A widely followed crypto strategist says Bitcoin (BTC) may repeat a historic pattern that could send altcoins soaring.

Analyst Justin Bennett tells his 111,500 followers on the social media platform X that Ethereum (ETH) and other alts could outperform Bitcoin similar to 2021 when people suddenly sold their coins over a two-month period.

“If Bitcoin does anything close to this, altcoins could set up for one hell of a run in March-April. ETH rallied 182% in just 48 days during the April-May 2021 BTC top. The time to load up is coming, but we aren’t there yet, in my opinion.”

Looking at his weekly chart, the trader suggests ETH/BTC may repeat a massive rally and soar to 0.15636 BTC, a value of $8,062 at time of writing.

ETH/BTC is trading for 0.05773 BTC ($2,980) at time of writing, up more than 1% in the last 24 hours.

The trader says that if ETH/BTC only returns to its 2021-22 high of 0.08597 BTC, ETH would return to around its all-time high of $4,878, as long as Bitcoin remains in the $50,000 range.

“The crazy thing is that even if ETH/BTC only reaches back to its 2021/2022 high, it would put ETH at its ATH, as long as BTC can maintain these $50,000 levels. A lot of speculation still, but that’s what makes a market.”

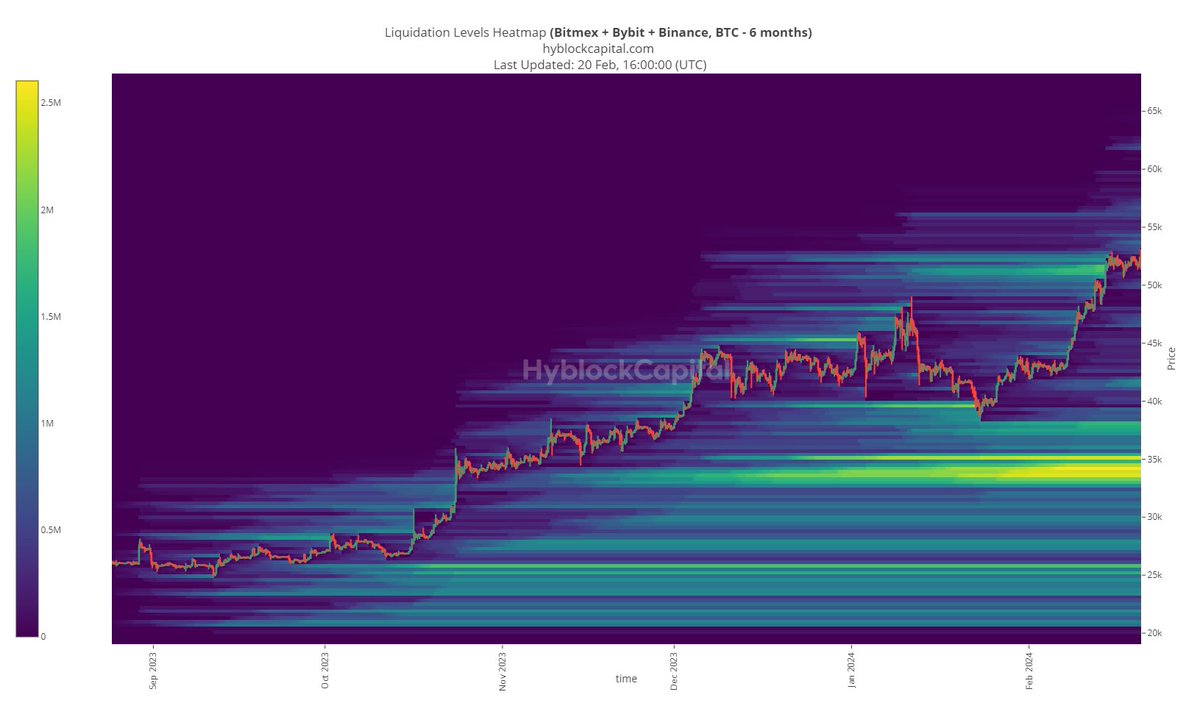

Bennett also thinks that there remains a possibility that Bitcoin could decline to the $30,000 range based on the liquidation heat map, which is used in technical analysis to predict the price levels at which large-scale liquidation events may occur and to identify key support levels.

“Why might BTC target $30,000-$35,000? This (chart map below):”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3