- Whale transactions have steadily risen since Bitcoin halving.

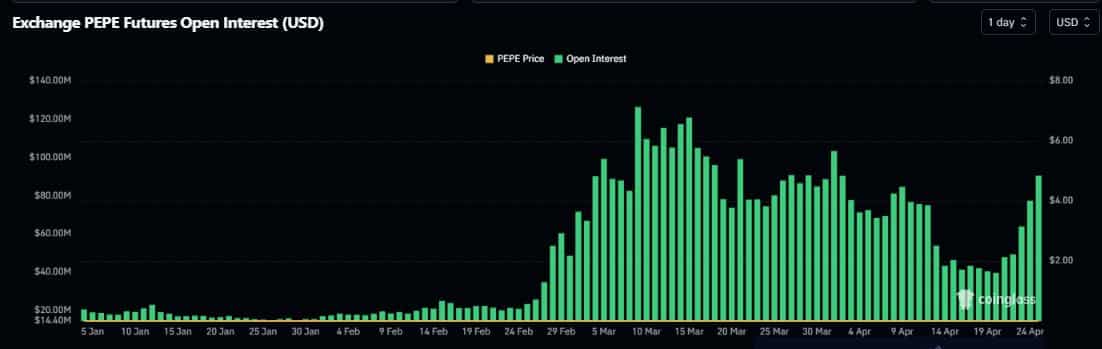

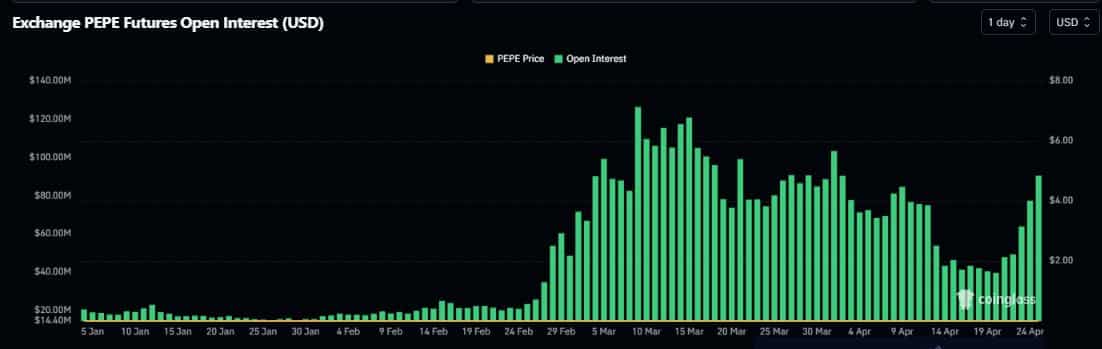

- The OI in PEPE futures more than doubled to $90 million since halving.

Frog-themed token Pepe [PEPE] was getting picked up in huge quantities lately.

Whales set their eyes on PEPE

According to on-chain tracking platform Spot On Chain, a whale stockpiled a whopping 211.6 billion PEPE tokens, worth $1.6 million at prevailing prices, over the last 24 hours, as the meme coin soared more than 15% in value.

The wealthy investor purchased the tokens from Binance [BNB], Gate.io, and decentralized exchange Uniswap [UNI].

The purchase cost them an estimated $1.54 million, resulting in an unrealized profit of nearly 4% as of this writing.

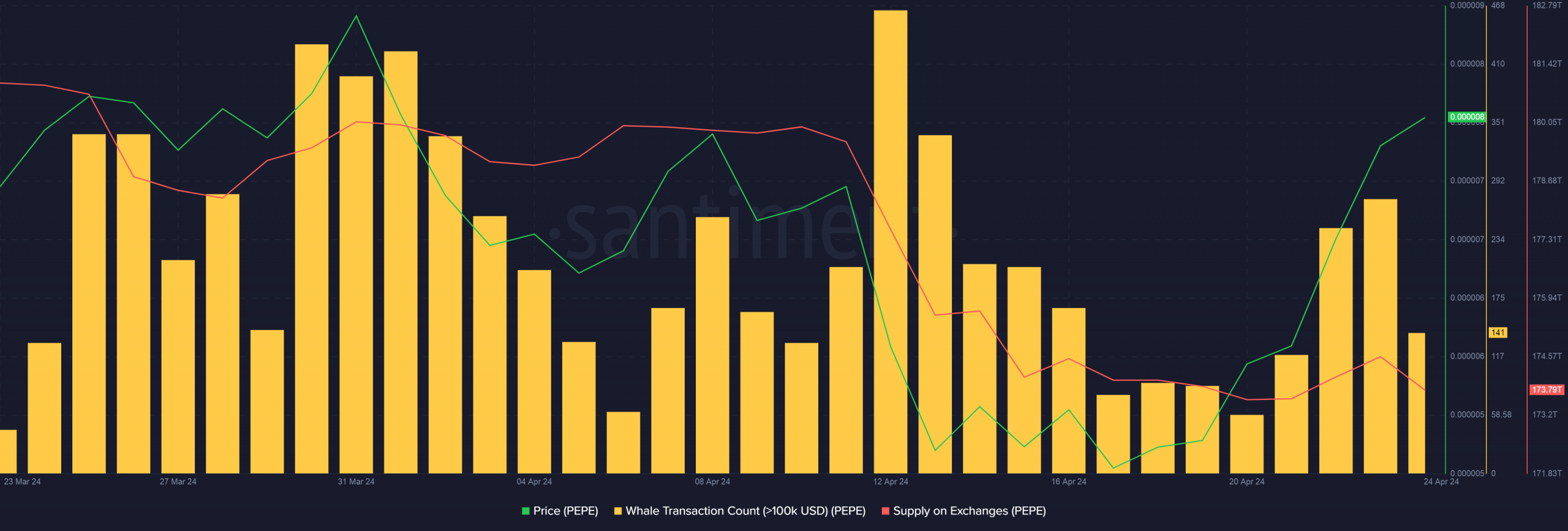

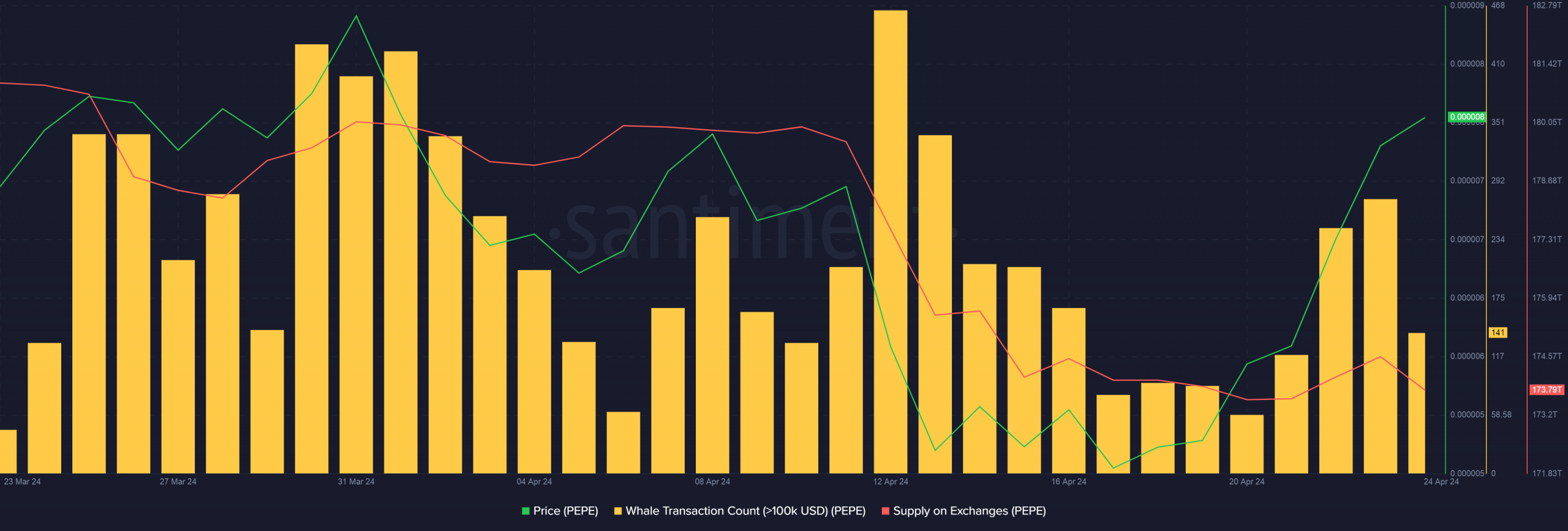

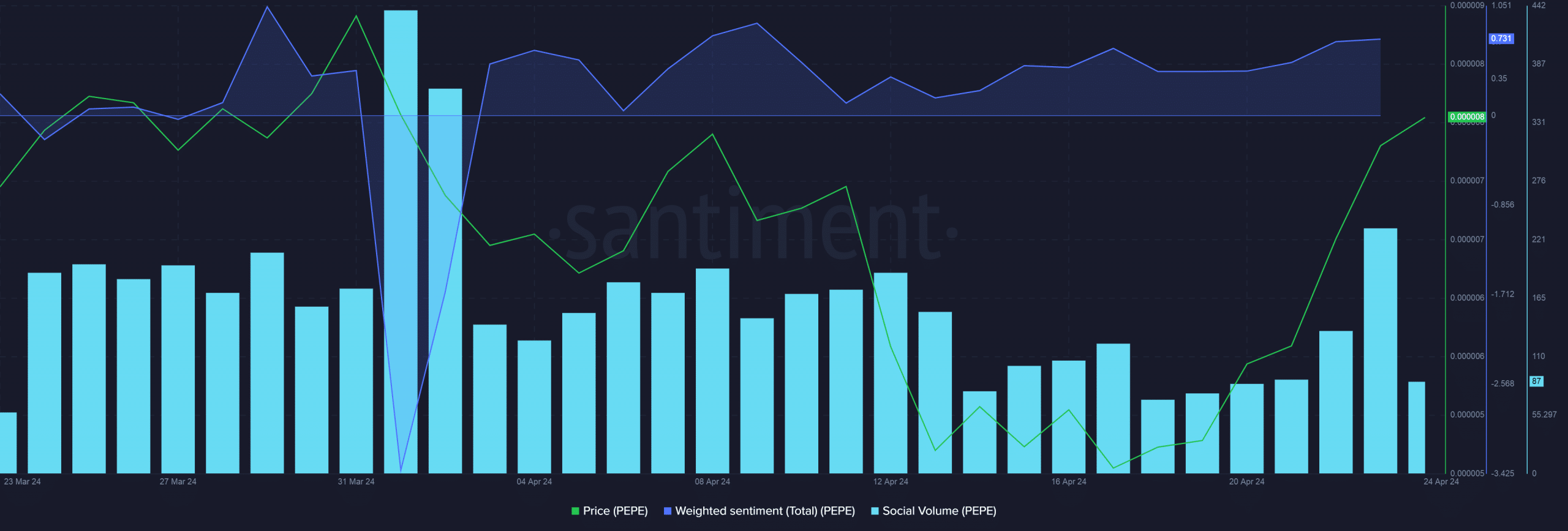

Whales have become active since Bitcoin [BTC] halving. According to AMBCrypto’s analysis of Santiment’s data, large transactions exceeding $100,000 have steadily risen since the pivotal event.

Moreover, after an initial burst, PEPE supply on exchanges began to drop, suggesting that investors were looking to HODL the meme coin.

Source: Santiment

Traders positions for PEPE’s rise

The price rally was also accompanied by surge in speculative interest for PEPE.

The Open Interest (OI), or the money invested in unsettled PEPE futures contracts, more than doubled in the last four days to $90 million, as per AMBCrypto’s analysis of Coinglass’ data.

An increase in price, followed by an increase in OI, typically confirms the uptrend.

Source: Coinglass

Additionally, the number of traders taking long positions for PEPE exceeded those shorting the coin in the last 24 hours, as per the Long/Short Ratio. This suggested a pivot towards bullish sentiment.

Read Pepe’s [PEPE] Price Prediction 2024-25

Positive talk around PEPE increases

The price pump also boosted PEPE’s social activity. The number of mentions of the coin in top crypto-focused social channels reached a 3-week high on the 23rd of April.

Most of the social commentary was positive, as evidenced by the positive Weighted Sentiment indicator. This meant that the public looked towards PEPE with optimism.

Source: Santiment