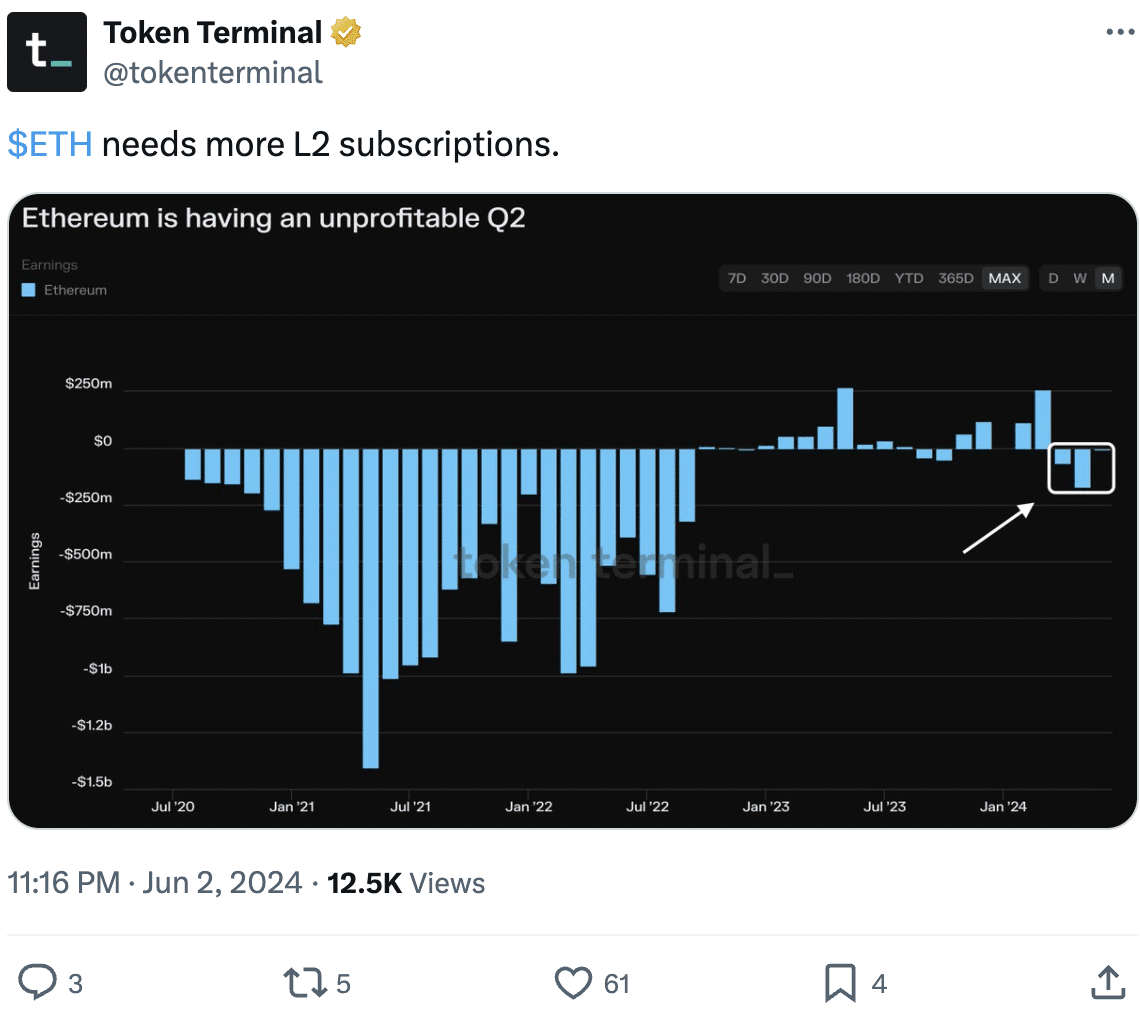

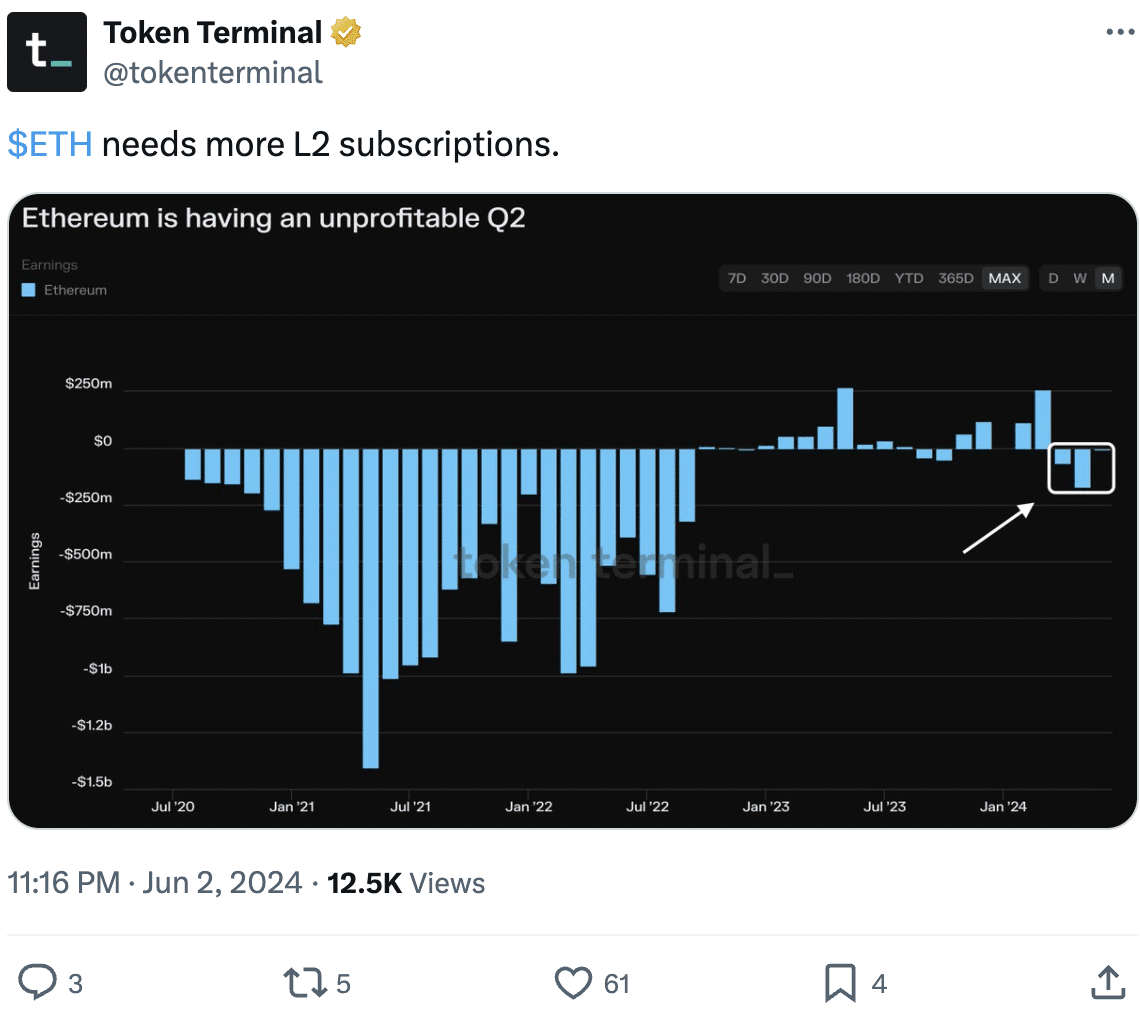

- Ethereum’s performance in Q2 was unprofitable, indicating a difficult quarter.

- Whales and retail investors took some profits as prices surged.

Ethereum [ETH] witnessed a surge in price and popularity over the last few days following the announcement of Ethereum ETFs.

A disappointing quarter

Despite this, the ecosystem was not doing too well. Token Terminal’s data indicated that Ethereum was having an unprofitable Q2.

If Ethereum continues to have problems generating revenue, it would make it much harder for the network to sell its holdings.

Source: X

However, interest in ETH remained had remained relatively high.

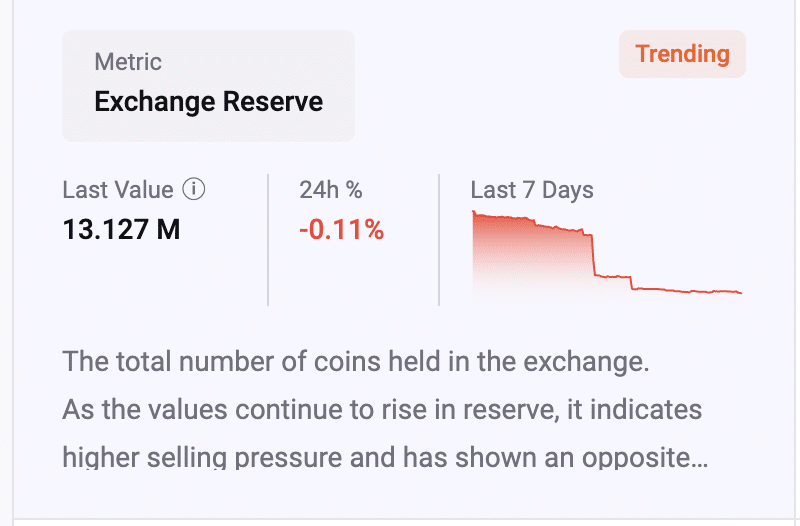

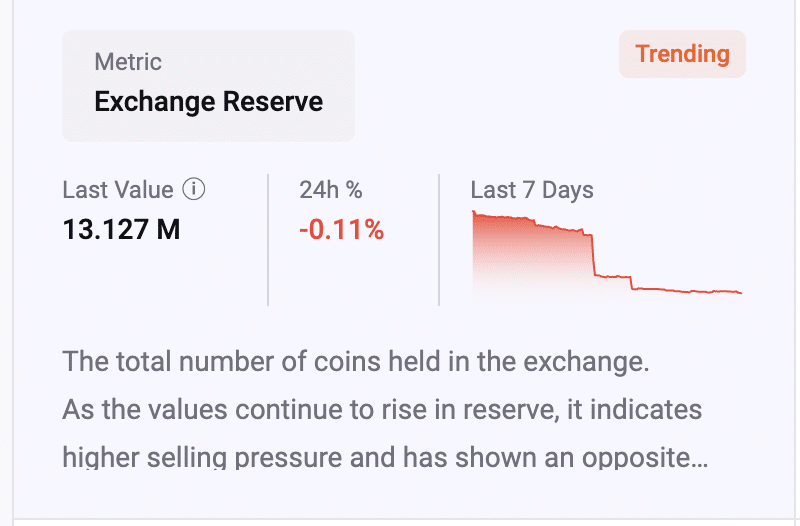

Following the 23rd May approval of spot Ethereum exchange-traded funds ETFs in the United States, more than $3 billion worth of Ethereum was withdrawn from centralized crypto exchanges, indicating a potential supply squeeze.

Data showed that the amount of Ethereum on exchanges decreased by around 797,000, or $3.02 billion, between 23rd May and 2nd June.

Source: CryptoQuant

This reduction in exchange reserves implies fewer ETH is available for sale as investors move their assets to self-custody for purposes other than immediate selling.

Ethereum’s supply on exchanges was now at its lowest level in years, just 10.6%. This reduction in supply, coupled with a surge in demand from investors post numerous ETF approvals could further boost the price of ETH and nuge it towards its all time high (ATH).

Nevertheless, concerns linger that Grayscale’s Ethereum Trust (ETHE), which manages $11 billion in funds, could impact Ethereum’s price action. This is based on the example of the Grayscale Bitcoin Trust (GBTC), which saw $6.5 billion in outflows within the first month of its approval.

How is ETH doing?

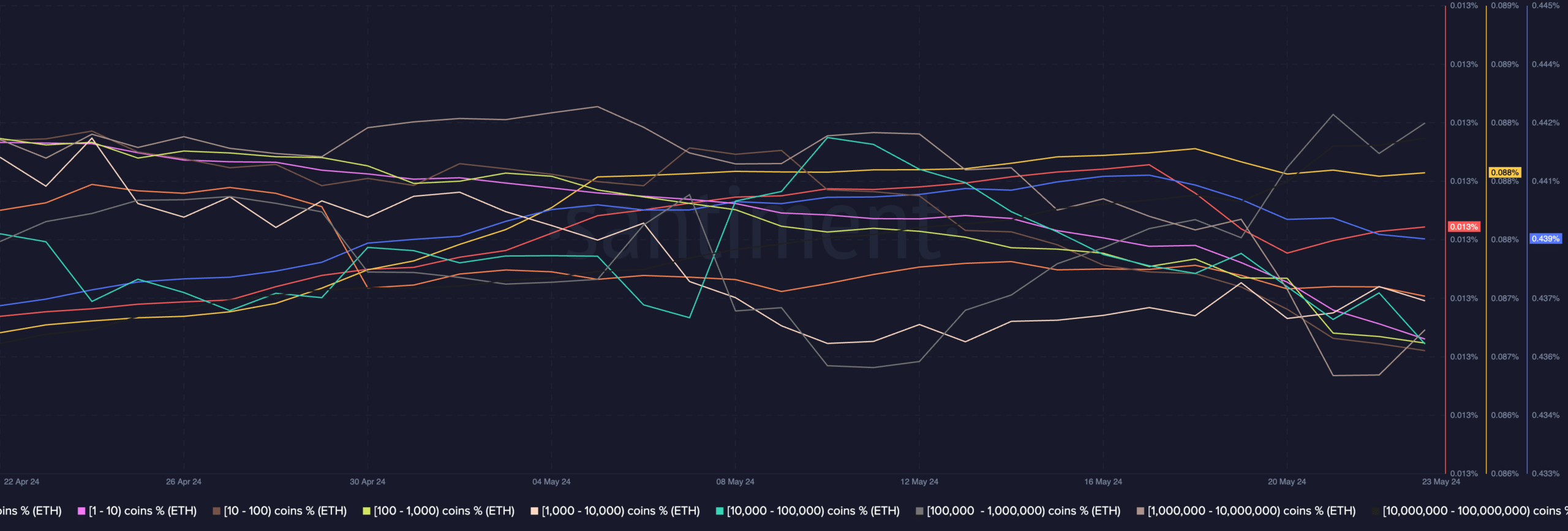

At press time, ETH was trading at $3,833.59 and its price had grown by 1.19% in the last 24 hours. Surprisingly, both whale interest and retail interest dipped slightly over the last few days.

AMBCrypto’s examination of Santiment’s data revealed that cohorts holding anywhere between 0.01 ETH to 10 ETH had witnessed a decline in overall ETH held by them.

Moreover, the addresses holding more that amount also let go of some of their ETH.

Is your portfolio green? Check the Ethereum Profit Calculator

This behavior exhibited by both whales and retail investors indicated that a lot of holders were indulging in some level of profit taking as prices soared.

However, the sell offs have not been significant enough to impact prices negatively.

Source: Santiment