Lenders have begun raising additional capital to meet new targets set by the Central Bank of Nigeria, which gave them two years from last month to meet the new standards. In some cases, this will mean an increase in capital of approximately 10 times the current minimum.

The new requirements are to ensure banks have a strong capital base to absorb unexpected losses and the ability to contribute to Nigeria’s growth and development, the central bank said after the government set a target of reaching a $1 trillion economy by 2030.

Larger banks with a larger capital base and capacity “can underwrite higher levels of credit, which is critical to stimulating and catalyzing economic growth,” it said.

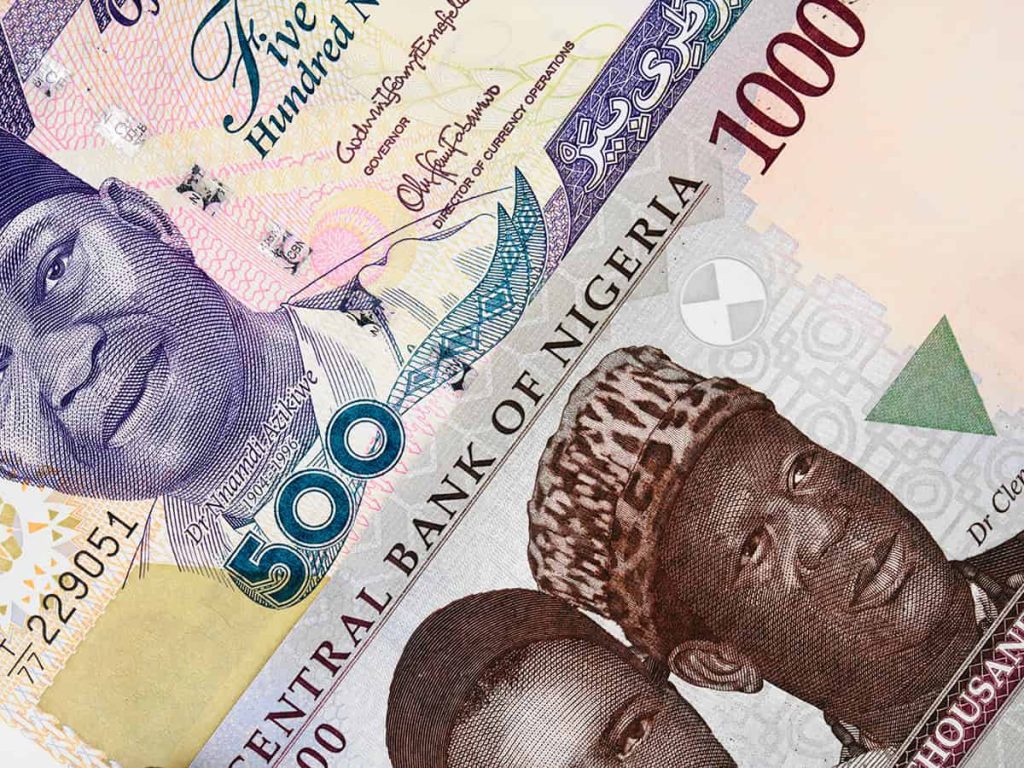

The regulator set the new capital base for internationally licensed commercial banks at 500 billion naira (from 50 billion or 36.5 million US dollars), while requirements for national and regional lenders increased to 200 billion and 50 billion naira respectively (from US$25 billion). and 10 billion). The capital of interest-free lenders was increased to N20 billion and N10 billion for regional licenses (from five billion).

Options to meet the requirements include infusion of new capital through private placements, rights issues and/or subscription offers; mergers and acquisitions; and/or increasing or decreasing the license authorization level. Additional Tier 1 capital will not be eligible, the central bank said.

Recapitalization is “a necessary evil in an economy experiencing exchange rate volatility and high inflation,” says Damilar Asimiyu, a macro strategist and head of research firm Afrinvest Consulting in Lagos. The naira has fallen from 129 to the US dollar in 2005, when Nigerian banks last raised their capital base, to more than 1,100 to the dollar now, pushing down the value of banks’ assets. All Tier 1 lenders are likely to scale, Asimiyu predicts. Lenders in this group are known by the acronym FUGAZ, which stands for First Bank, United Bank for Africa (UBA), Guaranty Trust, Access and Zenith. “They will raise funds cleanly.” Among second-tier banks, he expects consolidation. Some members of the FUGAZ group have already begun to act. UBA announced that on the 24th of this month it will seek shareholder approval to raise new capital through a rights issue and private placement. Zenith shareholders were due to meet on May 8 to authorize the bank to raise capital on the Nigerian or international capital markets, the bank said in a statement. Guaranty’s board of directors proposed raising $750 million through a public and private offering.