- Miners continued to be profitable after the halving, thanks to Runes.

- Retail interest in BTC grew, however, whale interest remained stagnant.

Typically, after a Bitcoin [BTC] halving, there is a reduction in revenues collected by miners due to the reduced block rewards.

However, recent developments in the cryptocurrency mining landscape have painted a different picture, with miners seeing green and record-breaking revenues.

Miners benefit from Runes

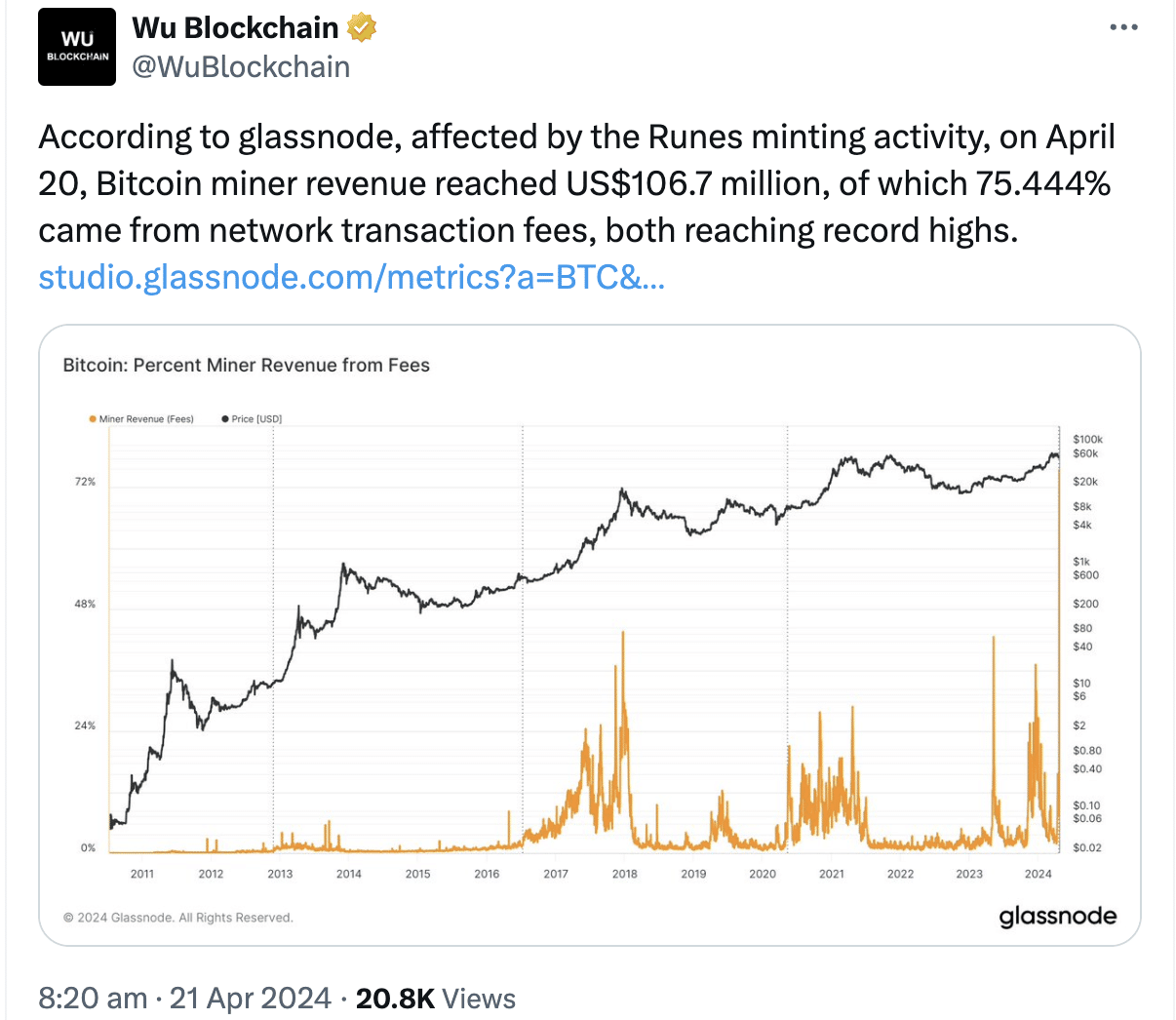

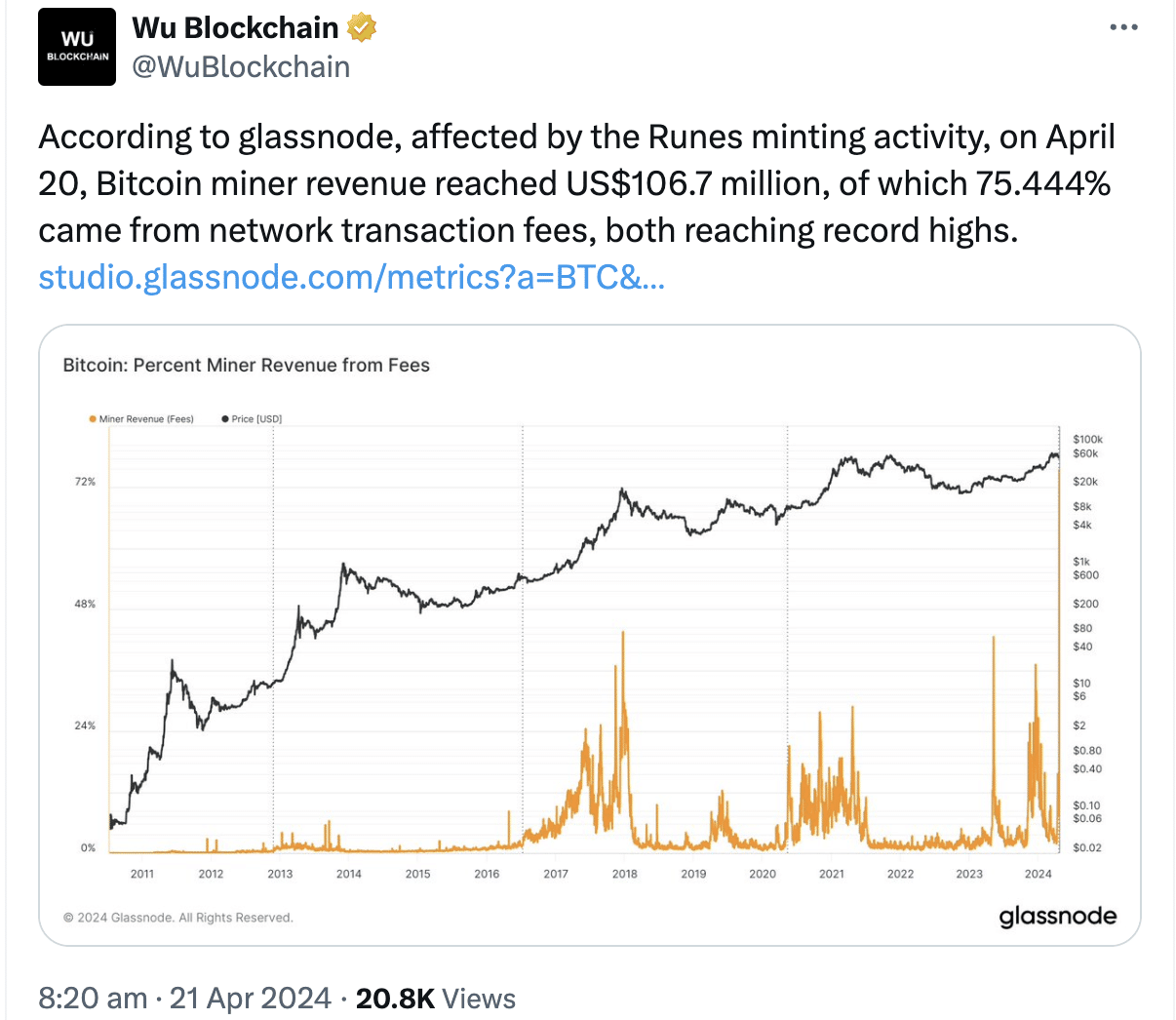

According to Glassnode, Bitcoin miner revenue surged to an impressive $106.7 million on the 20th of April.

A significant portion, 75.444%, of this revenue came from network transaction fees, marking a new high for Bitcoin miners.

Source: X

This surge in miner revenue can be attributed to the rise of Bitcoin runes, a protocol enabling the creation of fungible tokens on the Bitcoin blockchain.

This innovation allows for the creation of new cryptocurrencies or tokens that operate on the same network as Bitcoin, contributing to increased mining profitability.

The profitability of Bitcoin mining is essential for miners as it directly impacts their bottom line.

Higher profitability means miners can cover their operational costs more efficiently and potentially reinvest in mining equipment or infrastructure upgrades.

This, in turn, strengthens the overall security and resilience of the Bitcoin network.

Moreover, the high profitability of Bitcoin mining could have positive implications for the broader BTC market.

With miners earning more revenue, there is reduced selling pressure on BTC as miners may be less inclined to sell their newly minted coins.

This dynamic could contribute to price stability and potentially even upward price movements for BTC.

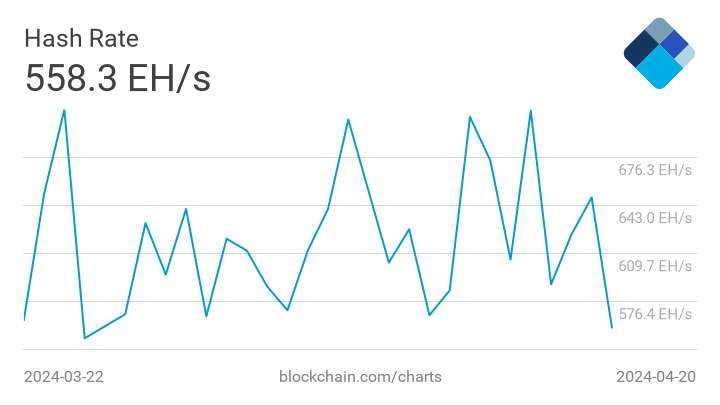

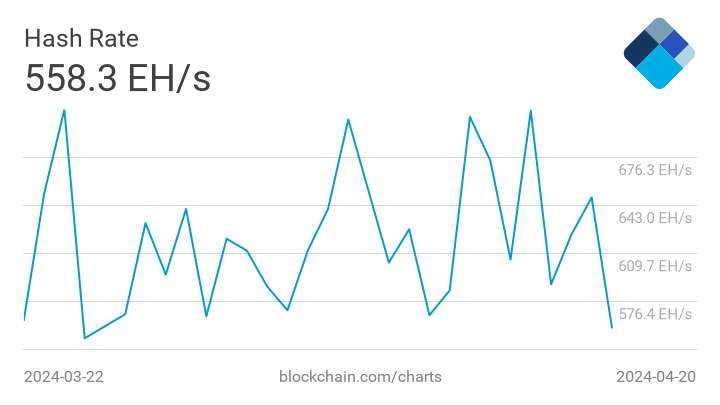

However, the hashrate around BTC declined significantly in the last few days, which could impact miners negatively in the future.

Source: Blockchain

How is BTC doing?

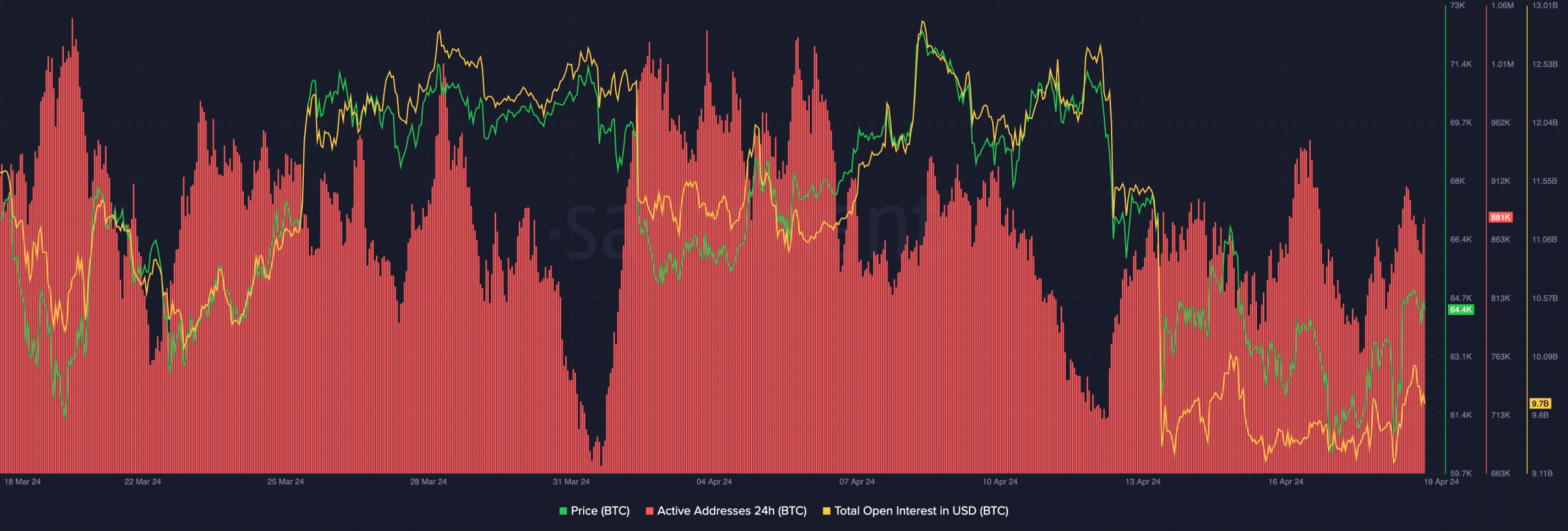

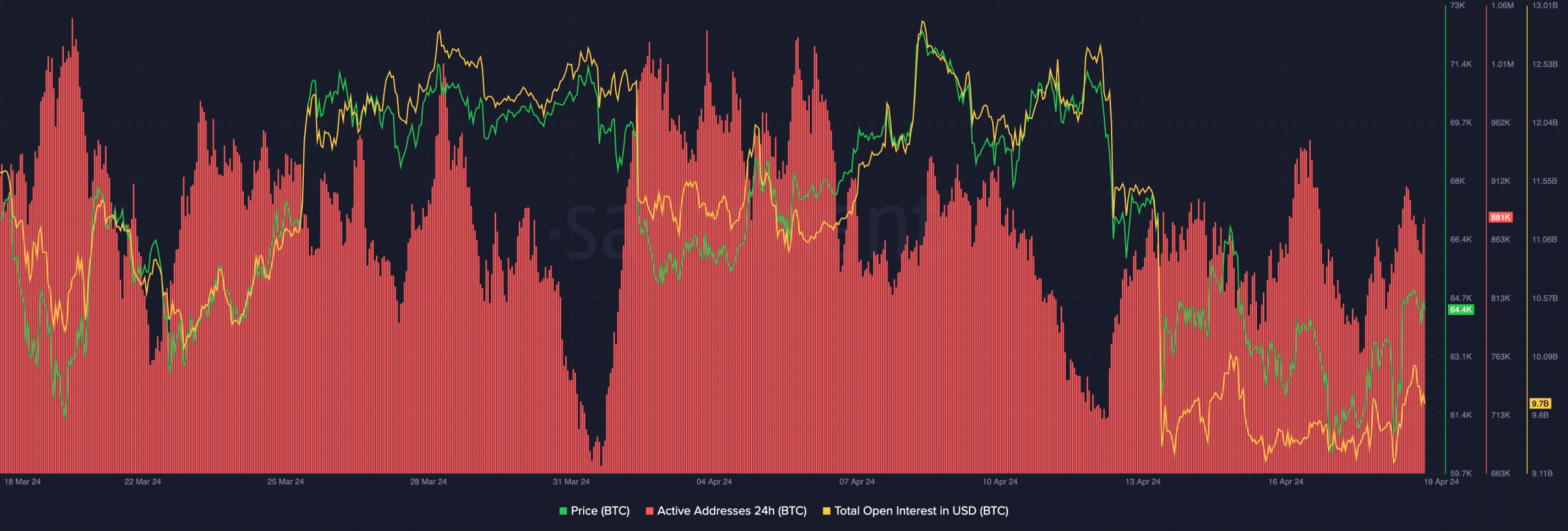

Speaking of price movements, BTC was trading at $64,883.09 at press time, reflecting a 2.10% increase in the last 24 hours.

This uptick in price, coupled with the growing profitability of mining, bodes well for the overall sentiment surrounding BTC.

Additionally, active addresses on the BTC network have seen significant growth in recent days.

This uptick in activity suggests increasing interest and engagement with the Bitcoin blockchain, further supporting positive price momentum.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

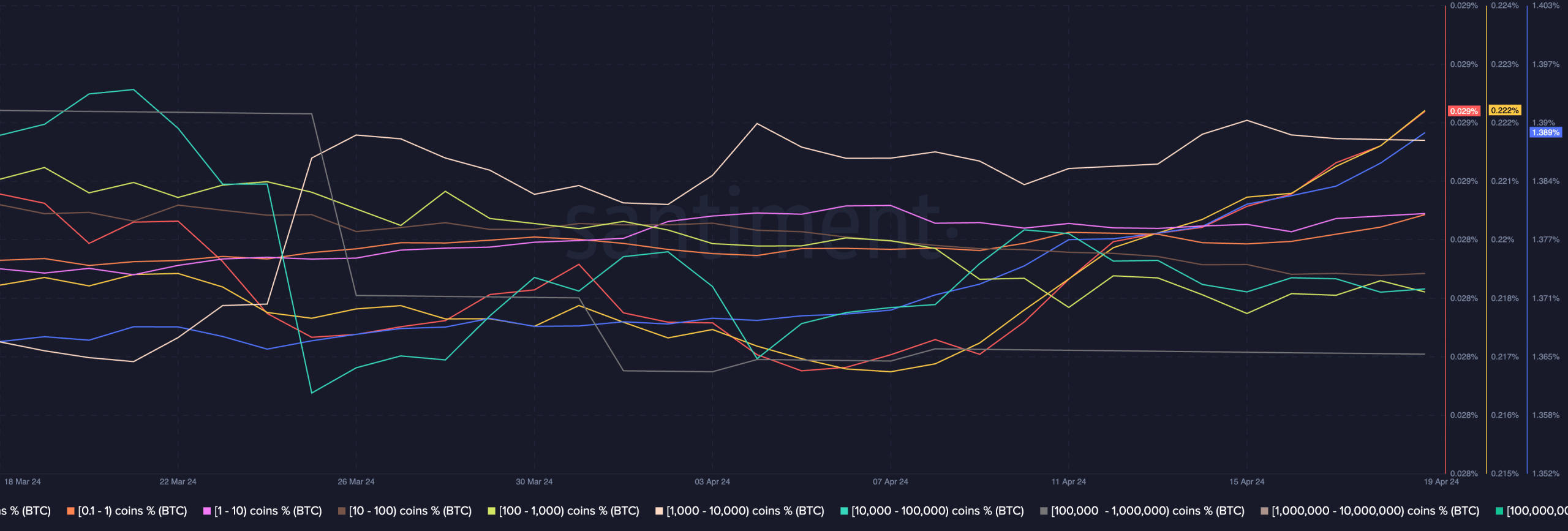

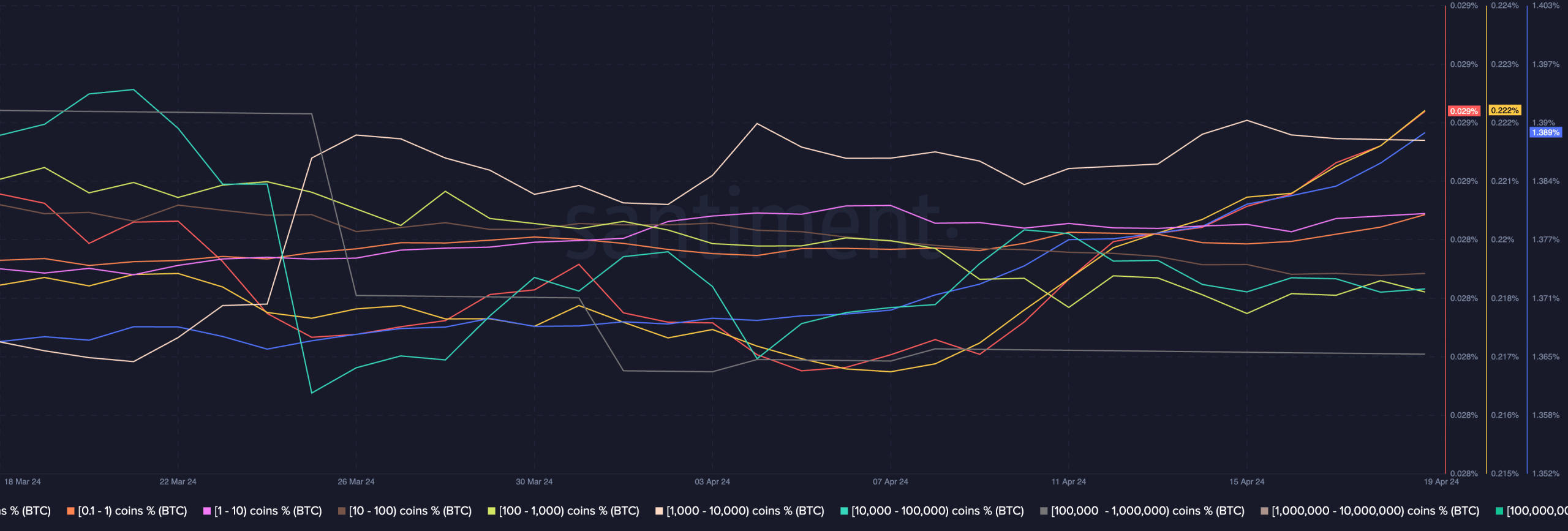

While retail interest in BTC has been on the rise, whale interest appears to have stagnated, indicating a potential shift in market dynamics.

However, Open Interest, a measure of market activity and liquidity, has witnessed a slight uptick, suggested continued interest from traders and investors in BTC futures markets.

Source: Santiment