A widely followed crypto analyst says that he’s identified when Bitcoin (BTC) could reach its cycle high if history were to repeat itself.

In a new strategy session, crypto trader Rekt Capital tells his 481,200 followers on the social media platform X that the top crypto asset by market cap tends to peak 518-546 days after its halving event, which occurs in April every four years.

“In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving. In the 2019-2021 cycle, Bitcoin peaked 546 days after the halving.

If history repeats and the next bull market peak occurs 518-546 days after the halving… That would mean Bitcoin could peak in this cycle in mid-September or mid-October 2025.”

However, Rekt Capital notes that due to the latest crypto market crash, the crypto king’s rate of acceleration has drastically fallen.

“Earlier this year, Bitcoin was accelerating in this cycle by 260 days. Currently however, thanks to this over 3-month consolidation, this rate of acceleration has drastically dropped and is now approximately 150 days.

The longer Bitcoin consolidates after the halving, the better it will be for resynchronizing this current cycle with the traditional halving cycle.”

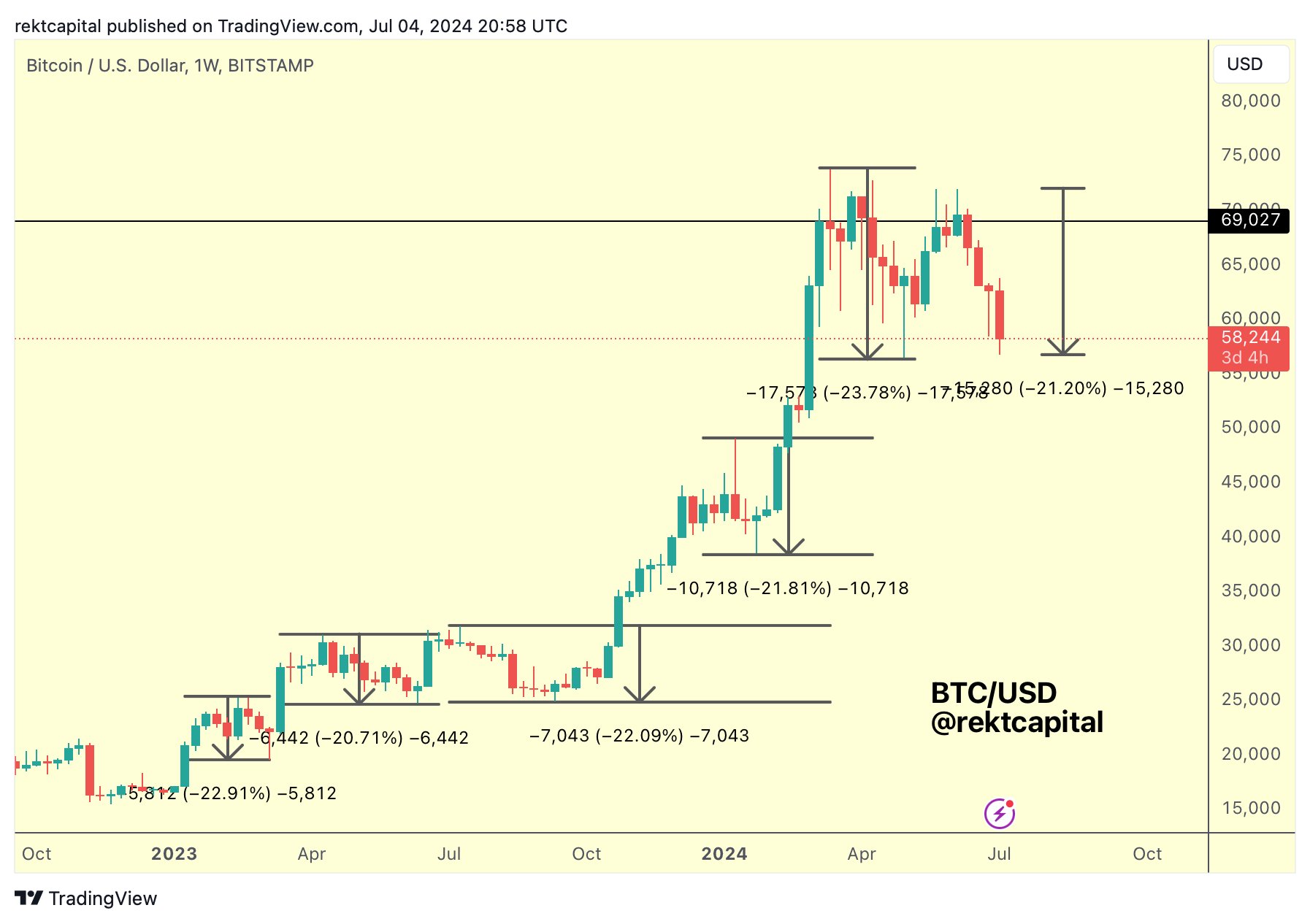

The trader goes on to make the case that BTC has likely bottomed out by comparing all BTC pullbacks since February 2023.

“Here is a list of all Bitcoin pullbacks dating to the bear market bottom of 2022:

- -23% (February 2023).

- -21% (April/May 2023).

- -22% (July/September 2023).

- -21% (January 2024).

- -23.6% (April/May 2024).

- -21% thus far (June 2024) Average retrace in this cycle is -22%.

Therefore this current pullback is almost an average -22% correction.”

Bitcoin is trading for $56,521 at time of writing, a 2.6% decrease during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney