Quant analyst PlanB says that Bitcoin (BTC) is entering a phase that has historically coincided with rallies.

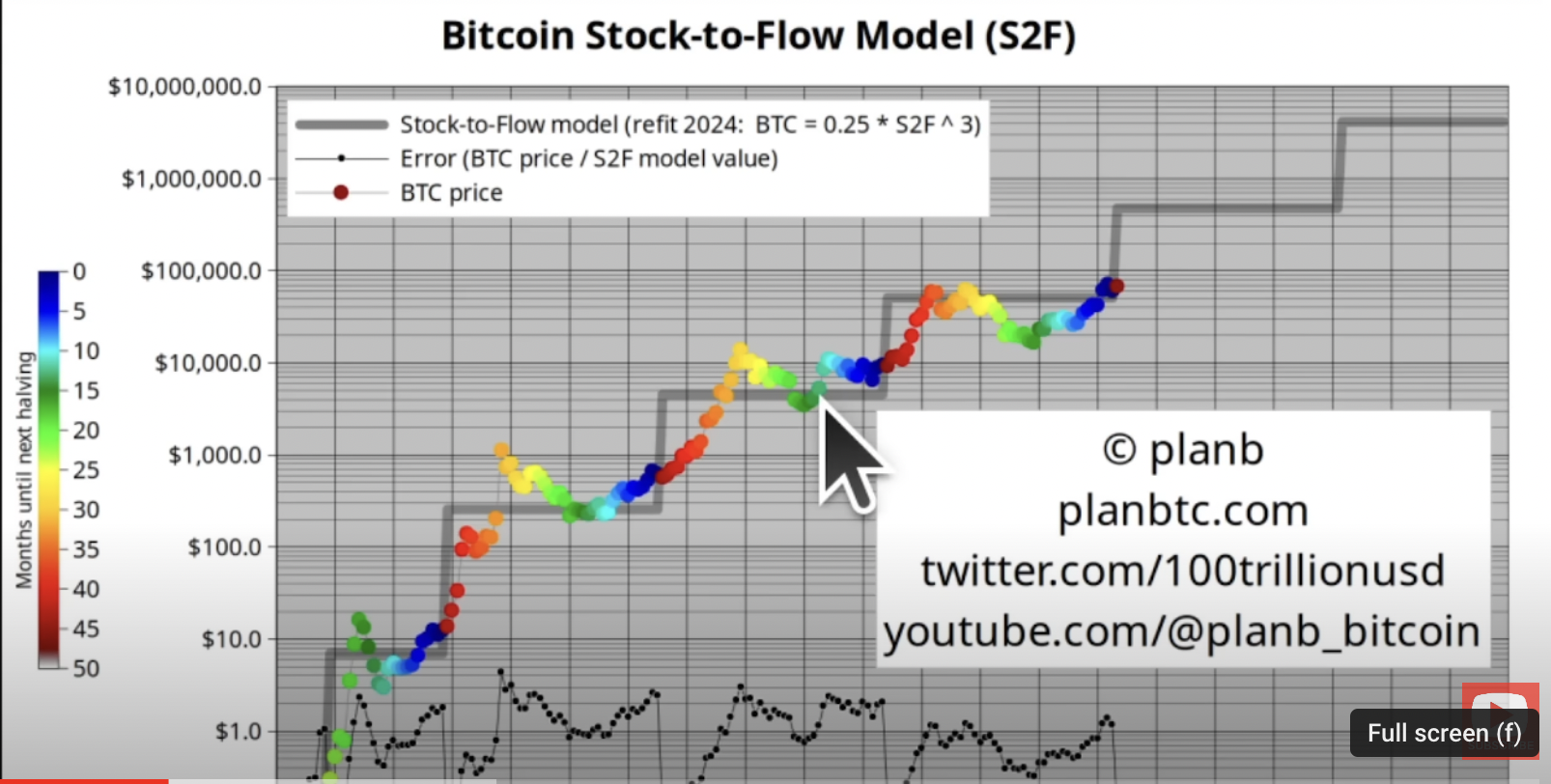

In a new strategy session, PlanB provides an update on his stock-to-flow (S2F) model, which was traditionally used for traditional commodities before he adapted it to Bitcoin.

The S2F model predicts the performance of an asset based on the idea that the price increases as the asset becomes more scarce. Historically, PlanB’s S2F model has signaled the beginning of strong bull runs immediately after the halving with the printing of a red dot.

“It’s the first month after the halving, and the start of the new cycle. So, in my opinion, Bitcoin will pump after the halving like it did last halving cycle in 2020, and the cycle before it in 2017, and also after the halving in 2012 in 2013. So I think we’ll see a pump again and of course, that’s the core of the stock-to-flow model, but time will tell.”

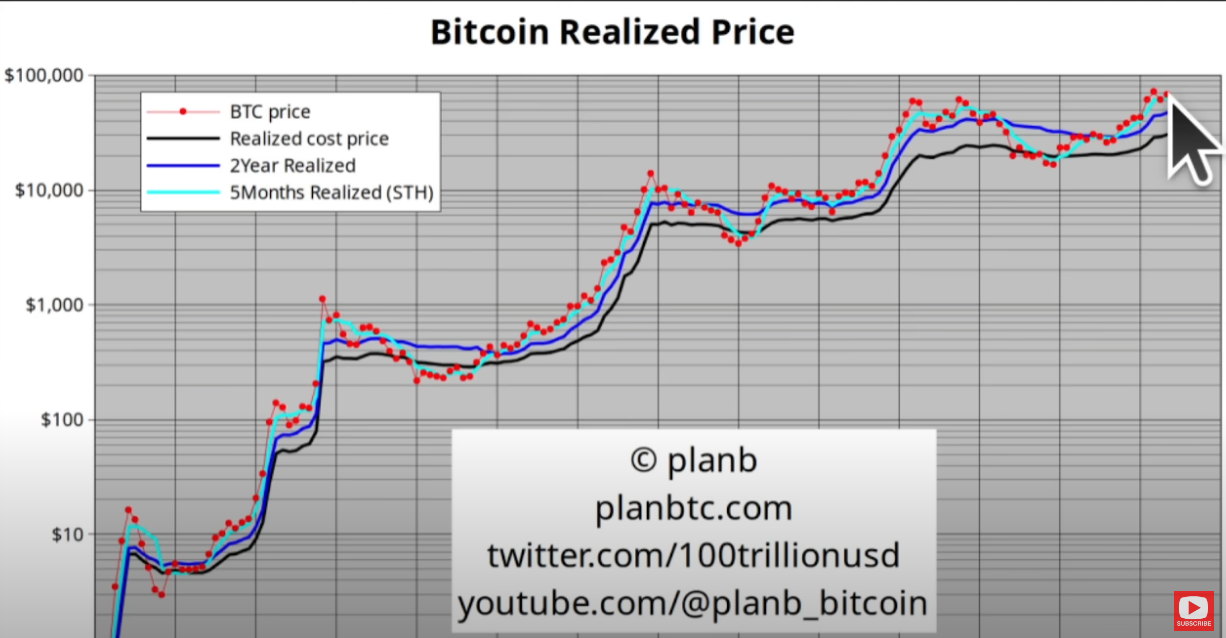

PlanB also looks at the realized price metric, which records the value of all coins in a current time frame at the price they were last transacted on-chain, divided by the number of BTC in circulation. He says the five-month realized price level has historically been a strong support level in bull markets.

“It’s a support level for bull market dips, like this dip in the 2020 bull market. It jumped off this support line and the same happened in 2017, this bull market dip jumped off the light blue line here as well. So, I expect that to happen again, and in fact, we saw it in April. April dipped, it was in a bull market, and okay, the five-month realized price was $60,000, and Bitcoin was slightly below that at $59,000 or $58,000, but still, in terms of monthly closes, the five-month realized price was an excellent support level and we bounced this month in May off that level.”

At time of writing, Bitcoin is trading for $68,971, up over 1% in the past day.