- Shiba Inu is stuck within a two-month range formation and is headed for the low.

- The network activity was stable, and one metric promised an uptrend.

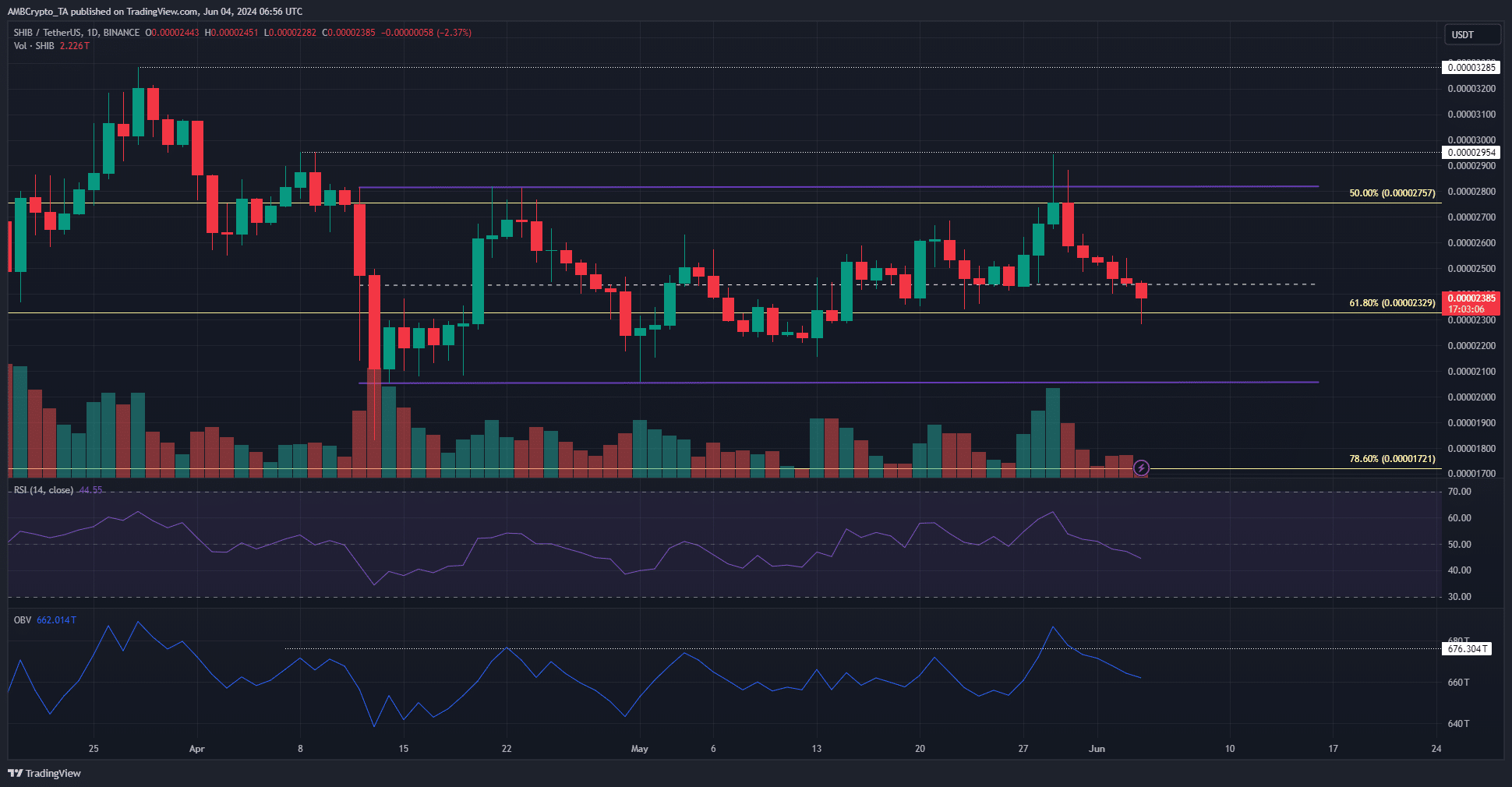

Shiba Inu [SHIB] retested a support level but the bulls were unable to hold on. This was followed by a spurt of volatility which saw SHIB prices slashed by 6.9%, but the prices have begun to rebound.

The Shiba Inu price prediction is bearish in the short term due to the loss of the support level. In the higher timeframes, SHIB bulls have a lot of work to put in.

The range formation is set to continue

Source: SHIB/USDT on TradingView

On Monday, the 3rd of June, Shiba Inu was trading at $0.0000244. This was the mid-range support level, but a few hours before press time it was ceded to the sellers. This meant that the price was likely headed toward the $0.000022 or $0.0000205 level.

The OBV tried to climb above the six-week high in late May but was rebuffed. This indicated a lack of consistent buying pressure. It further reinforced the short-term bearish expectations.

The RSI also fell below neutral 50 and served as an early warning of a bearish momentum shift. Hence the Shiba Inu price prediction is that we likely see a 9%-13% drop soon.

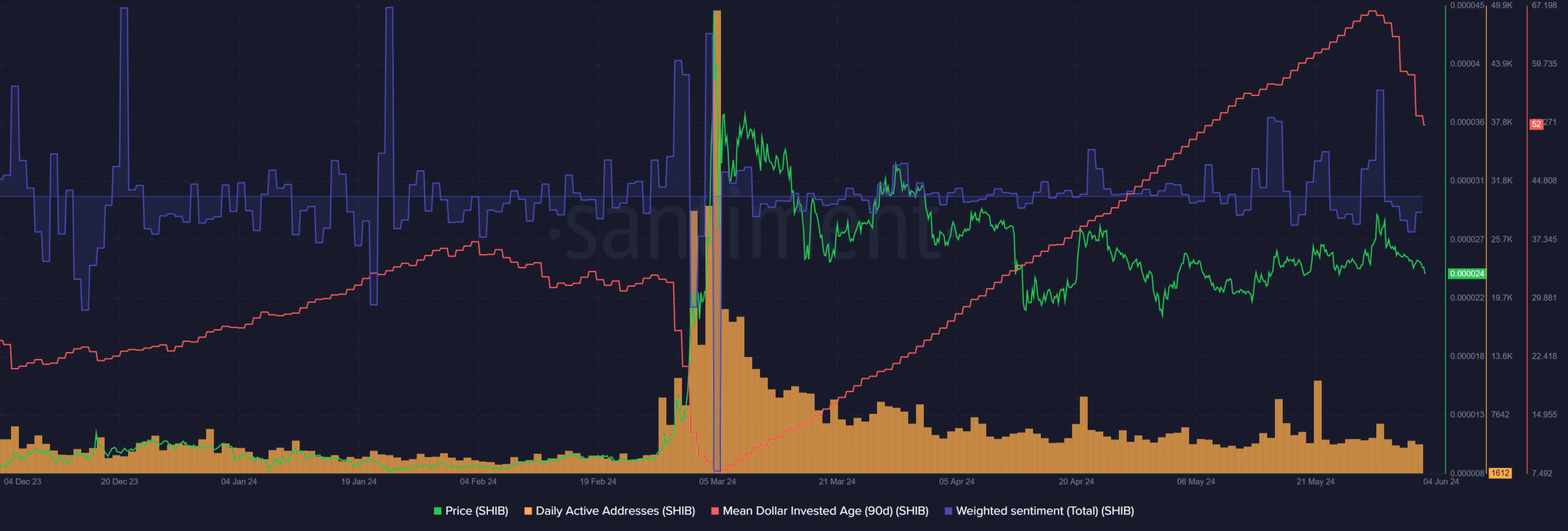

The MDIA showed strong bullishness similar to the latter half of February

The mean dollar invested age represents the age of all tokens on the network weighted by their purchase price. An uptrend in this metric shows that the acquired SHIB is more dormant.

Investors are happy to hold on, but network stagnancy can make it harder for prices to grow. The MDIA was in a strong uptrend since early March, but this trend was broken on the 30th of May.

The past few days noted a drop in this metric. A continued dip will be bullish as it increases the likelihood of a price rise shortly.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The daily active addresses were relatively stable over the past two months. Meanwhile, the weighted sentiment fell into negative territory. Overall, short-term losses are expected.

The Shiba Inu price prediction is a revisit to or near the range lows followed by a rebound toward $0.000028.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.