- The presence of MEV bots on the Solana network grew materially.

- Interest in NFTs fell while overall sentiment declined.

Over the last few months, activity on the Solana [SOL] network has surged. This surge in activity, could be partly attributed to the overall interest in memecoins on the network.

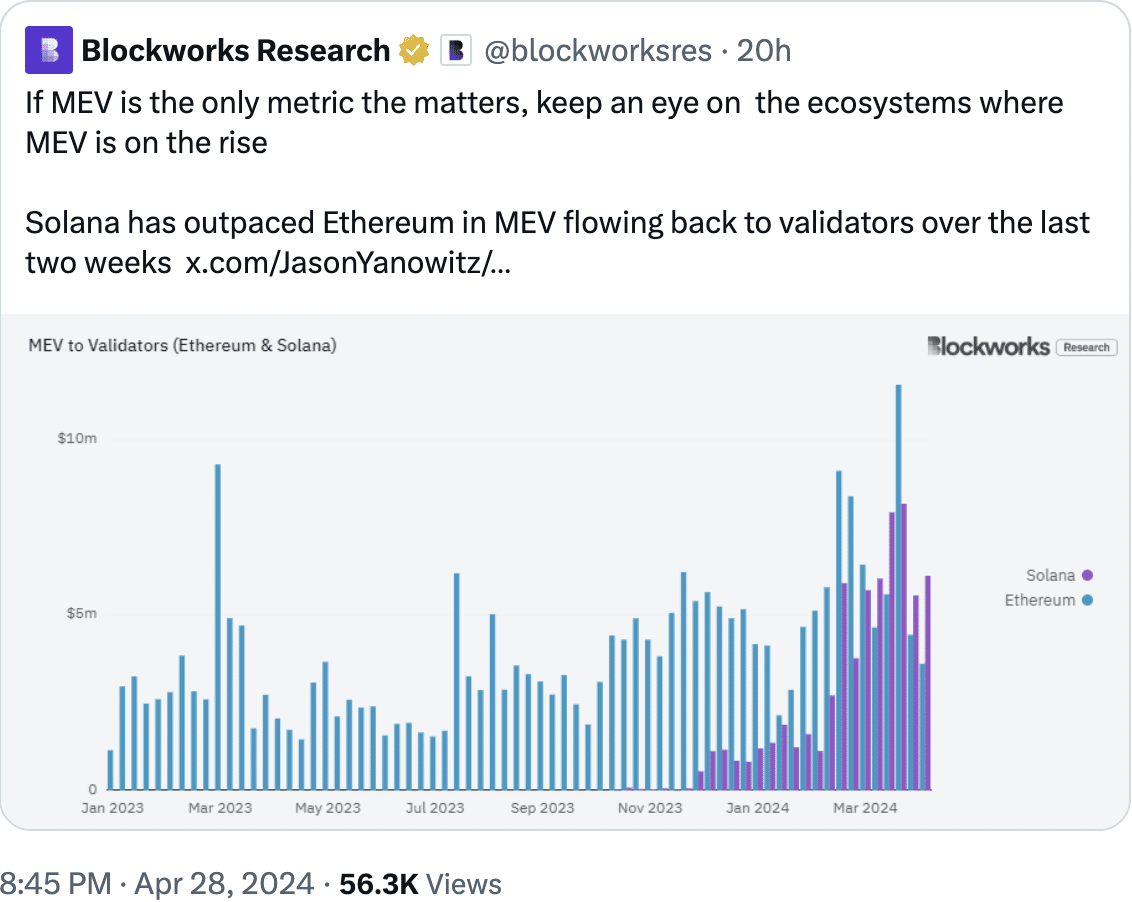

MEV bots take over

However, a large part of this activity was driven by MEV bots. According to new data, Solana outpaced Ethereum in MEV flowing back to validators over the last two weeks.

MEV bots are software programs that scan blockchains for profitable opportunities related to transaction ordering. They can exploit things like arbitrage which is buying low, and selling high on different exchanges.

They are also responsible for frontrunning which is when these bots insert their transactions before another user to manipulate prices and make a profit.

Source: X

Even though high MEV bot activity is a sign of a growing ecosystem, it does come with some problems. High MEV activity can negatively impact the experience of any user, which can cause a decline in activity and sentiment around a protocol over time.

Active efforts would be needed from the network to reduce this to make it a better experience for users.

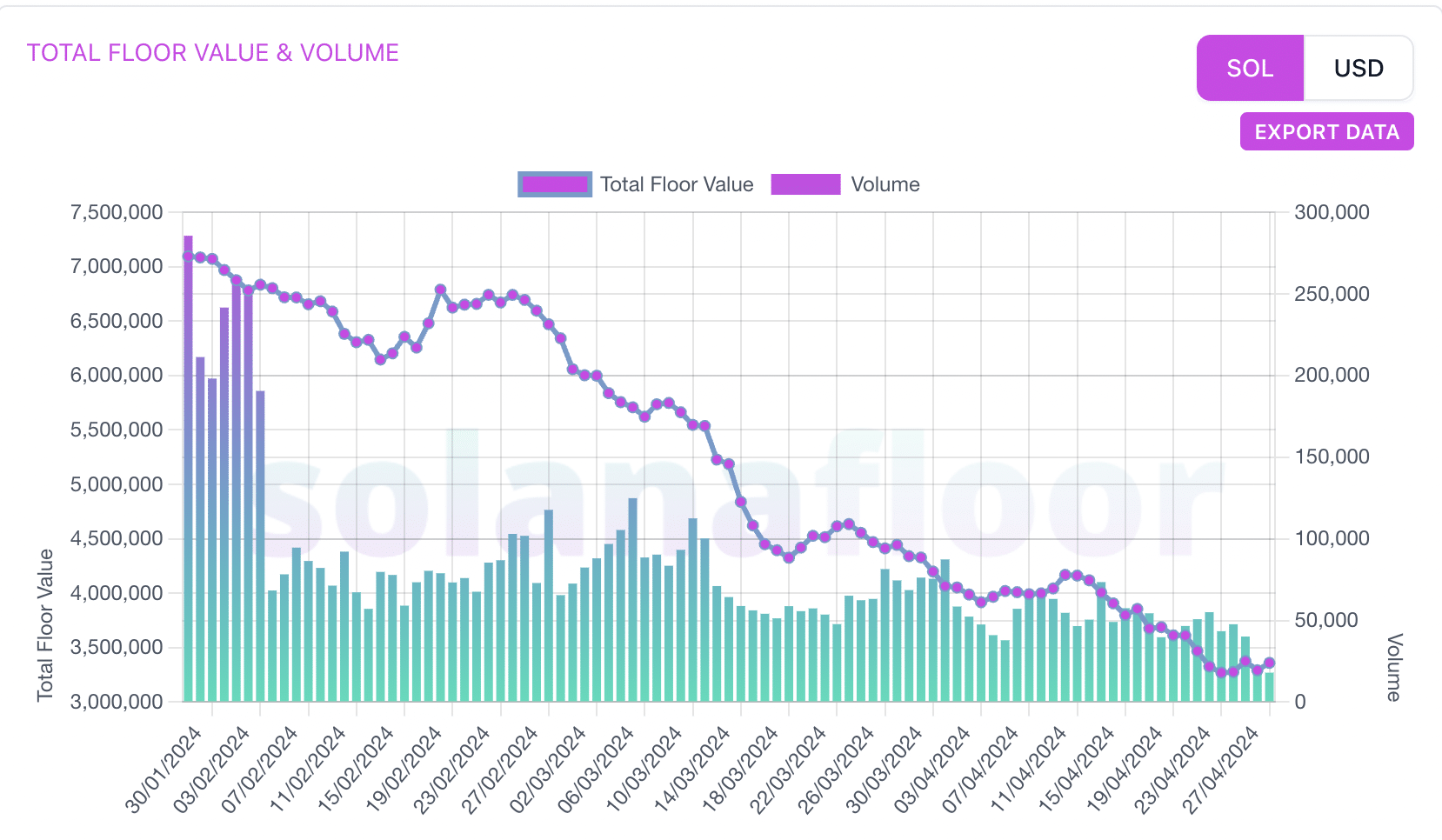

Another factor that could impact sentiment around the Solana network would be the interest in its NFT sector. Over the last month, the trading volume for Solana NFTs had declined significantly.

Coupled with that, the total floor value for the Solana NFTs also declined significantly.

Source: Solana Floor

Solana would need to attract more users to its NFTs to improve the overall health of the ecosystem.

A decline in sentiment

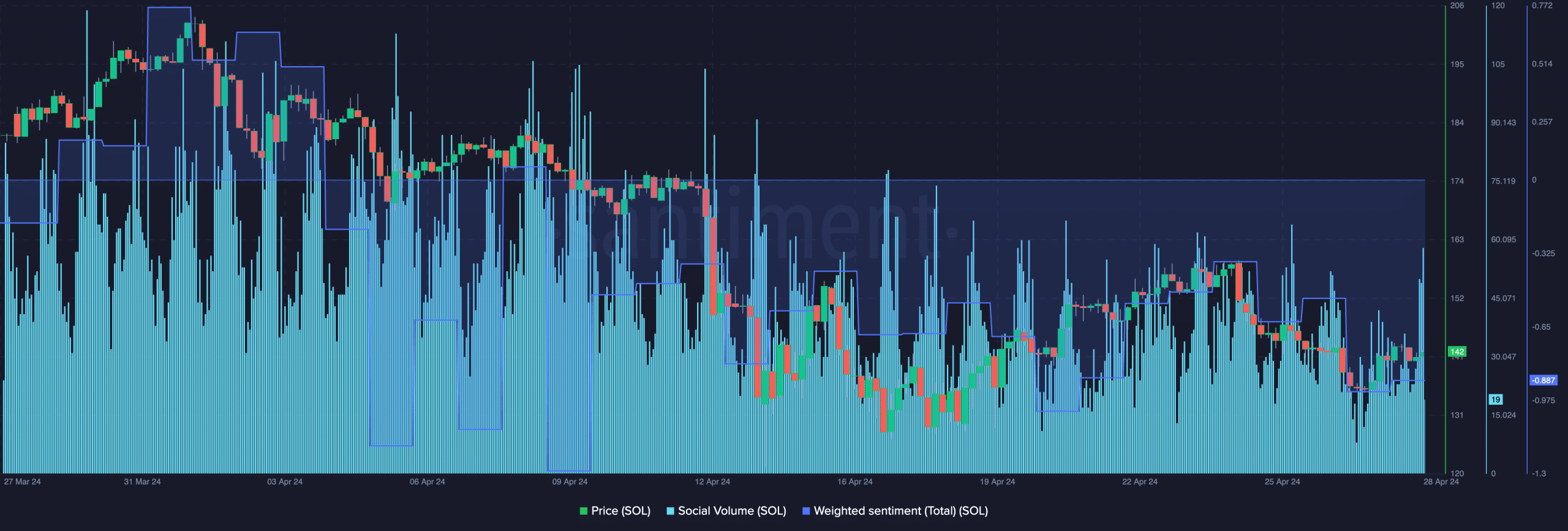

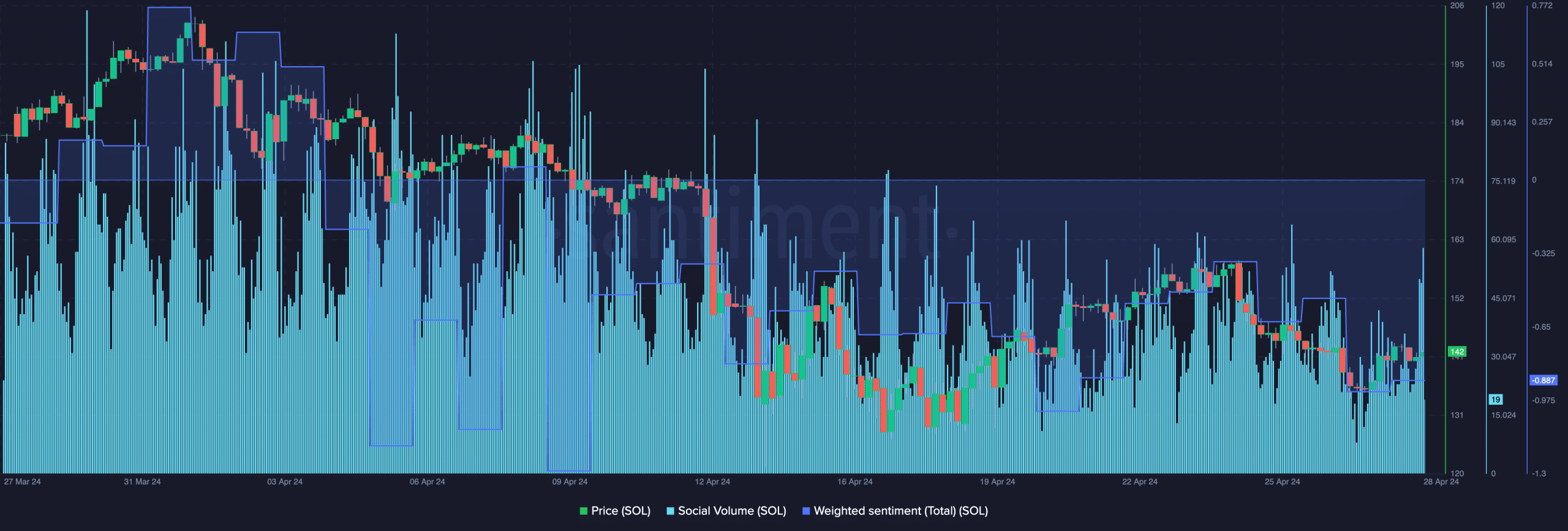

Coming to the token, it was observed that the price of SOL had fallen by 4.64% in the last 24 hours. Coupled with that, the social volume around the SOL token had also declined.

The falling social volume indicated that the popularity of the SOL token waned over the last few weeks. Additionally, the weighted sentiment around the token also dropped.

Read Solana’s [SOL] Price Prediction 2024-25

This suggested that the number of negative comments around SOL had outnumbered the positive ones at the time of writing.

The negative sentiment around SOL could exert downward pressure on SOL’s price in the future.

Source: Solana Floor