- LTC was up by more than 9% in the last seven days.

- Metrics suggested that Litecoin was undervalued.

The crypto market turned bullish just a day after Bitcoin’s [BTC] fourth halving, letting several cryptos, including Litecoin [LTC], showcase impressive performances.

If the latest data is to be believed, then this might just be the beginning of LTC’s bull show, as it might surge by over 300% in the coming weeks.

Litecoin bulls are back

According to CoinMarketCap, LTC’s price has risen by more than 9% over the past week. In the last 24 hours alone, the coin was up by nearly 4%.

At the time of writing, LTC was trading at $85.37 with a market capitalization of over $6.3 billion. The recent rise in price allowed Litecoin to break above a long-term bullish pattern.

World of Charts, a popular crypto analyst, recently posted a tweet highlighting that LTC broke above a multi-year Symmetrical Triangle pattern.

This suggested that the coin’s price might as well rally by more than 300% in the weeks to follow.

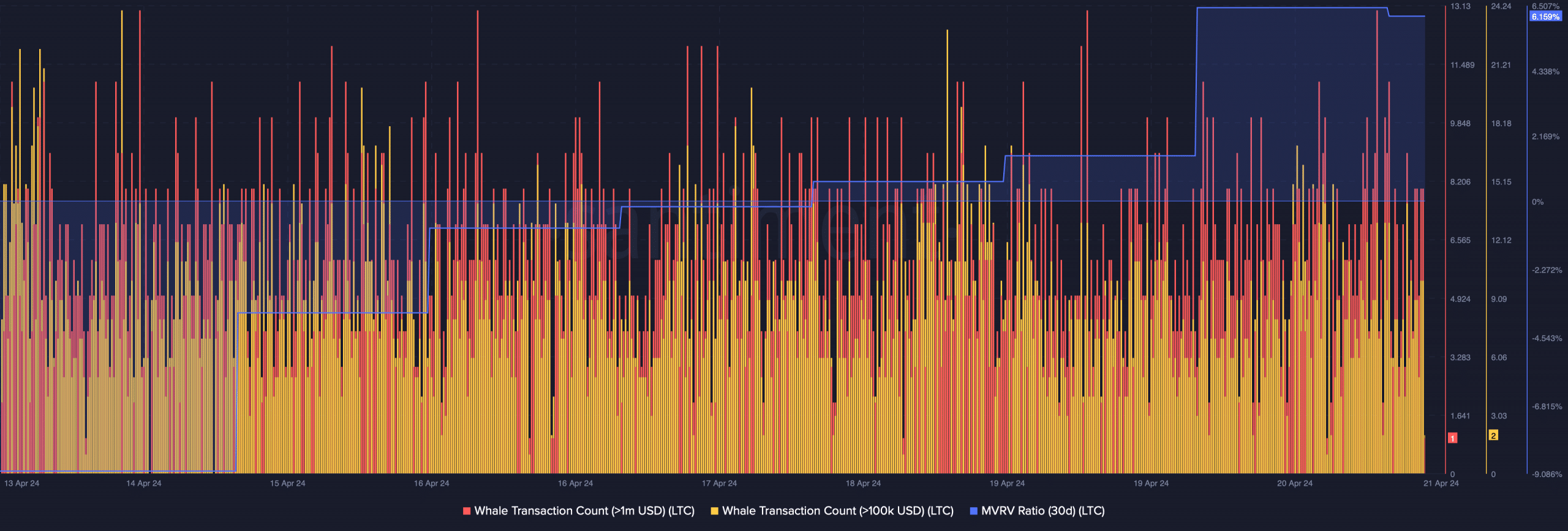

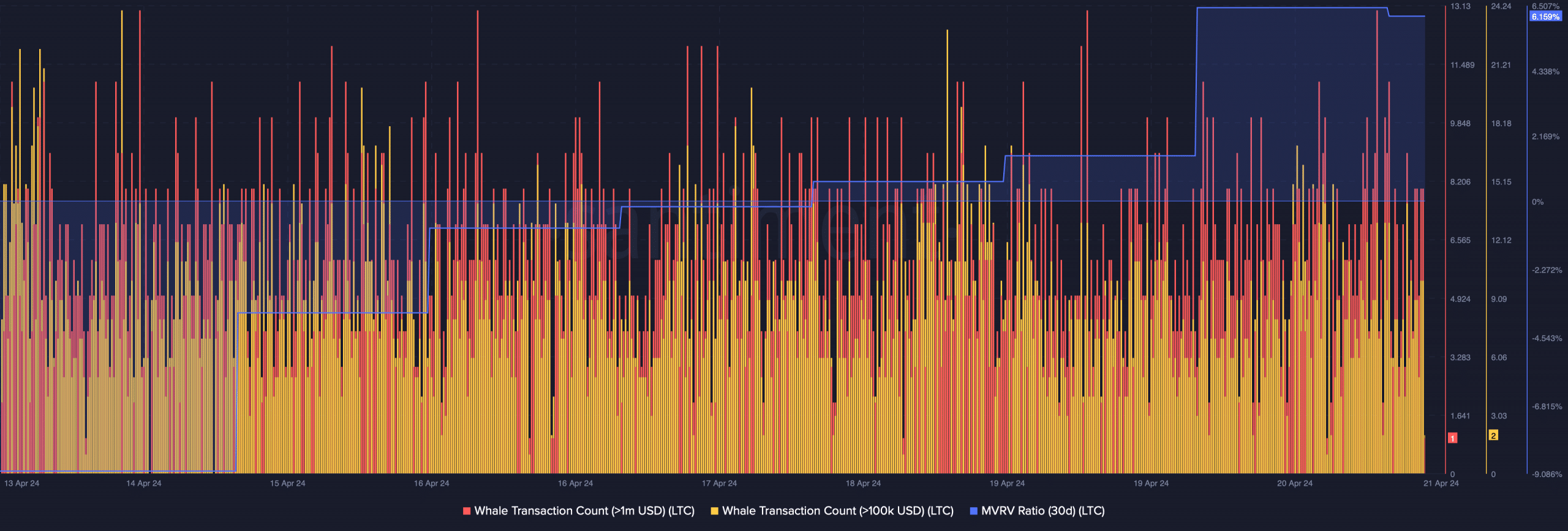

AMBCrypto’s analysis of Santiment’s data revealed that while the coin’s price surged, whale activity around it also increased. This was evident from its high whale transaction count last week.

The price hike also caused its MVRV ratio to turn positive, meaning that more investors were in profit. At press time, LTC’s MVRV ratio had a value of 6.16%.

Source: Santiment

Litecoin’s rally to last?

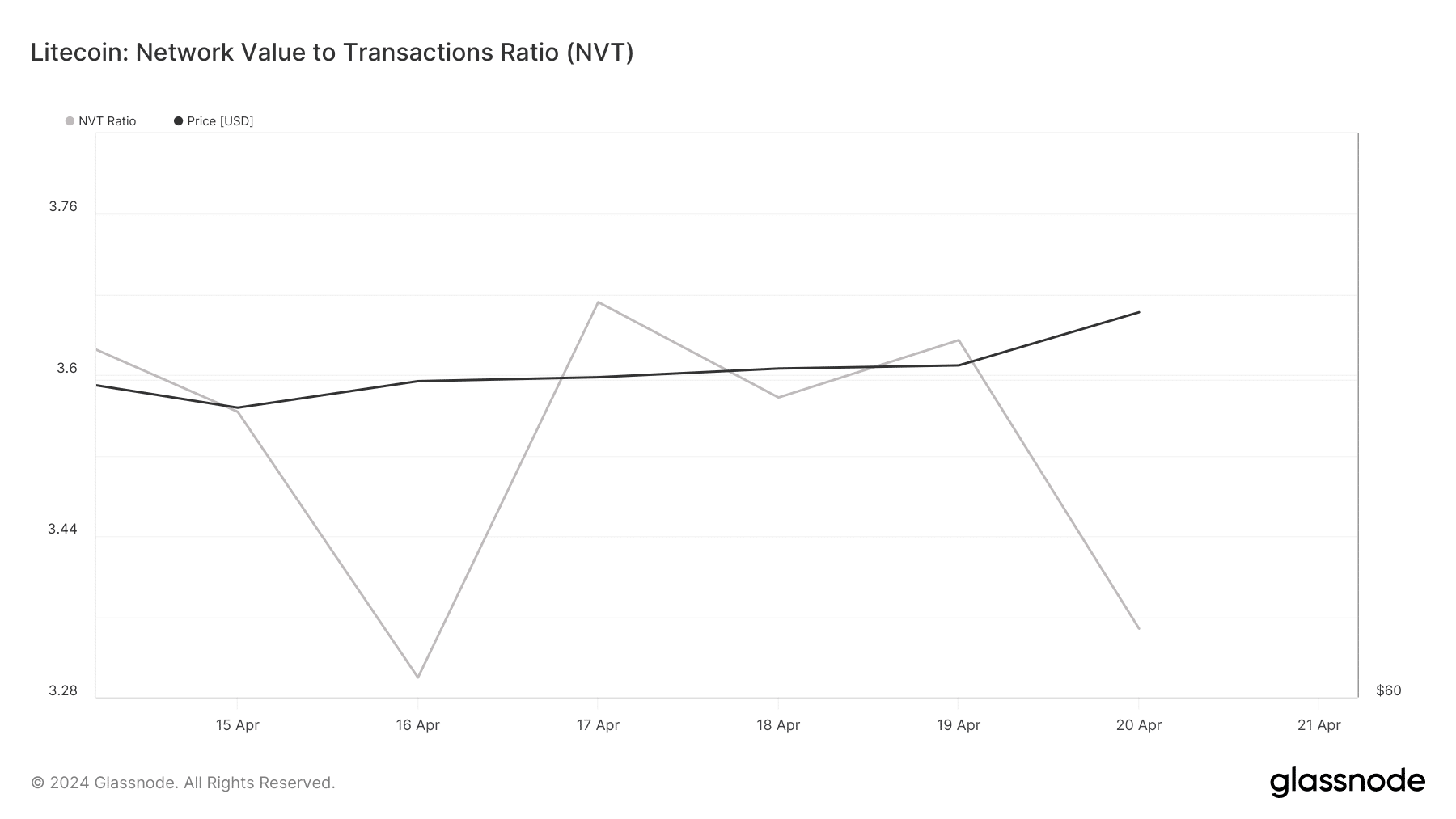

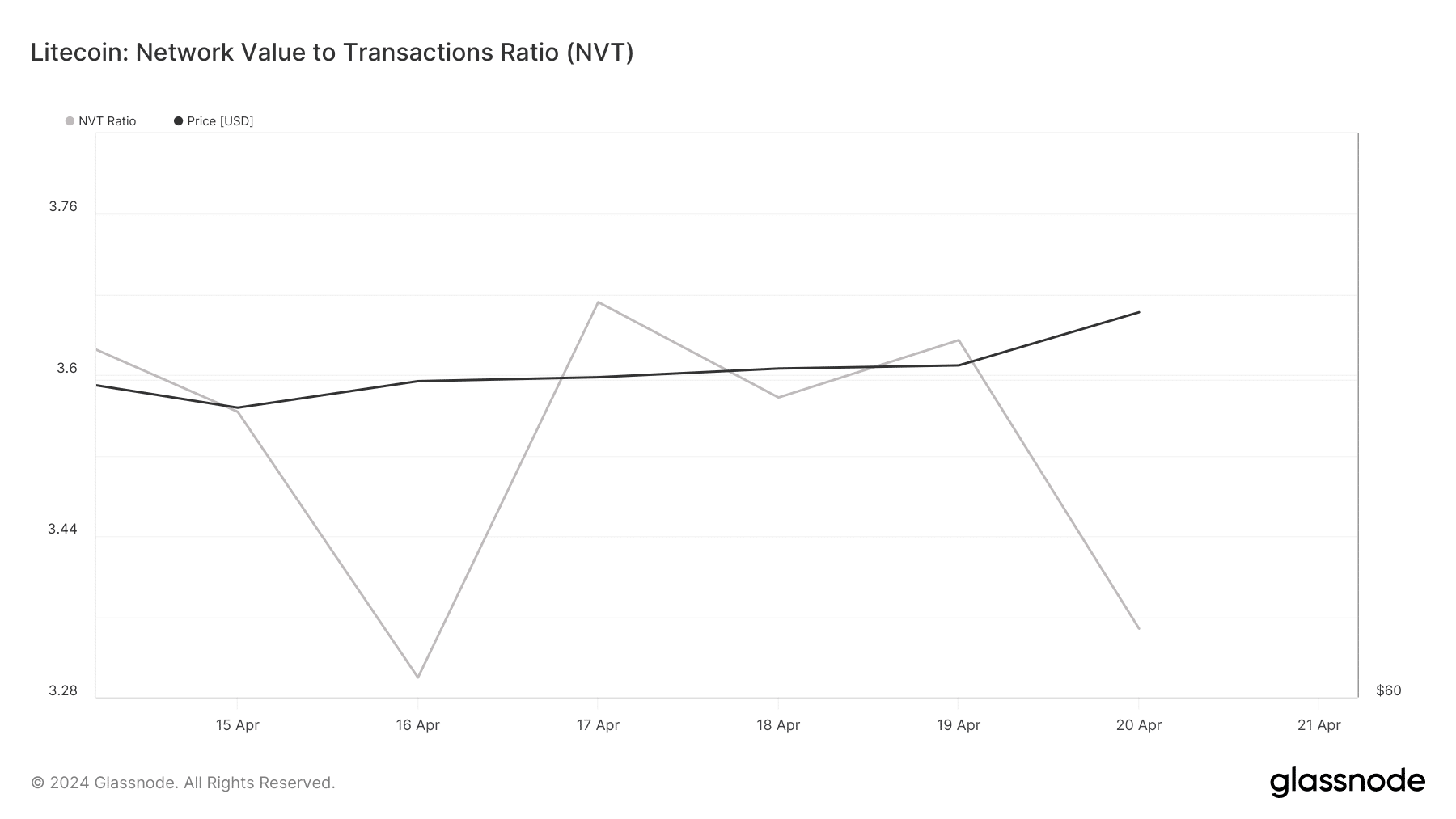

AMBCrypto’s look at Glassnode’s data pointed out yet another bullish metric. We found that LTC’s network to value ratio dropped sharply on the 20th of April.

A decline in the metric means that an asset is undervalued, hinting that the bull rally might last longer.

Source: Glassnode

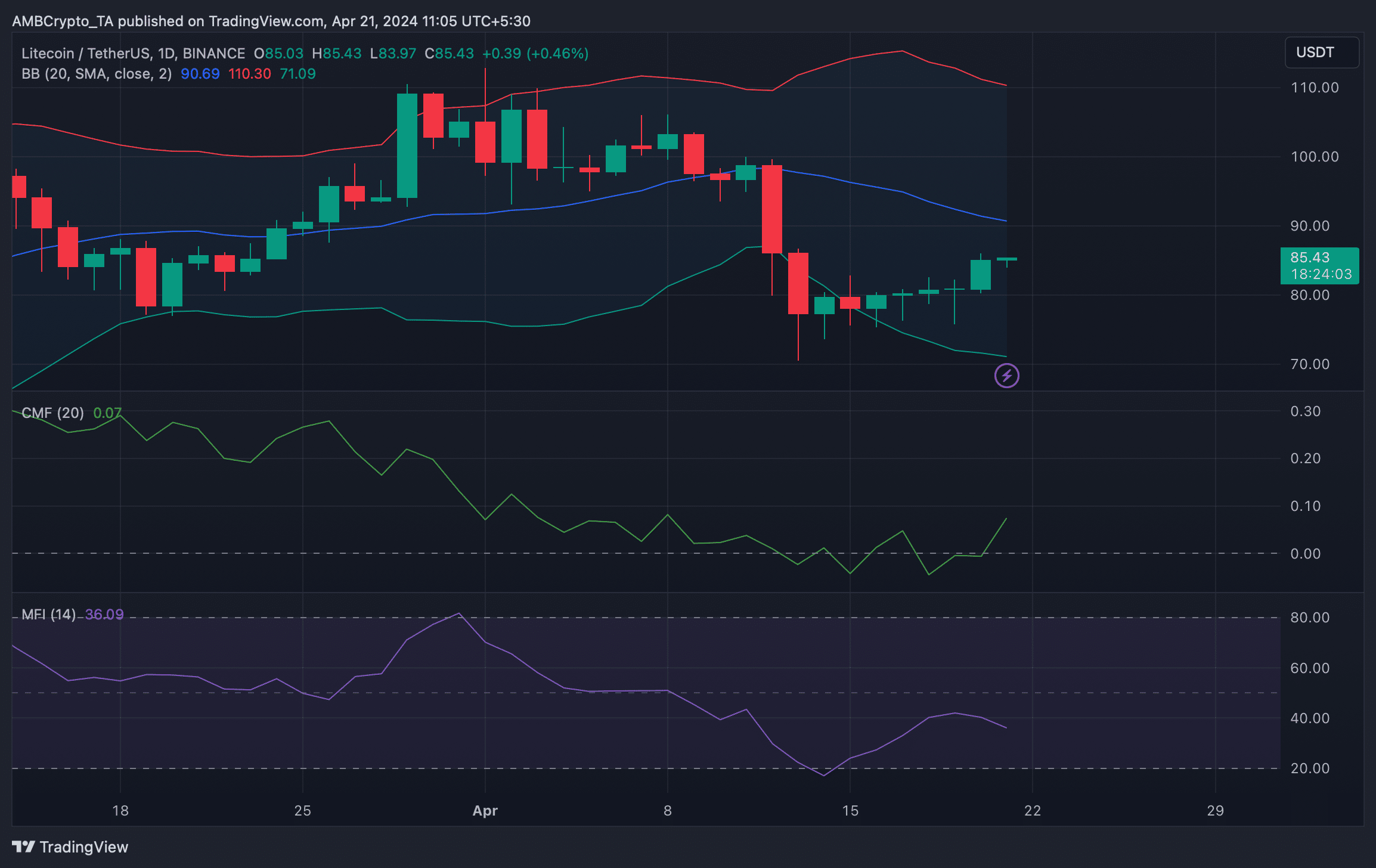

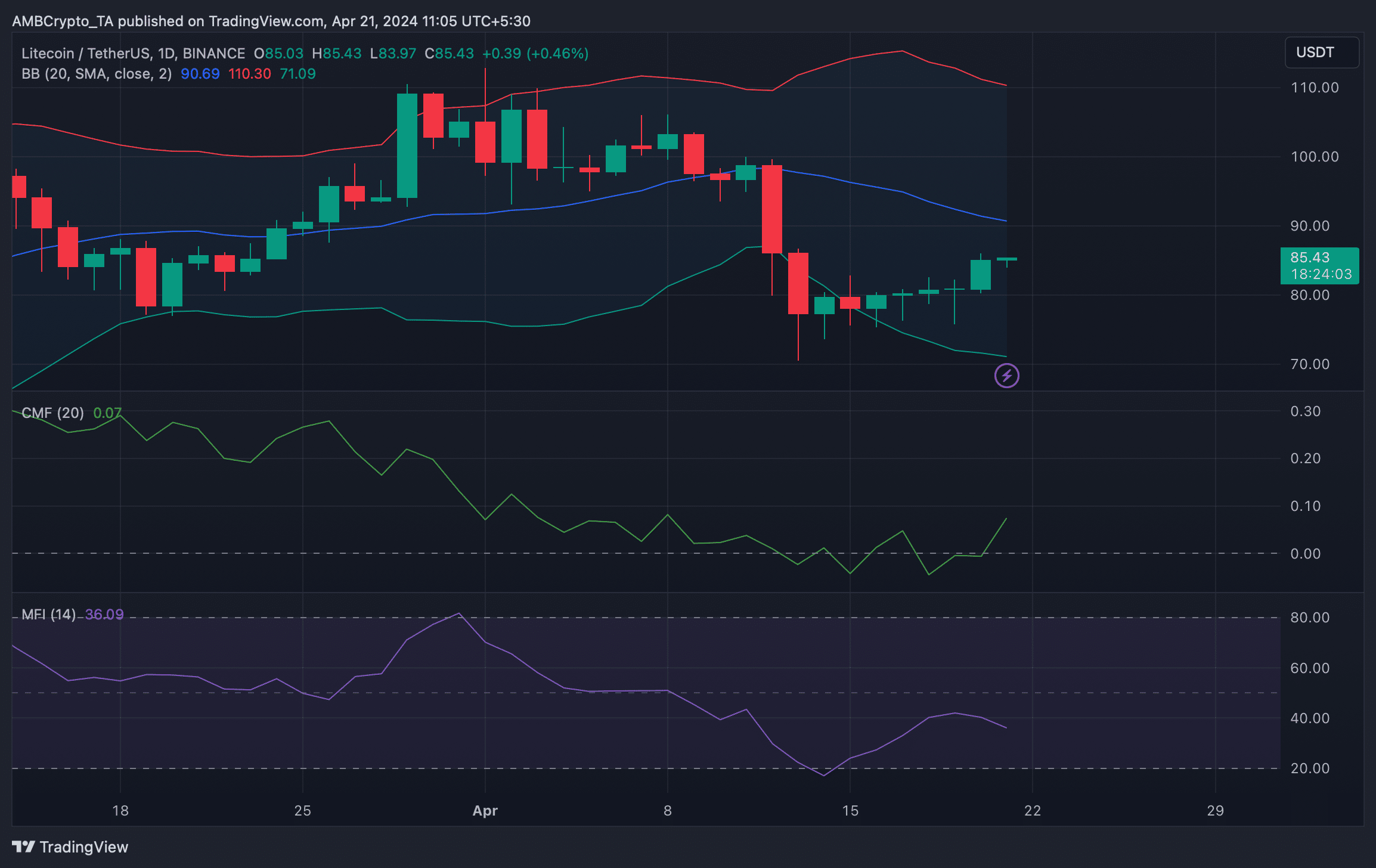

We then analyzed Litecoin’s daily chart to better understand. It showed that the Chaikin Money Flow (CMF) had registered a sharp uptick and was headed above the neutral mark at press time.

Source: TradingView

LTC’s price was also closing in on its 20-day Simple Moving Average (SMA). A successful breakout above that could result in a continued price rise.

Read Litecoin’s [LTC] Price Prediction 2024-25

However, the coin’s Money Flow Index (MFI) went southwards, which hinted that LTC might not be able to sustain its bullish momentum in the coming days.

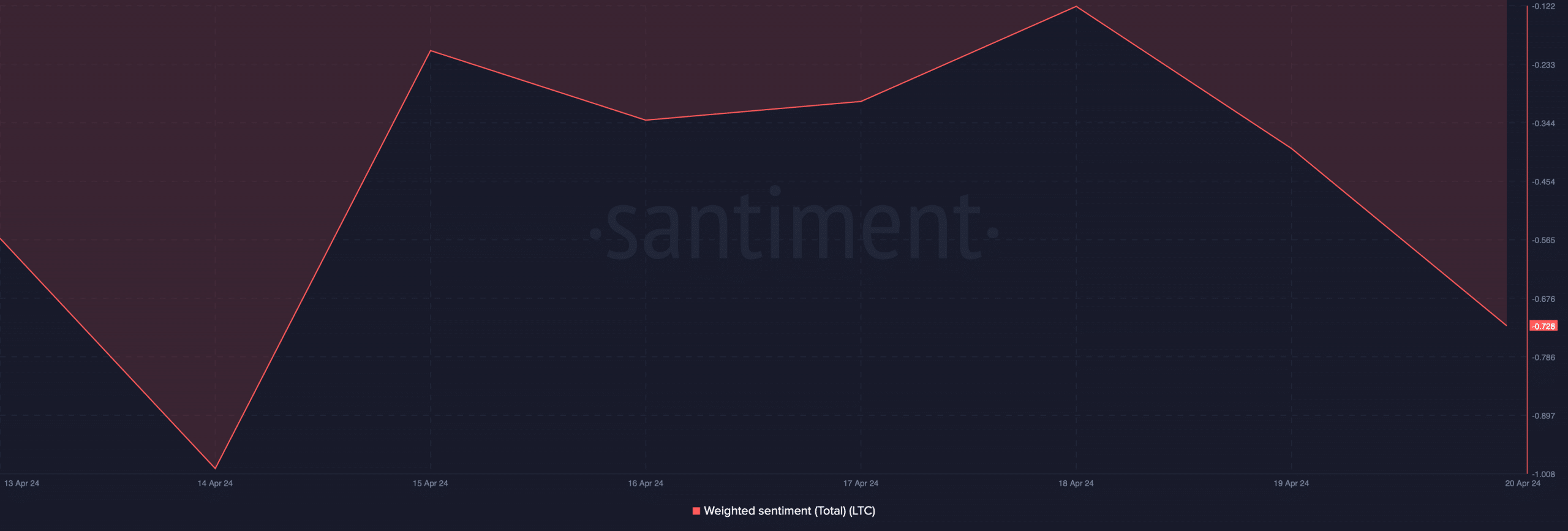

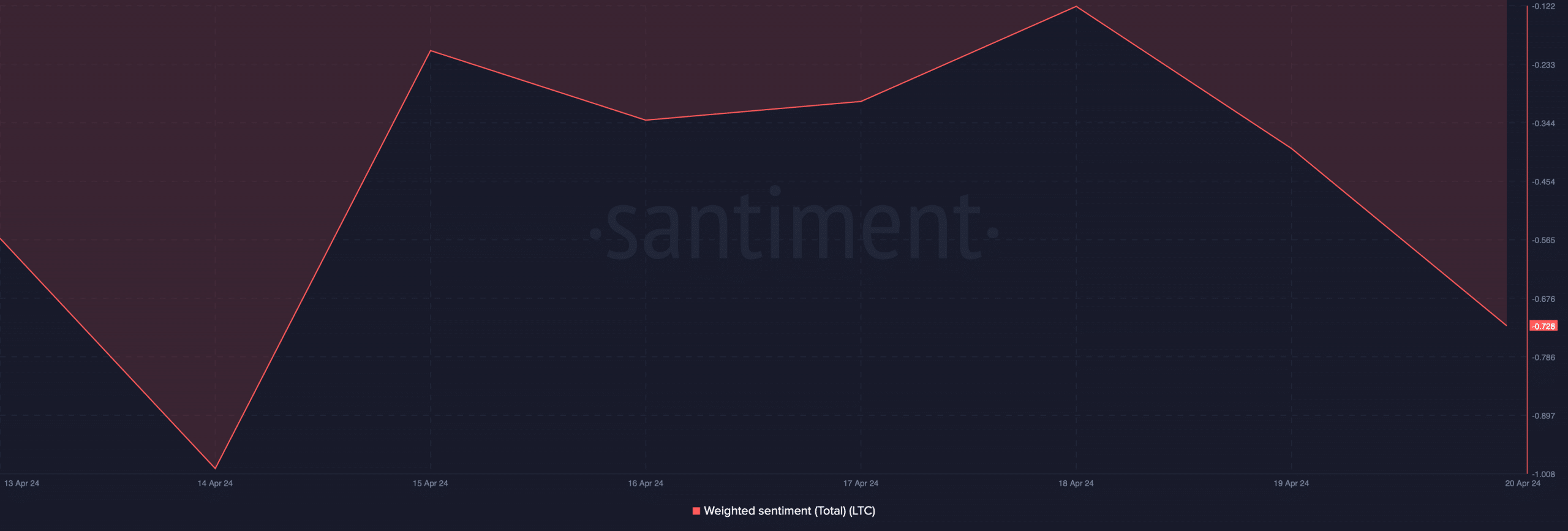

It was also surprising to see that, despite the recent price uptick, market sentiment around LTC remained bearish. This was evident from the drop in its Weighted Sentiment on the 20th of April.

Source: Santiment