- The negative funding and higher price movement might send SHIB to $0.000030.

- Indications from the volume suggested a possible consolidation phase.

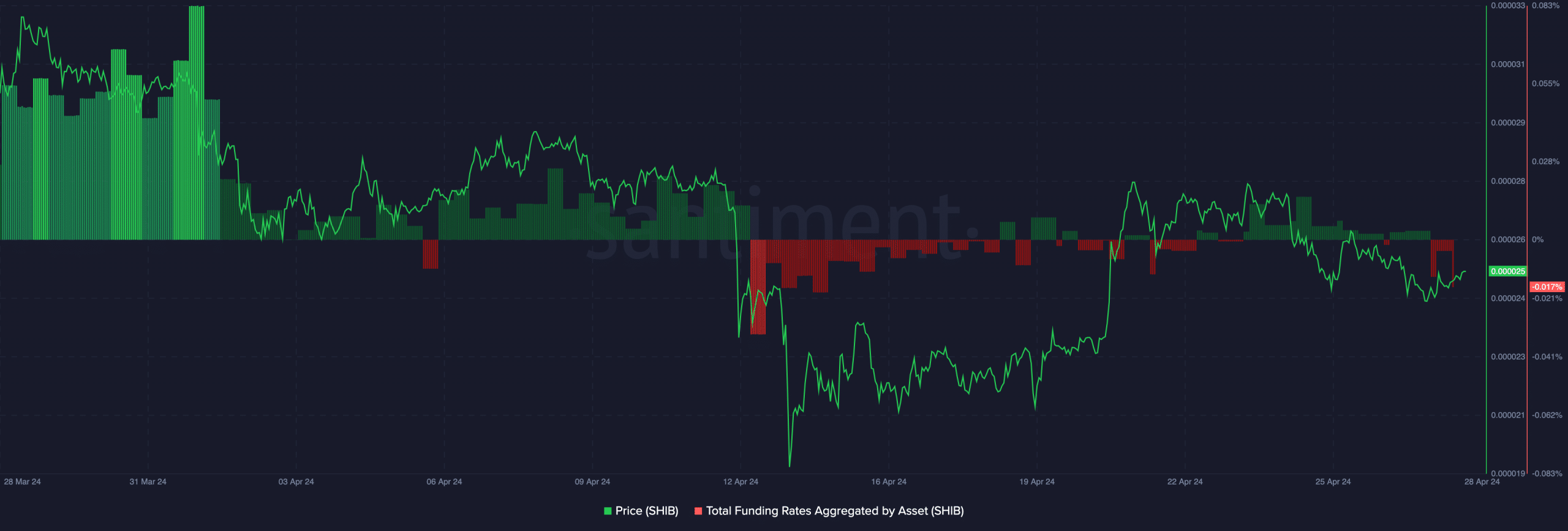

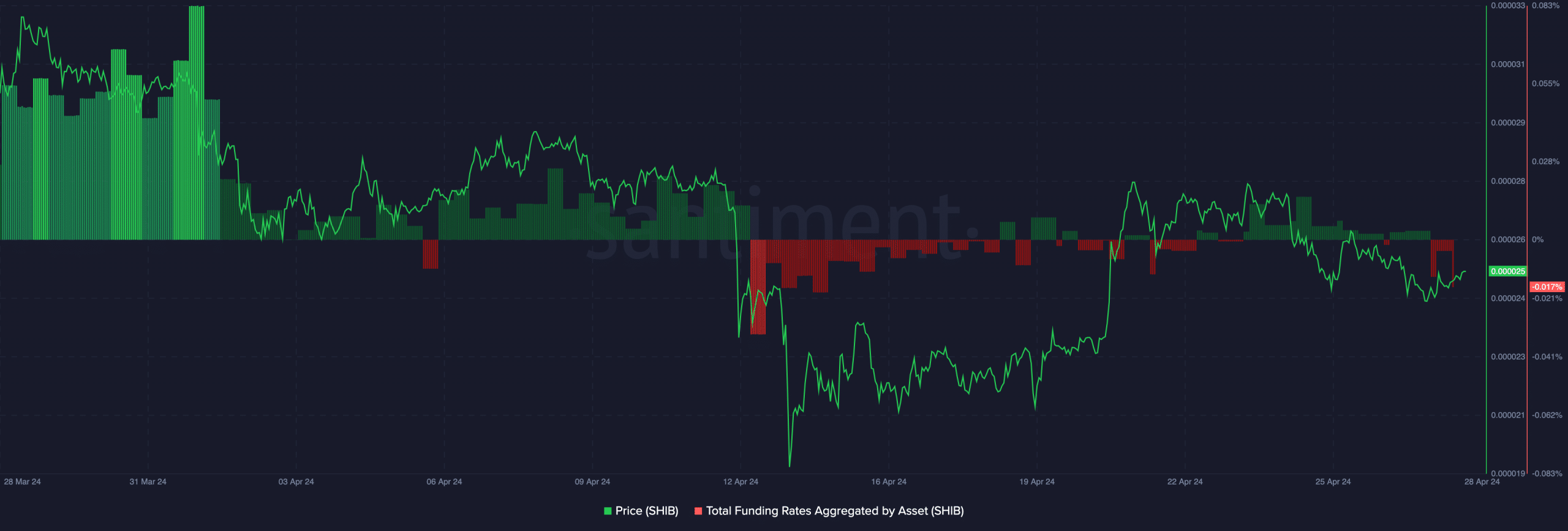

After hitting a positive reading earlier, Shiba Inu’s [SHIB] aggregated Funding Rate fell to the positive region on the 28th of April. Funding Rate is the cost of holding an open perp position.

If the metric is green, longs are paying shorts a fee, and the broader sentiment among traders is positive.

On the other hand, negative funding implies that more traders are betting on a price decrease for the cryptocurrency involved.

SHIB may not back the crowd

However, price does not always play to the gallery of trader sentiment. For SHIB, this might be the case considering the price movement. In the last 24 hours, the price of Shiba Inu moved upwards.

With funding becoming more negative as the price moves slightly higher, perp sellers might be fading the move. Hence, buyers on the spot market seem aggressive, and this could fuel a further increase for SHIB.

Source: Santiment

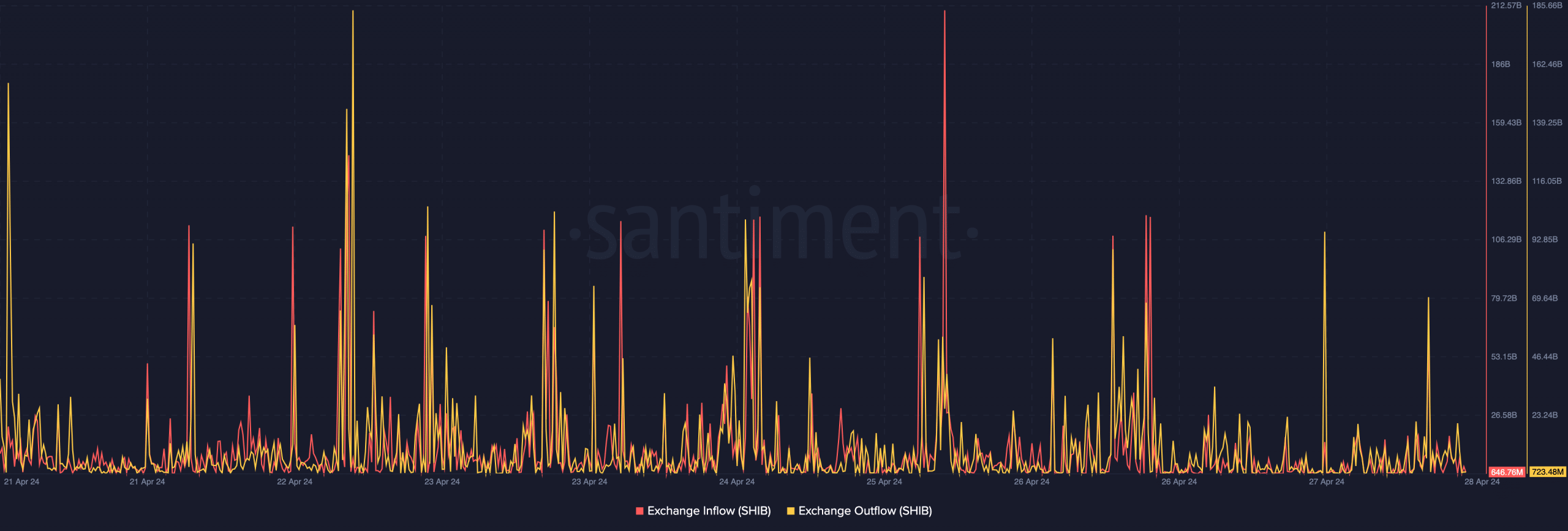

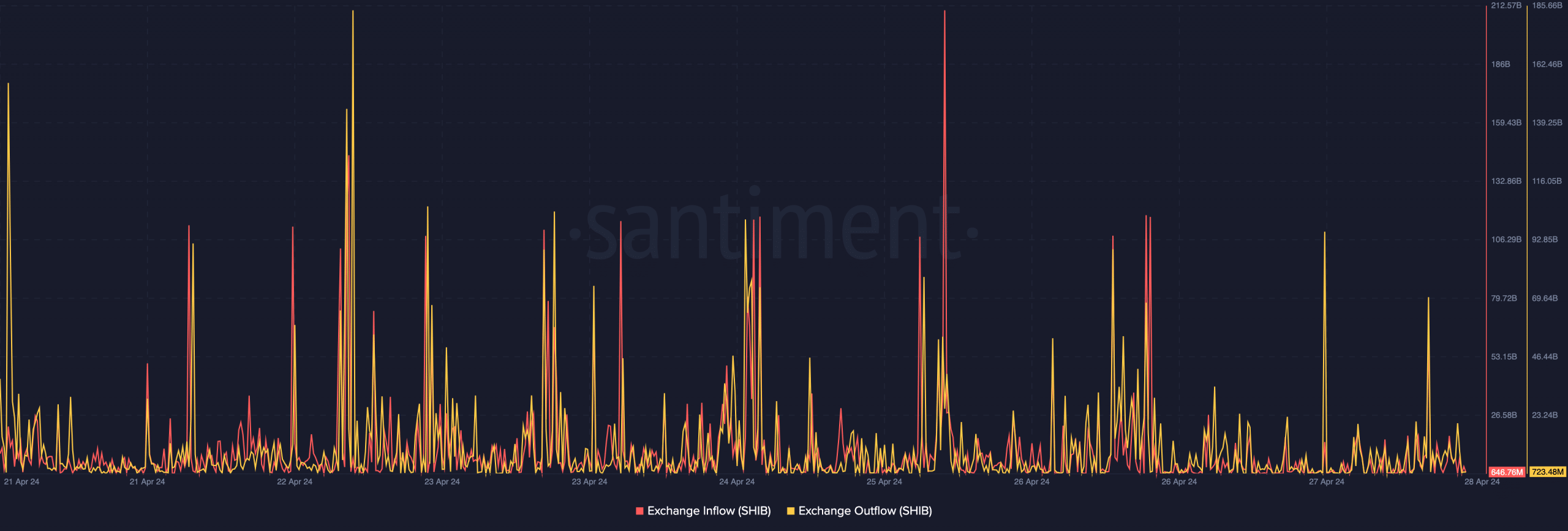

But the signal from Funding Rate might not be the only determinant of the price. This is why AMBCrypto looked to other metrics.

This time, we considered looking at the exchange flow. As of this writing, Shiba Inu’s exchange outflow was 723.48 million. This data represents the number of tokens withdrawn from exchanges.

Conversely, the exchange outflow was 646.76 million. This is the number of tokens sent to exchanges. Most times, the intention behind this action is to sell, thus, leading to a price decline.

However, when you look at the difference between both metrics, you would agree that most participants tilted to the bullish side of things.

As such, it might be difficult for bears to capitulate SHIB’s price. If this remains the situation going forward, there is a high chance of seeing the token revisit $0.000030 within a short period.

Source: Santiment

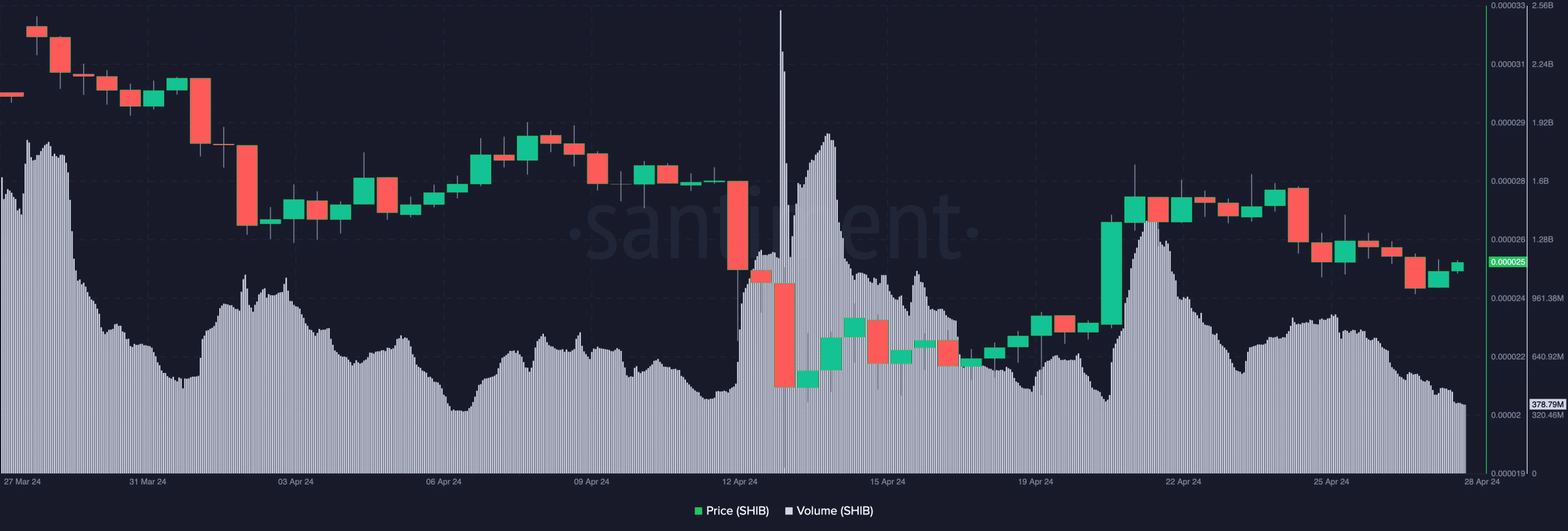

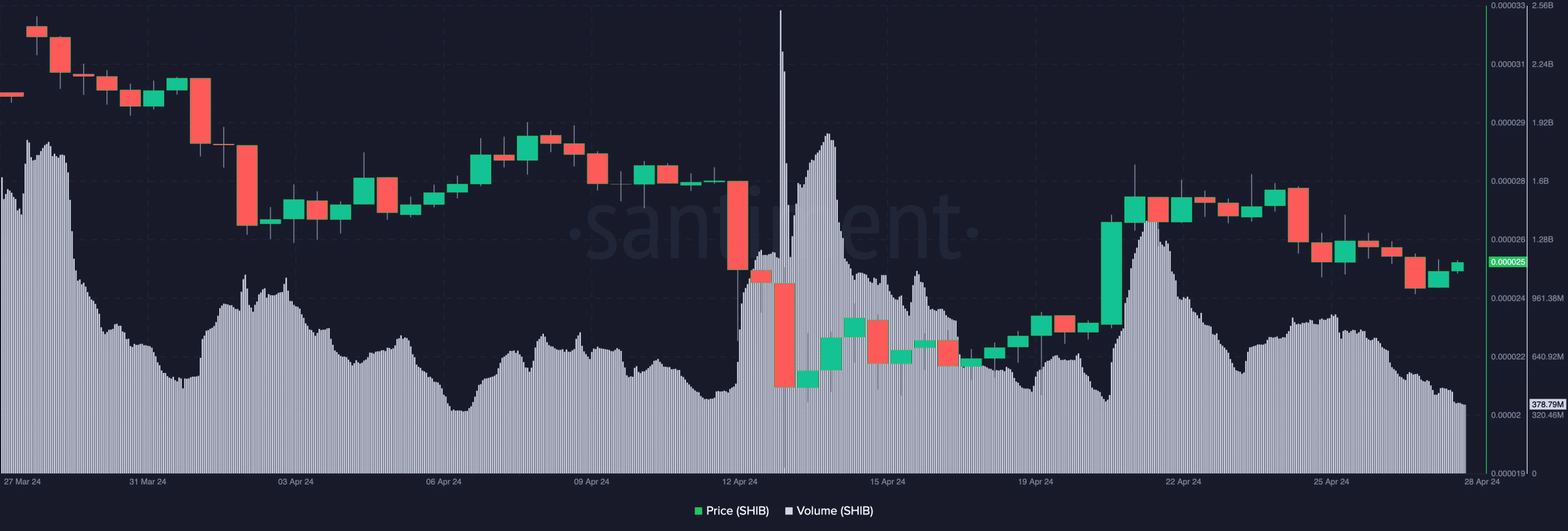

Price chooses end-to-end movement

Despite the projection, traders might need to keep an eye on SHIB’s volume. Volume reflects interest in an asset. If it increases, it means participants are exchanging a lot of the cryptocurrency involved.

On the other hand, a decline in the volume implies decreasing interest in trading the token. Beyond this interpretation, volume also has an impact on price.

Should the volume rise alongside the price, an uptrend might continue. However, press time data showed that Shiba Inu’s volume decreased.

Source: Santiment

A situation like this can invalidate the bullish thesis explained above, as the upswing could become weak.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

If this is the case, SHIB might undergo a consolidation period, which could see its price move between $0.000024 and $0.000027 in the short term.

However, a rise in volume while the price stays up could invalidate the bias, and SHIB might eventually retest $0.000030.