- Bitcoin’s recent price drop has led to significant market liquidations.

- Poor performance of the Hong Kong and U.S. spot ETFs underline market struggles.

As Bitcoin [BTC] continued to struggle under significant market pressure, dipping below the $58,000 mark, analysts are now projecting a substantial price correction of 30-40% in the current market cycle.

This potential drop could see the leading cryptocurrency adjust to values not seen since earlier bullish runs, sparking concerns and anticipatory strategies among investors.

Bitcoin dangles close to $55K

Bitcoin’s recent market behavior has been less than favorable, with a 10% decline over the past week, bringing its trading price precariously close to $55,000.

According to analyst Scott Melker, Bitcoin has breached critical support levels that are now acting as resistance, potentially leading to further declines. He cautioned,

“Nothing but air until around $52,000 on the chart.”

This suggested that Bitcoin could face a free-fall if it fails to maintain current support levels.

The technical perspective offers a bleak outlook as well.

Melker pointed out that the Relative Strength Index (RSI), typically a reliable indicator of when an asset is oversold and likely to rebound, has not reached oversold territory.

This deviation suggests a lack of strong buying interest and supports the thesis of further price drops.

This condition is mirrored in the broader price trends observed on the charts, where Bitcoin exhibits a pattern of lower highs and lower lows, signaling sustained bearish momentum.

According to Melker, the ongoing plunge is only a fraction of what is to come, noting,

“This is still ONLY A 23% correction, very shallow for a bull market and consistent with other corrections on this run. We are yet to see a 30-40% pull back during this bull market, like those of the past.”

Broader market implications

Beyond the immediate price action, broader market indicators reveal underlying challenges.

Data from blockchain analytics firm Santiment showed a significant drop in Bitcoin’s daily active addresses.

It plummeted from over 17 million in March to around 14.7 million as of the 1st of May, indicating waning user activity and interest.

Source: Santiment

The Social Dominance echoed this sentiment, showing a 20% fall.

Source: Santiment

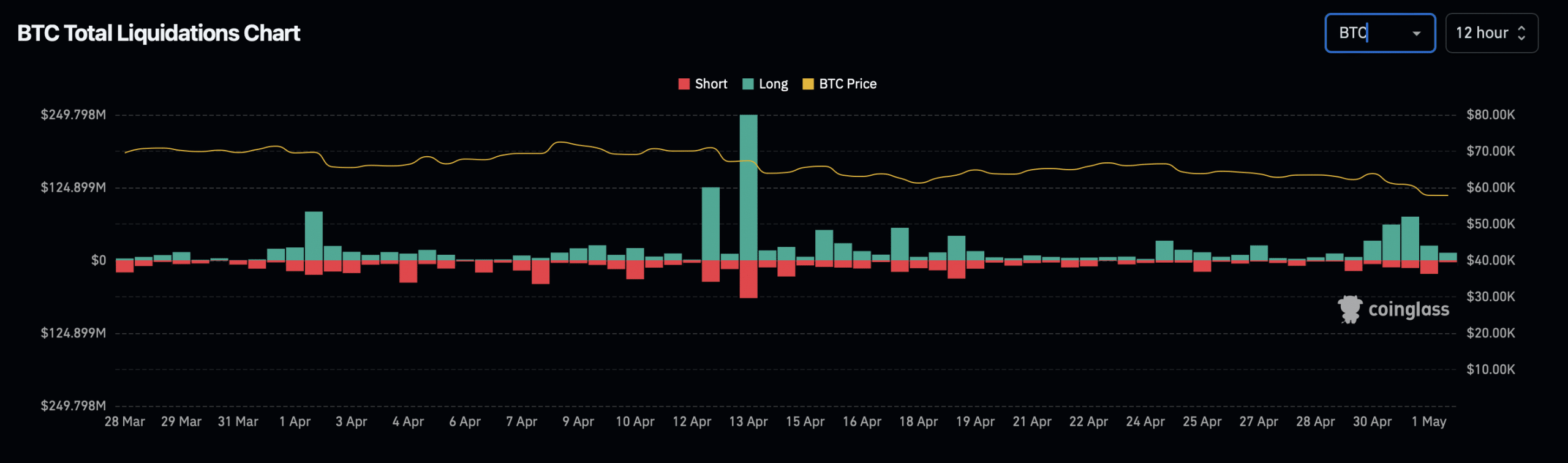

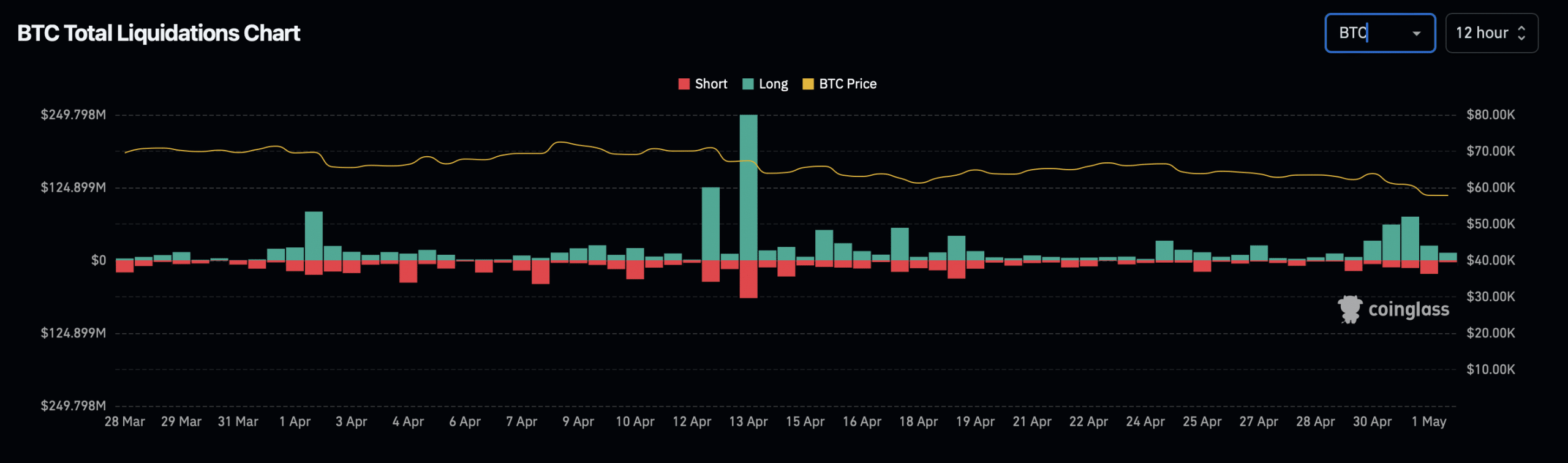

The downturn in Bitcoin’s value has not only dampened the aforementioned market metrics but has also triggered widespread liquidations, impacting numerous traders.

According to Coinglass, in the last 24 hours alone, approximately 60,795 traders have been liquidated, with total liquidations amounting to $205.12 million.

Source: Coinglass

Concurrently, as reported by AMBCrypto, the underwhelming debut of the newly listed spot ETFs in Hong Kong only exacerbated the situation.

These ETFs managed a mere $11 million in trading volume on their first day, starkly contrasting with the much higher figures achieved by U.S.-based spot ETFs at their launch in January.

Furthermore, U.S. spot ETFs have been experiencing a significant outflow, with $161 million withdrawn on Tuesday alone, marking the fifth consecutive day of outflows, as analyzed by AMBCrypto using SoSo Value data.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Additionally, the anticipation of the U.S. Federal Reserve maintaining steady interest rates in the upcoming FOMC meeting—due to higher-than-expected inflation—has led traders to withdraw from riskier investments.

This added further pressure to an already strained market.