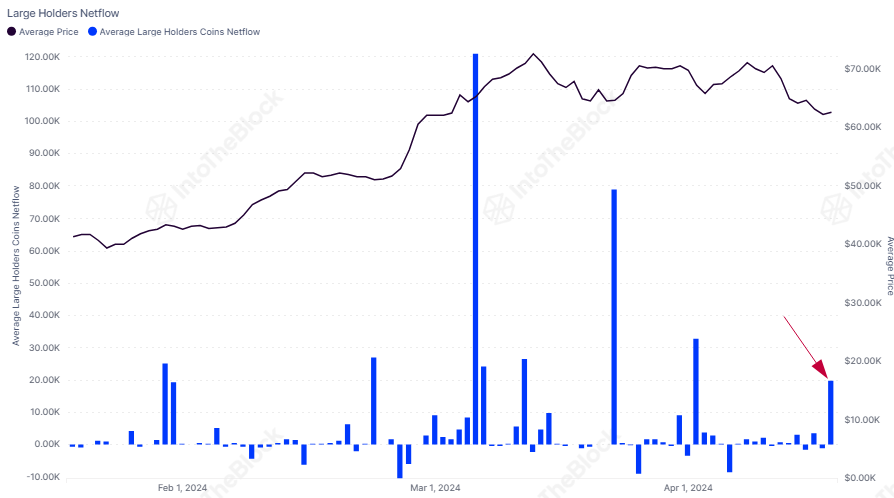

Bitcoin whales gobbled up more than $1 billion worth of BTC amid the top crypto asset’s price dip on Thursday, according to the crypto analytics firm IntoTheBlock.

IntoTheBlock notes that whales holding more than 0.1% of the total BTC supply collectively accumulated 19,760 Bitcoins worth $1.235 billion, at an average price of $62,500 per coin.

Explains the firm,

“Historically, accumulations by these addresses have often preceded rises in Bitcoin’s price.”

IntoTheBlock also notes that miners’ BTC holdings hit a 12-year low going into the halving on Friday night, indicating that miners have been net sellers leading up to the event, which slashed Bitcoin’s block rewards from 6.25 BTC ($398,134) to 3.125 BTC ($199,067).

The analytics firm also analyzes the historical price impact of Bitcoin halvings.

“This chart shows BTC price performance after each Bitcoin halving. Typically, a bullish trend emerges, lasting approximately one year after each halving.”

IntoTheBlock notes that $180 million worth of Bitcoin left centralized exchanges this week, making it six consecutive weeks of net outflows for the top crypto asset.

Bitcoin is trading at $63,921 at time of writing.

IntoTheBlock also notes that $0.5 billion worth of Ethereum (ETH) was withdrawn from centralized exchanges this week, the highest amount since February.

Ethereum is trading at $3,057 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney