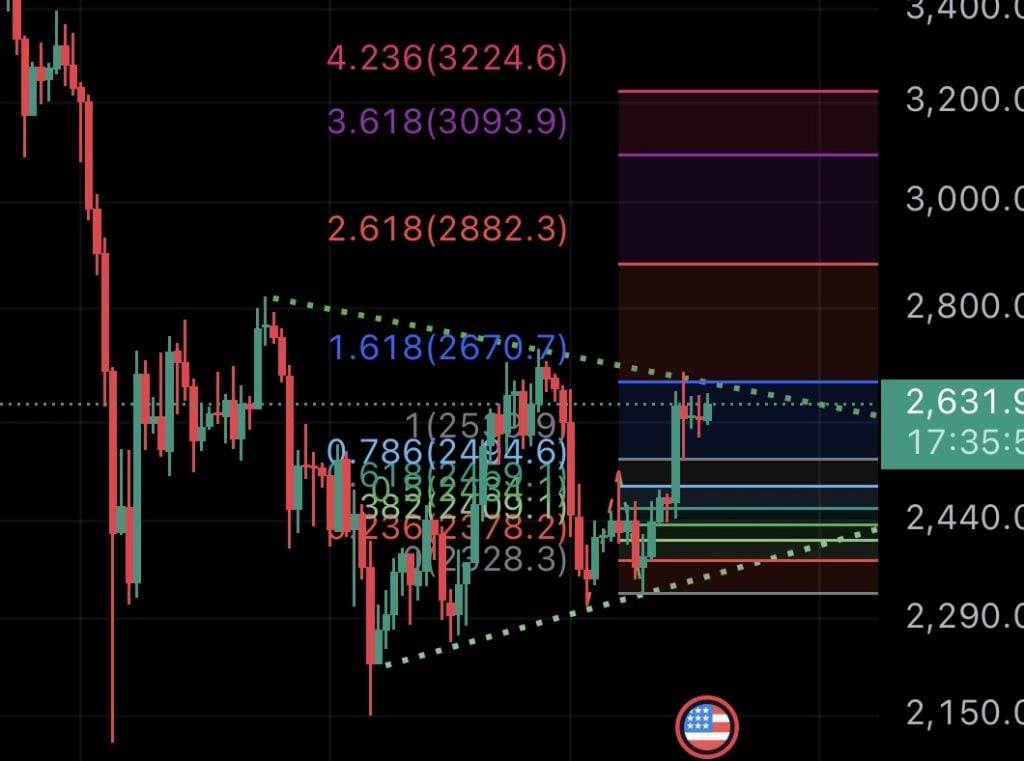

As Bitcoin (BTC) price teases to spike above the crucial support/resistance level around $68k, Ethereum (ETH), the largest altcoin with a fully diluted valuation of about $316 billion and a daily average traded volume of around $15.1 billion, approached a crucial resistance level around $2,626.

In the past week, Ether’s price has rallied over 9 percent, thus approaching the upper border of a symmetrical triangular consolidation. Consequently, speculation of the next Ether move has resulted in a spike in its Open Interest (OI), with more traders betting on a bullish breakout.

Ethereum Whales Are Back

After shying away from the Ethereum market in the past few months, as shown by the significant cash outflows from the US spot Ether ETFs, on-chain data shows that whale investors are now buying more ETH.

In the past two days, the US spot Ether ETFs have registered a net cash inflow of over $62 million, led by BlackRock’s ETHA.

Meanwhile, the supply of Ether on centralized exchanges declined by nearly 3 million in the past 24 hours, led by Binance, Kraken, and OKX.

On the Flipside

According to shrewd crypto analyst Benjamin Cowen, the Ethereum market outlook is heavily impacted by the macroeconomic changes, more so now that the Fed will be initiating its quantitative easing (QE) program.

Notably, Cowen highlighted that the supply of Ether has been rising by around 60k per month for the past six months. As a result, Cowen highlighted that it would only take three to four months for Ether’s supply to reach pre-merge levels.

However, Cowen noted that the trend has changed dramatically since the Fed initiated the 50 bps rate cut.

“Monetary policy affects this stuff more than many of us care to admit. But more rate cuts will likely increase demand on the ETH network,” Cowen noted.