- ETH’s inflationary state persisted as issuance remained 3X the burn rate.

- Analysts were bullish on ETH post-ETF approval, but short-term drop could not be overruled.

Ethereum’s [ETH] inflationary state debate has been re-ignited again on ‘Crypto Twitter’ amidst ETH ETF approval speculation.

Notably, Bitwise’s Chief Investment Officer (CIO) Matt Huogan reavaled that Ethereum’s issuance currently stood at approximately $10 million per day.

“Total ETH issuance is ~$10 million per day. That’s before you consider the burn.”

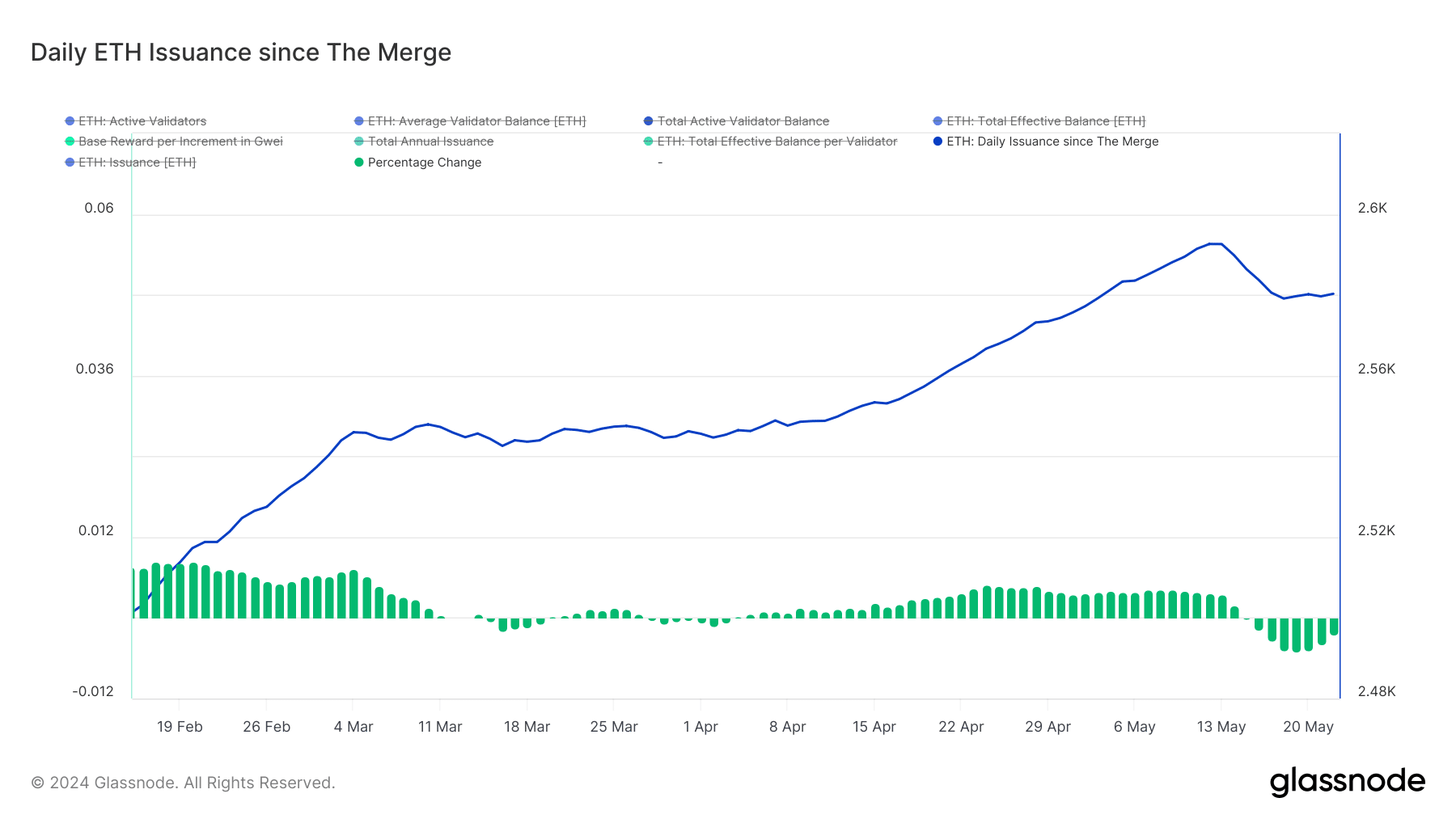

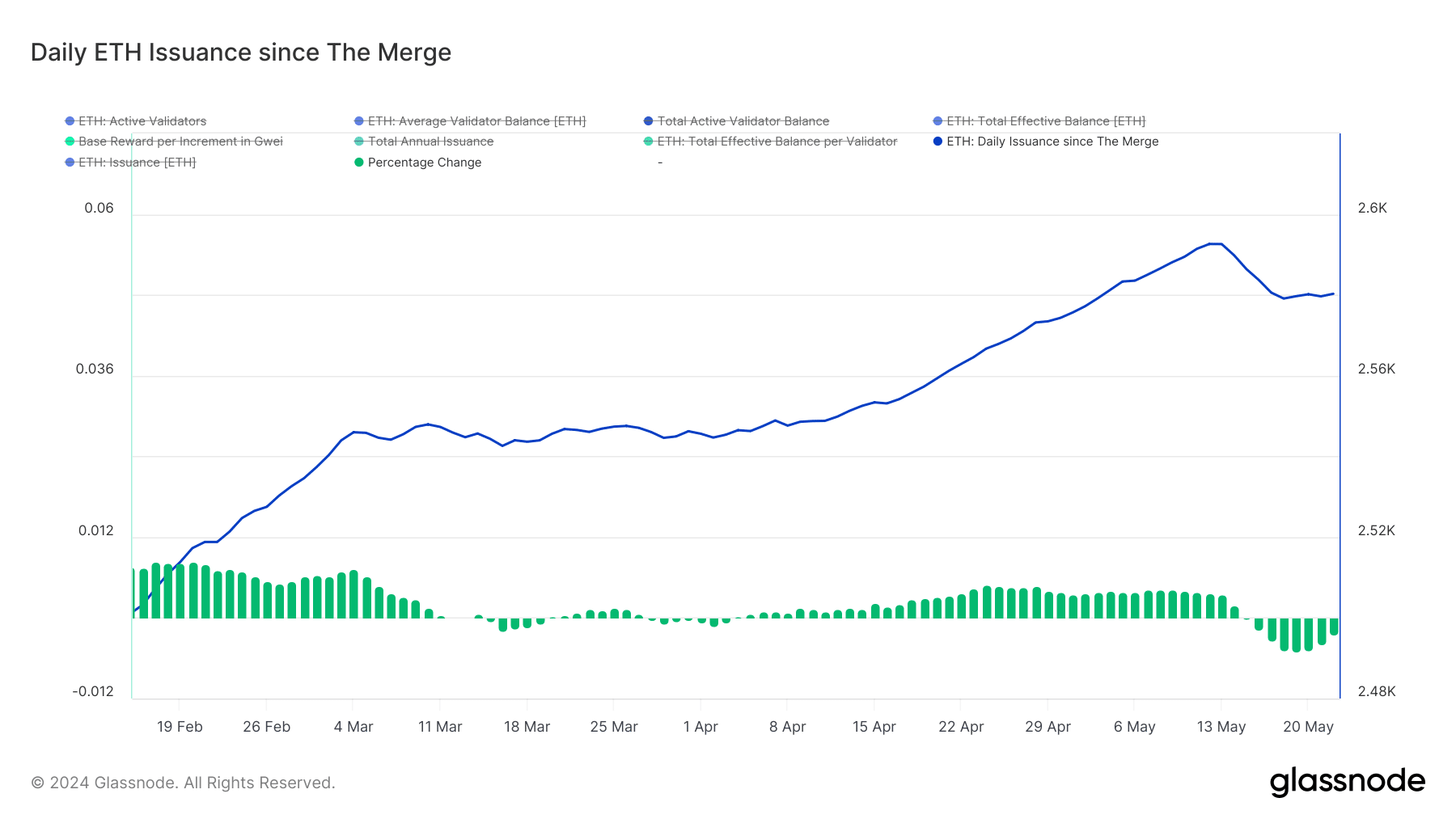

A spot check on Glassnode confirmed Hougan’s claim. Per the crypto intelligent data provider, daily issuance at the network on the 22nd of May was 2.58K ETH.

Based on press time market prices of $3.7K, that translated to $9.5 million.

Source: ETH Daily Issuance

Ethereum lost its deflationary status following the Dencun upgrade, as ETH’s burn rate (the pace of removing ETH from supply) trailed the issuance rate.

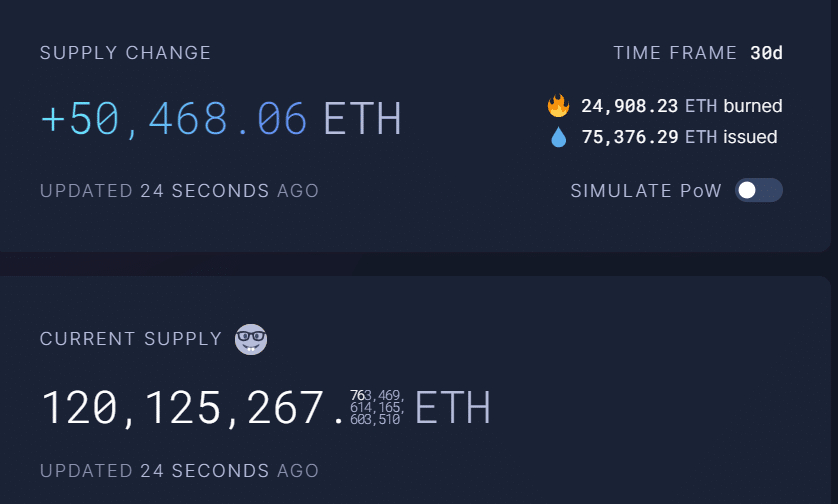

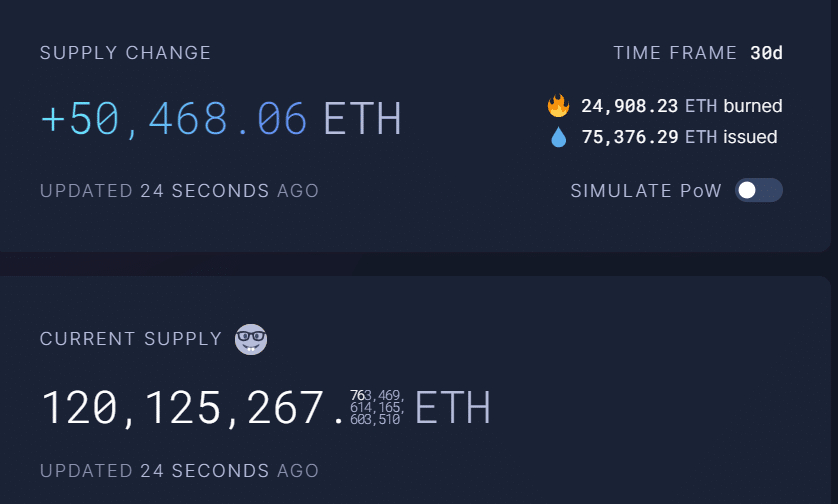

In the last 30 days, the network’s ETH issuance was 3X more than the burn rate. A similar trend was observed on the 7-day chart as well.

Source: Ultra Sound Money

It meant that there was more ETH supply that could derail further price prospects.

After The Merge in 2022, ETH’s issuance attained a deflationary status, prompting BitMEX founder Arthur Hayes to refer to it as a ground for ‘ETH’s bull run.’

One of the Ethereum educators, Adriano Feria, noted that it could take ETH ‘months to be deflationary’ again.

ETH to rally 75% post-ETF approval confirmation?

Nevertheless, the ETF approval catalyst could outweigh the inflationary status and front a massive run.

According to Bernstein, a private investment firm, ETH could rally 75% to $6,600 after the approval, citing BTC’s price action in January after the ETF launch.

Crypto asset trading firm, QCP Capital, shared a similar sentiment, albeit with varying nuances based on ETH funding rates and volume changes.

According to the firm’s recent Telegram update, ETH’s price could stabilise in the short term and rally in the mid-term.

‘ETH Perp funding went from 50% to flat in 12 hours, with June forwards still yielding 15%, possibly reflecting diminished short-term speculation but sustained medium-term bullishness.’

This meant that traders in the futures market expected ETH to rise in the coming weeks. However, QCP Capital underscored that ‘short-term downside volatility’ could be likely.

That said, Ethereum whales have been positioning accordingly for the ETF speculation, meaning the $4K level could be breached if approval is confirmed.

At the time of writing, ETH consolidated below $3800, 22% down from its last cycle’s all-time high of $4,867.