- Crypto analyst Babenski predicted a possible 1,000% surge for XRP.

- Despite optimistic forecasts, market indicators show mixed signals.

Ripple [XRP] has struggled to achieve a substantial rally in recent years.

Although the asset has experienced a modest year-to-date increase of 9.1%, it has also faced a minor setback, declining by 1.7% over the past week.

This downward trend continued into the present day, with a slight drop of 0.3%, bringing its current trading price to $0.52.

This ongoing price fluctuation has kept investors on their toes, as XRP continues to grapple with both market volatility and significant regulatory challenges.

XRP’s long road

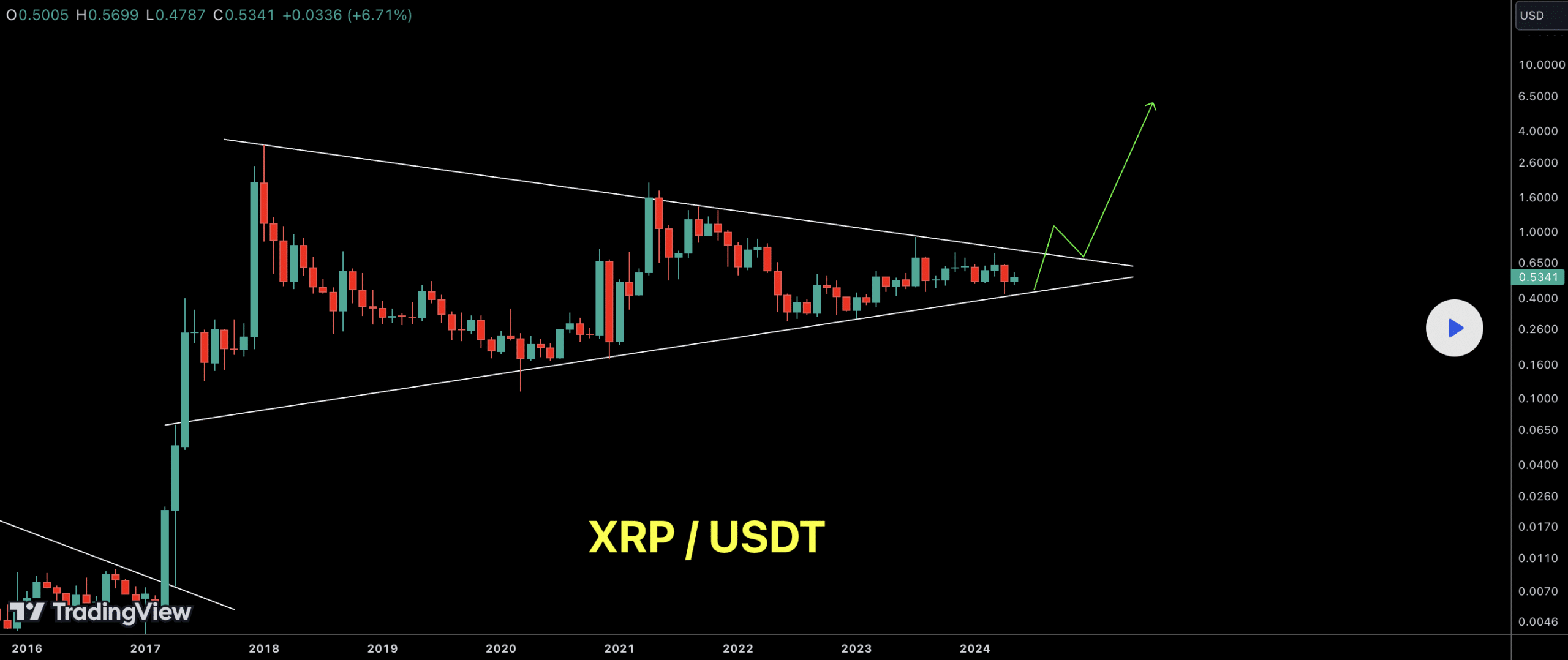

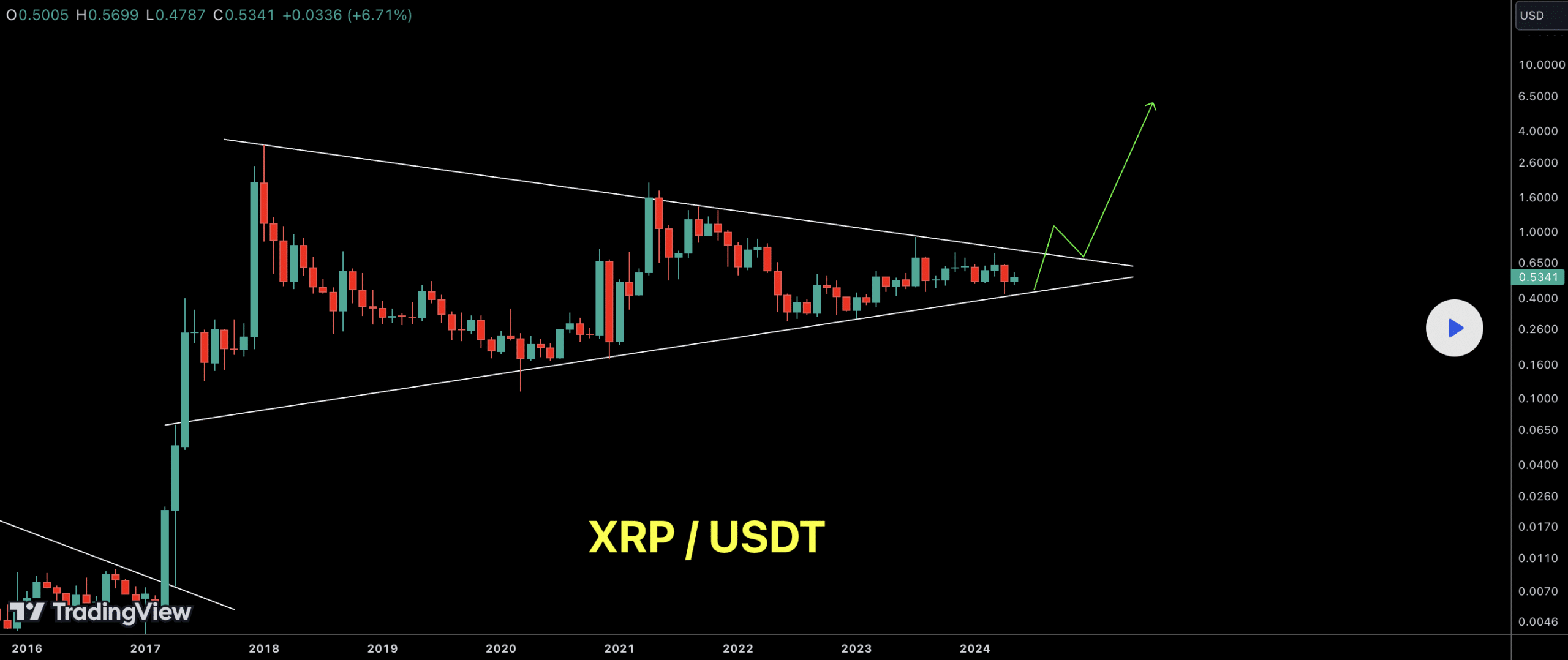

In 2017, XRP began what would become a lengthy accumulation phase, initially sparked by a bull run. Many expected this phase to conclude in the subsequent bull market of 2021.

However, the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Ripple in 2020 severely affected XRP’s price trajectory.

In doing so, it diverged its path from other cryptocurrencies, which experienced substantial gains during the same period.

Despite a partial victory in this legal battle in 2023, XRP has not managed to reclaim the $1 mark, continuing its trend within the accumulation range as it enters 2024.

Crypto analyst Babenski has brought renewed hope to XRP with a fresh analysis on TradingView, suggesting that XRP may finally be poised to exit its long-standing accumulation phase.

Source: TradingView

Babenski’s predictions hinted at a potential breakout that could propel XRP’s price by over 1,000%, potentially establishing new all-time highs around $6.

This optimistic forecast is based on technical patterns observed on the charts, which indicate a possible upward trajectory if key resistance levels are breached.

Can the breakout actually happen?

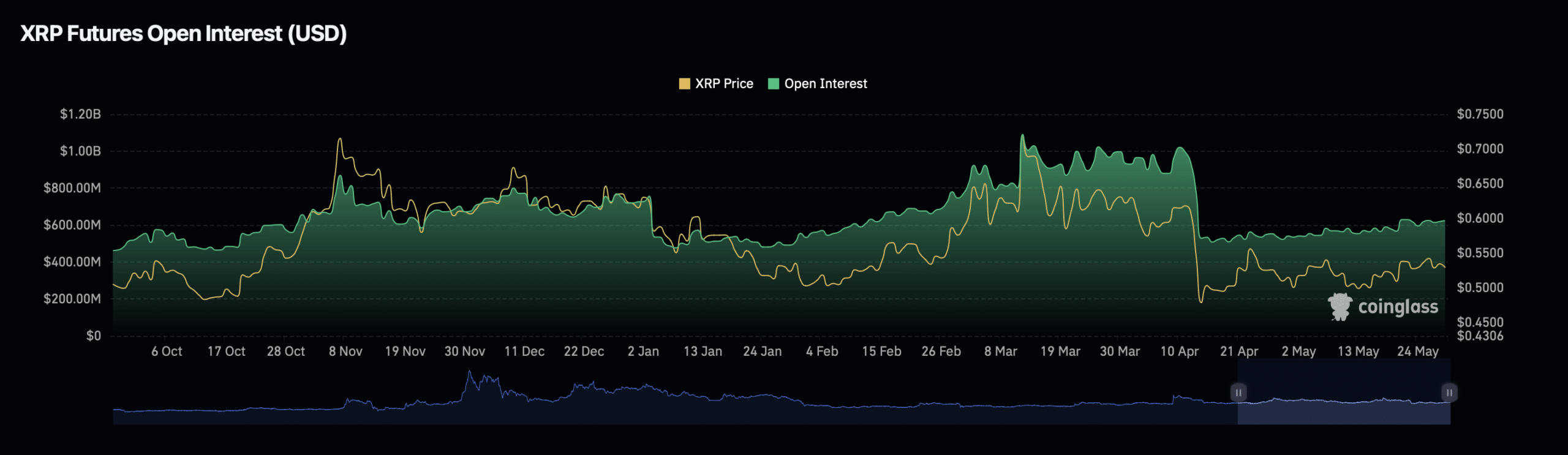

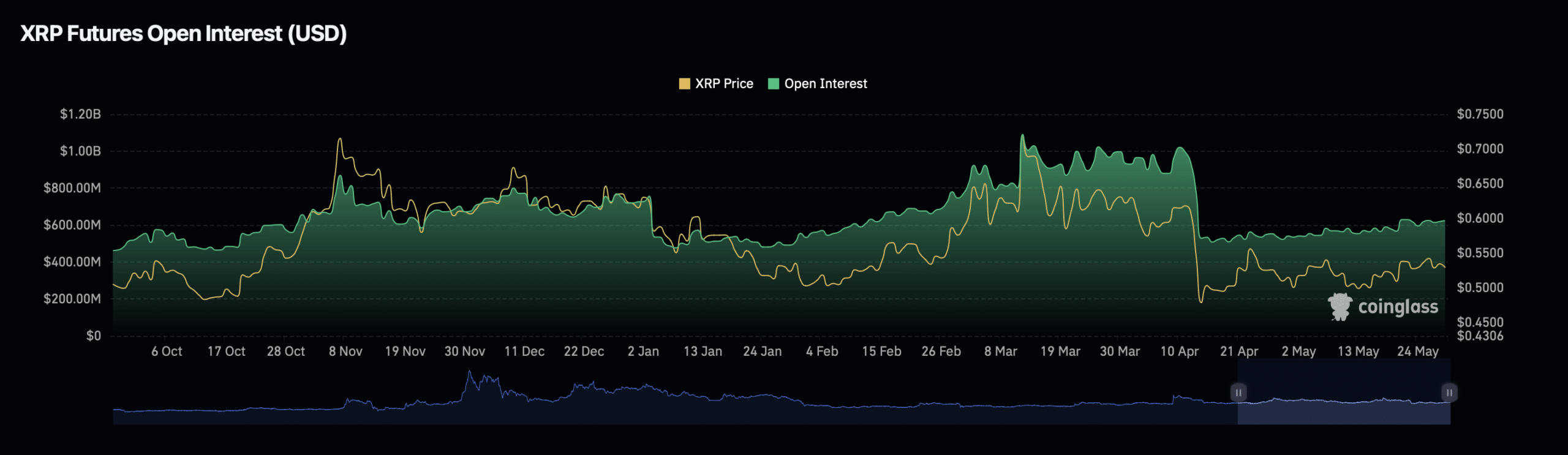

However, diving deeper into the market metrics provides a more complex picture.

Current data on XRP’s open interest—which reflects the total number of outstanding derivative contracts—shows a mixed signal of market sentiment.

According to Coinglass, while there has been a 2.98% increase in Open Interest in the past day, there’s been a significant decline of 21.32% over the same period in terms of open interest volume, totaling $737.73 million.

Source: Coinglass

This discrepancy suggests that while more positions are being opened, the transactional volume is decreasing, potentially indicating a holding pattern among traders awaiting the market’s next move.

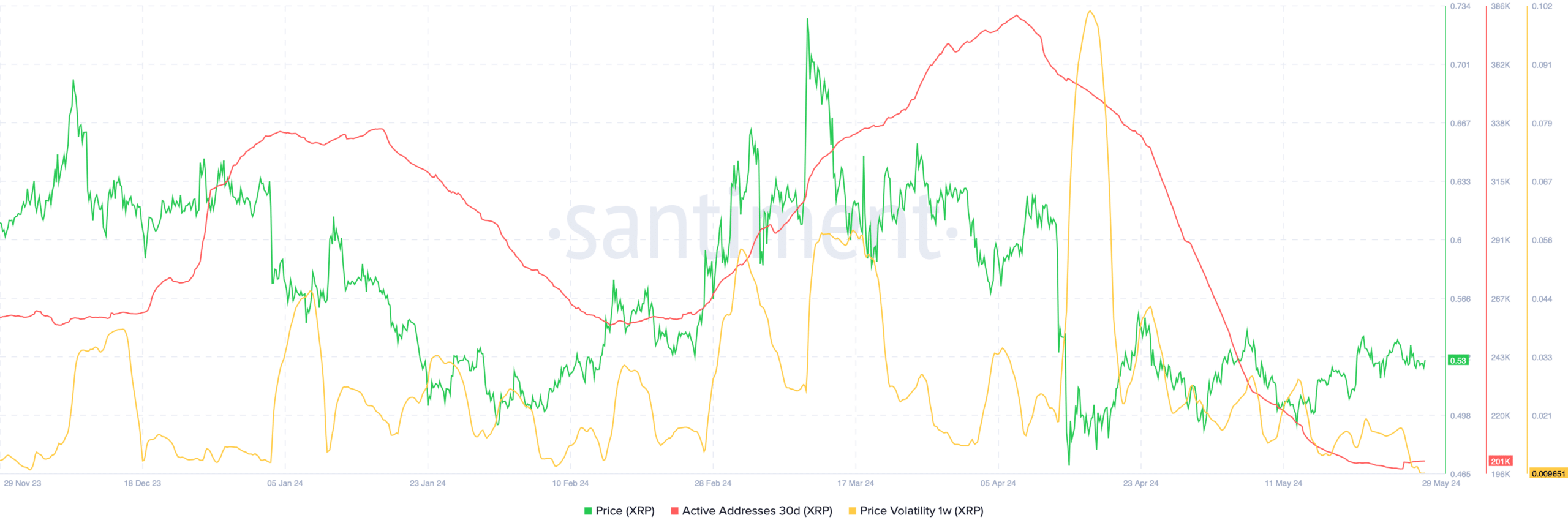

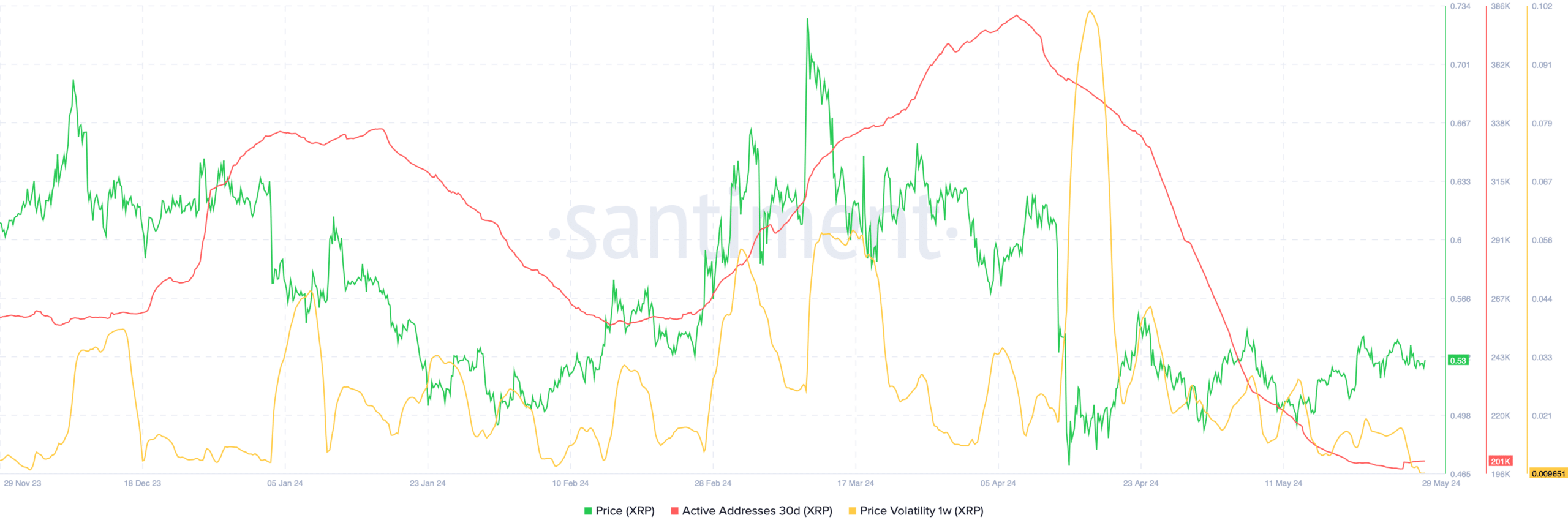

Furthermore, metrics from AMBCrypto and Santiment underlined a stagnation in market engagement.

The number of XRP holders remains static at 5.2 million, reflecting a lack of fresh accumulation despite fluctuating prices.

Additionally, a decrease in price volatility and active addresses points to reduced trading activity and lower engagement, suggesting that the market might be entering a consolidation phase.

Source: Santiment

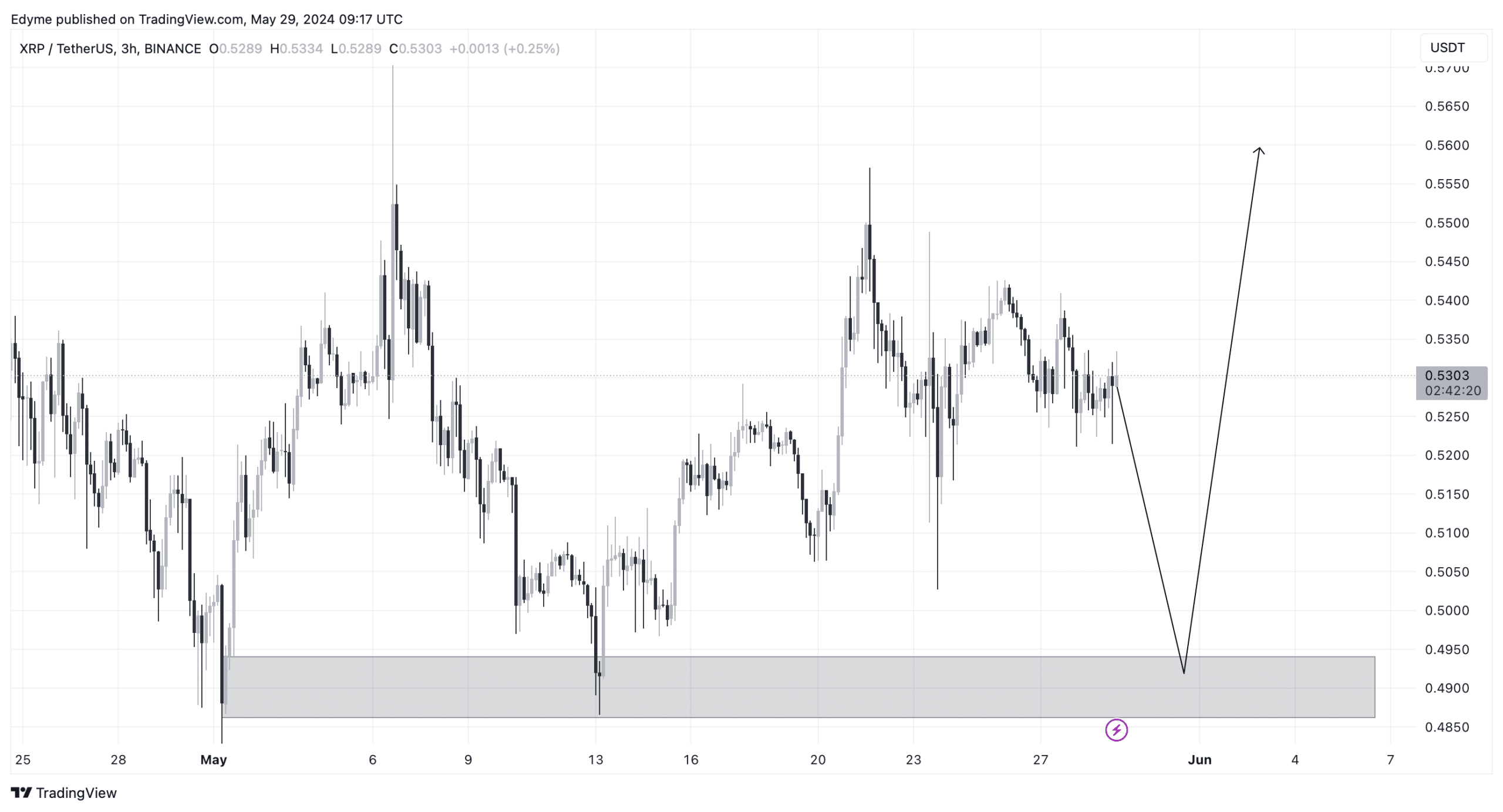

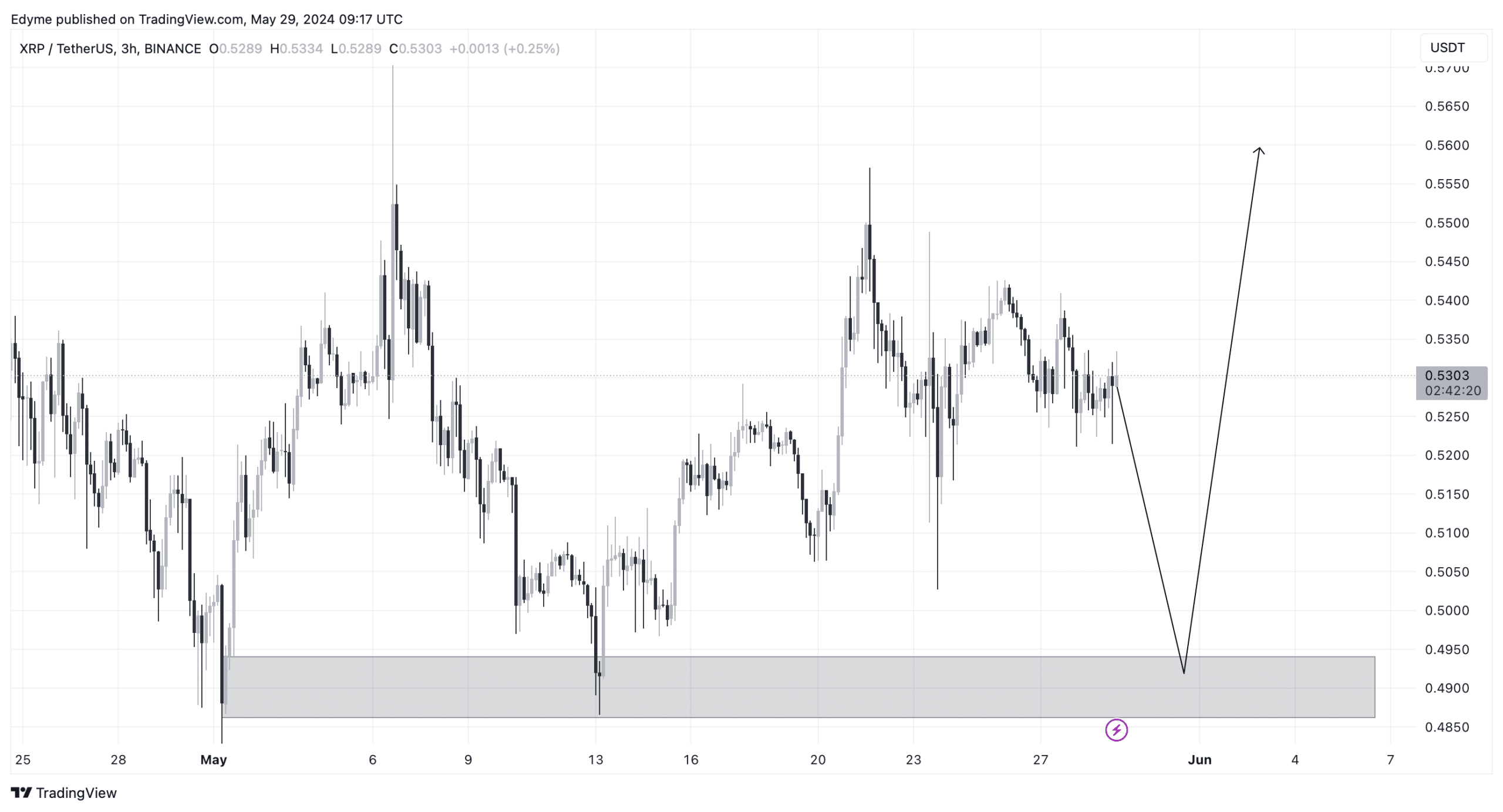

A technical analysis on XRP’s chart hinted at possible price movements and structural breaks to the upside for XRP.

Realistic or not, here’s XRP’s market cap in BTC’s terms

However, investors and existing holders may still witness a drop to around the $0.49 mark, a level necessary for accumulating enough market liquidity to fuel an upward surge.

Source: TradingView

This nuanced understanding of XRP’s market position, supported by a blend of technical and on-chain analysis, provides a comprehensive view of what might lie ahead for XRP.