Ethereum’s been on fire, shooting up by 29% to hit $3,200 over the past week. But with some big players, like Tron’s Justin Sun, cashing in on the rally, people are starting to wonder: can Ethereum hold on to this high, or are we looking at a drop ahead?

Let’s look at what’s happening and what this could mean for ETH. When is the next big move coming?

Justin Sun’s Sell-Off Shakes Things Up

As Ethereum’s price surged, Tron founder Justin Sun took advantage of the high, selling 19,000 ETH for about $60.83 million at an average price of $3,202 per token. This sale gave Sun a gain of around 5.69%, or roughly $69 million.

However, despite the size of this sale, it only represents a small portion of his ETH holdings—Sun still holds around $1.19 billion in ETH, totaling 392,474 tokens.

Moves by major players like Sun naturally attract market attention. Does this sale suggest that other whales might start cashing out, or was it simply a strategic sale to lock in some gains?

Dormant Investors Returns After Years

Sun isn’t the only whale moving ETH around right now. Recently, an early Ethereum investor, who bought during the initial coin offering (ICO), came back into action after being quiet for years. This investor moved 1,555 ETH—worth about $5 million—to Coinbase. What’s wild is that they initially paid only $1,951 for all 6,292 ETH they bought during the ICO, which is now worth over $20 million. Talk about returns.

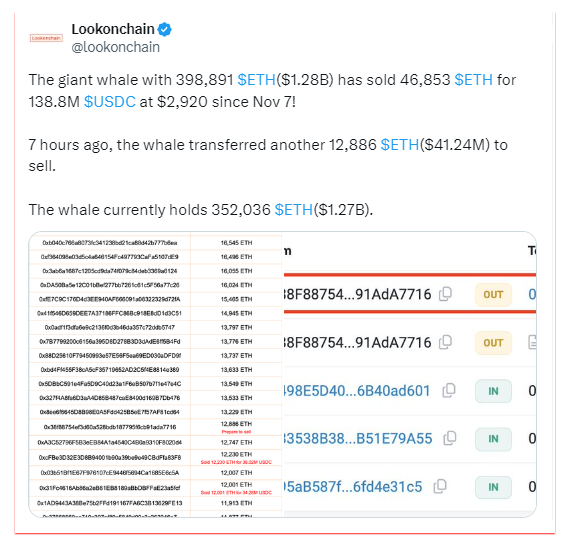

A third major ETH holder, with around 398,891 ETH, recently sold 46,853 ETH for $138.8 million in USDC at a slightly lower price of $2,920. Shortly after, this whale moved another 12,886 ETH to exchanges, adding $42 million more to their sale. However, they still hold around 352,000 ETH in their wallet, showing continued confidence in Ethereum despite these recent sales. They’re not giving up just yet!

Is $3,200 Just the Start?

With all this buying and selling, $3,200 is now a key resistance level for Ethereum. If ETH can push past this price, it could continue its upward trend. Analyst Michael van de Poppe remains optimistic, suggesting that Ethereum has potential to keep growing in the coming months.

Blockchain analytics firm Santiment also sees bullish potential, noting that Bitcoin’s recent rally may support Ethereum as profits flow into other cryptocurrencies. Additionally, with spot Ethereum ETFs drawing fresh interest following Trump’s election win, demand for ETH is looking strong.

What’s Next for ETH?

Ethereum’s future is still uncertain, but with whales sticking around and ETF interest growing, ETH could have more room to grow. Investors are watching closely to see if Ethereum can break through or if big sales will push it back down. For now, all eyes are on $3,200—and everyone’s waiting to see what ETH does next following Bitcoin rise to $81,000.

The future of Ethereum remains uncertain, but one thing is clear: the market is filled with both opportunity and risk. Do your research well and invest wisely for the best outcome!