The convergence of decentralized finance and artificial intelligence has created a new narrative known as DeFAI in Web3. This concept is set to bridge the DeFi accessibility gap by using AI to reduce barriers to entry.

Industry leaders expect DeFAI to be a transcendental success and urge builders to adopt its intrinsic characteristics now or risk being left behind. BeInCrypto spoke with experts from Mira, RogerThat, WOO X, and Offchain Labs to learn more about its use cases and potential for future innovation.

The DeFi Challenge

When Web3 experienced its first-ever decentralized finance (DeFi) boom in 2020, it represented a transformative movement away from traditional financial systems.

The revolution, led by Ethereum, created direct, peer-to-peer transactions and investment opportunities without intermediaries. The approach eliminated a previously fundamental reliance on central authorities.

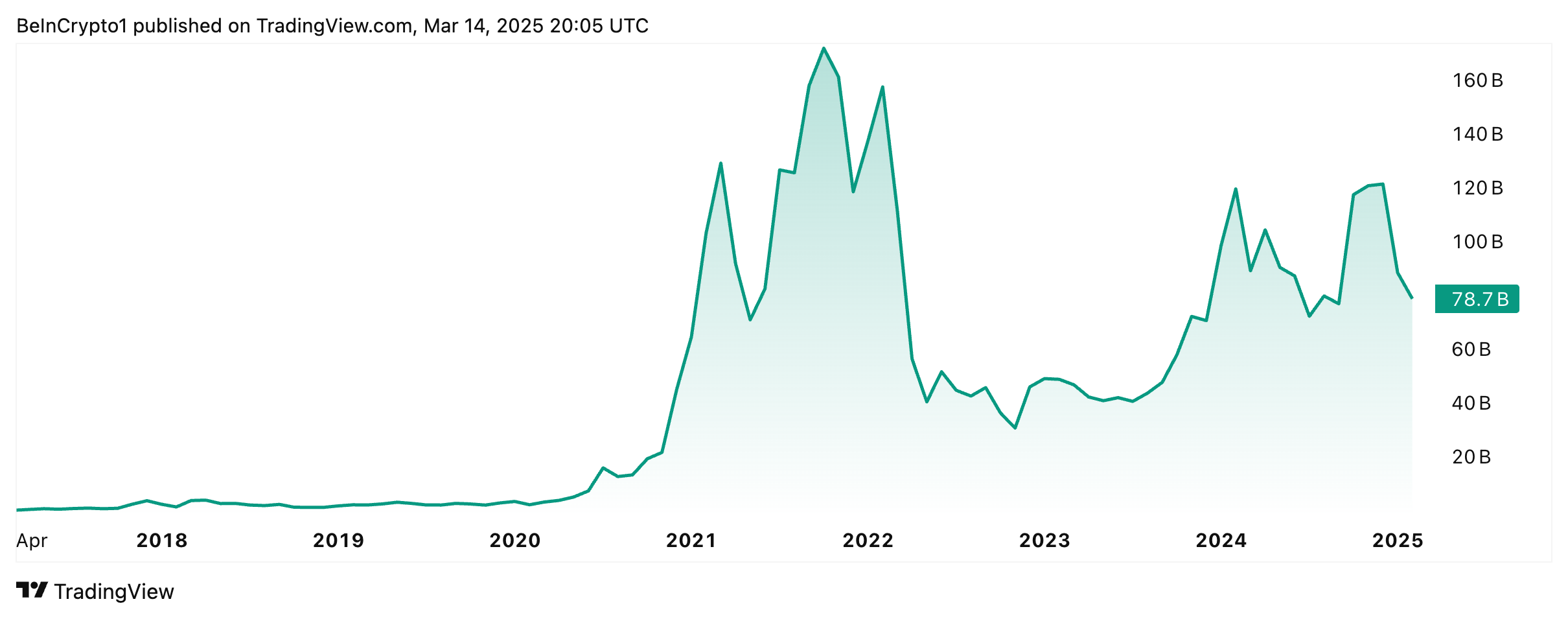

By October 2021, the DeFi market had reached its highest market capitalization, valued at nearly $172 billion. Today, that number rests at $78.7 billion.

The evolution of DeFi’s market capitalization. Source: TradingView.

However, DeFi platforms remain complex today. Wading through these systems requires significant technical knowledge, including risk management, data interpretation, and continuous market awareness, which can be daunting.

“Traditional DeFi platforms often overwhelm users with intricate technicalities and non-intuitive interfaces,” Jack Tan, Co-founder at Woo X, told BeInCrypto.

The knowledge required to use and deploy these applications successfully is enough to deter new users from leaping from Web2 to Web3.

The Dawn of DeFAI

The promised advantages of DeFi are often difficult to capitalize on due to the demands associated with interacting with a continuously active market. Consequently, builders quickly sought methods to leverage DeFi’s capabilities without overwhelming users with its complexity.

Soon enough, artificial intelligence (AI) rose to the task. Its potential to simplify decision-making and streamline processes across various industries naturally led to the birth of DeFAI.

“Imagine just saying, ‘Hey Anon, buy SOL when it dips 20%,’ and DeFAI handles the rest. It’s about removing that traditional friction crypto usually brings to the table. By simplifying the process and making everything more automated, DeFAI opens up DeFi to a much wider audience, even those who aren’t familiar with all the technical stuff,” explained Dominic Cypher, Co-founder of RogerThat.

As continuous innovation refines DeFAI’s capabilities, the challenges associated with traditional DeFi will become obsolete.

DeFAI as a Web3 Adoption Accelerator

For Karan Sirdesai, CEO and co-founder of Mira, DeFAI will accelerate the speed of crypto and blockchain adoption.

“DeFAI is going to flip the crypto adoption narrative completely. Right now, we’re asking users to understand blockchain, learn DeFi concepts, and manage complex risks. DeFAI fundamentally changes this. Instead of users adapting to crypto, we’ll have intelligent systems adapting crypto to users. A small business owner shouldn’t need to understand cross-chain bridges or liquidity pools to access optimal yields. Verified AI agents can handle these complexities while providing clear, provable records of their decisions,” he said.

According to Offchain Labs Chief Strategy Officer AJ Warner, DeFAI can dramatically increase on-chain activity before expanding DeFi’s user base.

“DeFAI has the ability to increase on-chain activity by an order of magnitude before it onboards a single user. If every on-chain user had an agent rebalancing their LP positions, monitoring loan health, or trading on their behalf, total throughput on-chain would be exponentially higher,” he said.

In due time, DeFAI technology will supersede the capabilities of even the most experienced traders.

A Financial Advisor on Auto-Pilot

DeFAI goes beyond simplifying interactions. It acts autonomously while also simultaneously creating predictive analytics and managing real-time risk.

“Instead of requiring users to adjust their strategies manually, DeFAI uses AI to automatically allocate assets, rebalance portfolios, and optimize yield while continuously monitoring on-chain data for market shifts,” Tan told BeInCrypto.

In due time, humans will not need to miss out on a full night’s sleep, knowing that their agentic financial advisor can manage their portfolio at any time without needing supervision.

“Soon, DeFAI can manage trading strategies for users 24/7, with AI analyzing market conditions in real-time and adjusting positions automatically. It will optimize yield strategies, execute trades, and mitigate risk without human intervention, allowing users to capitalize on market opportunities around the clock,” Tan added.

For Sirdesai, this can only happen once a trustless verification system is established.

“Users need to see not just what AI agents are doing, but why they’re making specific decisions. The interfaces that will win are the ones that make verified autonomous operations transparent and understandable. When users can confidently delegate complex DeFi operations to AI agents while maintaining clear oversight, that’s when we’ll see mainstream adoption take off,” he said.

Given DeFAI’s current and future capabilities, experts predict the narrative will achieve exponential growth.

Market Growth and Institutional Interest

Though DeFAI is less than a year old, industry leaders have warned that the emerging sector will redefine the cryptocurrency market in 2025 and beyond. Leading platforms like CoinGecko and CoinMarketCap are already dedicating entire sections to track its growth.

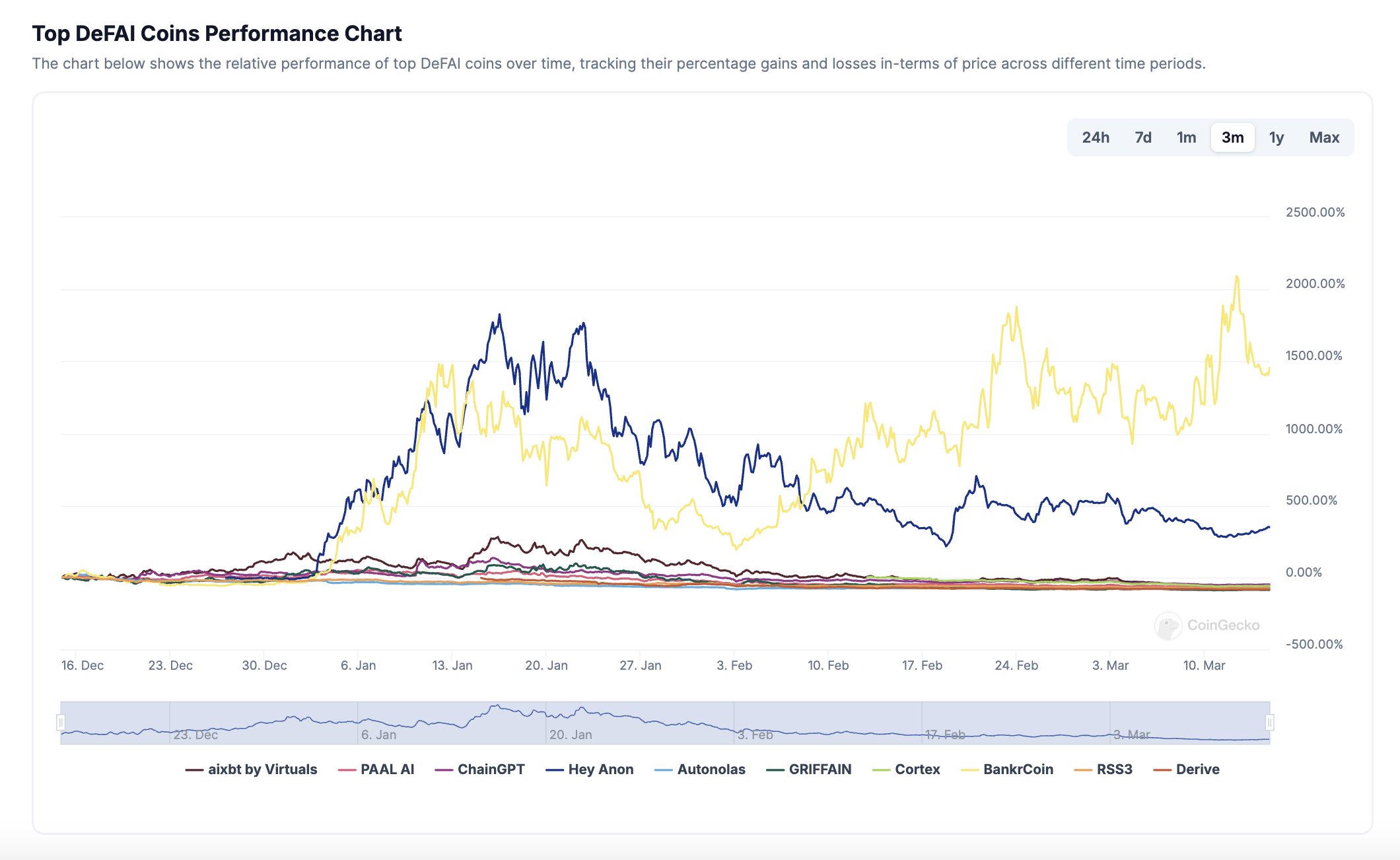

The performance and growth of leading DeFAI projects over time. Source: CoinGecko.

According to CoinGecko data, DeFAI coins have already garnered over $853 million in market capitalization. The top projects leading the charts include aixbt by Virtuals, PAAL AI, ChainGPT, Hey Anon, Autonolas, and GRIFFAIN.

“Look at how fast AI is taking off right now—ChatGPT alone is growing faster than Facebook, TikTok, and pretty much everything else. The same thing will happen with DeFAI. As we automate DeFi with AI, make it smarter, and improve the user experience, we’ll see a massive increase in adoption and market cap,” Cypher told BeInCrypto.

Meanwhile, the sector’s success has caught the attention of major institutional players in traditional finance.

“Experts predict exponential growth in DeFAI’s market cap, and several factors support this outlook. First, DeFAI builds on the rising demand for AI-driven automation in DeFi, making decentralized finance more accessible to a broader audience. Institutional players like BlackRock and Goldman Sachs are already exploring DeFi, reinforcing long-term confidence in the sector,” said Tan.

In the meantime, traditional DeFi platforms should start considering how to integrate these functionalities into their existing projects to remain competitive.

AI Integration Approaches

According to Sirdesai, platforms are adopting contrasting AI integration approaches. Some are developing proprietary AI solutions, while others are focusing on building accessible APIs to allow interaction with third-party AI agents.

“The most forward-thinking platforms are realizing that verified AI integration isn’t optional, it’s existential. When users can access sophisticated trading strategies or yield optimization through verified AI interfaces, they’re not going to go back to manually managing positions across multiple protocols. But what’s really telling is how the integration approaches differ. Some platforms are rushing to launch basic AI features, while others are building comprehensive agent integration frameworks,” he said.

Sirdesai noted that the most compelling innovation occurs in newer, AI-native platforms rather than established protocols.

“They’re building with the assumption that most interactions will eventually be agent-to-agent, with humans setting high-level parameters rather than executing individual transactions. This architectural shift will force traditional platforms to either adapt or risk becoming obsolete as capital flows to more efficient, AI-enabled systems,” he added.

All the while, the shift must be accompanied by user-friendly interfaces.

A Return to Basics: User Experience

According to Cypher, product development should be carried out while considering the existing knowledge gaps in Web3.

“The main thing is making it simple. DeFi has always been intimidating for newbies, so creating a platform that’s intuitive and easy to navigate is key. The goal should be to make complex tasks like trading, yield farming, or liquidity providing feel easy, almost like using any other app,” he said.

Warner voiced a similar opinion, boiling down the key considerations for designing user-friendly DeFAI interfaces into four simple questions:

“Is this something I would use? Could my mom use this? How is this making a user’s experience better or easier? Is this a strategy that can work for an extended period of time?,” he said.

While the potential of DeFAI to democratize decentralized finance is evident, how platforms will navigate the integration of AI and the level of trust established through verifiable actions will determine its ultimate trajectory.