- Analyst claims ETH will eclipse BTC in crypto summer.

- The US liquidity injection could boost the market in the second half 2024.

Ethereum [ETH] could outshine Bitcoin [BTC] as we inch closer to crypto summer. The bold projection was made by Raoul Pal, founder of Real Vision and key crypto market commentary figure.

In an X post, Pal underscored that crypto summer is an altcoin season that shifts attention from Bitcoin to others. Part of his post read,

“Crypto Summer is usually the start of Alts season, which goes full “bubble-tastic” in Fall. This is when ETH bases and begins to outperform BTC. This is when SOL accelerates its outperformance of BTC & ETH.”

Adding a timeline to his projection and how “crazy” things can get, Pal highlighted that,

“Once the markets are full refreshed, that is usually when The Banana Zone starts, picking up to full mania towards the latter part of the year…and well into 2025”

Source: X/Rauol Pal

The US liquidity factor

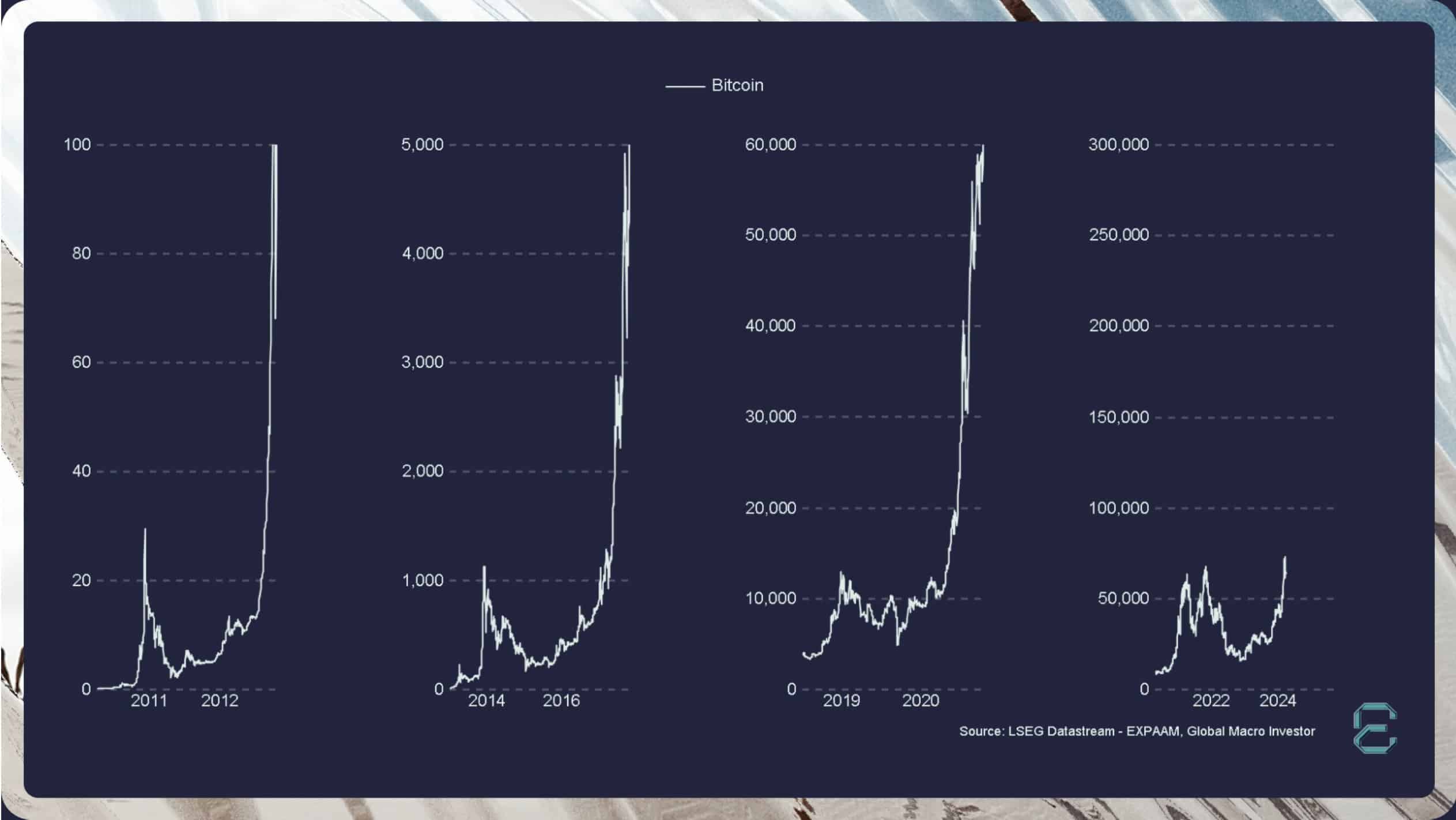

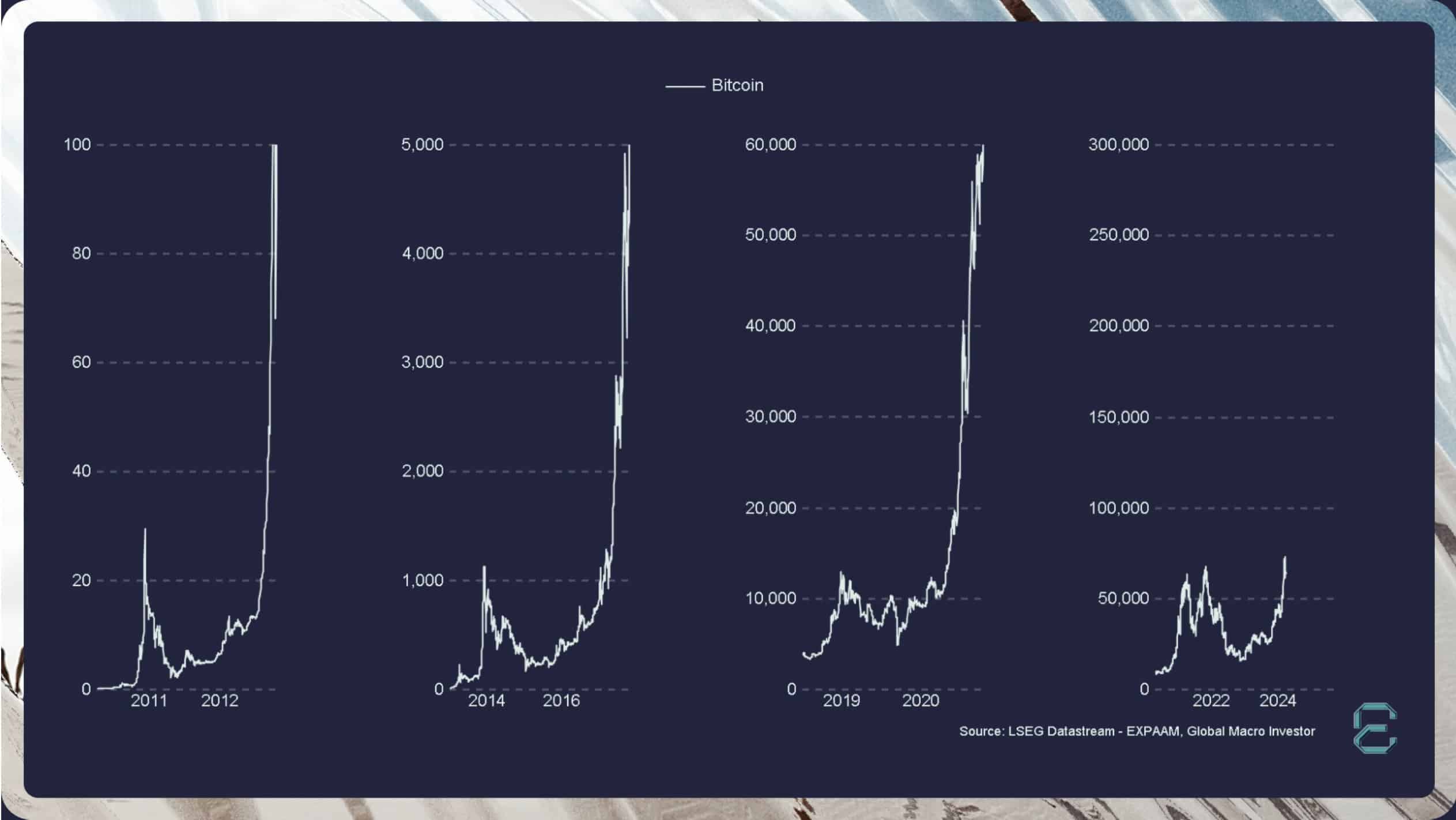

Pal’s projection is purely based on historical data. However, past performance doesn’t necessarily dictate future outcomes. So, what could be the key catalyst for Pal’s wild projection?

An easing macro front is one of the likely factors. The Singapore-based crypto trading firm, QCP, emphasized how US liquidity injection could drive markets.

In a weekend update over Telegram, the firm acknowledged that US inflation was still hot. However, it reiterated that the US treasury could inject more liquidity in the second half of the year. Part of the statement read,

“However, at this point, monetary policy might matter much less than fiscal policy, which will be the main driver of liquidity and asset performance.”

The firm added that,

“The upcoming Quarterly Refunding Announcement (QRA) on 1st May could also see higher issuances in short-term US bills. This will drain the RRP, which currently has USD 400 billion, and also increase liquidity.”

Last week, BitMEX founder Arthur Hayes made a similar projection. He highlighted that extra liquidity will be injected into the economy during the US elections.

More liquidity means an extra money supply within global or local markets, especially when central banks cut interest rates. This is a perfect condition for risk-on assets to rally.

Whether Ethereum outperforms Bitcoin remains to be seen. However, much of the hyped “crypto summer” could be fueled mainly by macro factors rather than historical cycles.