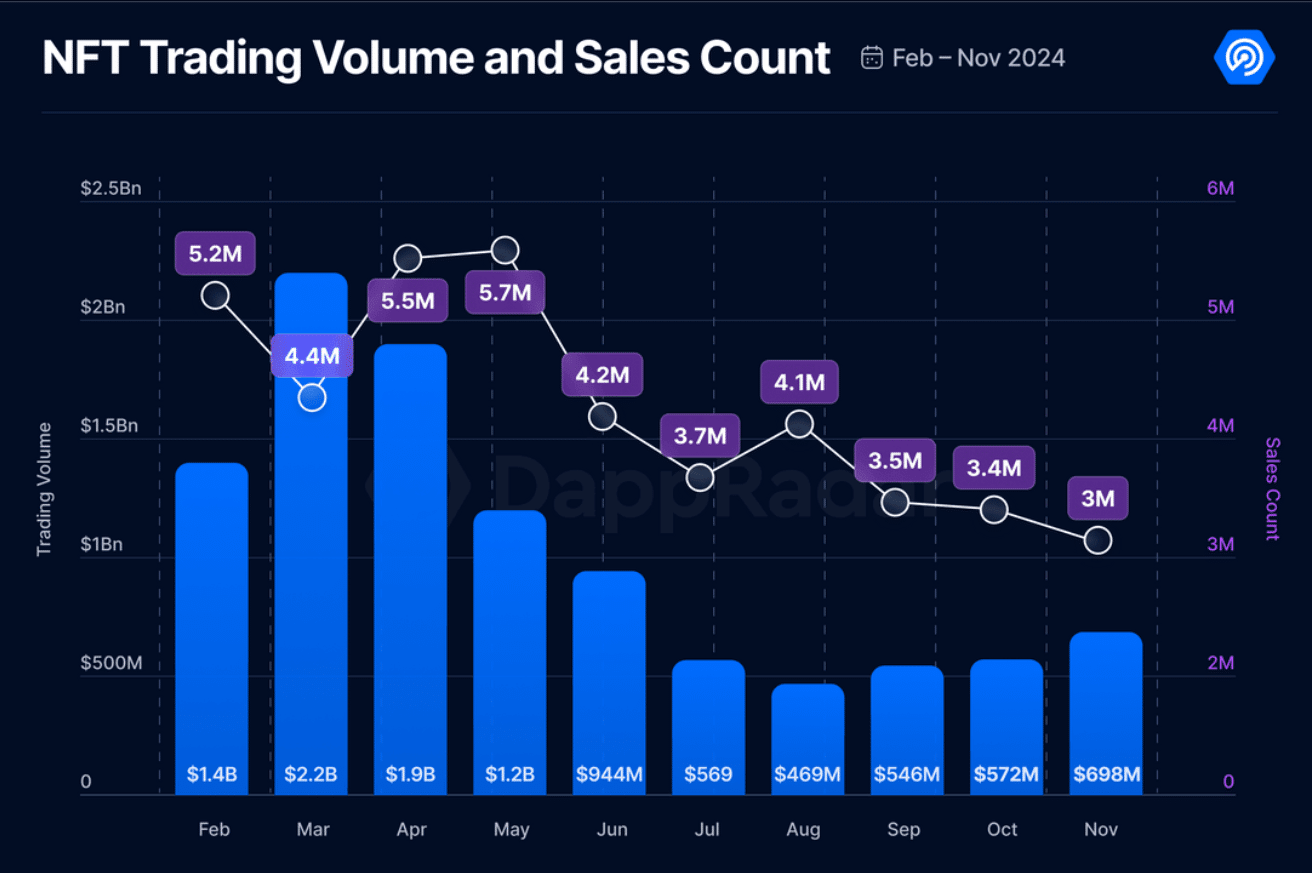

After months of slowdown, the NFT market now shows signs of recovery with a 22% increase in trading volume as of November, boosted by prices and high activity in blue-chip collections.

The market of non-fungible tokens seems to be showing signs of recovery, with an over 20% surge in trading volume in November, per a report by DappRadar. According to the data, NFT trading volume reached $698 million, marking a 22% increase from October.

DappRadar’s analyst Sara Gherghelas attributes the growth to “increased engagement with blue-chip collections” like those from Yuga Labs and rising token prices, alongside increased liquidity and confidence among investors.

“Improved liquidity and increased engagement with blue-chip collections are fostering confidence among collectors and investors, who are now viewing NFTs not only as speculative assets but also as cultural commodities.”

Sara Gherghelas

Despite the growth in trading volume, sales volume declined by 11% to 3 million units, which might be signaling a shift toward more valuable transactions.

The recovery also comes amid broader market trends. As reported by NFTevening, November also saw a rise in the overall NFT market value, which grew to $8.8 billion. At the same time, daily trading volume across all chains rose by almost 50%.

The data shows that blue-chip NFT collections like CryptoPunks and Bored Ape Yacht Club were crucial to the market’s rebound. While CryptoPunks saw a 392% increase in trading volume, BAYC saw strong demand, with its floor price rising 75.79% week-on-week to $79,727.

Ethereum (ETH) remains the leader in trading volume, while Polygon (POL) holds the “top position for the number of NFT sales,” Gherghelas says, adding that the rise of marketplaces like Blur, which surpassed OpenSea in trading volume, highlights the rapidly evolving NFT landscape.