Blockchain bonds are becoming increasingly popular as more financial industry players seek to enhance efficiency and transparency in the $130 trillion industry. The latest is the island nation of Palau, which has issued a blockchain bond to tap into local capital for infrastructure projects.

In Germany, regional lender WIBank tested the waters with a €5 million ($5.4 million) blockchain bond as part of the region’s distributed ledger technology (DLT) trials.

Palau taps blockchain savings bonds

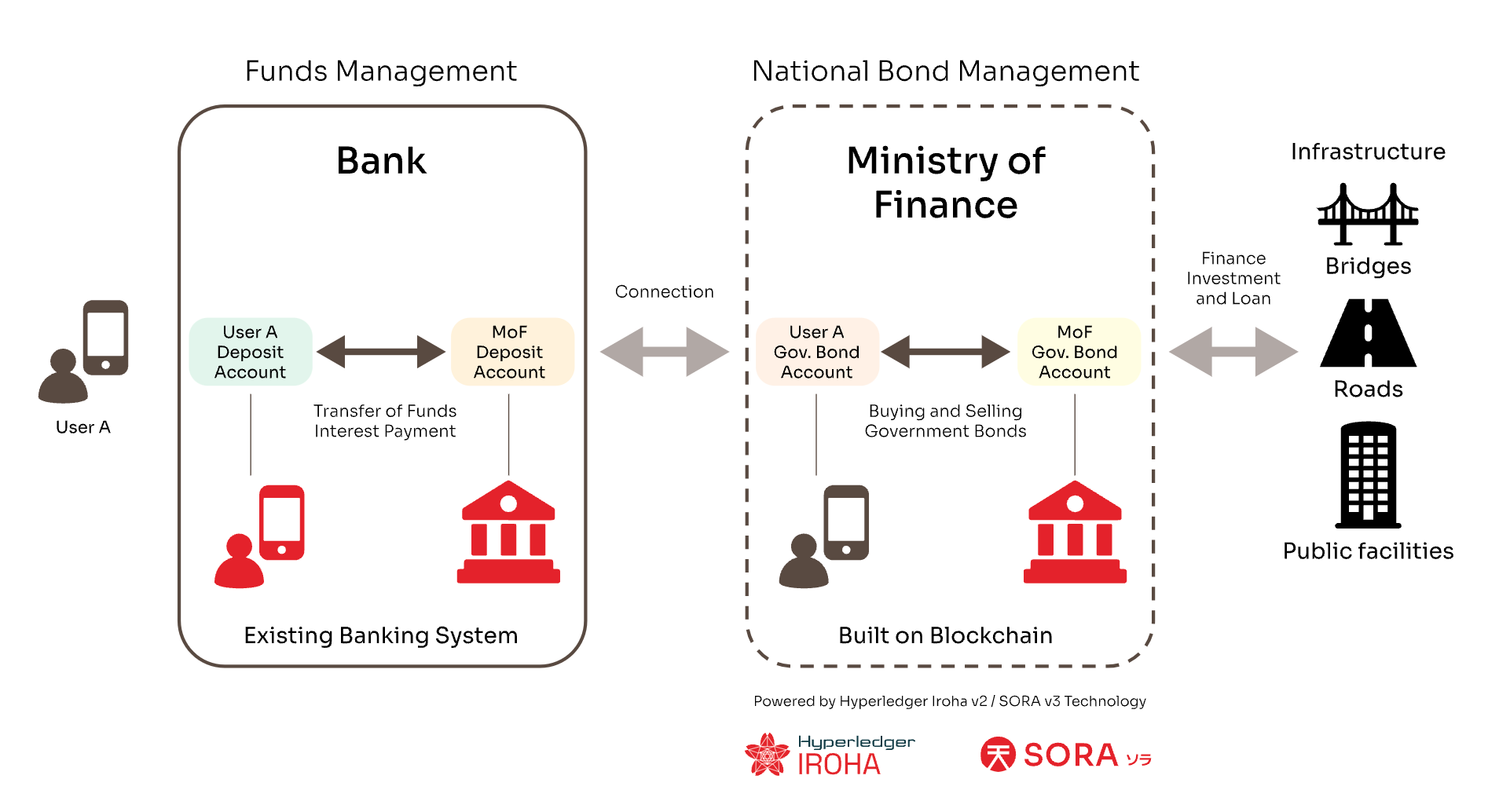

Palau is exploring blockchain savings bonds to raise capital for its infrastructure projects. It has partnered with Soramitsu, a Tokyo, Japan-based blockchain services company, on the initiative. Japan’s Ministry of Economy, Trade and Industry (METI) also participated.

Palau is an island nation in the western Pacific Ocean. It is made up of 500 tiny islands, and its population is around 20,000. Tourism is its main industry. Palau’s economy is closely intertwined with the United States, with the Bank of Hawaii among the most popular bank on the island. Inevitably, this leads to a funneling of capital from the locals through bank deposits to the U.S. and other nations in Micronesia.

The Palau government aims to tap this market and reduce capital outflow with the new blockchain savings bonds, dubbed Palau Invest.

“The savings bonds initiative allows us to fund crucial projects like housing, small and medium enterprise development, and infrastructure with domestically sourced capital,” commented President Surangel Whipps Jr.

“By investing in these areas, we stimulate job creation, enhance business opportunities, and foster a vibrant economy.”

The project starts with a savings bond prototype, which will allow local investors to learn about the system and its workings. Neither Soramitsu nor the Palauan government revealed how long this process will last before they fully issue the bonds. But once they launch, investors will be able to purchase them through an app on their phones.

The bond will be issued on a Hyperledger Iroha 2-based permissioned blockchain network developed by Soramitsu. The company has vast experience in creating blockchain applications for governments. It has been working with Cambodia’s central bank for years, culminating in the launch of Bakong, a blockchain-based payments system, in 2020. It’s also working on a similar project with the central bank of Laos and on central bank digital currency (CBDC) feasibility studies with the Philippines, Papua New Guinea and Vietnam.

Germany’s WIBank issues €5 million blockchain bond

In Germany, the regional development bank Wirtschafts und Infrastrukturbank Hessen (WIBank) has issued a €5 million bond on a public blockchain.

WIBank is a subsidiary of Landesbank Hessen-Thüringen, known popularly as Helaba, a regional bank that serves nearly half of all German savings banks as a central clearing institution.

The bond was settled using Trigger, a system developed by Germany’s central bank to enable the settlement of DLT-based securities transactions using central bank money. Trigger connects the blockchain holding the tokenized assets (in this case, the Ethereum Layer-2 network Polygon) to the traditional payment infrastructure, which in Germany is known as TARGET2, for atomic transactions. Trigger capitalizes on the benefits of DLT technology without the risk of digital currencies.

The process’s atomicity, realized through delivery versus payment transactions, eliminates counterparty risk. Since the transaction relies on central bank money rather than digital assets, credit risk is also reduced.

Helaba, WIBank’s parent company, acted as the cash settlement agent, while Bankhaus Metzler, Germany’s second oldest bank, was the sole investor. Deloitte and Munich law firm Annerton were also involved. Cashlink, an asset tokenization leader in Germany, tokenized and settled the bond on the public blockchain.

Christian Forma, the Head of Treasury at WIBank, believes that the experience the lender gained “opens up new possibilities for the further development of existing financial products in conjunction with innovative technologies. This minimizes risks and optimizes processes for both us and our investors.”

WIBank joins other German banks exploring blockchain bonds to boost efficiency and enhance transparency. Last month, Frankfurt-based KfW, the world’s largest national development bank, issued a €50 million ($54.6 million) bond that settled via the Trigger solution. This followed a €100 million ($109.3 million) blockchain bond issued in August.

But while these bonds are becoming increasingly popular, they are still a niche market limited to a few participants. The €100 million ($109.3 million) bond, for instance, only attracted six investors, all clients of bookrunner DZ Bank.

In some jurisdictions, bond issuers are integrating their blockchain products with conventional channels to make bonds available to a larger investor base. For instance, in Hong Kong, HSBC (NASDAQ: HSBC) recently integrated the HKMA’s Central Moneymarkets Unit (CMU) when issuing a HK$1 billion ($130 million) digital bond on its Orion blockchain platform.

Watch: Liquid Noble democratizes precious metals investment

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>