- Ethereum has seen an increased inflationary trend recently.

- ETH was trading at around $3,300 as of this writing.

Ethereum [ETH], previously recognized for its deflationary trend, has shifted towards a more inflationary pattern in recent months.

While the mechanism to burn ETH—part of its transaction fee model introduced in EIP-1559—has continued, the overall supply of Ethereum has still increased.

The hope among investors and market observers is that demand for ETH will increase with the finalization of approvals for exchange-traded funds (ETFs).

Ethereum becomes more inflationary

The inflationary trend in Ethereum’s supply has reportedly reached its highest level since 2022, particularly following its recent network upgrade in March.

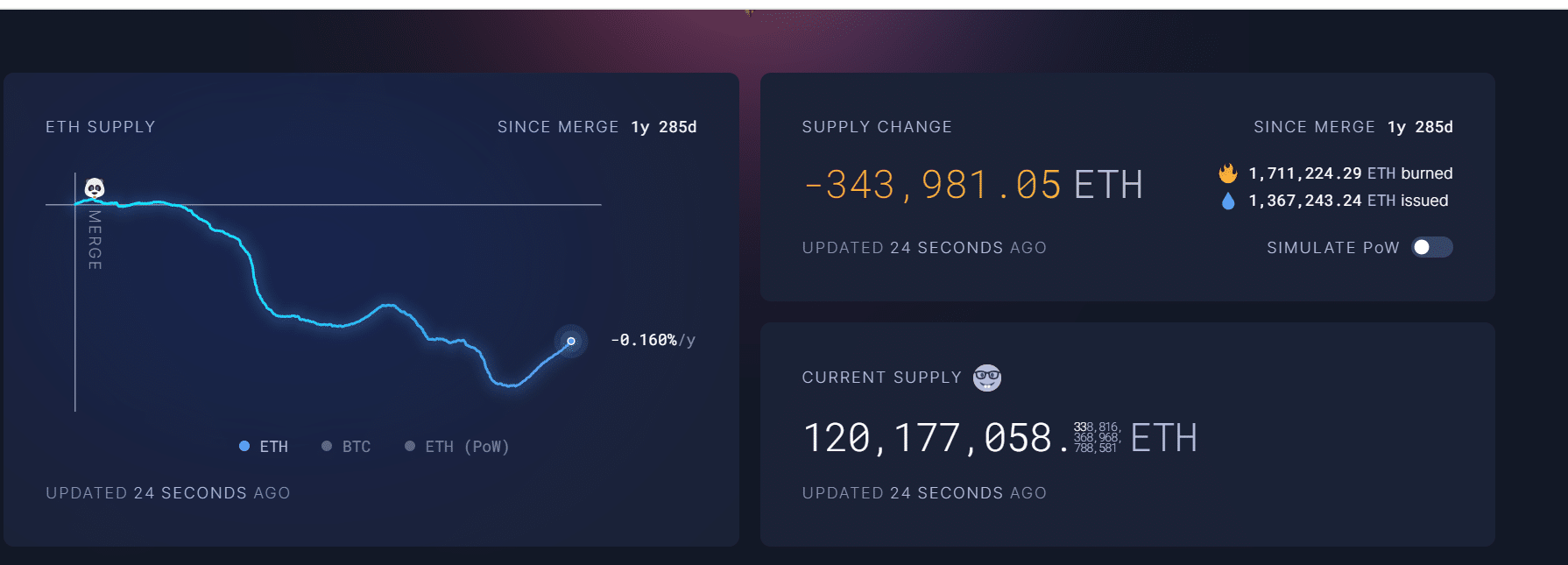

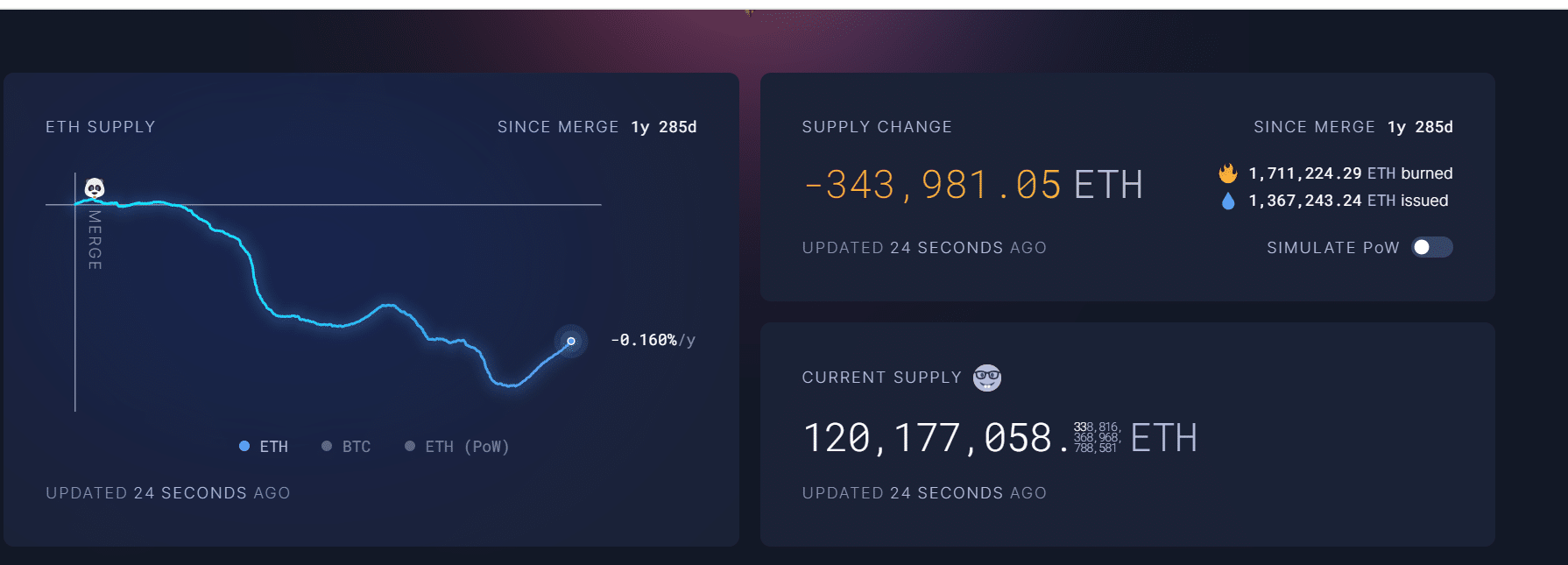

According to data from Ultrasound Money, the total supply of ETH has expanded by over 112,000 ETH in the past four months.

This increase in supply is largely attributed to the effects of the upgrade, which took place on 13th March.

Source: Ultrasound money

The upgrade, part of ETH’s ongoing development and improvement protocol, has had a significant impact on the network’s economic model.

Ethereum not easing up on burns

Despite the recent inflationary trends observed in Ethereum’s supply due to the upgrade, the overall balance since the implementation of the Merge remains deflationary.

According to Ultrasound Money, over 1.7 million ETH have been burned due to transaction fees, while the total new supply added since the Merge is over 1.3 million ETH. This results in a net reduction of over 344,000 ETH being removed from circulation.

The ability of this mechanism to outweigh the supply increase from the upgrade maintained ETH’s appeal as a deflationary asset.

Such dynamics are crucial for its long-term valuation, as the reduction in supply, assuming steady or increasing demand, can lead to an appreciation in ETH’s market price and make it an attractive hold for investors.

Ethereum ETFs imminent

The prospects for the launch of an Ethereum ETF appear more promising, as highlighted by Bloomberg ETF analyst Eric Balchunas.

He noted that VanEck, a significant player in the ETF market, has taken a crucial step by filing an 8-A form for their Ethereum Trust on 26th June.

This form is essential for corporations looking to issue securities on national exchanges, signaling a readiness to proceed with the ETF.

Eric Balchunas pointed out the strategic timing of this filing, drawing a parallel to VanEck’s previous actions with their Bitcoin spot ETF, which was filed exactly seven days before its launch on 11th January.

This pattern suggests that the ETH ETF might be following a similar timeline, potentially indicating an imminent launch.

How it could impact ETH

The introduction of Ethereum ETFs could significantly impact the market dynamics for ETH.

Read Ethereum (ETH) Price Prediction 2024-25

By facilitating broader and more regulated access to ETH for institutional and retail investors, these ETFs could increase demand for ETH.

This heightened demand, coupled with Ethereum’s existing deflationary mechanisms, could absorb excess supply and enhance Ethereum’s deflationary trajectory.