- DOGE’s value has reduced by almost 5% in the past 24 hours.

- Trading activity in its derivative and spot markets has cratered.

Dogecoin’s [DOGE] price fell by almost 5% in the last 24 hours at press time, while the prices of other leading meme assets have registered minor gains.

According to CoinMarketCap, during that period, the prices of memecoins, such as dogwifhat [WIF] and Pepe [PEPE], have increased by 1.15% and 1%, respectively.

The demand for DOGE loses momentum

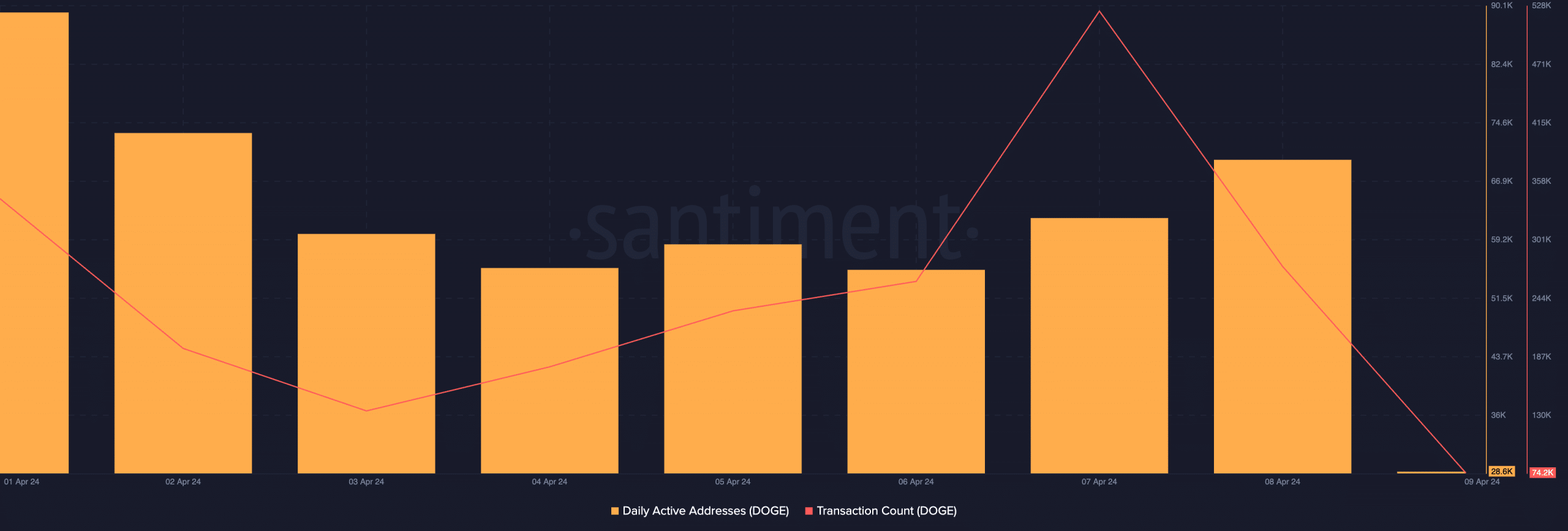

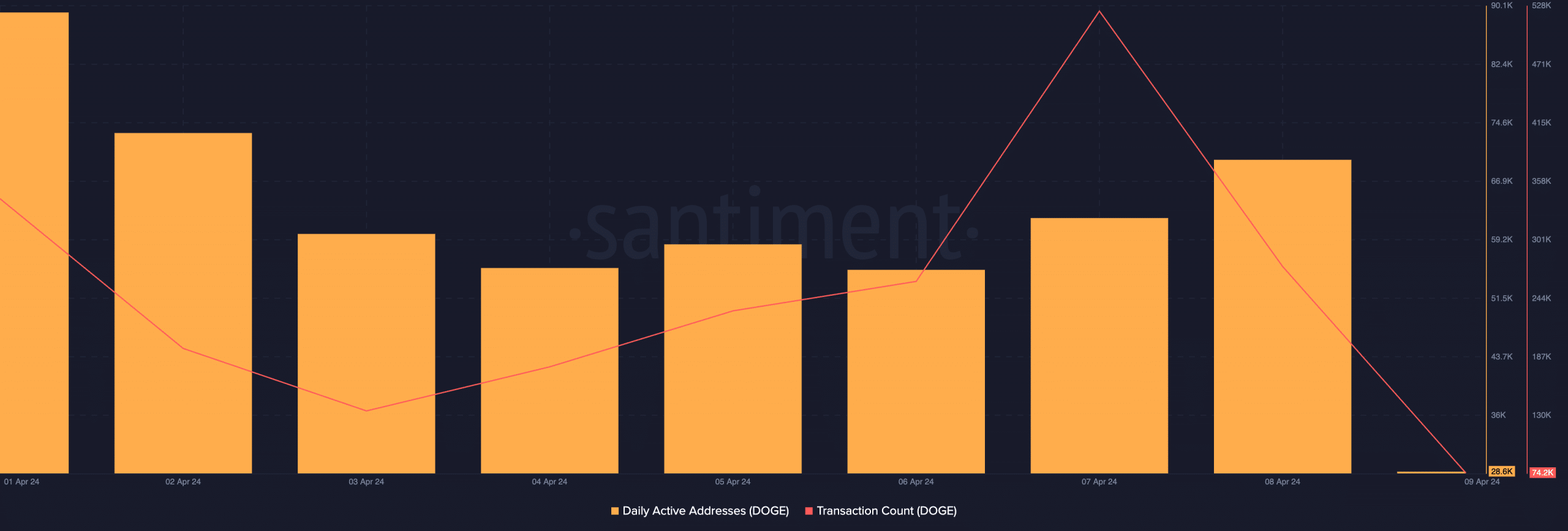

At press time, DOGE traded at $0.19. The coin’s trading volume has declined by 10% in the past 24 hours. On-chain data retrieved from Santiment showed that the price fall was caused by a drop in demand for the altcoin during the period under review.

The daily count of addresses involved in transactions involving DOGE has plummeted by 61%.

Due to the decline in DOGE’s daily active addresses in the past 24 hours, the count of transactions completed within that period involving the altcoin has also decreased. According to Santiment’s data, it has fallen by 73%.

Source: Santiment

An assessment of DOGE’s social activity revealed a decline since 7th April.

The social dominance and social volume metrics, which track an asset’s individual interactions, socially driven engagements, and actions such as likes, comments, retweets, and upvotes, are important as they are precursors to the growth in an asset’s price or otherwise.

According to Santiment, DOGE’s social dominance and social volume have dropped by 33% and 78% in the past two days.

DOGE’s futures market offers no respite

Poor sentiments were also observed in the coin’s derivatives market, as Coinglass data showed a double-digit decline in trading volume in the last 24 hours.

During the same period, the coin’s futures open interest has decreased by 4%. As of this writing, this was $1.64 billion.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

As the meme market hype declined, DOGE’s futures open interest initiated a decline and trended downward since the beginning of April. Between the 1st and 9th of April, the memecoin’s futures interest has fallen by 26%.

When an asset’s open interest declines this way, it signals a decline in market activity. It suggests that futures market participants are exiting their positions without opening new ones.