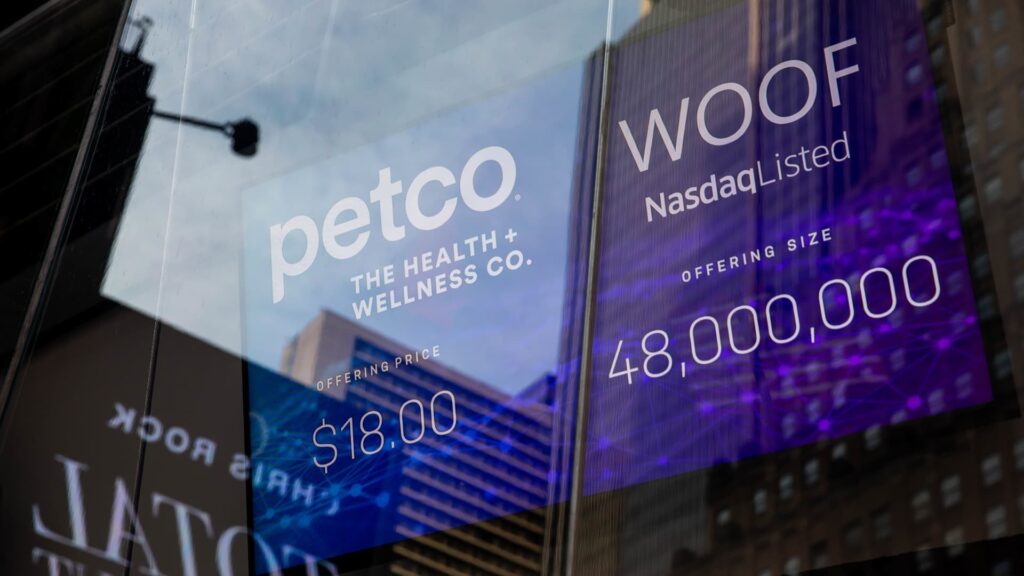

See the companies making headlines in midday trading. Cryptocurrency stocks. Stocks whose returns are tied to the price of bitcoin rose as the cryptocurrency hit a new record for the third day in a row. Cryptocurrency exchange Coinbase was up about 3%, and Bitcoin proxy MicroStrategy was up almost 10%. In the cryptocurrency mining sector, Marathon Digital, Riot Platforms and Iris Energy added more than 2%. CleanSpark jumped about 7%. Texas Roadhouse. The restaurant chain gained nearly 3% as it improved to match Baird’s performance. The company said the Kentucky-based chain should be able to continue growing even though it is near all-time highs. Moelis & Co. — Shares rose nearly 4% after Goldman Sachs upgraded the investment bank to neutral from sell and said it was a “large beneficiary of the start of a cyclical upturn” after earnings fell. Tesla – Shares fell 3.5% after Wells Fargo downgraded the electric vehicle maker to underweight from equal weight, noting “a risk to volume as price cuts have a diminishing impact.” Nvidia, Advanced Micro Devices, Micron Technology — Shares of chip makers fell Wednesday as the artificial intelligence rally continued to fade this week. NVIDIA shares fell 3%. Micron shares fell 3.8% and AMD shares fell 4.2%. Dollar Tree — Shares of the discount retailer fell more than 13% after a disappointing quarterly report. Dollar Tree reported adjusted earnings of $2.55 per share on revenue of $8.64 billion for the fourth quarter. Analysts polled by LSEG, formerly known as Refinitiv, had forecast $2.65 per share on revenue of $8.67 billion. The company also announced that it has identified 970 of its Family Dollar locations that may be closed. Dollar General — Shares of the discount retailer fell 3% after rival Dollar Tree’s quarterly results were worse than expected. Dollar General is set to release earnings on Thursday before the market opens. It’s up more than 14% this year. GE HealthCare — Shares fell 3% after the health care company announced a secondary offering of 13 million shares. GE HealthCare Technologies was spun off from General Electric in early 2023. Legend Biotech – Shares gained 4.6% after Raymond James initiated coverage of the commercial biotech company with an Overweight rating. The firm is bullish on Legend Biotech’s Carvykti therapy, which treats multiple myeloma. Royal Caribbean, Carnival — Shares of both cruise line operators rose after Goldman Sachs initiated buy rating coverage on the shares, saying it sees pricing power and pent-up demand for cruise shares. Royal Caribbean shares rose about 2%, while Carnival’s share price jumped 3.3%. Petco Health and Wellness — Shares fell 6% after the failing pet store announced it was looking for a new CEO. The company reported higher fourth-quarter revenue on Wednesday, posting adjusted earnings per share of 2 cents on revenue of $1.67 billion. Analysts had expected earnings of 2 cents per share on revenue of $1.62 billion per LSEG. — CNBC’s Alex Harring, Brian Evans, Samantha Subin, Yoon Lee, Lisa Kailai Han, Pia Singh and Michelle Fox contributed reporting.