After a significant breakout above $138, it appears that crypto whales are making big bets on Solana (SOL) and are currently on a buying spree. On September 14, 2024, the on-chain analytic firm Lookonchain made a post on X (previously Twitter) that a crypto whale had purchased a significant 10,000 SOL, worth $1.37 million from Binance and staked it.

Crypto Whale Buys $1.37M of Solana

The post on X also noted that this whale had bought and staked a massive 50,000 SOL, worth $6.85 million. Additionally, it received a reward of over 174 SOL, worth $23,700.

Solana Price Momentum

Despite this massive purchase, it appears that SOL may potentially retest its breakout level to confirm the successful breakout. At press time, SOL is trading is trading near $137 and has experienced a price surge of over 3.75% in the last 24 hours. During the same period, its trading volume increased by 20%, indicating higher participation from traders and investors following the breakout.

Solana Technical Analysis and Upcoming Levels

According to the expert technical analysis, SOL appears bullish and is currently facing strong resistance from the 200 Exponential Moving Average (EMA) on the daily time frame. At present, it is crucial for SOL to close a daily candle above the 200 EMA to trigger a significant upside rally.

If SOL closes its daily candle above $140, there is a strong possibility that it could soar by 18% to the $165 level and further to the $185 if bullish sentiment persists. However, this bullish thesis will only hold if SOL closes the daily candle above the $140 level, otherwise, it may fail.

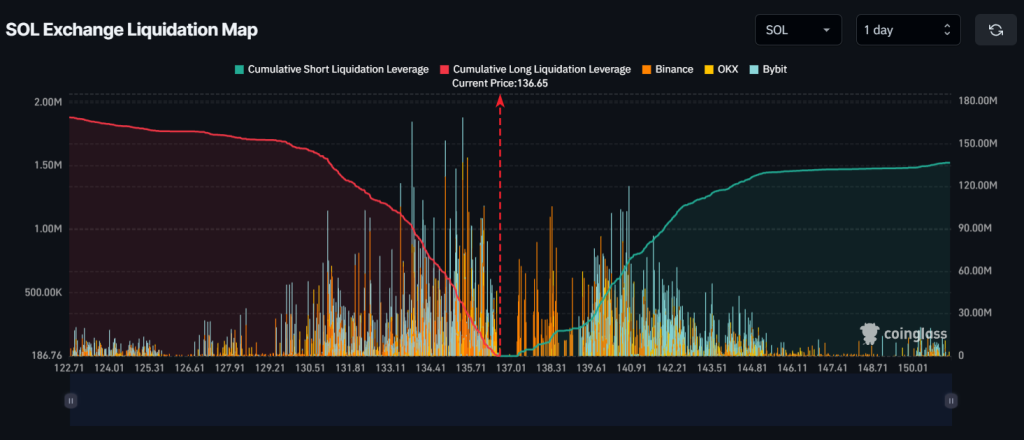

Major Liquidation levels

Currently, the major liquidation levels are near $135 on the lower side and $140.81 on the upper side. Traders are over-leverage at these levels, according to the coinglass Data.

If the market sentiment remains bullish and the price rises to the $140.81 level, nearly $65 million worth of short positions will be liquidated. Conversely, if the market sentiment shifts and the price falls to the $135 level, approximately $38.5 million worth of long positions will be liquidated.

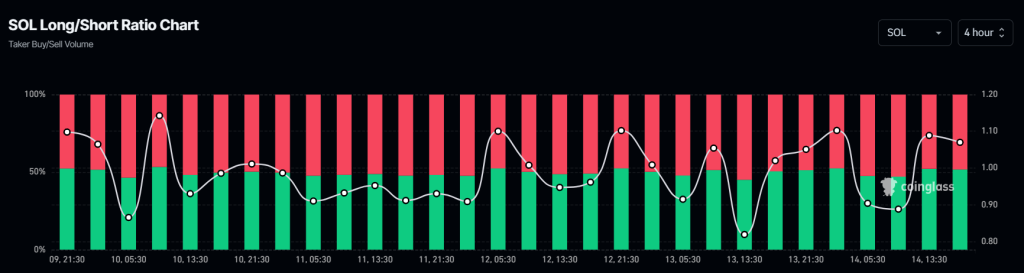

Traders’ Bullish Market Sentiment

In addition, SOL’s Long/Short ratio currently stands at 1.0695, indicating traders’ bullish market sentiment. Traders and investors use this ratio to determine whether an asset is bullish and help them decide whether to build long or short positions. A value above 1 suggests bullish market sentiment, while a value below 1 indicates bearish sentiment.

The data also highlights that currently, Solana’s 52.68% of top traders hold long positions, while 48.32% hold short positions.