Market volatility is nothing new, but it has reached its height in recent years. This has led to a lot of hype and buzz around stablecoins, which are designed to maintain a stable value regardless of market trends. The USDT Tether token is one of the most popular stablecoins on the market, and many crypto traders have turned to it to mitigate the effects of market volatility. However, there is some controversy surrounding USDT Tether, as some have claimed it’s being used to manipulate the crypto market. Despite this, it is still among the most widely used stablecoins. Let’s deep dive into the USD Tether token — a modern take on the age-old concept.

Key Takeaways

- USDT is a stablecoin designed to maintain a 1:1 peg with the US dollar, backed by reserves including cash, U.S. Treasuries, and other assets.

- USDT is widely used for trading, secured loans, and liquidity in cryptocurrency markets, offering a stable medium of exchange.

- Despite quarterly attestations, concerns remain over the transparency of Tether’s reserves due to the absence of a full audit.

- Tether CEO Reeve Collins played a key role in establishing USDT as a major stablecoin in global markets.

- Tether has faced scrutiny over reserve transparency, market manipulation allegations, and security breaches, but remains the most widely used stablecoin.

Tether Prediction Table

Tether Historical

What is Tether (USDT)?

USDT, also known as Tether, is a cryptocurrency whose value is pegged to the US dollar — a stablecoin. A stablecoin is a type of cryptocurrency that seeks to peg its value to another asset, such as the US dollar reserves or gold. USDT was launched in 2014 by Tether Limited (Tether Ltd). USDT is backed by Tether’s reserves, which are held in various bank accounts. USDT is used to buy other cryptocurrencies as well as to provide liquidity for exchanges.

However, USDT also was at the center of controversy several times due to concerns about its reserves and transparency.

In November 2017, Tether experienced a significant security breach, resulting in the theft of around $31 million worth of USDT tokens. That year also saw Tether struggling to fulfill all withdrawal requests. Despite Tether representatives promising an audit report to verify that each USDT token is backed 1:1 by US dollars, such an audit has yet to materialize.

What Is USDT Backed by?

As of 2024, Tether (USDT) is backed by a combination of assets primarily composed of cash and cash equivalents, which account for approximately 90% of its reserves. The total reserves amount to around $110.3 billion, while the liabilities, which include digital tokens issued, make up approximately $104 billion. This results in an excess reserve of $6.3 billion, demonstrating a strong financial position.

In addition to cash and cash equivalents, Tether’s reserves also include substantial holdings in U.S. Treasuries, which exceed $90 billion. Tether has also strategically invested over $5 billion in various sectors, such as artificial intelligence, renewable energy, peer-to-peer communication, and Bitcoin mining.

Tether’s financial strength is further highlighted by a record-breaking net profit of $4.52 billion in the first quarter of 2024. This profit includes gains from investments in Bitcoin and gold, as well as operating profits from U.S. Treasury bills.

Despite the lack of a formal audit, Tether’s quarterly attestation reports, conducted by BDO, provide detailed insights into its reserves and financial health, reinforcing its commitment to transparency and stability.

How Does USDT Work?

USDT is pegged to its matching fiat currency — the US dollar. This means that each USDT Tether token is backed by an equivalent amount of cash, making it a safe investment during times of economic uncertainty. In addition, USDT can be used to purchase goods and services, with the volatility of other cryptocurrencies being out of the picture. To achieve this stability, USDT tokens are minted or burned based on demand. When more USDT tokens are needed, new tokens are minted and deposited into exchanges. When there is less demand for USDT, tokens are burned in order to reduce the supply. This matching of supply and demand helps to ensure that each Tether token remains pegged to the US dollar. As a result, USDT provides investors with a safe and stable way to store value.

Tether was first released on the Bitcoin blockchain through the Omni Layer protocol, but it can now be issued on all blockchains that support Tether. According to CoinMarketCap, as of June 2024, there are more than 10 chains doing so, including Ethereum, Ton, Omni, BNB Smart Chain, Terra Classic, Polygon, Fantom, Optimism, Tron, Bitcoin Cash, Solana, NEAR, Dogechain, Liquid Network, and many more.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

How Does Tether Stay at $1?

Tether (USDT) maintains its value around $1 through a strategic blend of financial mechanisms and market dynamics. Primarily, Tether is pegged to the U.S. dollar, with Tether Limited claiming that each USDT token is backed by an equivalent amount of U.S. dollars or assets of equivalent value. This backing fosters confidence among users that USDT’s value remains stable and consistent.

Moreover, Tether leverages arbitrage opportunities and market forces to ensure price stability. When USDT’s price deviates from $1, arbitrageurs step in. If the price drops below $1, they can buy USDT cheaply and redeem it at its nominal value, nudging the price back up. Conversely, if the price exceeds $1, they can sell it, applying downward pressure on the price.

The role of Tether Limited is crucial in regulating the supply of USDT tokens. The company adjusts the circulating supply based on market conditions by either issuing new tokens (minting) or removing tokens from circulation (burning). These actions are undertaken to align the supply with the current demand, aiding in maintaining the $1 peg.

Thus, the stability of Tether at $1 results from a careful balance of asset-backed assurance, arbitrage and market-driven price adjustments, and proactive supply management by Tether Limited.

USDT vs USD: Is USDT The Same As USD?

While USDT (Tether stablecoin) and USD (US dollar) share the same value—1 USDT is typically equal to 1 USD—they are fundamentally different in structure, usage, and oversight.

In short, while USDT mirrors the value of USD, it functions as a digital asset within crypto ecosystems, offering flexibility and efficiency. However, it carries risks tied to transparency and regulatory uncertainty, which are less of a concern with traditional USD. Both have their strengths, but they serve distinct purposes in their respective financial systems.

Controversies and Trust in USDT: Is Tether Safe?

Allegations have surfaced over the years suggesting Tether Ltd’s involvement in manipulating the price of Bitcoin. Despite these controversies and the ongoing scrutiny regarding its reserve transparency and auditing practices, USDT remains a dominant player in the stablecoin market. It continues to be one of the most widely used stablecoins on cryptocurrency exchanges, bolstering its position in the digital finance ecosystem.

Tether’s commitment to reducing riskier assets in its reserves and increasing transparency aims to strengthen trust among users and investors. However, the lack of a comprehensive audit report and the lingering doubts about its financial management practices remain points of concern for many in the cryptocurrency community.

How to Mine / Stake USDT?

Tether mining is not possible: its generation is performed only after backing with real money. This perplexes some cryptocurrency users because the idea is contrary to digital money. Nonetheless, this particular token occupies the middle ground between traditional currency and virtual assets.

USDT Crypto: Advantages & Disadvantages

One key difference between USDT and other digital assets is that USDT is backed by commercial paper. This means that there is always real collateral backing each USDT in circulation. As a result, USDT has a very low risk of default.

In addition, USDT can be quickly and easily exchanged for other currencies on crypto exchanges. And what’s more, Tether has expanded in popularity thanks to its integration into numerous different blockchains.

This makes it an ideal choice for investors who want to trade digital assets without having to worry about the volatility of the crypto market.

However, some people argue that the use of commercial paper makes USDT less transparent than other digital assets. They also point out that the USDT exchange rate is often lower than the dollar-to-bitcoin rate, meaning that users may not get as much value for their investment in USDT. Other major cons are:

- Disturbance of the global market balance due to the combination of real and virtual money;

- Accusations that the company behind the coin uses a special reservation scheme, where more tokens are made than there is real money. By doing this, Bitcoin’s exchange rate increases to control the market;

- Security problems caused by the events of November 20, 2017 — the day when Tether’s system was hacked. 30 million USDT were stolen, the creators could not get the coins back, and the security level did not improve either.

Ultimately, each investor will need to weigh the advantages and disadvantages of USDT before deciding whether or not it’s a fit for them.

Tether Tokens Compared to Other Stablecoins

When choosing between stablecoins, investors should consider their goals and risk tolerance.

USDT vs USDС (USD Coin)

There are currently two assets vying for the title of the top stablecoin — USDT (Tether) and USDC (Circle). Both aim to provide a stable cryptocurrency that is pegged to the US dollar, but there are some key differences between the two.

USDT is issued by Tether, a company that also runs the popular cryptocurrency exchange Bitfinex. USDC is issued by Circle, a financial services company backed by Goldman Sachs. One key difference between the two stablecoins is that USDT is backed by real currency assets, while USDC is backed by fiat currency deposits stored in regulated banks. This means that USDT is more susceptible to fluctuations in the value of real assets, while USDC should be more stable overall. In contrast to USDC, which is renowned for its safety and greater regulatory compliance, USDT is more frequently used for trading and payments. This makes USDT more accessible to a wider range of users. Ultimately, both stablecoins have their pros and cons, but USDT remains the most popular choice for those looking for a stable cryptocurrency.

USDT vs BUSD

BUSD is the native token of the Binance Smart Chain, a blockchain that runs in parallel with the Binance Chain. By exploiting this smart chain, users can develop decentralized applications (dApps), issue their own tokens, and use smart contracts. The transaction fees on the Binance Smart Chain are paid in BUSD, which is burned (destroyed) after each transaction. This reduces the supply of BUSD, making it a deflationary currency.

The total supply of BUSD is capped at 100 million. So far, 50 million tokens have been minted and are in circulation. The remaining 50 million will be minted over time as more transactions are made on the Binance Smart Chain.

USDT and BUSD are two popular stablecoins that have different benefits and risks.

BUSD is a stablecoin that is pegged to the US dollar, too. BUSD is 100% backed by US dollars in US banks insured by the FDIC. BUSD is available for purchase on Binance and other exchanges like Paxos. You can easily buy it on Changelly as well.

USDT is more widely available and has been around for longer, but unlike BUSD, it is not backed by an asset.

BUSD may be more volatile than USDT because it is new and can’t boast such a large availability, but it offers investors the stability that comes with being backed by an asset.

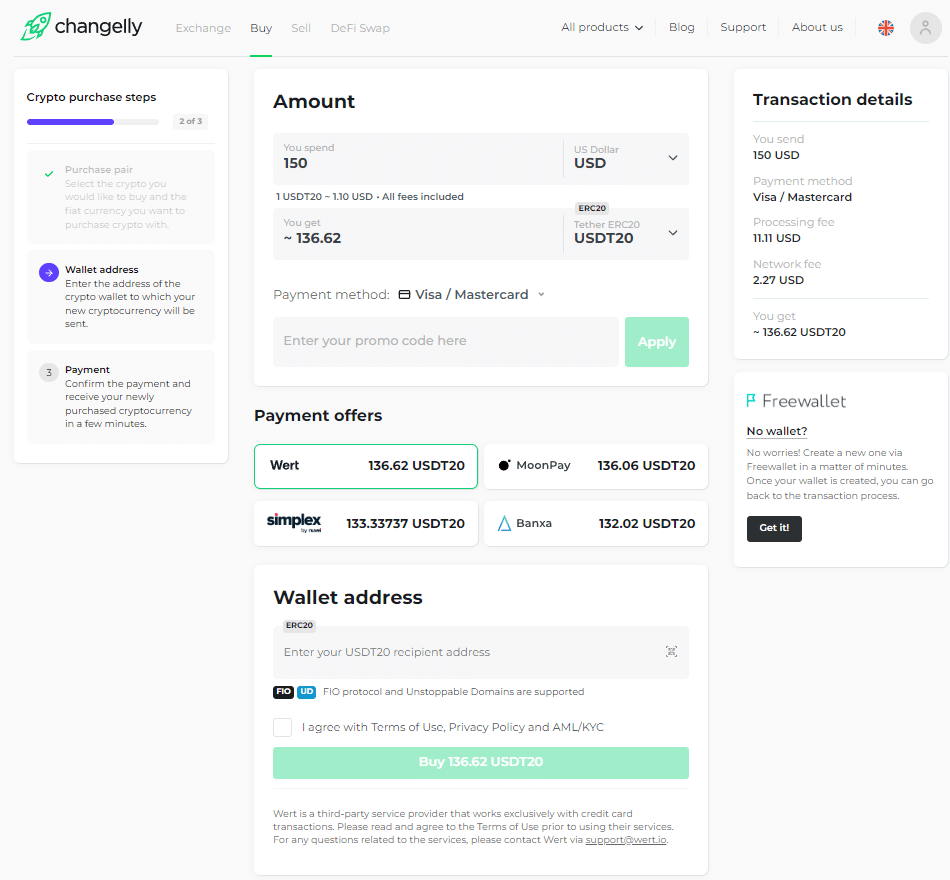

How to Buy USDT on Changelly?

Changelly made buying crypto a no-brainer! As a crypto exchange aggregator, our platform offers the best rates, instant transactions, low fees, 24/7 client support, and more perks — all garnered under a single interface!

Here’s a little instruction on how to buy USDT on Changelly.

First, open the Buy page. Select the pair of fiat currency and crypto you’d like to exchange. In our case, it is USD and USDT.

Next, select the amount you are going to spend to buy the coin in the “You spend” column. The service will automatically calculate how much crypto you will get in exchange for this amount.

Then you need to choose the payment offer you like. After that, enter your card details and your crypto wallet address to which your coins will be transferred. If you don’t have a crypto wallet yet, you can open it right away on the same page.

Cryptocurrency transactions are irreversible, so please double-check your wallet address before proceeding to the next step.

Finally, you need to confirm the payment. After a few minutes, you will receive your newly purchased cryptocurrency in your wallet.

FAQ & Everything You Need to Know

What is a stablecoin?

A stablecoin is a cryptocurrency backed by another asset that keeps the value of the coin relatively constant. The underlying asset can be gold, fiat currencies such as the US dollar or euro, or other cryptocurrencies. Stablecoins help users avoid some of the volatility found in other crypto assets while still having exposure to digital assets. This makes stablecoins attractive for both businesses and traders alike.

What is Tether used for?

Stablecoins like Tether are used by cryptocurrency traders to protect their funds from the volatility of the market and to make passive income through staking or lending. Additionally, they turn to such assets to convert investments into and out of fiat money.

Is Tether (USDT) a good investment?

Tether USDT is the largest stablecoin by market cap; it offers stability by being pegged to the US dollar. One potential benefit of investing in USDT is its ability to maintain value in less stable economies and high-inflation countries.

However, it’s important to note that USDT does not generate a return on investment, so it cannot be viewed as a traditional investment. People trade Tether for other cryptocurrencies to benefit from its stability, not to gain any ROI.

Who owns Tether?

Tether is owned by a company called Tether Holdings Limited. This company is closely associated with the cryptocurrency exchange Bitfinex, and both are operated by the same parent company, iFinex Inc. The key individuals behind Tether include Brock Pierce, Reeve Collins, and Craig Sellars, who were involved in its creation in 2014.

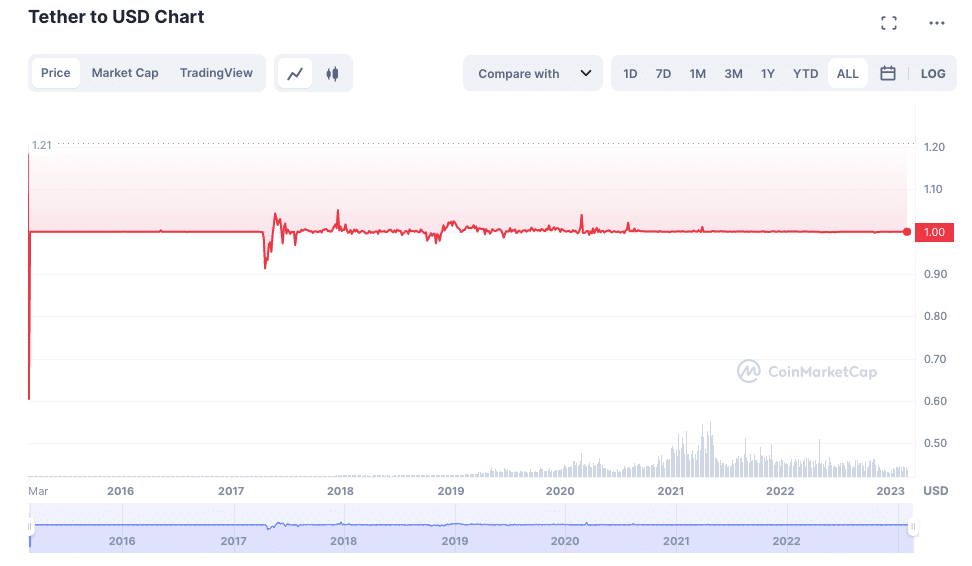

Is Tether always $1?

Tether is pegged to the dollar by design, so in theory, one Tether should always be worth $1. In practice, however, there can be discrepancies in the exchange rate as it fluctuates across different markets and exchanges. For example, if one exchange is offering more favorable rates than another, the price of Tether could temporarily rise or fall below its $1 peg until it resolves into equilibrium.

How do I convert USDT to cash?

You can use Changelly’s Sell page to exchange your Tether coins for US dollars or euros.

How does Tether make money?

Centralized stablecoins like Tether (USDT) generate income in a number of different ways.

Short-term loans and investing are two of the most common ways stablecoin businesses generate revenue. This approach is similar to how a bank runs: it lends out the money that clients deposit in savings accounts. The $1 billion loan made by Tether to Celsius Network in October 2021 is a clear illustration of this concept.

The issuance and redemption payments charged by centralized stablecoins generate income as well. Tether charges a redemption fee of 0.1%. However, to prevent minor redemptions, Tether charges a $1,000 minimum withdrawal fee.

Is Tether the same as Ethereum?

No, these two are completely different cryptos.

Is USDT a token or a coin?

USDT is a stablecoin that is pegged to the US dollar, but technically, it is a token. The USDT token was originally issued on the Bitcoin blockchain, but currently, it can be issued on any of the 50+ chains that support USDT.

How much is the USDT token?

Unlike other cryptocurrencies that fluctuate in value, USDT (Tether) price remains stable at $1.

What is the future of the USDT (Tether) coin?

The aim of USDT is to provide a stable alternative to traditional fiat currencies in the digital currency space. When you buy Tether, you are effectively buying a promise from the company that you can redeem your tokens for USD at any time. This gives the token its value and stability. USDT can be used to purchase goods and services, or it can be traded on digital currency exchanges. Unlike other digital currencies, which are often subject to volatility, USDT remains pegged to the US dollar, making it a more stable option for those looking to trade or use digital currencies. As the adoption of digital currencies grows, USDT is likely to become an increasingly popular option for those looking for a stable digital currency.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.