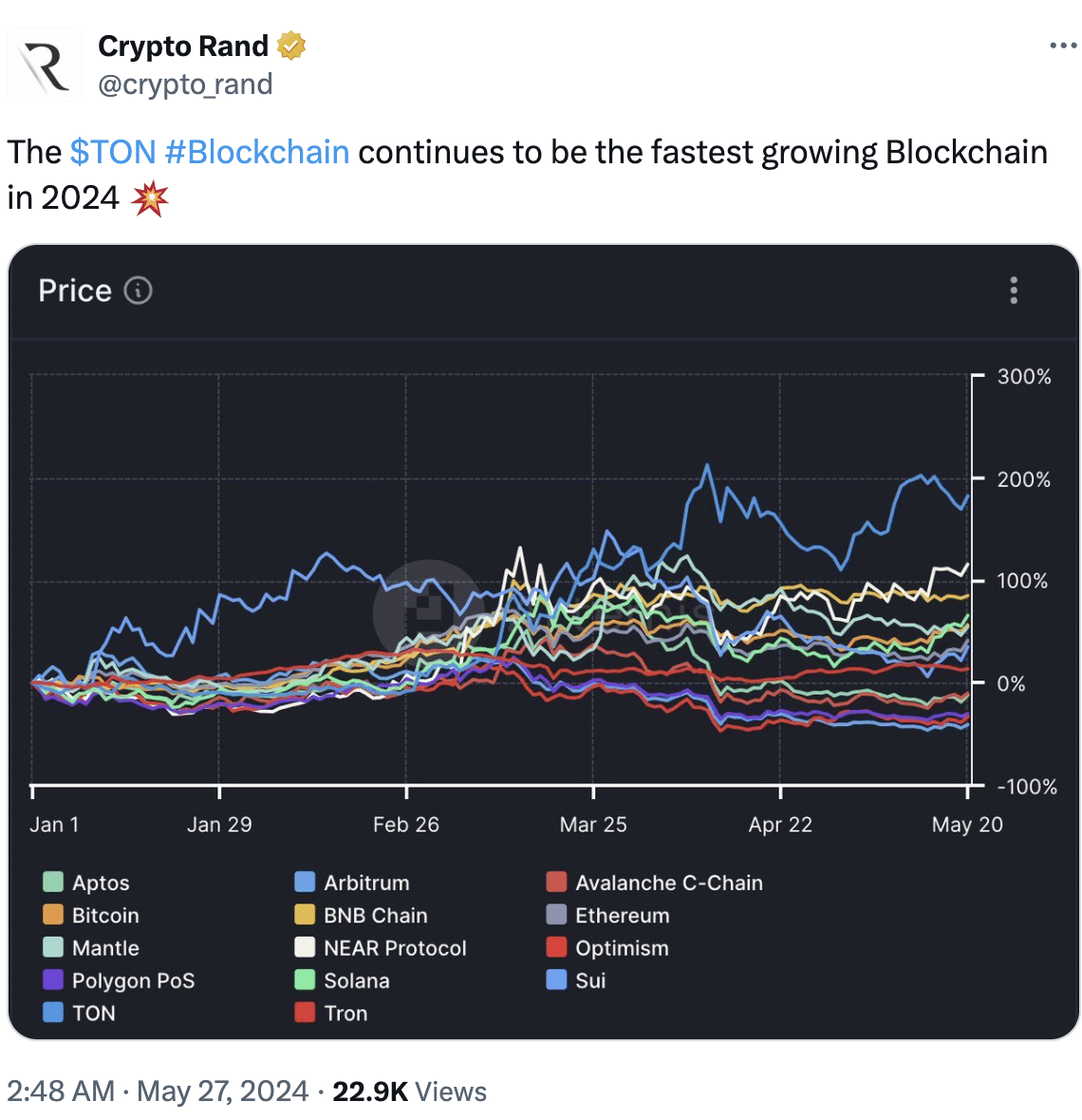

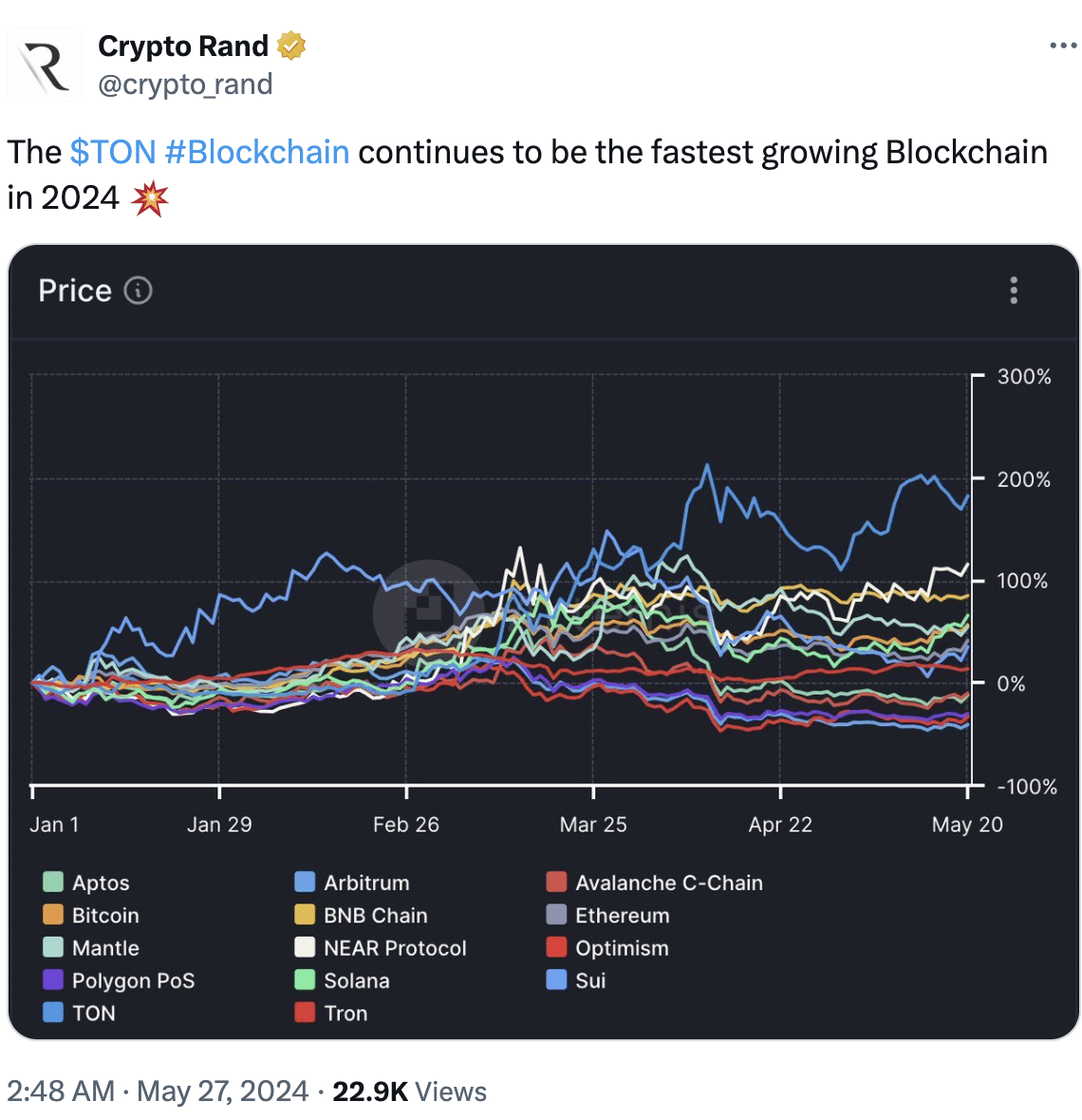

- TON outperformed a large number of tokens in terms of price growth in 2024.

- However, activity on the network continued to decline.

Toncoin [TON] network has been one of the dark horses of the cryptocurrency sector in the recent bull run.

The TON token gained massively from the popularity of its network, causing it to outperform all other tokens in terms of price growth in 2024.

Source: X

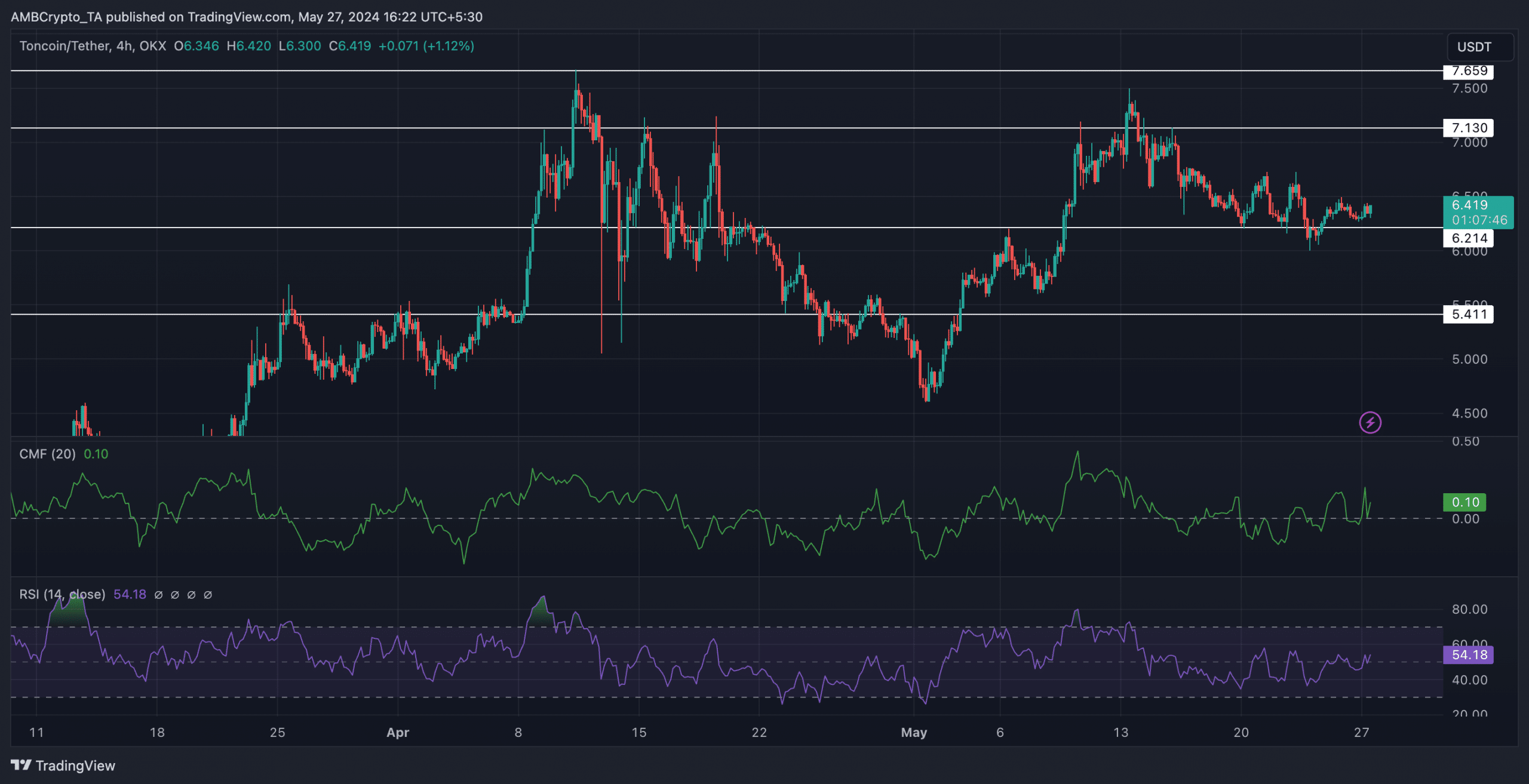

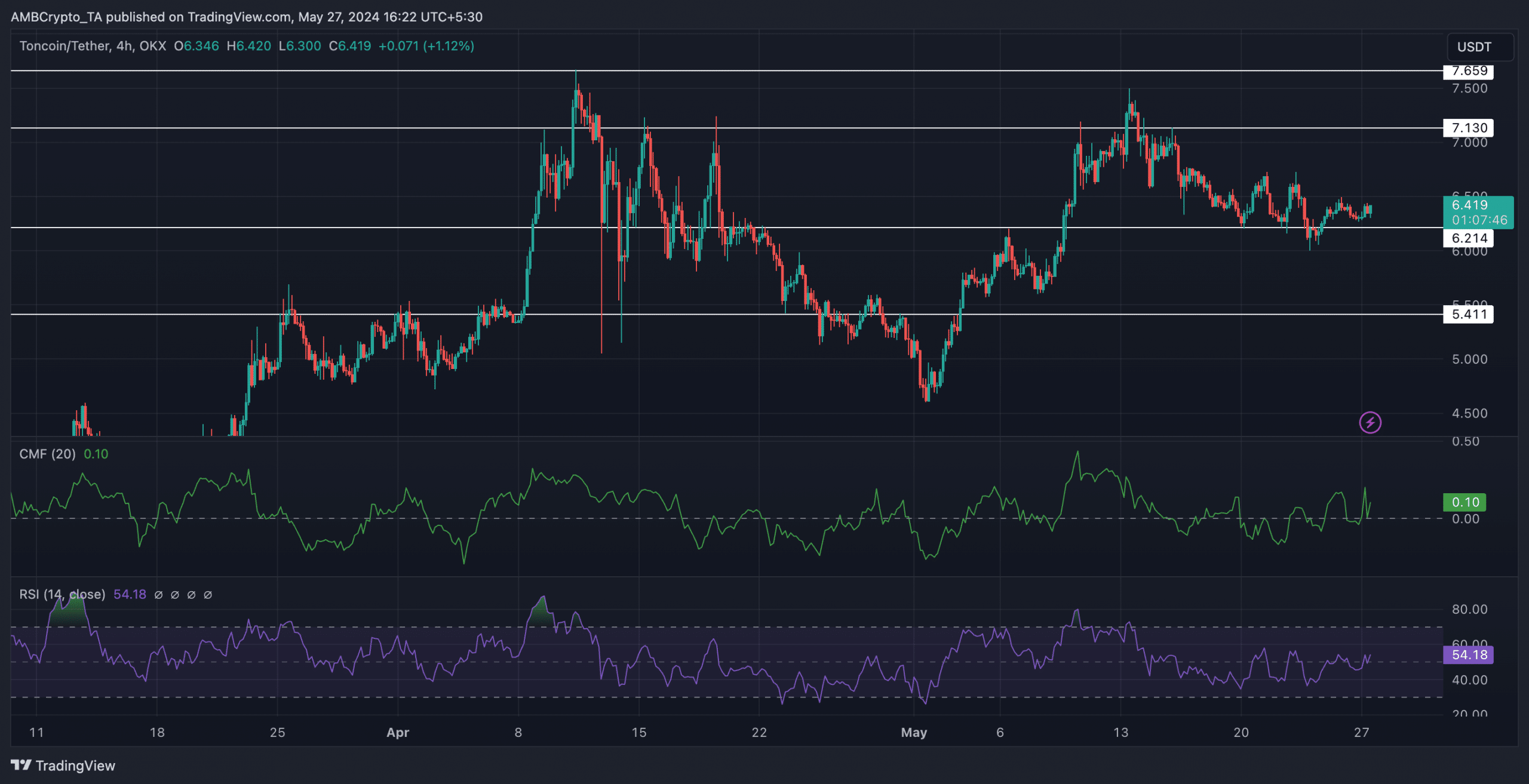

Looking at the price

At press time, TON was trading at $6.40 and its price surged by 1.38% in the last 24 hours. Since the 11th of April, the price of TON moved sideways without showing any trend favoring either the bears or the bulls.

After testing the $7.659 level, the price of TON fell by 19.16%. TON spent the most time between the $71.30 and $5.411 levels during this period.

For TON to establish a significant bullish trend, it would have to retest the $7.659 level and push past it in the future.

A significant amount of bullish momentum would be required from TON for this to be achieved.

At press time, the RSI (Relative Strength Index) for TON coin had grown to 54.31 implying that there was some level of bullish momentum supporting TON, but it wasn’t material enough to cause a significant price change.

The CMF (Chaikin Money Flow) also surged to 0.10 implying that the money flowing into TON had risen.

Source: Trading View

Another factor that could impact TON’s price trajectory would be the appeal of the token to new users.

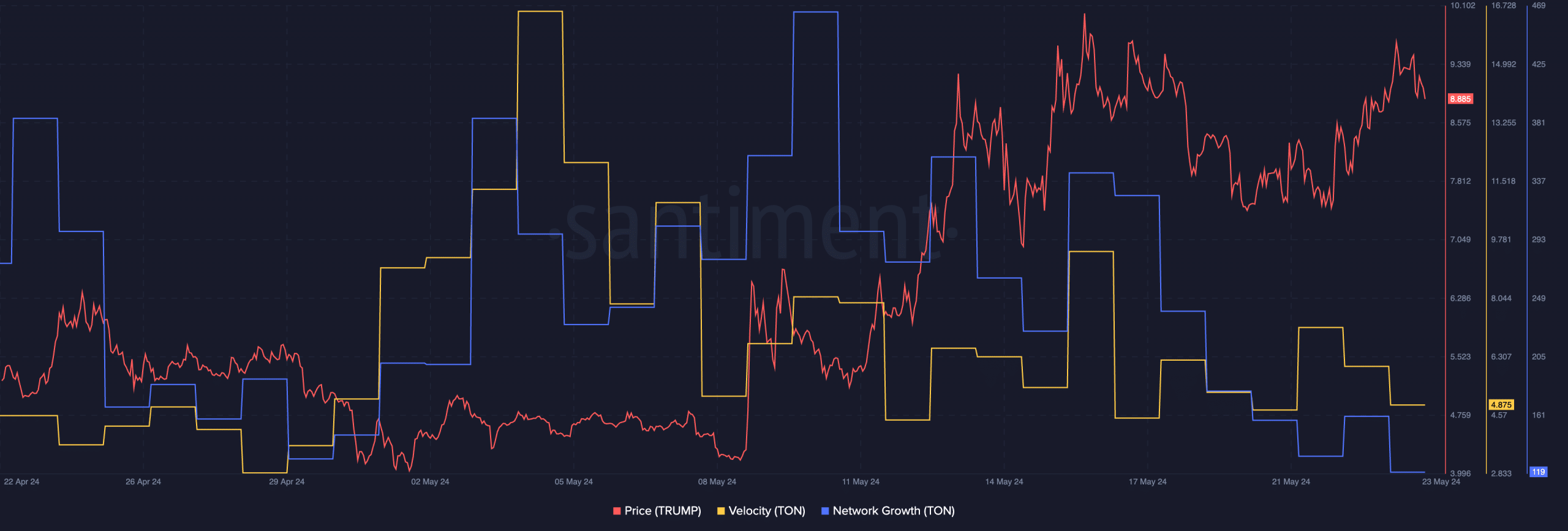

AMBCrypto’s analysis of Santiment’s data indicated a declining network growth, implying that new addresses were not interacting with TON as much as they were before.

Coupled with that, the velocity at which the token was being traded also fell, implying lower frequency of TON trades.

These factors could act as hurdles for TON’s rally in the future.

Source: Santiment

Is your portfolio green? Check the Toncoin Profit Calculator

Network status

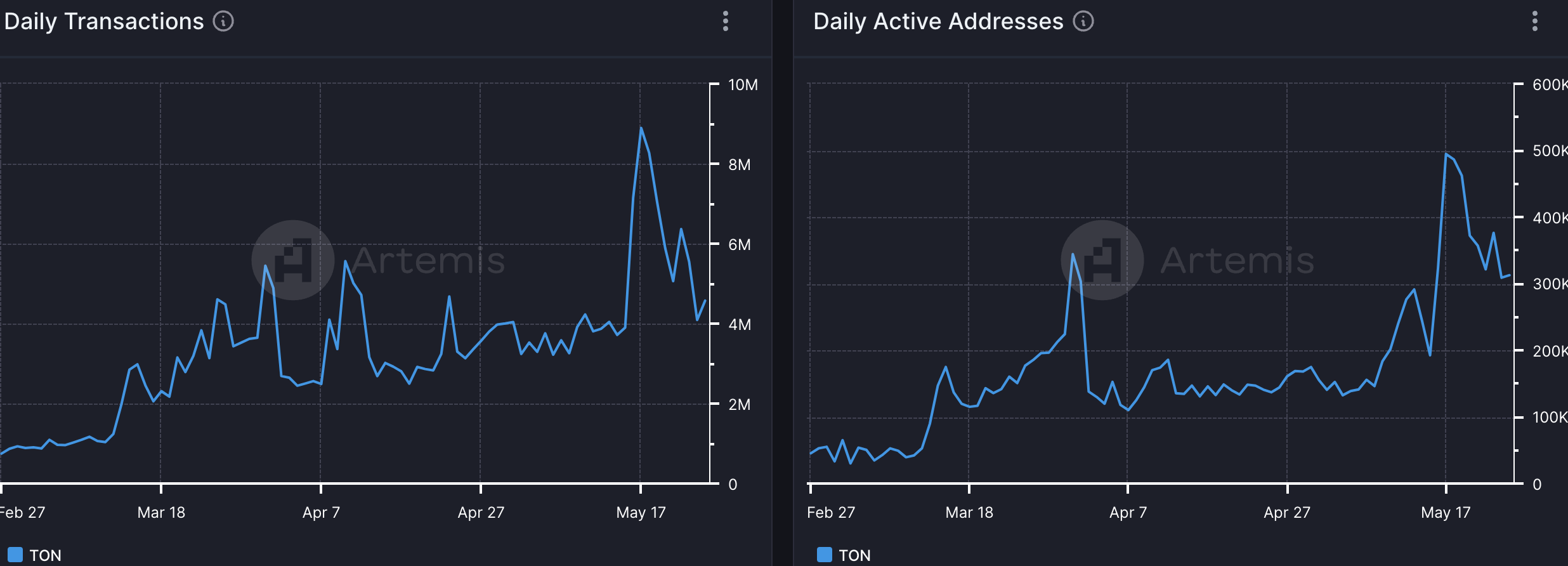

Another factor that can influence the price dynamics of TON would be the state of the network. AMBCrypto’s examination of Artemis’ data revealed that activity on the TON network plummeted in the last few days.

The number of transactions occurring on the network had fallen from 8.2 million to 4.3 million. Coupled with that, the number of daily active addresses on the network fell from 500,000 to 320,000.

Source: Artemis