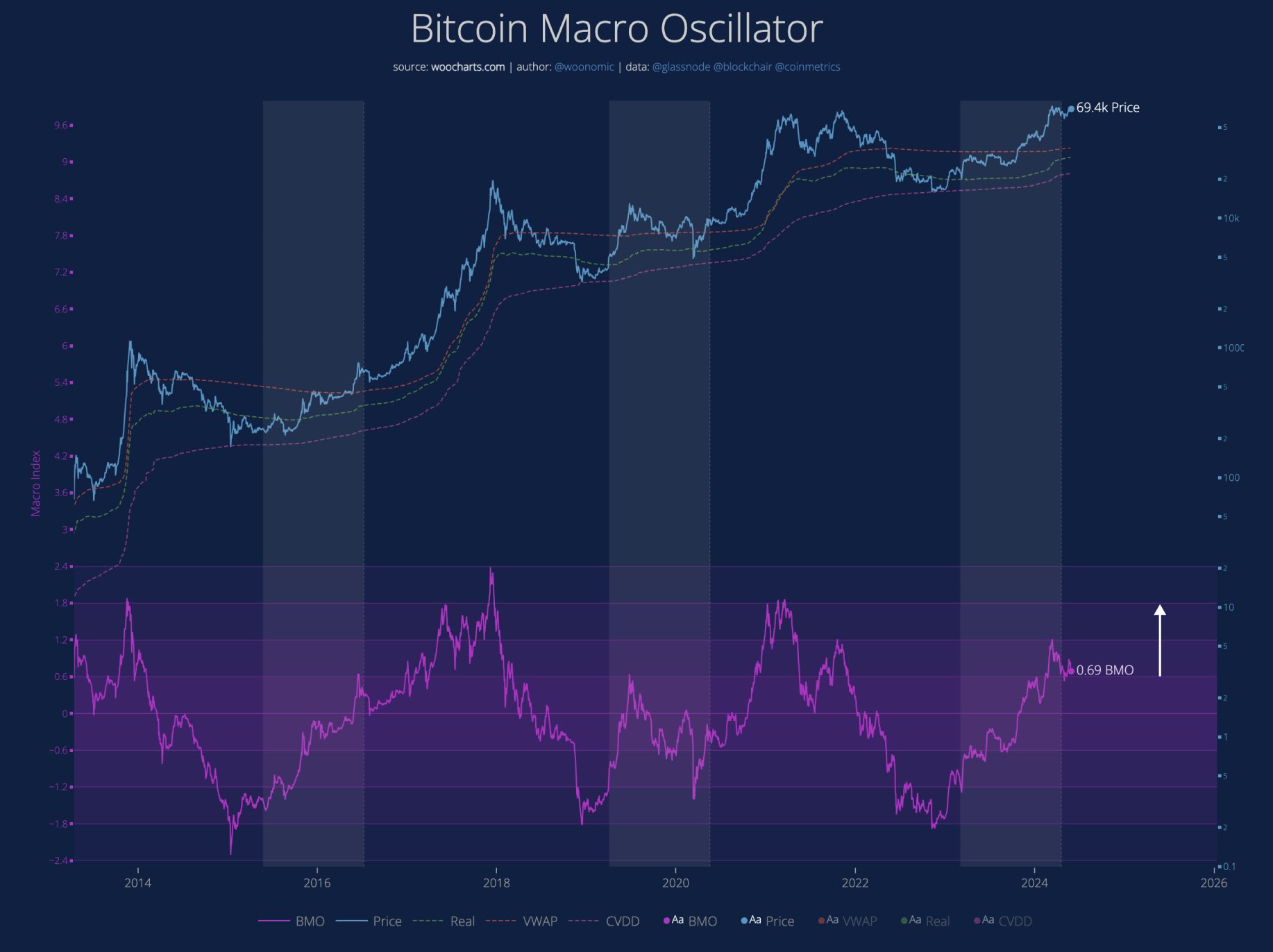

Woo also looks at the Bitcoin Macro Oscillator (BMO), which is a composite of four signals: the Market Value to Realized Value (MVRV) indicator, volume-weighted average price (VWAP) ratio, cumulative value-days destroyed (CVDD) and the Sharpe Ratio.

MVRV is the ratio of Bitcoin’s market capitalization relative to its realized capitalization (the value of all BTC at the price they were bought at) and is used to assess whether the crypto asset is undervalued or overvalued.

VWAP represents the average traded price of an asset throughout the day, taking into account both volume and price. Traders use the VWAP to help them determine whether an asset is trading underbought or overbought based on its intraday price action.

The coin days destroyed metric looks at the value of each Bitcoin transaction while giving weight to the number of days since the coins were last moved. The CVDD tracks the cumulative sum of the coin days destroyed metric as a ratio to the market age.

The Sharpe Ratio aims to compare the return of an investment with its risk by dividing a portfolio’s excess returns by a measure of its volatility.

Explains Woo,

“This 2.5 months of consolidation under bullish demand has been very good for Bitcoin, it means price has more room to run before topping out.

Chart: BMO moves 1 level down, now has 2-3 levels to climb before a macro market top.”

BTC is trading at $71,121 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney