- Solana sees a huge bearish trend following a market-wide correction.

- Indicators suggest low chances of a “Solana Summer” revival in the short term.

The phrase ‘Solana Summer’ was on everyone’s lips last week as SOL made some incredibly remarkable market performance. Its memecoins were making people millionaires overnight.

But as the rest of the market reels from the heavy correction following the Ethereum ETF approval, Solana uncharacteristically joins the bears.

Why is Solana down?

The short and straight reason Solana is down is the market-wide correction. Experts believe that this, like with Bitcoin [BTC] ETFs, will be temporary.

SOL’s daily chart shows a dominant downtrend, with the token progressively making lower highs and lower lows. This trend means there is strong selling pressure, so the bears sit comfortably at the top.

Volume is relatively steady, with spikes corresponding to significant price drops. High volume during a downtrend often confirms bearish momentum, suggesting strong seller participation.

Source: TradingView

The most recent movement shows a slight recovery attempt, with SOL bouncing back to around $165.25. Still, given the prevailing downward pressure, it remains to be seen if this recovery can be sustained.

Given the trend and volume dynamics, the short-term outlook remains bearish unless SOL can convincingly break above resistance at $166 and hold. SOL will likely continue to test lower supports without such a reversal signal.

Any potential reversal would need to be supported by a massive increase in buying volume and a breach above recent resistance levels, which would require massive pressure from the bulls.

What does social sentiment say?

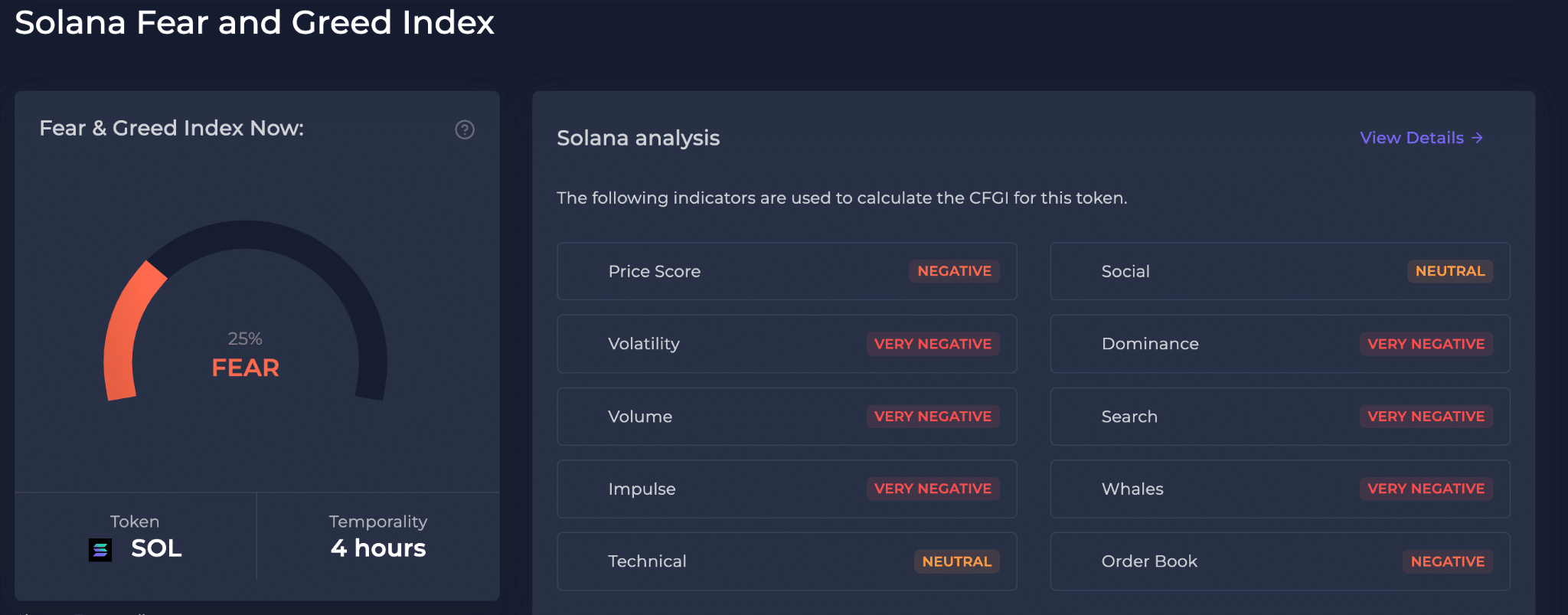

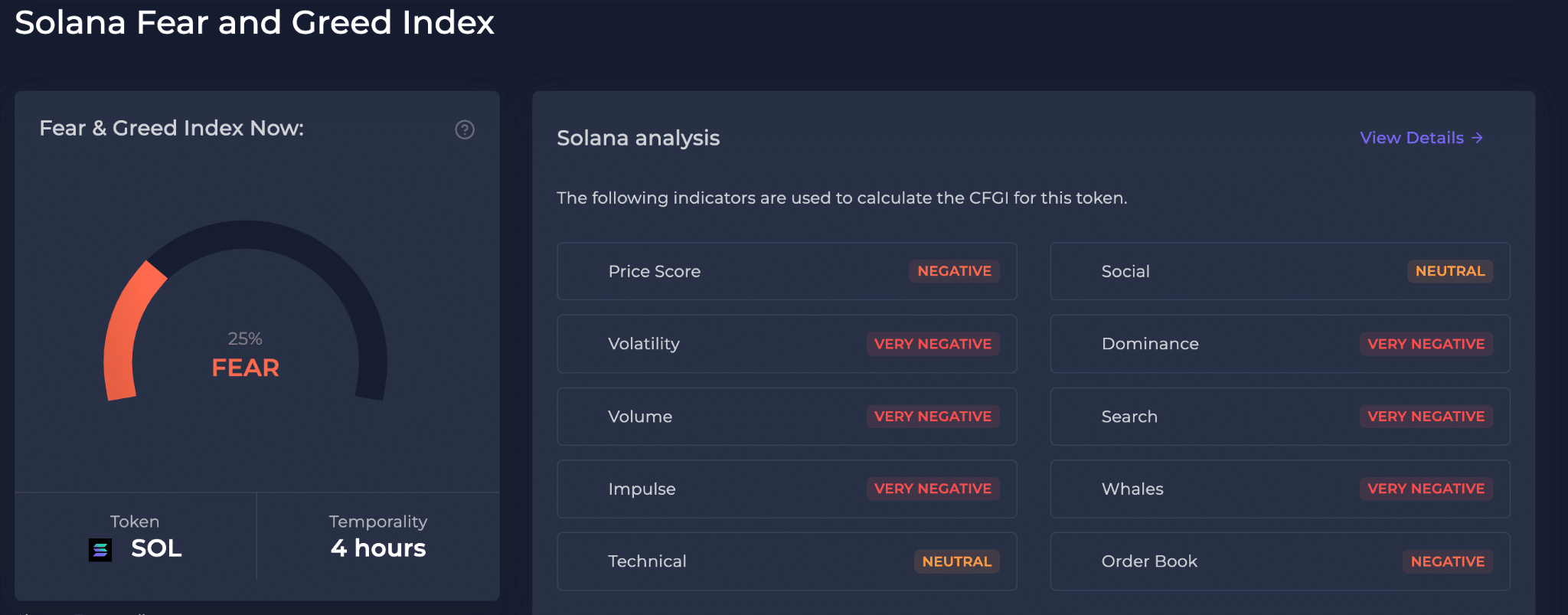

Social sentiments are also looking bad for Solana. The Solana Fear and Greed Index indicates a sentiment of “Fear” at 25%, meaning there is a strong bearish sentiment among traders and investors.

Source: CFGI

This apprehensive mood is driven by several bearish indicators, including very negative volatility, volume, impulse, and search trends. These indicators reflect a lack of confidence and decreased trading activity.

The technical indicators remain neutral, providing no strong counterbalance to the bears.

Read Solana’s [SOL] Price Prediction 2024-25

Additionally, bearish social media sentiment and whale activities show widespread disapproval and divestment from larger stakeholders, further pressuring the Solana market.

As things stand, the odds of a Solana Summer seem really low.