- Solana outperformed Ethereum in active addresses and trading volume.

- Despite Solana’s growth, Ethereum’s network activity and security position it as superior.

Mirroring the broader market trend, both Ethereum [ETH] and Solana [SOL] exhibited positive trading activity, with ETH experiencing a 1.4% increase and SOL showing a 4.64% hike in the past 24 hours.

However, delving deeper into their performance revealed an interesting insight: Solana has surpassed Ethereum in activity metrics, boasting a higher number of active addresses and trading volume.

Solana’s active addresses surged above 1 million, while Ethereum’s remained stagnant, highlighting a notable disparity between the two networks.

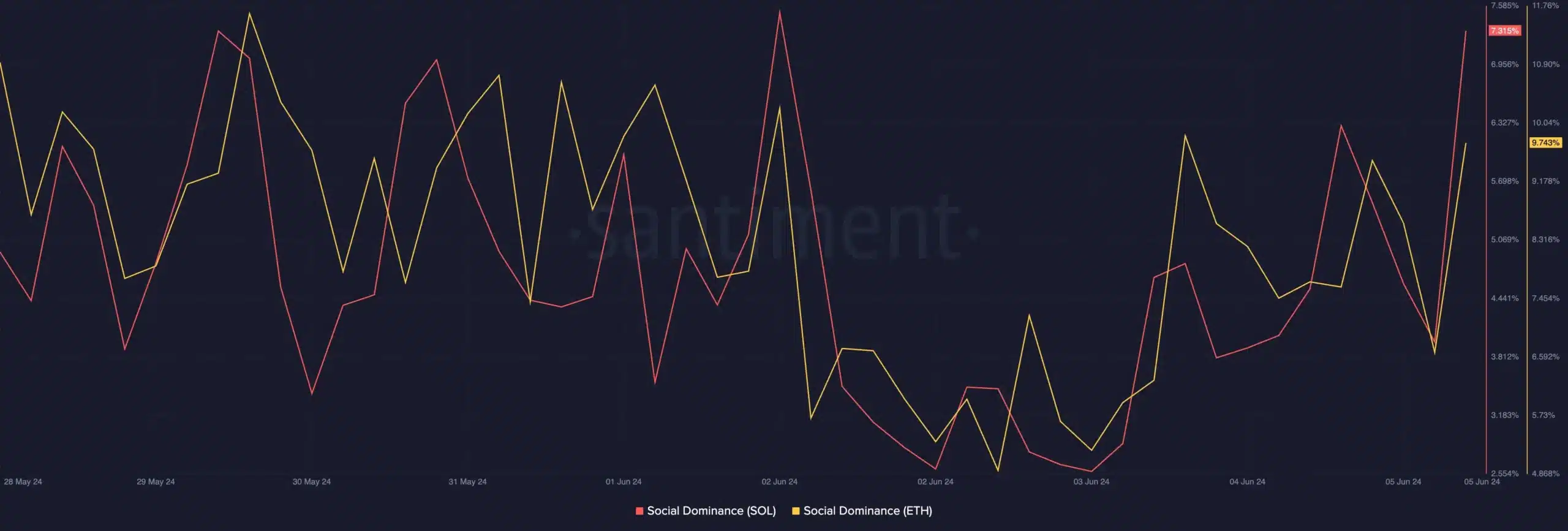

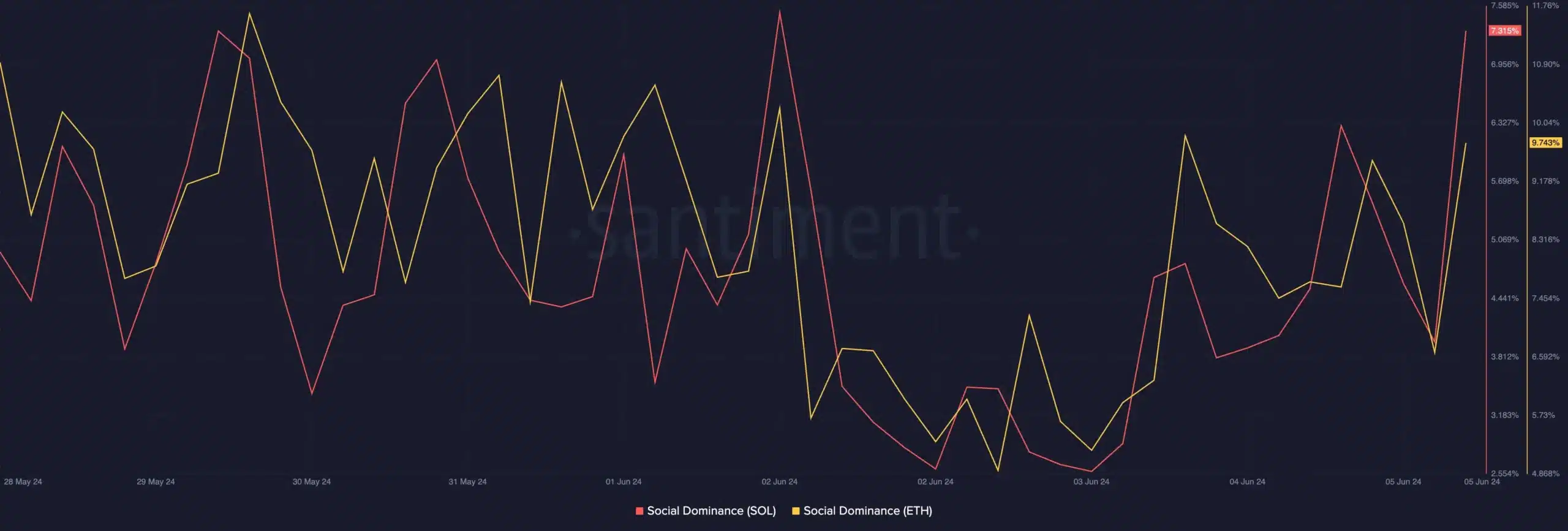

Further confirming this sentiment, AMBCrypto’s analysis of Santiment data revealed that SOL outperformed ETH in social dominance as well.

Source: Santiment

With such key metrics hinting at Solana’s potential to overtake Ethereum, a fundamental question emerges: Which blockchain will emerge victorious in 2024 and beyond?

Ethereum vs Solana: The debate

Sharing their insights, Ethereum Researcher Justin Drake and Solana Co-Founder Anatoly Yakovenko engaged in a debate on Ethereum versus Solana on the ‘Bankless’ podcast.

Shedding light on what’s good about Solana, Drake noted,

“I think what Solana is doing for Ethereum is that it is providing healthy competition. It’s a sort of accelerationism and not only because of good execution but also because of contrarianism.”

In response, Yakovenko, while praising ETH’s decision to prioritize security over scalability, he said,

“People think Ethereum is moving slowly but if you look at the size of the network, its value…I would be terrified of any changes to Solana if it was at that value.”

He further went ahead and added,

“Ethereum is at a point which I think every other L1 should be envious of, and try to get there as fast as they can. All of that I think puts it in a class in my mind actually above Bitcoin.”

This highlights that Ethereum is still the winner in the L1 space owing to the most network effects, liquidity, maturity, and security, making it pre-ordained to surpass Bitcoin and become number one.

However, on the other hand, Drake justified that Solana could become the ‘internet of value’, justifying its $100 billion valuation.

He further added that SOL’s developers are more focused on building user-targeting products rather than infrastructure, which contributes to its success.

SOL a competitor to ETH?

Adding to the fray, Raoul Pal, CEO of Real Vision and Global Macro Investor, drawing parallels with ETH’s 2020 bull run highlighted Solana’s emergence as a strong Ethereum competitor.

He best put it when he said,

“If you go back to 2020, Ethereum started basing and then began outperforming from about the summer onwards. It really started picking up towards the end of 2020, and then by 2021, it went ballistic, you know, it went into full banana mode. I think we’ll see something similar.”