A macro analyst at the investment giant Fidelity thinks there needs to be a sustained spike in money supply to bolster the argument that Bitcoin (BTC) and gold are stores of value that hedge against government-induced inflation.

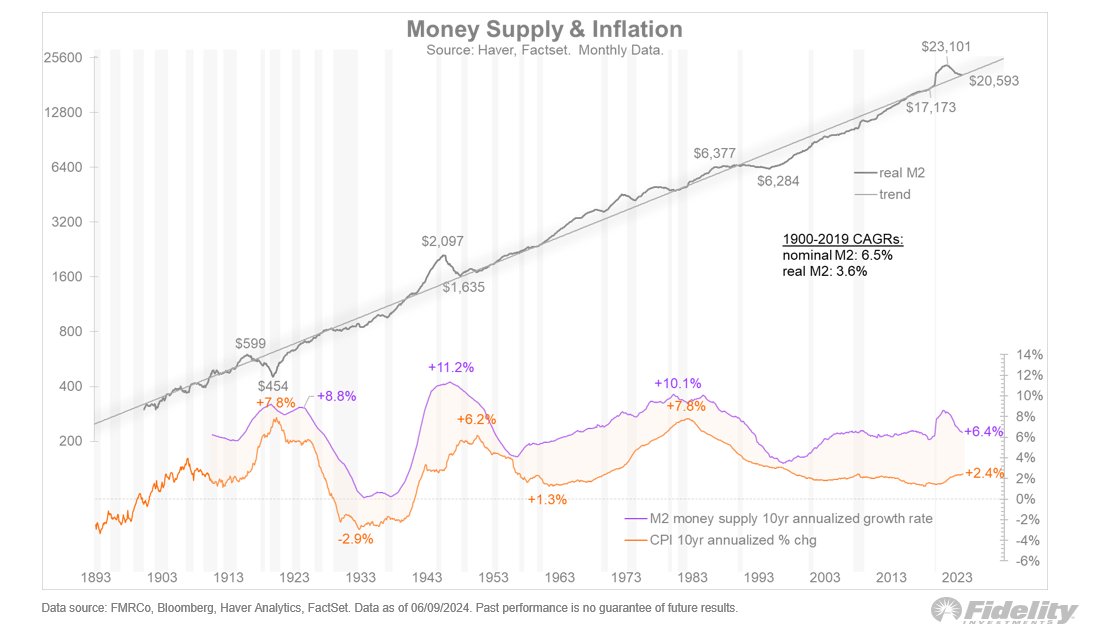

Jurrien Timmer, the director of global macro at Fidelity, notes on the social media platform X that sustained increases in the money supply tend to produce inflation, which gives way to the thesis that gold and BTC can be hedges against weakening money.

“My sense is that for the store of value argument to really accelerate, we will need to see sustained above-trend growth in the monetary aggregates. So far, we have not seen that, with the massive spike in real M2 during the pandemic quickly reversing under the weight of a restrictive Fed. That tells me that gold and Bitcoin are a play on something that may happen, but hasn’t happened yet.”

M2 is a money supply metric that measures peoples’ cash, checking accounts and other types of deposits that are easily convertible to cash.

Bitcoin is trading at $68,435 at time of writing. The top-ranked crypto asset by market cap is down nearly 4% in the past seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3