- Large transactions increased, indicating that FLOKI could hit $0.00040 in the short term.

- The token’s social dominance and weighted sentiment fell, predicting a possible bullish invalidation.

In the last seven days, Floki’s [FLOKI] price has increased by 24.79%, triggering different opinions about Floki Inu price prediction. At press time, the token changed hands at $0.00031.

A few days ago, specifically on the 5th of June, FLOKI hit a new All-Time High (ATH) of $0.00034. However, since that day, the price decreased and in the last 24 hours, has been swinging sideways.

Despite the retracement, AMBCrypto found that several metrics were supporting the bullish Floki Inu price prediction to come to pass. First on the list was the large transactions happening on the Floki network.

FLOKI has the “big boys” support

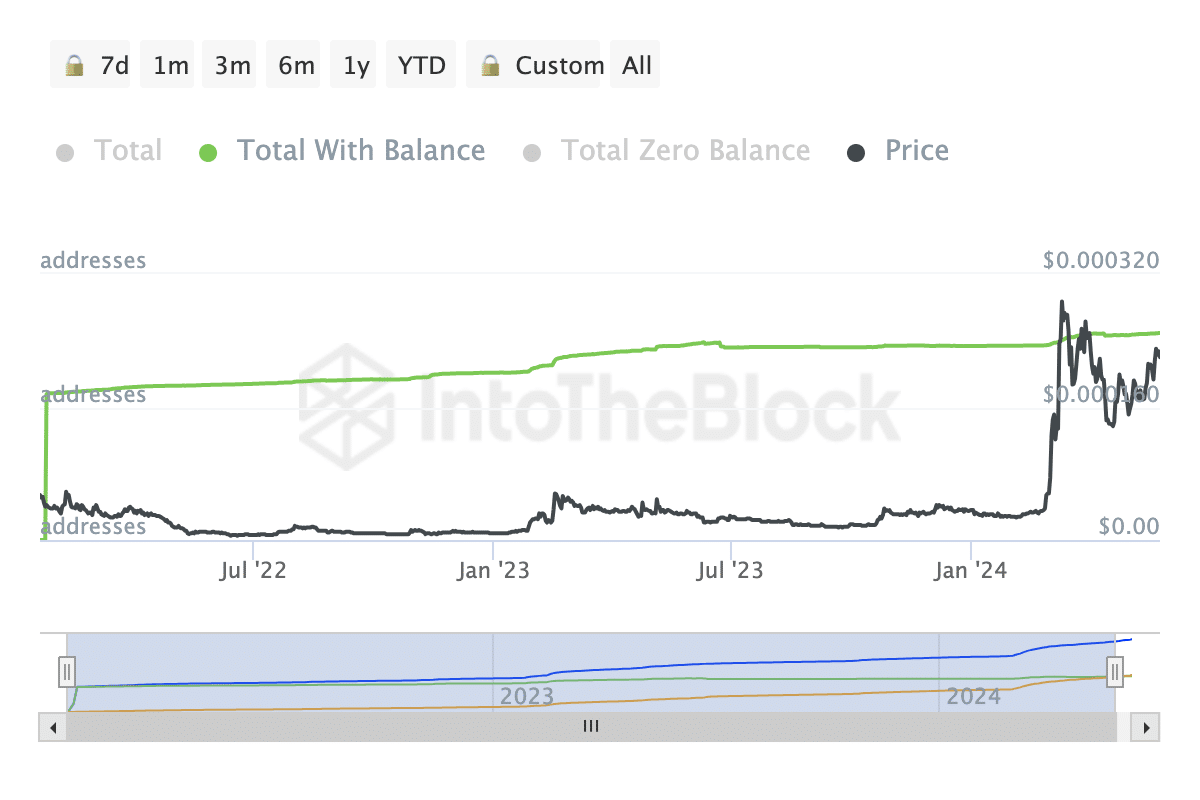

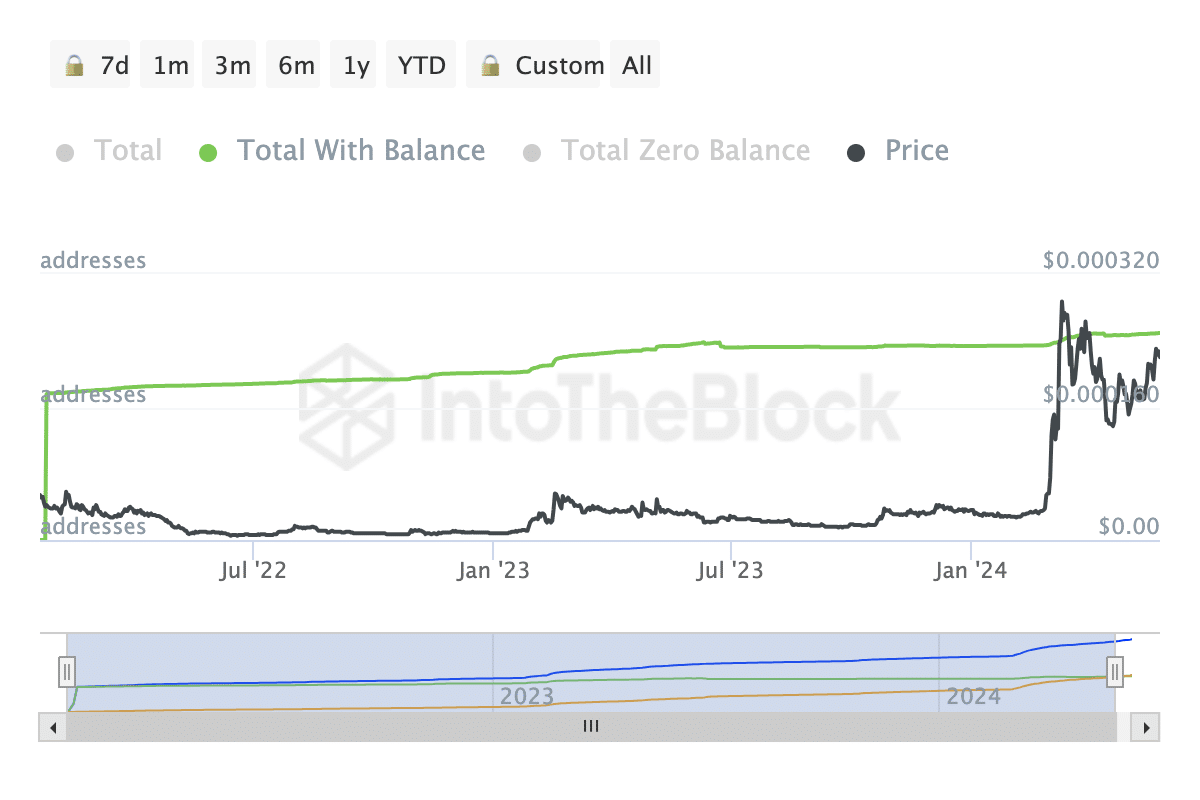

According to data from IntoTheBlock, large transactions had increased by 9.81% in the last 24 hours. For context, large transactions are tagged as transactions valued at $100,000 or more.

Spikes in this metric indicate high activity by institutional players. However, this could be either buying or selling. But FLOKI’s price action suggested that most of the volume tilted toward a purchase.

Should this metric continue rise, then FLOKI’s price could hit a new ATH. Beyond the transactions, AMBCrypto looked at the active addresses to determine if the Floki Inu price prediction indicated by the transactions could be validated.

At press time, daily active addresses on the network was 77,790. This was a notable increase from the number in the last week of May.

Source: IntoTheBlock

In general, active addresses tracks network activity. Most times, the metric has a strong correlation with FLOKI’s price.

If the indicator decreases, it means that interaction on a blockchain is decreasing. At the same time, it implies low demand for the cryptocurrency.

However, the recent increase indicates rising demand for FLOKI. If sustained, this could be trigger a Floki Inu price prediction toward $0.00040.

Furthermore, AMBCrypto reported that the Floki team was working on increased adoption for the memecoin. This was evident in the recent commitment market maker DWF Labs.

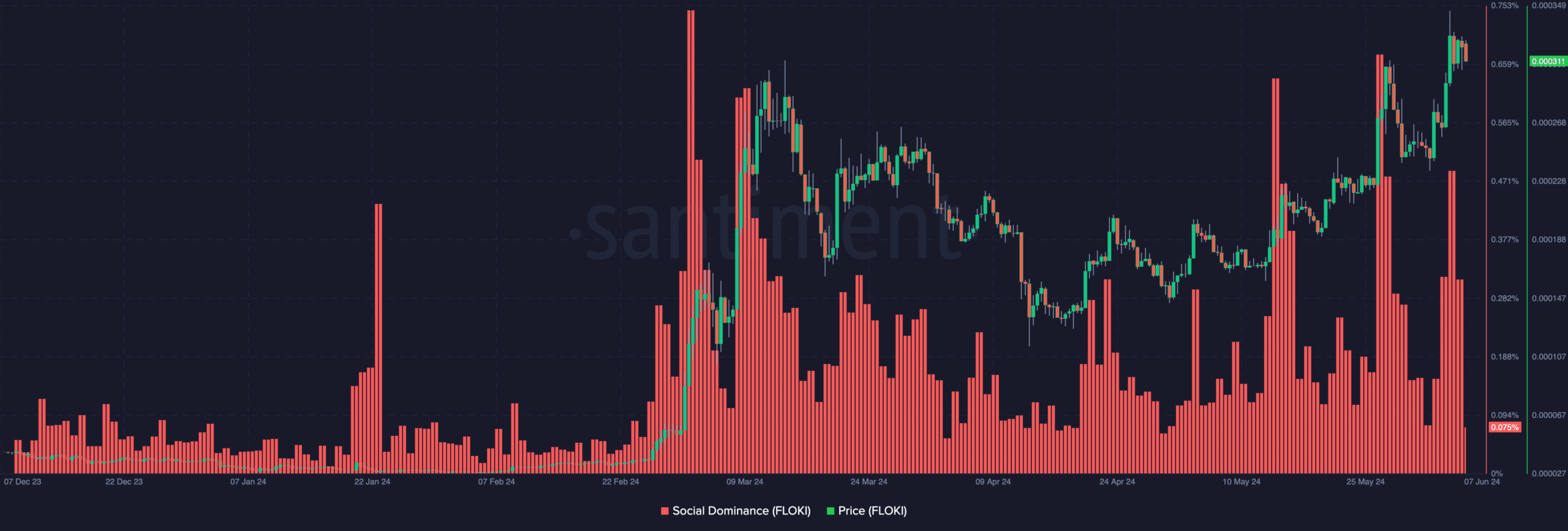

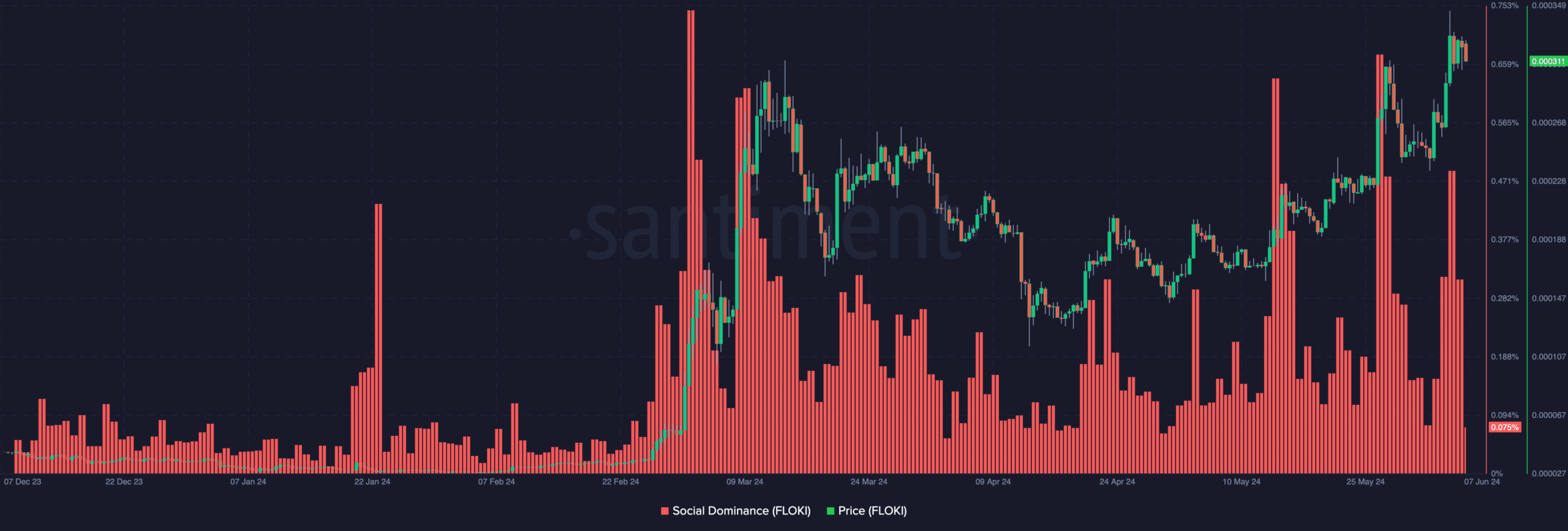

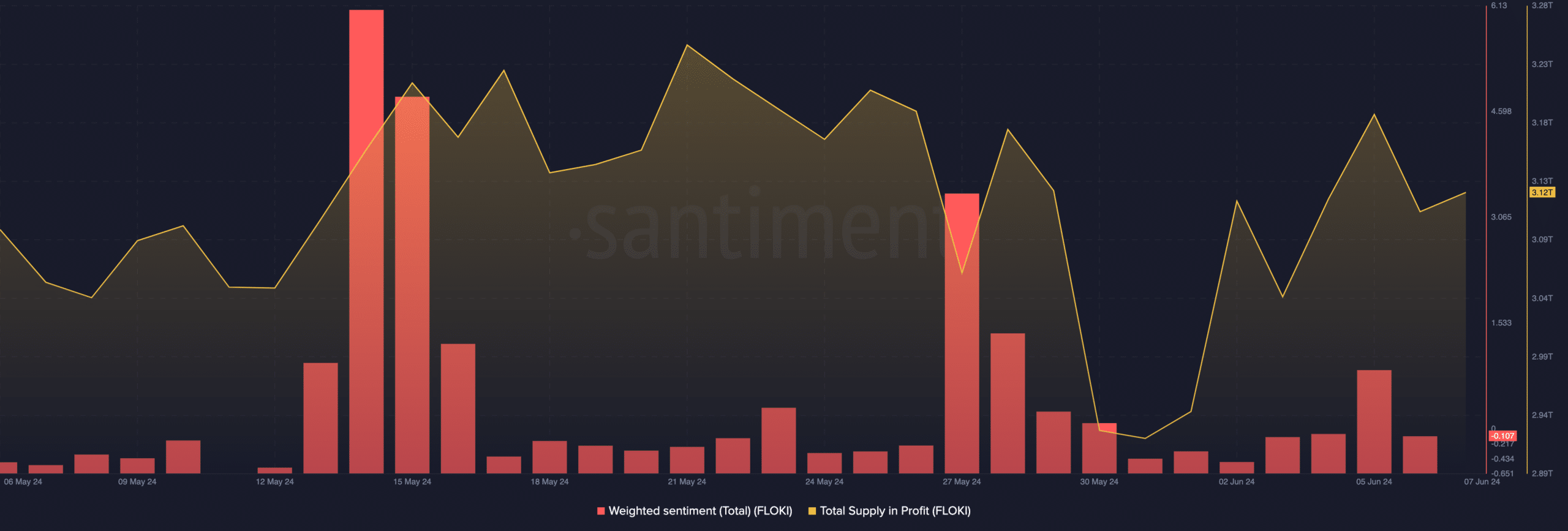

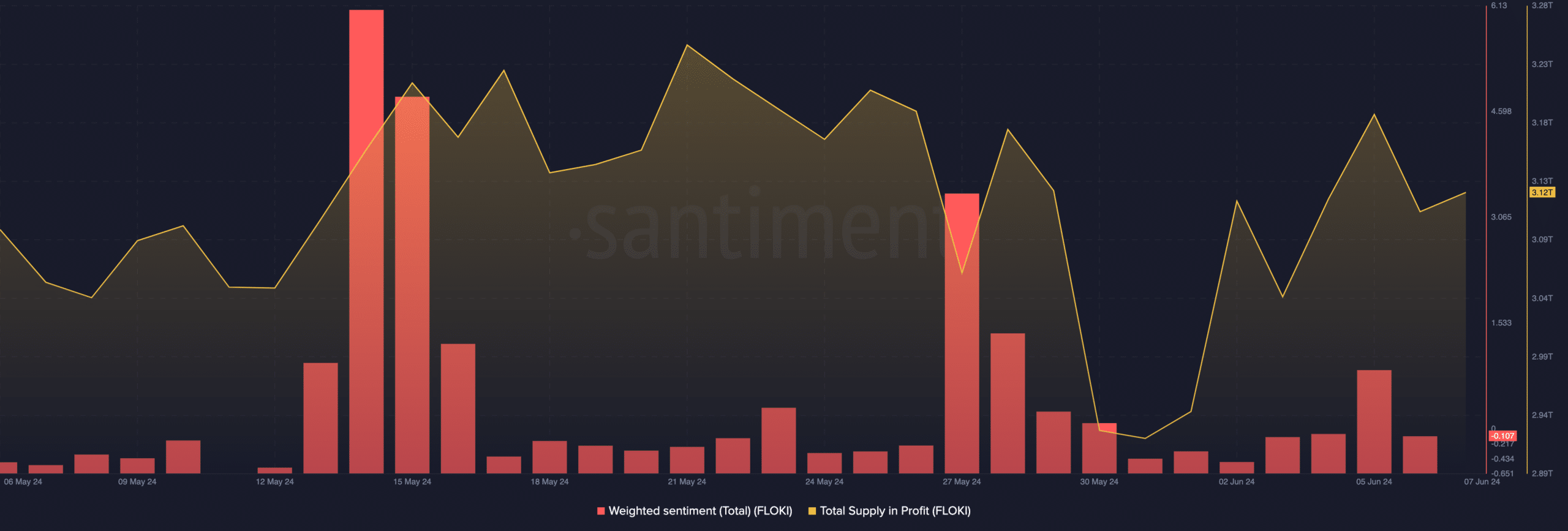

However, there has been a change with FLOKI which could affect the price prediction. According to on-chain analysis using Santiment, the token’s social dominance had plunged.

Will negative sentiment stop the memecoin?

Previously, the metric was 0.487%— on the 6th of June. But at press time, that ratio had fallen to 0.075%. This suggests that FLOKI-related discussion within the ecosystem had decreased.

Should this ratio continue to fall, FLOKI’s price could drop below $0.00030. However, a decline in social dominance could also serve as a buying opportunity for the token.

Looking at the chart below, anytime that the metric dumps, FLOKI’s price breaks out a few days later. As such, the pattern might repeat itself, and the $0.000040 Floki Inu price prediction could be plausible.

Source: Santiment

In addition, the sentiment around FLOKI had become negative, suggesting that traders are taking a cautious approach toward the cryptocurrency. Weighted Sentiment tracks the positive/negative comments about a project.

Considering the negative reading around the token, FLOKI could face another decline before another bounce occurs. In terms of the supply in profit, on-chain data showed that 3.12 trillion tokens were in the green.

Source: Santiment

Is your portfolio green? Check the Floki Profit Calculator

This is something that is important to the price action. For example, the number of tokens in profit hit 3.25 trillion on the 21st of May. At that point, the memecoin was overheated and triggered a correction in the price.

But since the supply in profit was lower, Floki Inu’s price prediction could be one to keep an eye on.