- Ethereum gas prices declined, but fees paid out to validators rose.

- The price of ETH declined, however, Network Growth surged.

The recent market drawdown impacted Ethereum [ETH] significantly as ETH’s prices fell below the $3400 level.

Low Ethereum gas, high fees

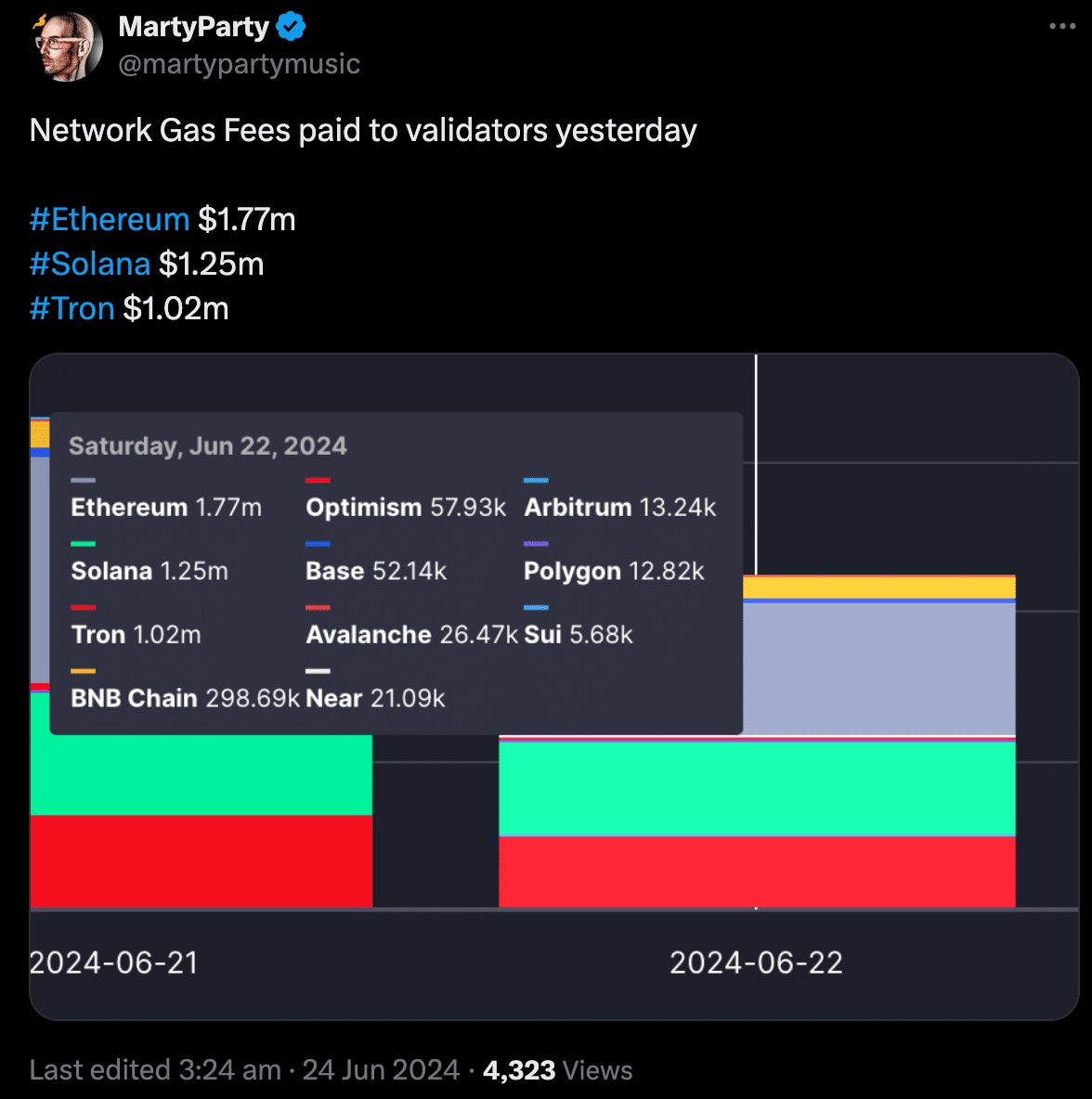

Coupled with that, the Ethereum gas price declined. Despite the declining gas prices, in terms of fees paid out to validators, Ethereum outperformed other networks such as Solana [SOL] and Tron [TRX] by a large margin.

The higher validator fees, despite a gas price drop, could indicate continued strong network usage on Ethereum.

Even with lower per-transaction fees, a higher volume of transactions could generate more total fees for validators.

While validator fees might be high now, they might not be enough to offset the overall price decline of Ethereum.

Source: X

At the time of writing, ETH had fallen by 4.14% in the last 24 hours. One of the reasons for the decline in ETH’s price would be its correlation to BTC which also fell considerably over the last few days.

According to AMBCrypto’s analysis of IntoTheBlock’s data, ETH’s correlation to BTC was at high 0.78.

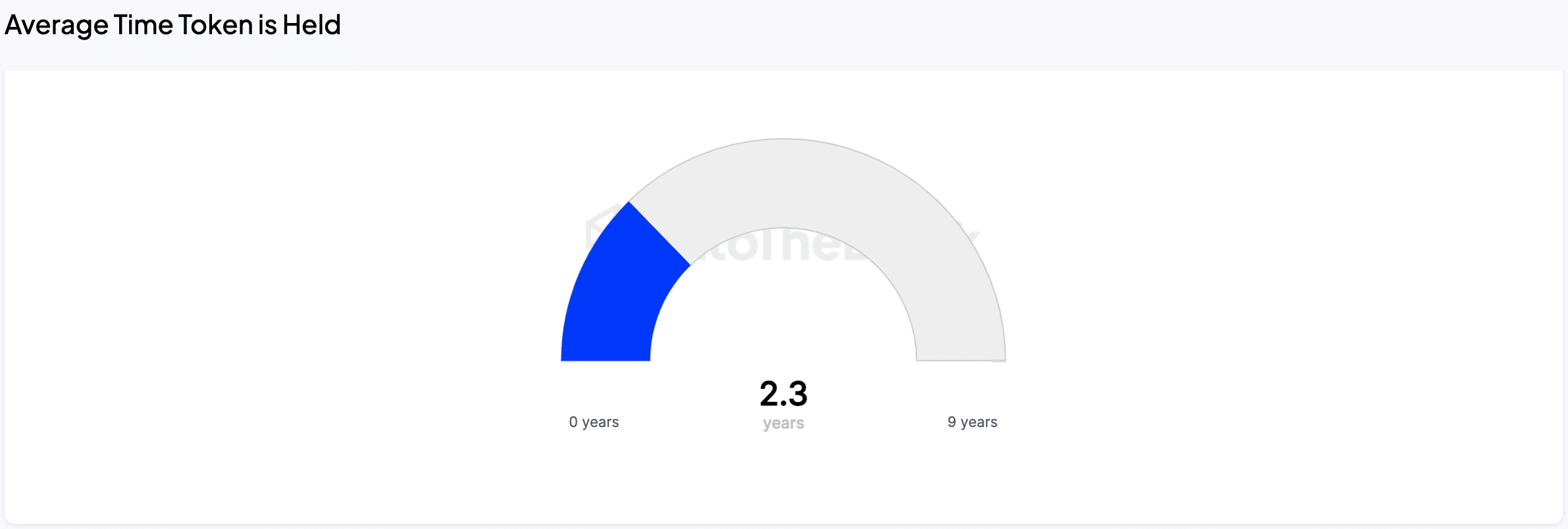

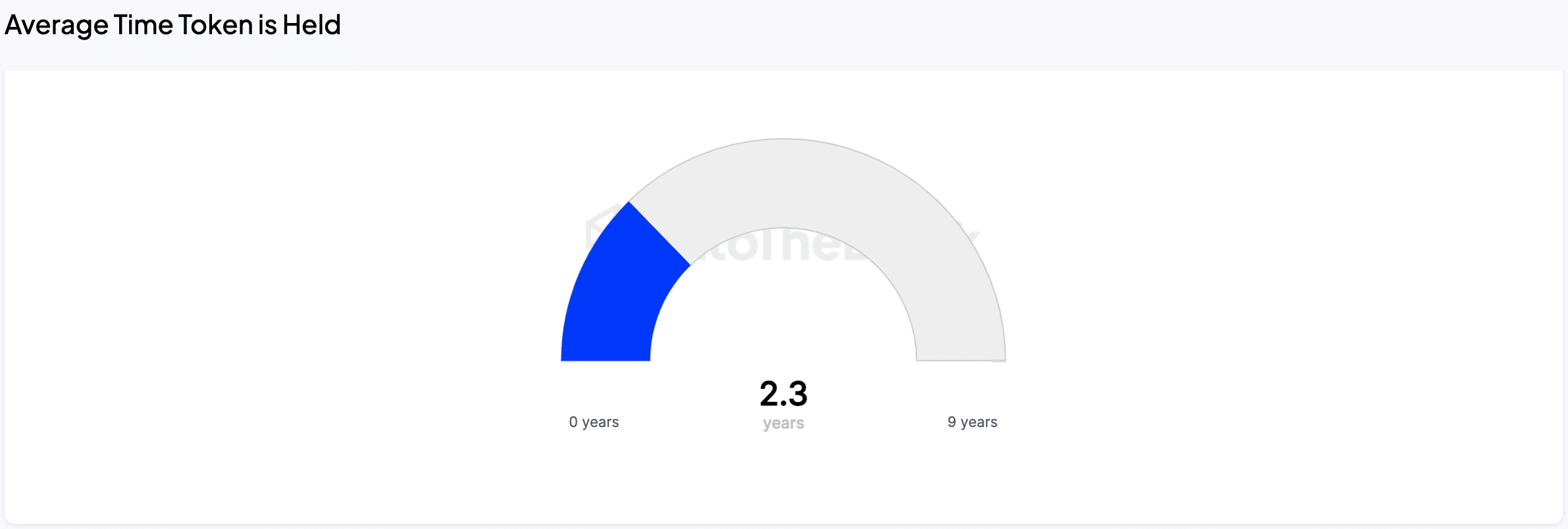

Even with a significant decline in Ethereum’s (ETH) price, a large portion of holders seem to be in it for the long haul. On average, investors are holding onto their ETH for a whopping 2.3 years.

This long-term view is further supported by the fact that coins being actively traded are still held for an average of 2 months, indicating a reluctance to sell.

The average holding time of traded coins offers valuable insights into investor confidence.

When coins are held for longer periods, it suggests investors believe in the long-term potential of Ethereum and are comfortable holding onto their assets.

Conversely, frequent trading activity may indicate a focus on short-term profits and less faith in the future of the market.

Source: IntoTheBlock

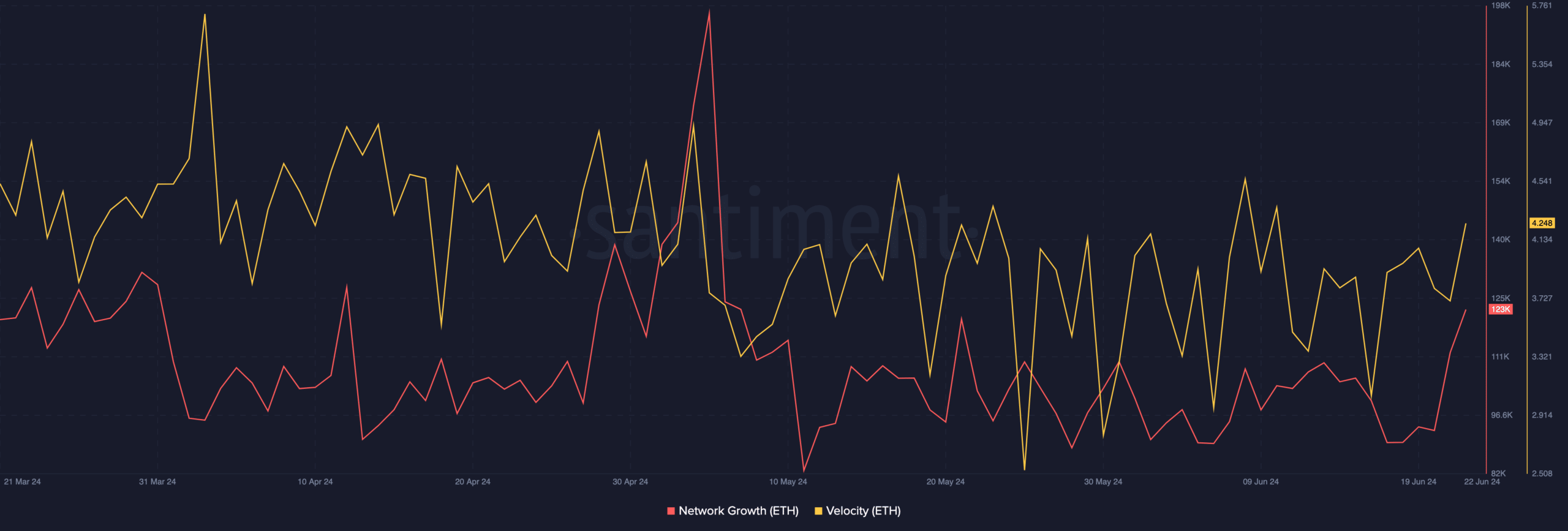

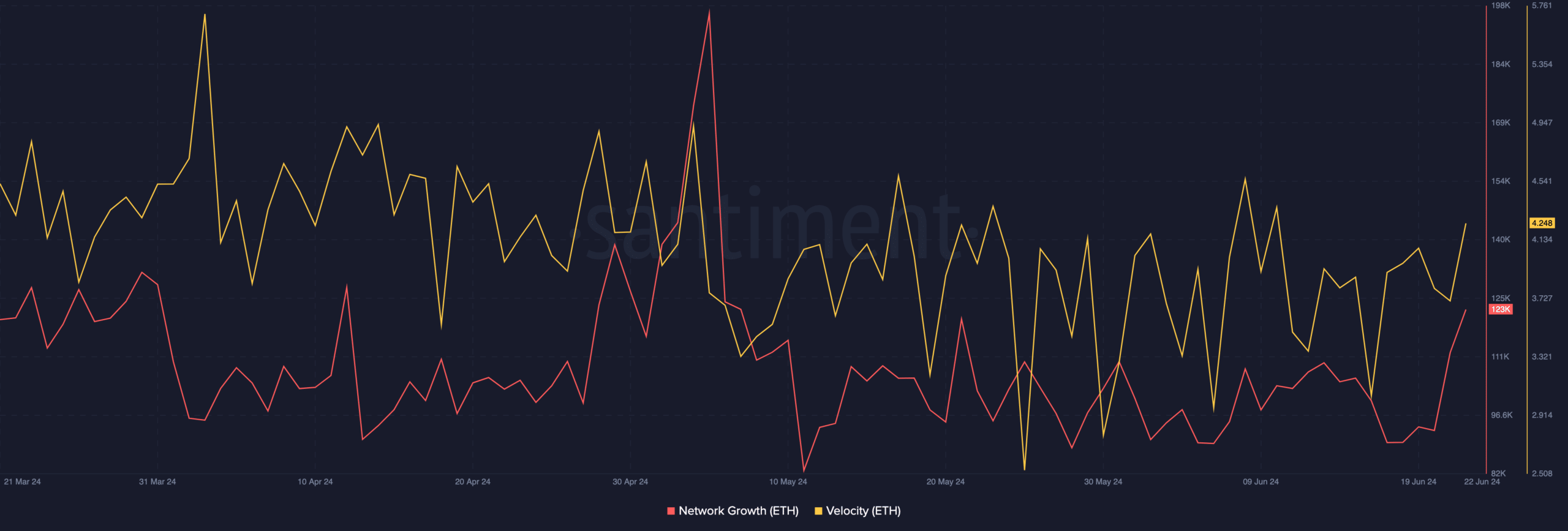

On-chain data

Network Growth for ETH surged materially over the last few days.

Read Ethereum’s [ETH] Price Prediction 2024-2025

So, many new addresses were interacting with ETH at the time of writing, implying that a large amount of addresses were interested in buying ETH at the current discounted rates.

Moreover, the velocity at which ETH was trading had also grown, suggesting that the frequency at which ETH was being transacted had surged.

Source: Santiment