- XRP has tanked 20% on a year-to-date (YTD) basis.

- Key whale cohorts were seen accumulating XRPs at discount.

Payment-focused cryptocurrency Ripple [XRP] extended its losing streak, taking a 1% dive in the last 24 hours of trading, data from CoinMarketCap showed.

The currency, the seventh-largest in terms of market cap as of this writing, has been battling intense selling pressure lately, crashing 7.72% over the week, and nearly 20% in a month’s time.

Nothing seems to be working?

The latest 24-hour drop came despite an important partnership announced by Ripple Labs, the company behind XRP and XRP Ledger (XRPL).

Notably, the firm entered into a strategic deal with HashKey DX and SBI Holdings to provide supply chain finance solutions to the Japanese market. The solutions would be powered by its layer-1 blockchain, XRPL.

However, the news of institutional adoption failed to lift XRP out of the woods.

While leading currencies of the industry like Bitcoin [BTC] and Ethereum [ETH] have seen impressive growth, around 45% and 32% respectively since 2024 began, XRP has tanked 20% on a year-to-date (YTD) basis.

Are whales onto something?

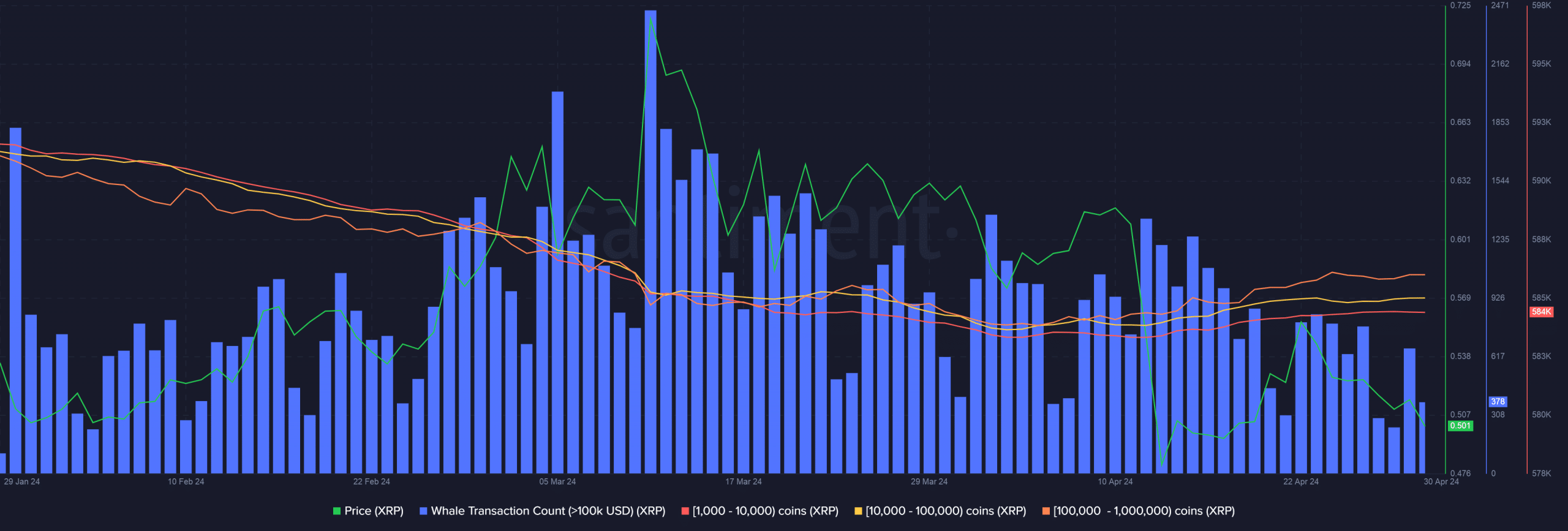

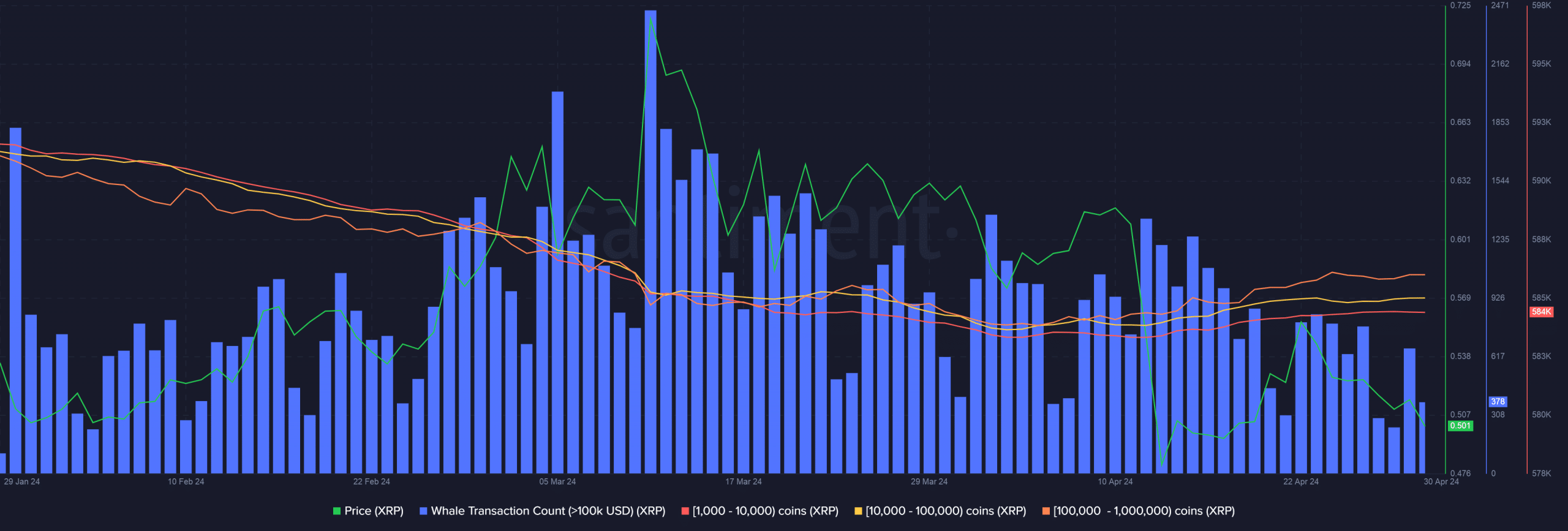

The number of large transactions exceeding $100,000 have been on the decline in the last two weeks, suggesting lower engagement from whale investors, AMBCrypto noted using Santiment’s data.

However, the noticeable aspect was that key whale cohorts were quietly accumulating XRPs at discount all this while, evidenced by the jump in holdings of these cohorts.

If the pace of accumulation keeps up, it might hold the key to XRP’s turnaround in the days to come.

Source: Santiment

Will the downtrend continue?

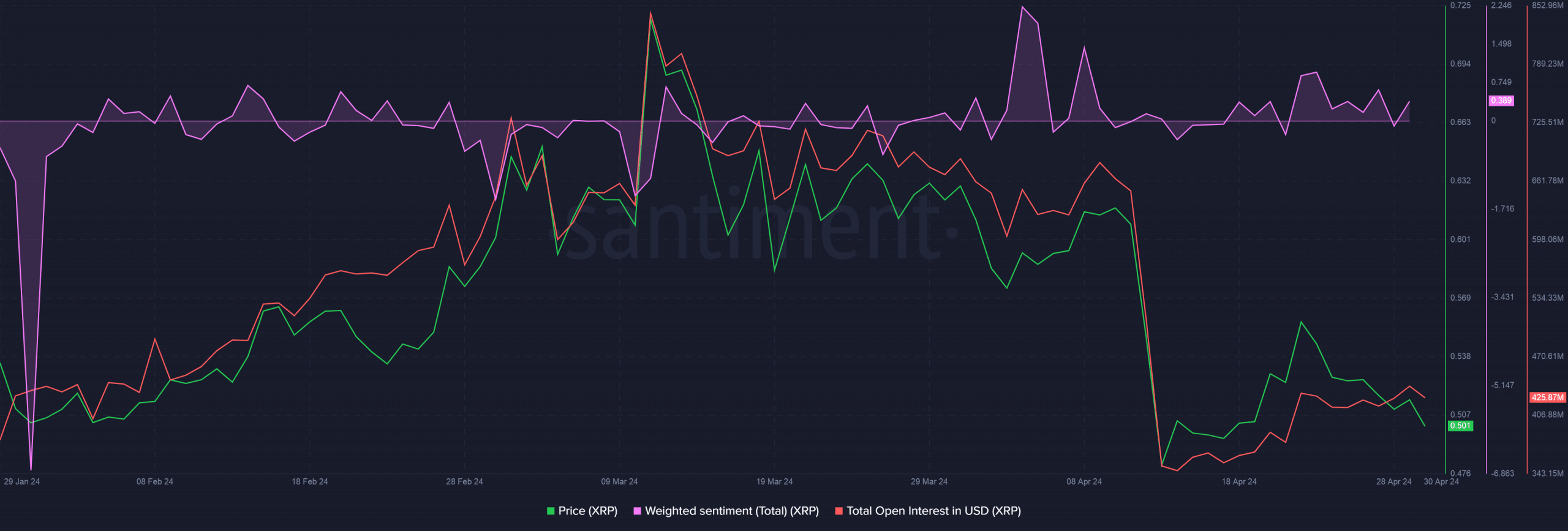

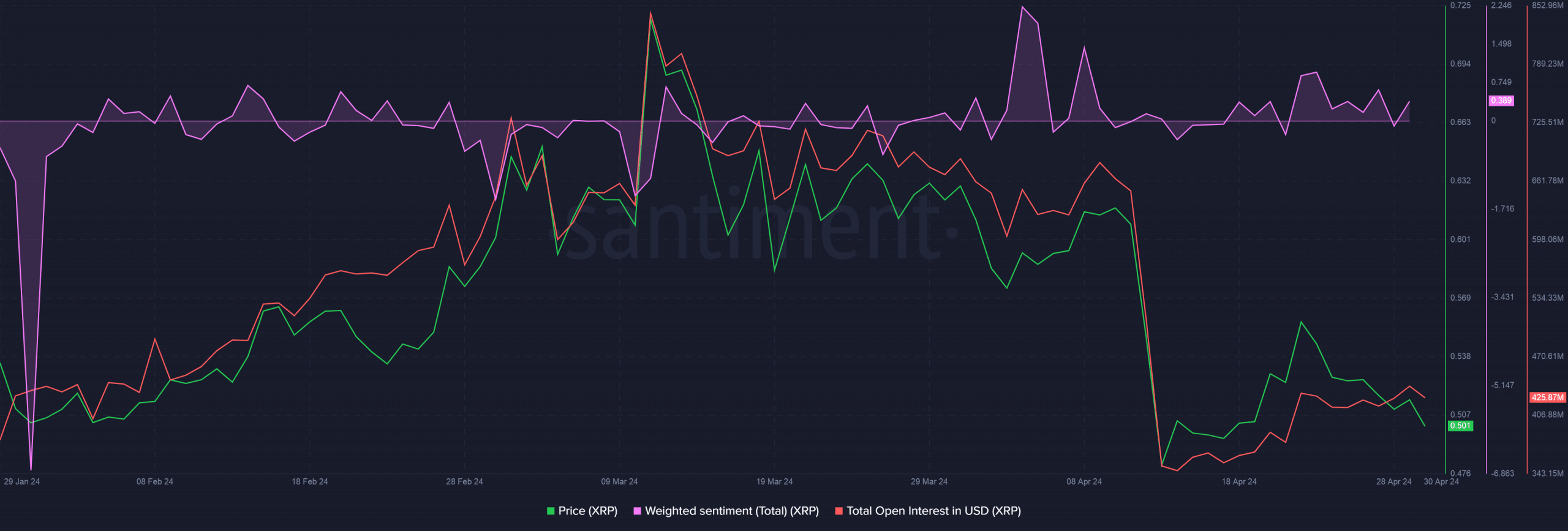

Meanwhile, XRP’s bearish price action slowed the pace of investments in its derivatives market. XRP’s Open Interest (OI) plunged 38% over the month to $425 million.

Typically, a fall in price followed by a fall in OI confirms a downtrend.

Source: Santiment

Is your portfolio green? Check out the XRP Profit Calculator

Interestingly, positive commentary around XRP on social media outweighed bearish predictions, as highlighted by the positive Weighted Sentiment.

Well, this may have been caused due to the aforementioned partnership by Ripple Labs, but the same didn’t reflect on the price action.