RWA tokenization example

On the 1st, US asset management company Superstate announced the financial product “Superstate Short Duration US Government Securities Fund (USTB)”, which is a tokenized fund.

USTB operates using the blockchain of the crypto asset (virtual currency) Ethereum (ETH) and is only available to eligible purchasers in the United States. He explained that this financial product is the first step toward ultimately launching a regulatory-approved public fund on multiple public blockchains.

Superstate is working to modernize investing by leveraging blockchain technology to tokenize the world’s assets. Last November, the company announced that it had raised $14 million in Series A funding to develop an on-chain fund accessible to U.S. investors.

connection: RWA tokenization Superstate raises approximately 2.1 billion yen

USTB invests in short-term U.S. government bonds and government agency bonds. The investment target is the federal funds rate (currently 5.25-5.5%). The fund’s fee is 0.15%.

connection: Chairman Powell denies possibility of March interest rate cut at FOMC meeting | 1st Financial Tankan

Purchases and redemptions are actually made in US dollars, but the stablecoin “USDC” is used to facilitate transactions. He also explained that there are plans to allow P2P-style transactions in the future, subject to certain restrictions.

USTB custody has been made flexible. Investors can choose self-custody, where they manage their own blockchain addresses, or use Anchorage Digital or BitGo as custodians.

Superstate CEO Robert Leshner told CoinDesk that he hasn’t decided on his next strategy, but is considering offering a fund that tracks the Nasdaq and S&P 500 indexes, as well as a fund that tracks the price of gold. It is revealed that there is.

RWA market growth

Financial products that tokenize investment opportunities in real assets (RWA), such as USTB, are attracting attention as blockchain use cases. For example, last month Binance listed RWA tokenization as one of the areas where it expects to see significant progress over the next year.

connection: Growth areas of the virtual currency market that Binance will focus on in 2024, such as the Bitcoin ecosystem and DePIN

What is RWA?

Abbreviation for “Real World Asset.” RWA that is tokenized on the blockchain includes real assets such as real estate, artwork, trading cards, and securities such as stocks and bonds.

connection:Why investors are interested in real asset tokenization and what is Real World Assets (RWA)?

The government bond tokenization market is in particular demand as interest rates rise in the United States. According to data from “rwa.xyz”, the market size for tokenized government bonds is 860 million dollars (126 billion yen). As shown in the graph below, the market has continued to grow since January last year.

Source: rwa.xyz

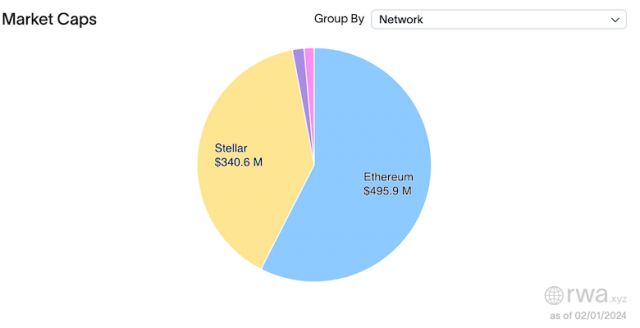

Ethereum has over 50% share of the blockchain in use, followed by Stellar (XLM). This is followed by Polygon (MATIC) and Solana (SOL).

Source: rwa.xyz

connection: Taiwan central bank highlights the benefits of CBDC and real asset tokenization (RWA)