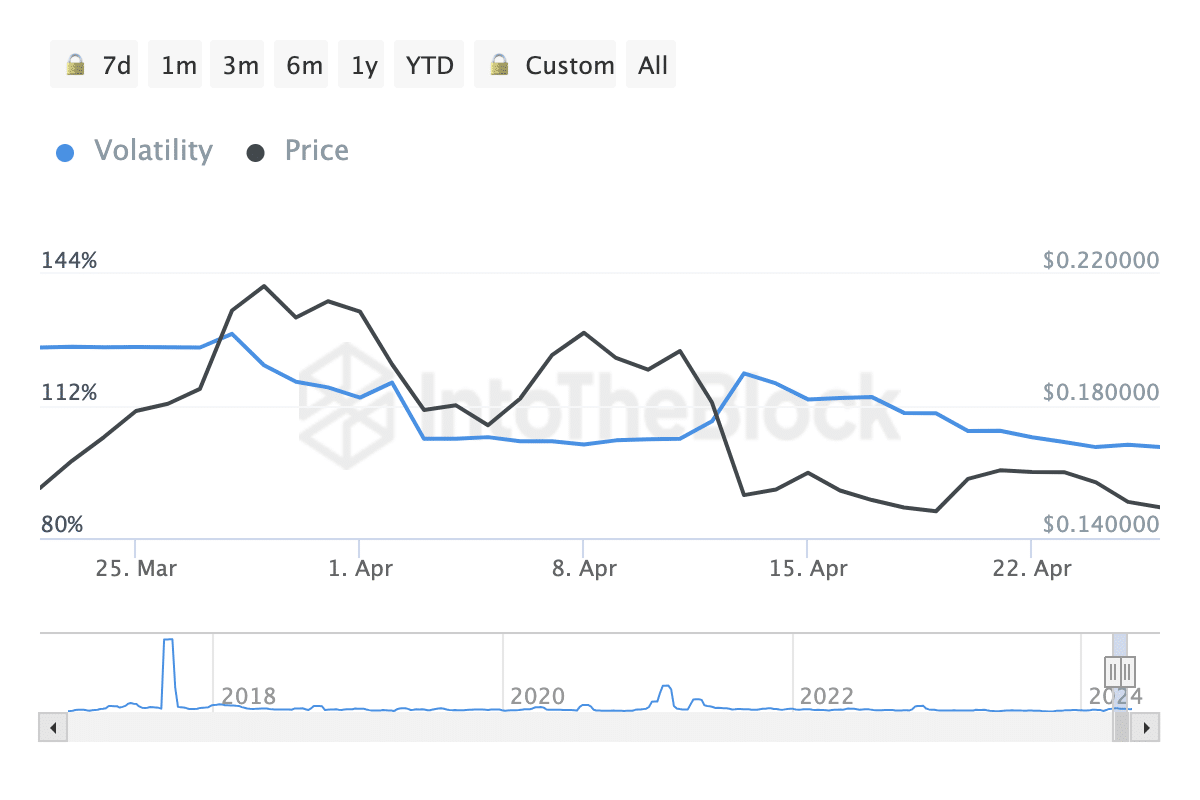

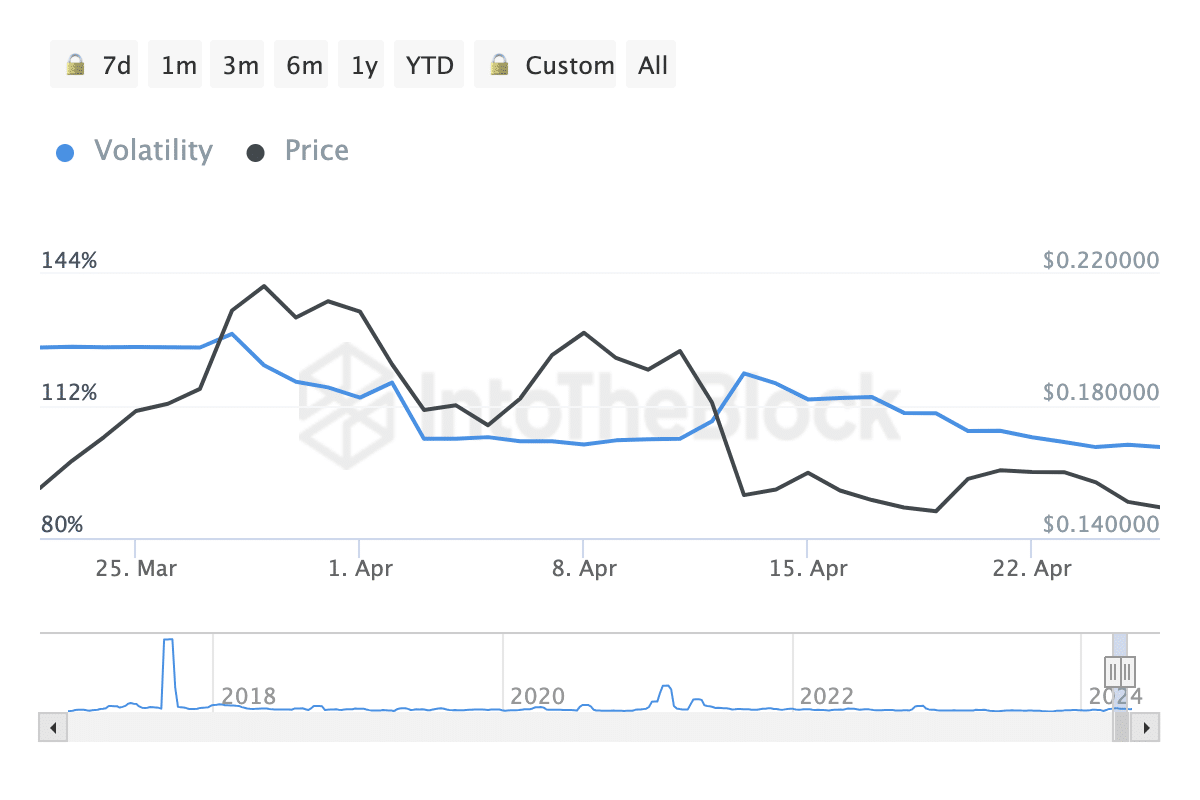

- Volatility around the memecoin hit a 30-day low, suggesting sideways movement

- Other on-chain metrics supported the prediction, but DOGE’s price might surge later on

If you think Dogecoin’s [DOGE] 2.60% hike in the last 24 hours is the beginning of a new rally, you probably need to give it a second thought. And no, this is not an opinion out of the blue either.

Instead, AMBCrypto found data to back this thesis. The first evidence we found was the coin’s volatility. According to our analysis using IntoTheBlock, Dogecoin’s volatility has hit its lowest point in the last 30 days.

An increase in volatility could trigger rapid changes in the price of a cryptocurrency. This is something memecoins like DOGE are known for. However, the decline here implies that the degree of price fluctuation might be lower.

Source: IntoTheBlock

Stay calm, the pump is not yet here

Should this metric fail to rise, DOGE’s predictions of $0.25 might not happen within a short period. At press time, DOGE was valued at $0.15.

For some time, the altcoin has been swinging between $0.14 and a peak of $0.16. Moving on, the consolidation might remain the same unless something changes on the Dogecoin network.

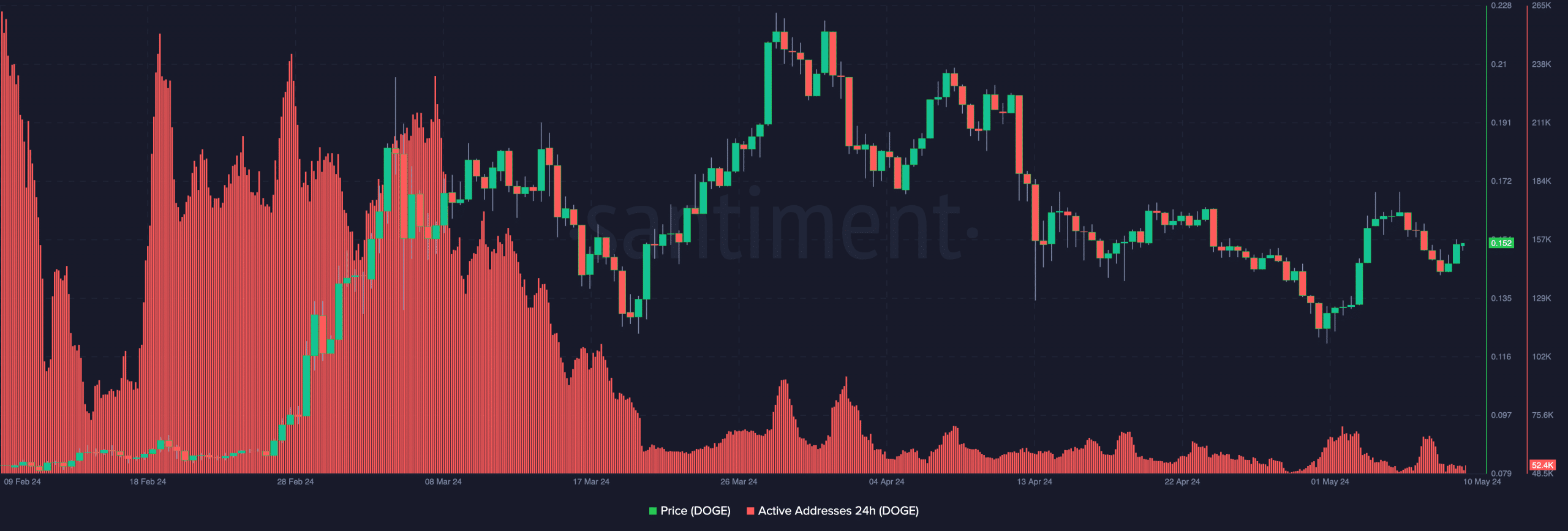

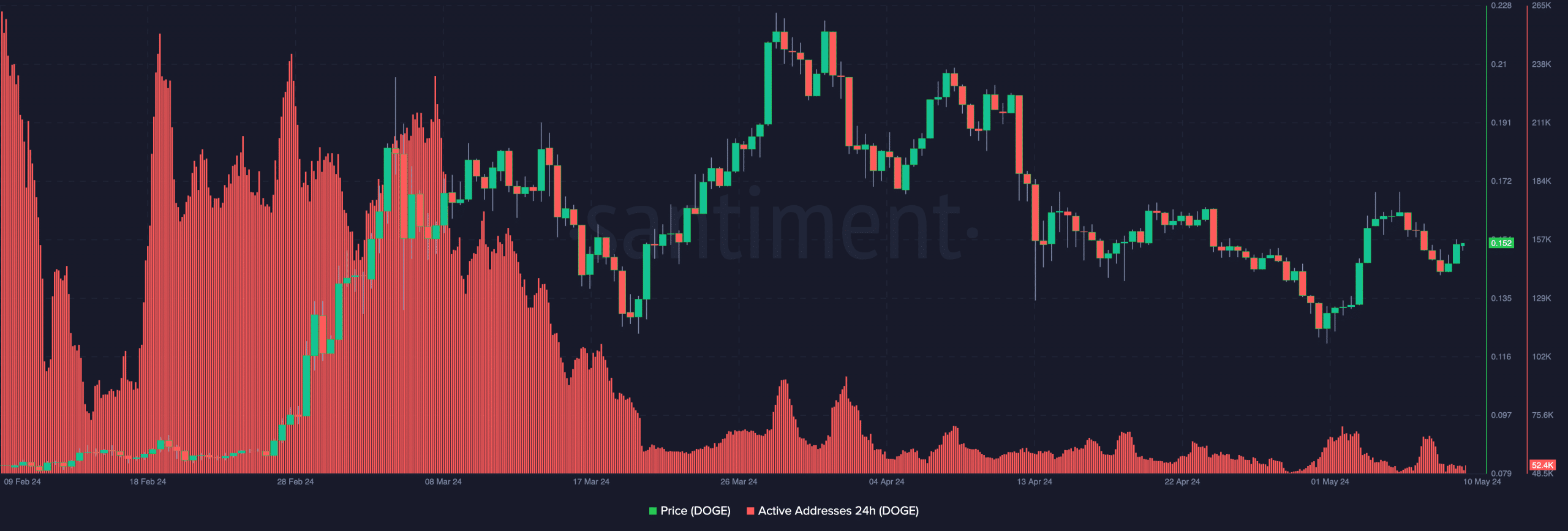

However, there seemed to be other on-chain metrics that supported the idea of sideways movement too. Active addresses, for instance, that can be used to track user activity on a network.

Historically, a surge in activity on Dogecoin comes with a significant price hike. As recently as March, when the 24-hour active addresses closed in on 250,000, DOGE’s price rallied to $0.22 on the charts.

However, at press time, the metric had a reading of just 52,400, indicating that participation on the network has been low. Should this remain the same in the coming days, DOGE might remain in a tight trading range, as has been the case over the last few weeks.

Source: Santiment

DOGE is not dead

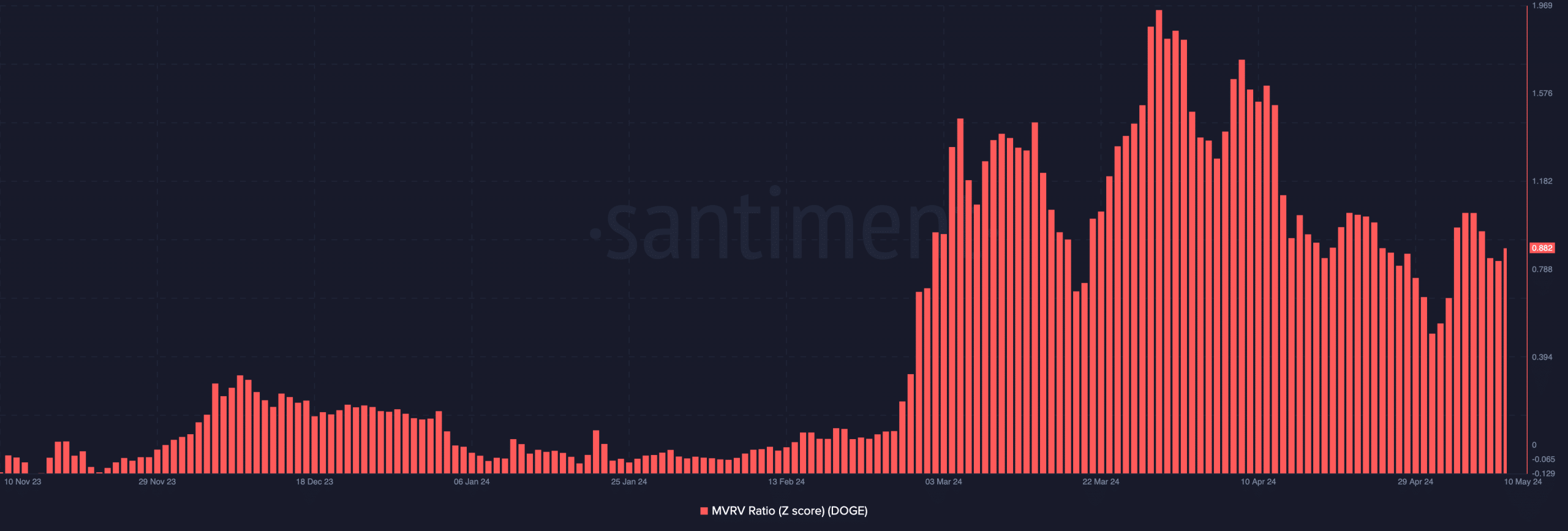

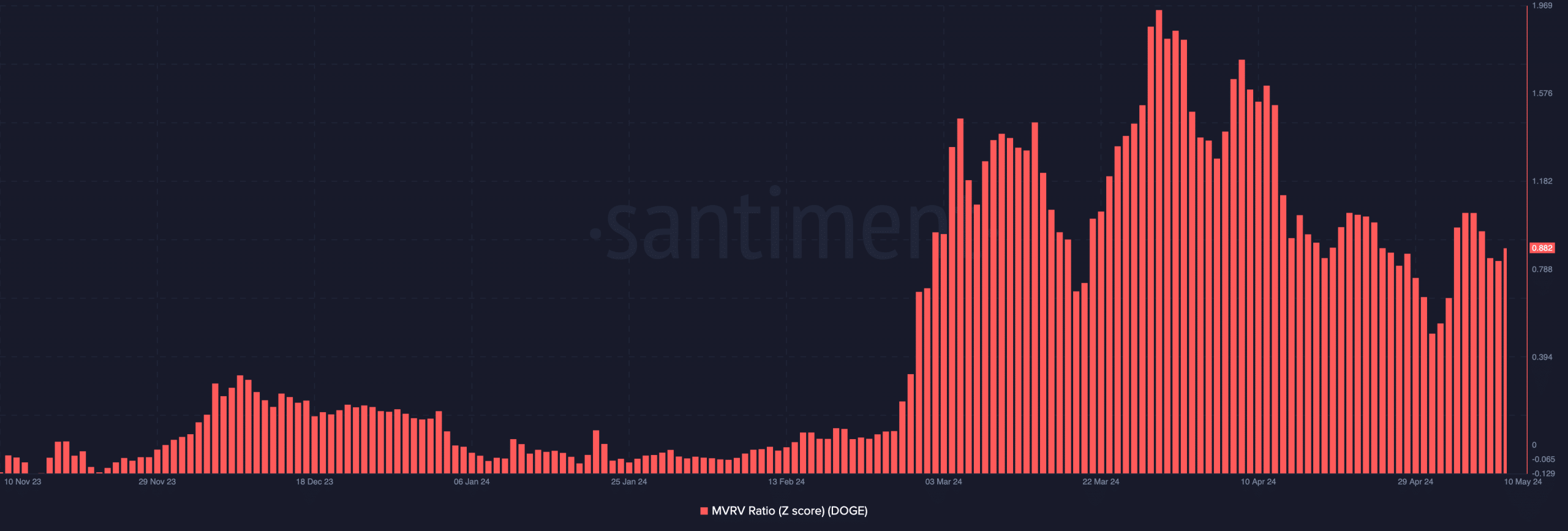

Despite the bearish outlook, however, DOGE might not slump into a bear phase. This was the signal AMBCrypto got from the MVRV Z Score.

MVRV stands for Market Value to Realized Value. This metric measures if a cryptocurrency is overvalued or undervalued relative to its fair value. When the Z Score is added, it checks if the market has fallen into a correction period or if the market is bullish.

A negative reading of the metric suggests a bear phase. On the contrary, if the Z Score is above zero and in the positive zone, then the price can appreciate on the charts.

At press time, Dogecoin’s MVRV Z Score flashed a figure of 0.88, indicating that the coin’s value could hike in the future. However, to validate this bias, the reading has to climb higher than 1.05. Failure to do that could keep DOGE ranging between $0.14 and $0.16 on the charts.

Source: Santiment

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

On the other hand, a slow move up the charts for the Z Score may foreshadow a price hike, one which might later turn out to be an explosive surge.