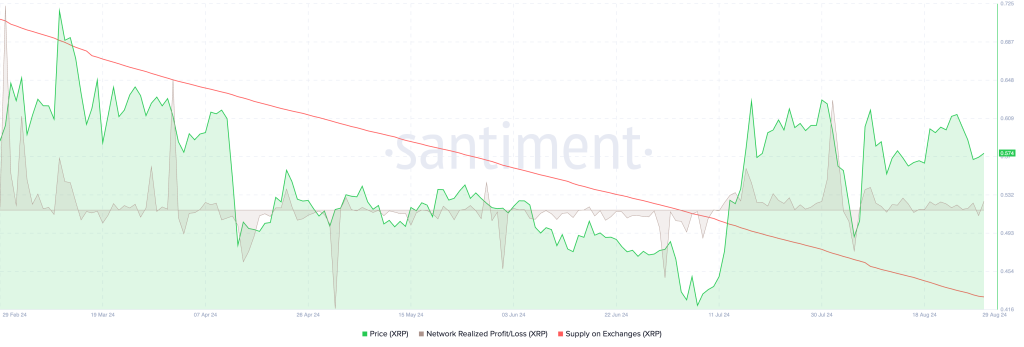

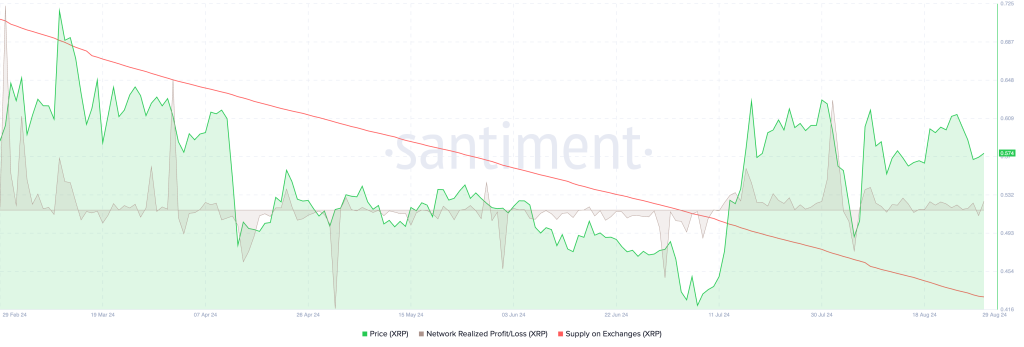

In this bearish market sentiment, cryptocurrencies are experiencing significant selling pressure. Amid this ongoing market downturn, on August 29, 2024, Ripple traders booked over $8.25 million in profit, according to the data from the on-chain analytic firm Santiment.

XRP Price Under Pressure

Historically, significant profit booking often leads to a massive price drop or increased selling pressure. There is a high possibility that this recent profit booking could potentially create a selling pressure in XRP.

At press time, XRP is trading near the $0.56 level and has experienced a price drop of 1.5% in the last 24 hours. Meanwhile, its trading volume has declined by 43% during the same period, indicating fear and lower participation among traders.

Mixed Sentiment: Bullish or Bearish?

The current price drop in XRP is not due to the profit booking but is instead caused by the overall market sentiment and the recent sharp decline in Bitcoin (BTC) price from $61,000 to $59,000 level.

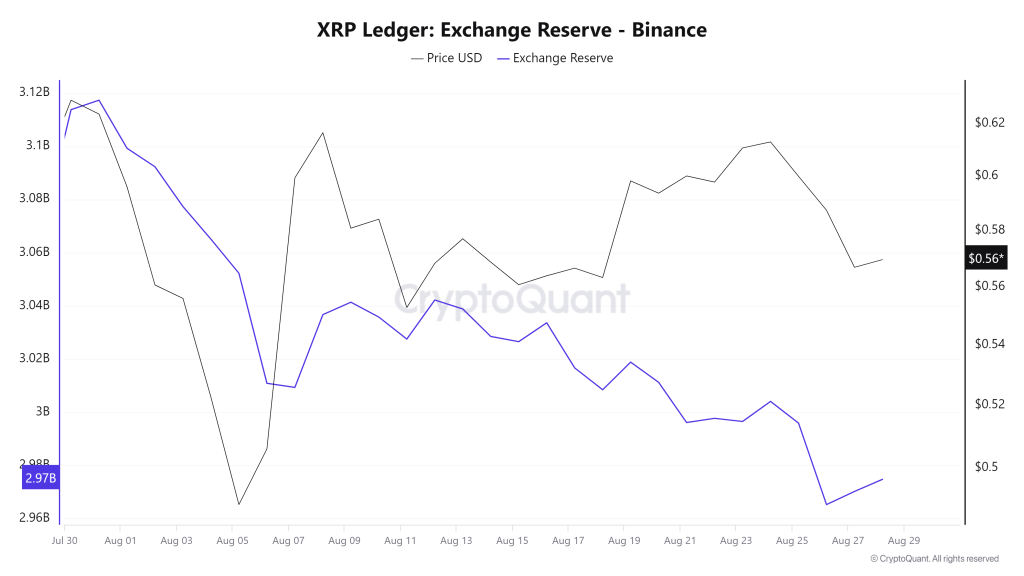

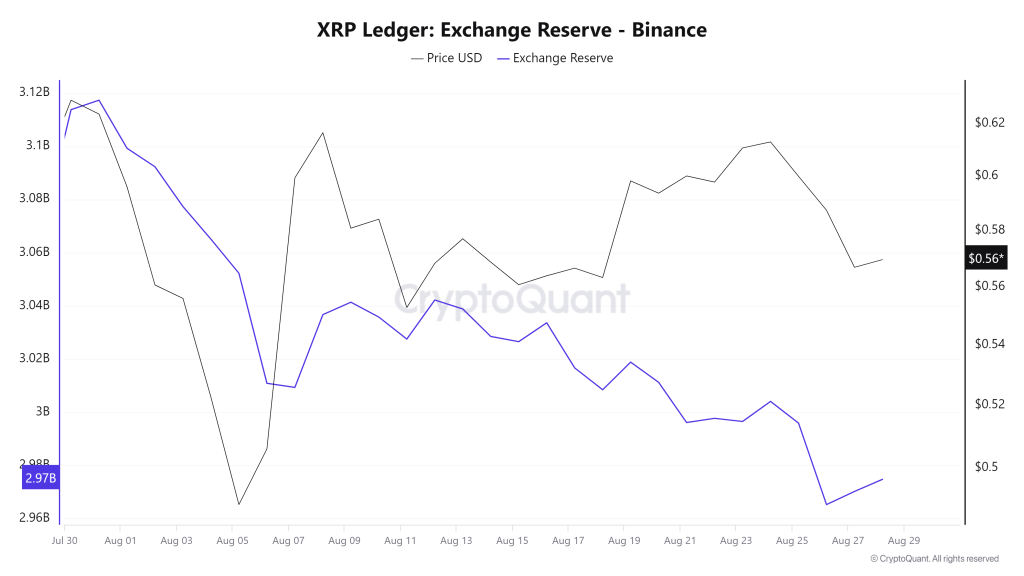

On the other hand, the exchange reserve has been continuously declining over the past months, according to the on-chain analytic firm CryptoQuant. As the XRP reserve continues to fall, it indicates potential accumulation by whales and institutions, suggesting a bullish sign.

These on-chain data reveal a mixed sentiment for XRP, leaving uncertainty about whether its price will surge or decline.

XRP’s Key Levels to Watch

According to expert technical analysis, XRP is currently gaining strong support from the 200 Exponential Moving Average (EMA) on a daily time frame and the horizontal level of $0.546. However, its Relative Strength Index (RSI) is below 50, indicating a potential price reversal.

Based on the price action, since July 2024, XRP has visited this level multiple times, and each time it has experienced a price reversal. However, this time we might see an upside momentum of over 14% to the $0.63 level.

If the sentiment remains bearish and the XRP price fails to hold the $0.546 level and closes a daily candle below the $0.54 level, we could see a price drop to the $0.48 level.