- If the development activity remains flat, DOGE’s price might fail to increase.

- The positive CLLD suggested that the price might fall to $0.12.

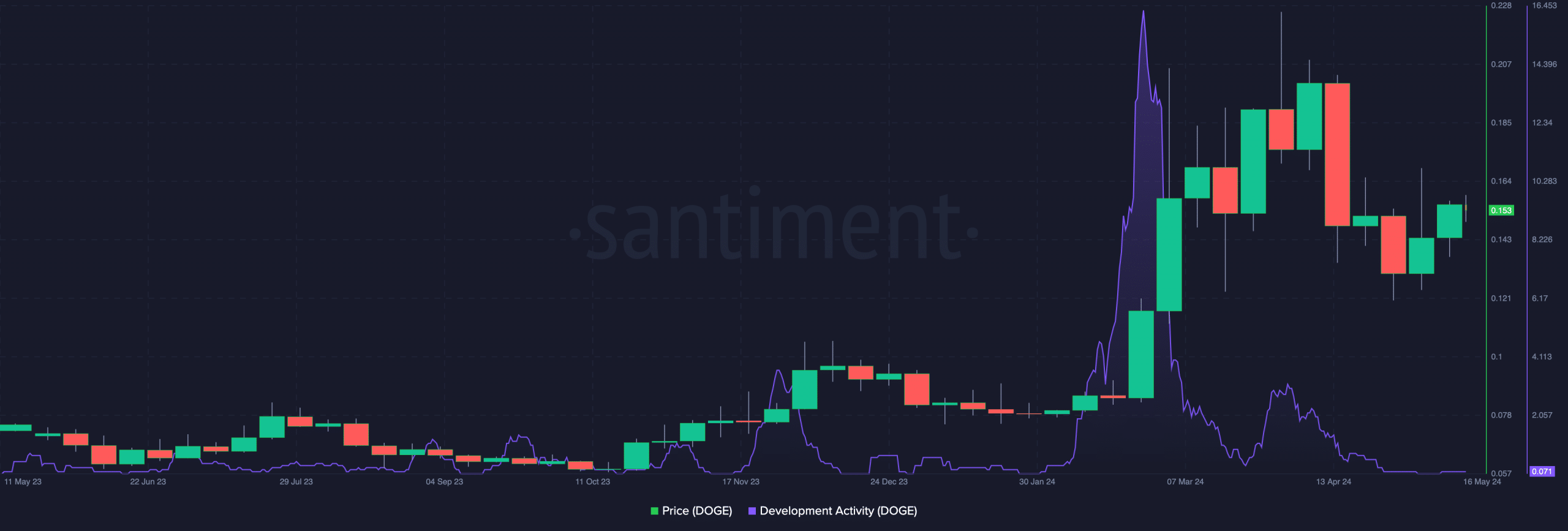

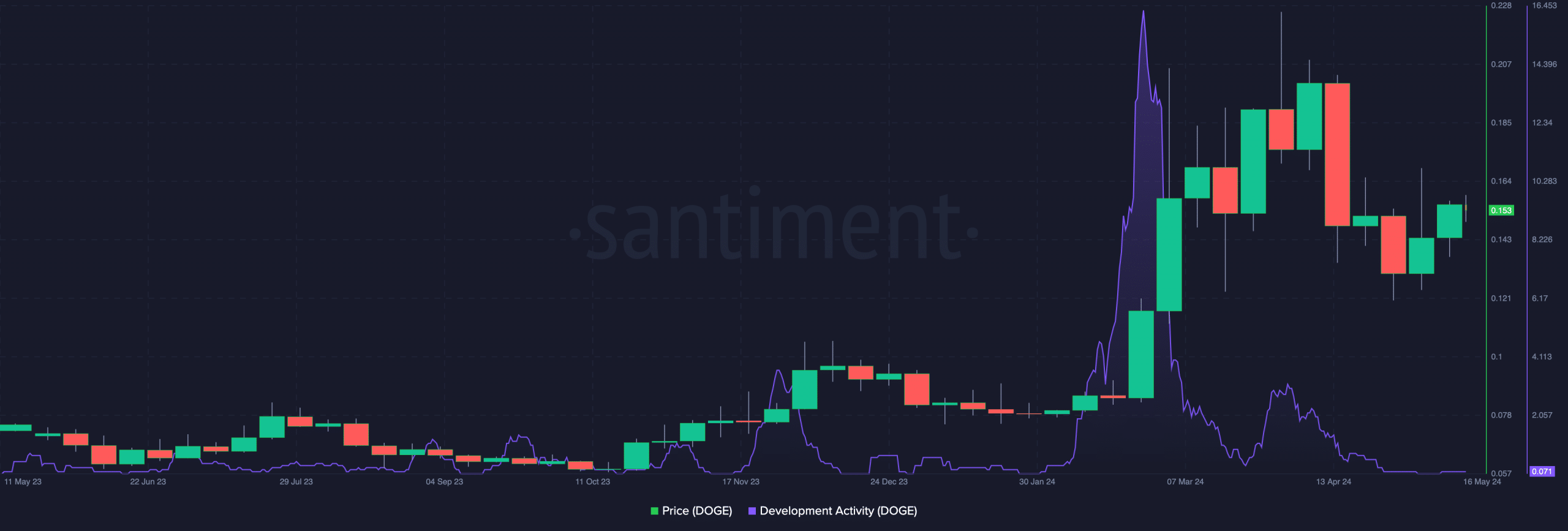

Not many would expect that development activity would have an impact on Dogecoin’s [DOGE] price. Funnily enough, however, AMBCrypto found that assertion to be untrue.

We realized this after examining the metric in question. At press time, development activity on the network was flat. This has been the case since 24 April. However, DOGE has also been consistently consolidating between $0.13 and $0.16 during this very period.

Moving hand in hand, side by side

Development activity measures the rate at which engineers publicly improve a project’s network. Looking back, the metric jumped from 0.39 to 16.24 back in February.

At the time, DOGE’s price skyrocketed from $0.08 to $0.14 to correspond with the aforementioned uptick. Something similar transpired between October and November 2023 too, with both the price and development activity moving hand in hand on the charts.

Source: Santiment

Therefore, it might not be out of place to assume that a hike in the metric might offer a price hike too. Also, if development activity falls, so will Dogecoin’s price.

Now, DOGE could face a hard time reproducing its performance in February and March. Still, it is important to assess other metrics too. This would tell if the prediction is valid or not.

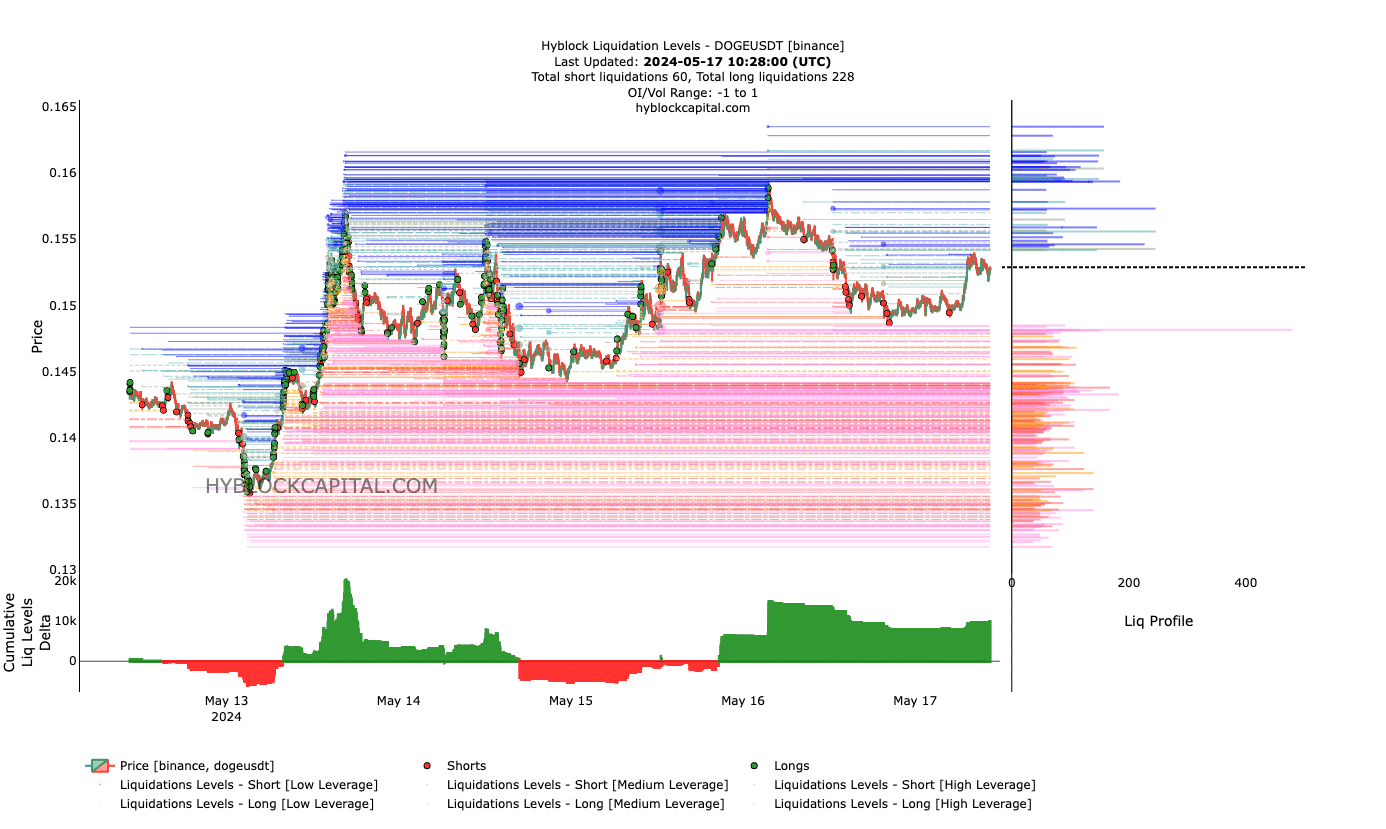

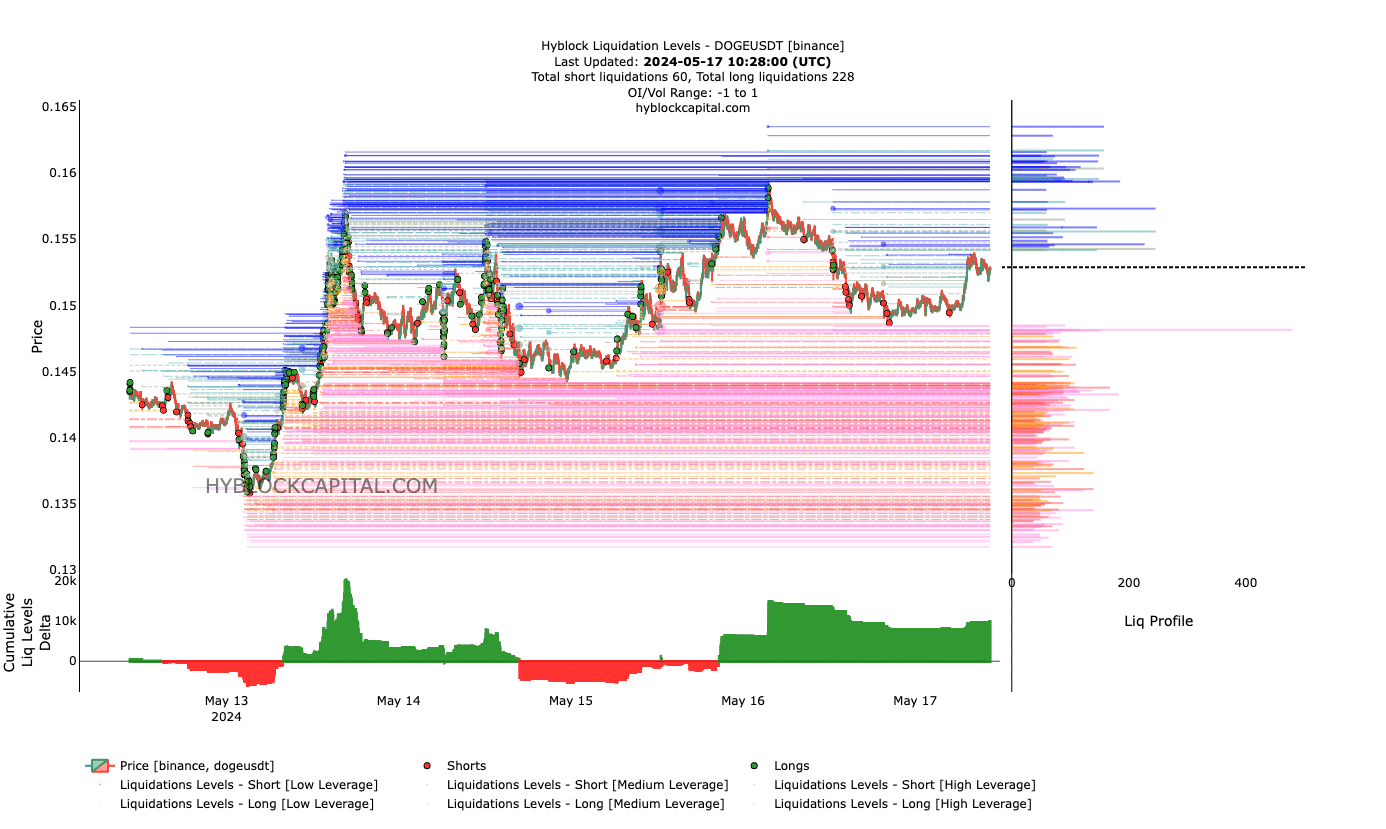

One indicator AMBCrypto looked at was the liquidation levels. This indicator shows estimated price levels where liquidation events might occur.

A liquidation event occurs when a trader’s open position is forcefully closed. Most times, this happens because the trader can no longer meet the requirements of keeping the position open.

Will the price fall again?

At press time, we noticed that the only possible liquidation points between $0.15 and $0.16 were scanty. This lack of liquidity could put DOGE’s price at risk.

This could be the case because Dogecoin’s price might not move to the upside as the zone is not magnetic. Hence, a possible move for DOGE could be a potential sideways movement.

In a worst-case scenario, the price might drop to $0.12. Apart from this indicator, AMBCrypto looked at Dogecoin’s Cumulative Liquidation Levels Delta (CLLD) as well.

Source: Hyblock

Positive values of the CLLD indicate more long liquidations. On the other hand, Negative values suggest that there are more short liquidations.

At press time, the CCLD was positive. From a price perspective, the reading indicates that Dogecoin might undergo a full retrace. If this remains the case, the $0.12 bearish prediction might be validated.

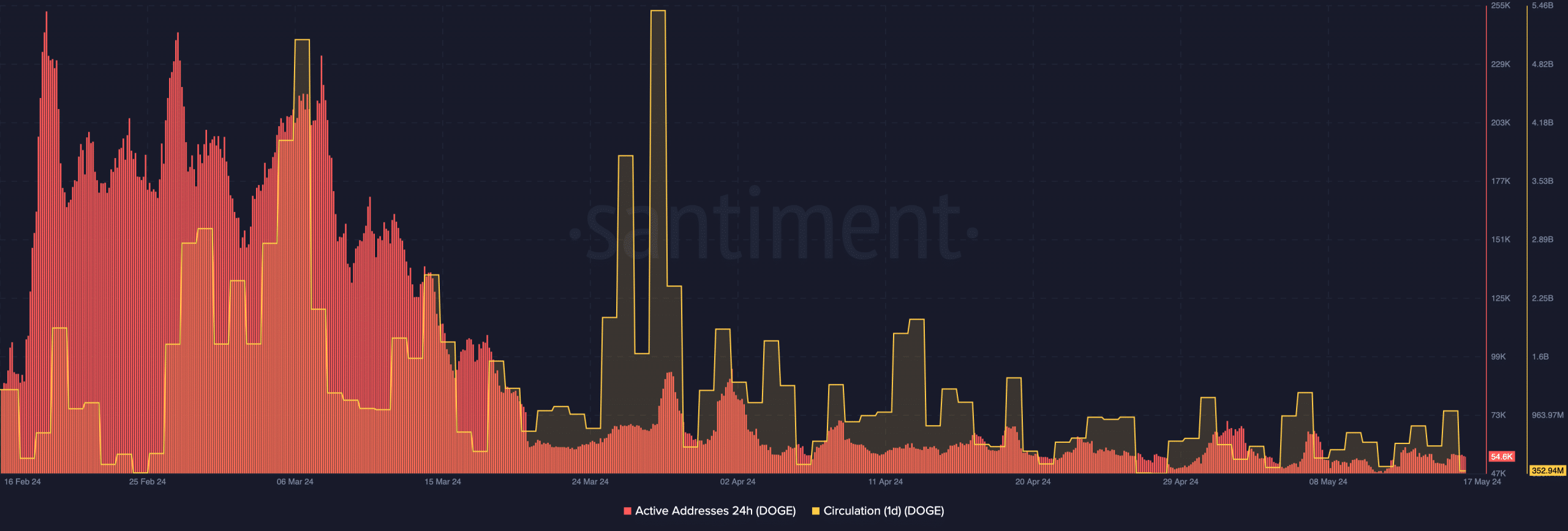

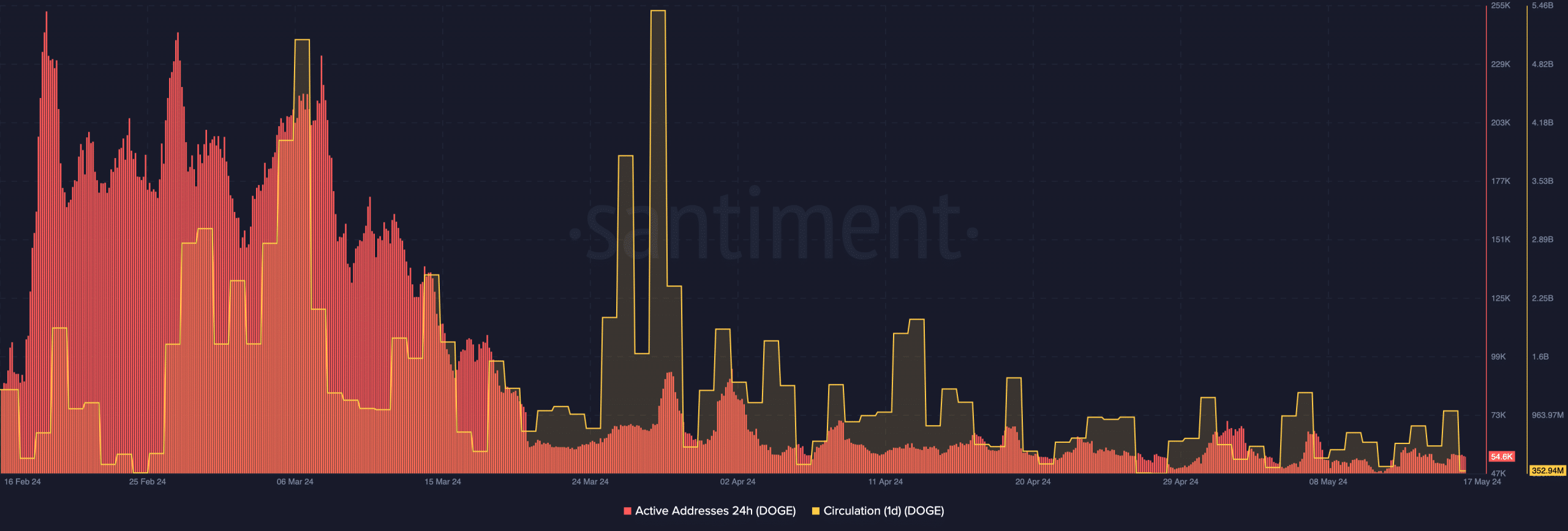

In addition to the analysis above, AMBCrypto also evaluated active addresses. At the time of writing, DOGE’s 24-hour active addresses were 54,600.

Three months ago, this same figure was over 250,000. Simply put, the decline was proof of decreasing network activity. Beyond that, the one-day circulation was 325.94 million as well.

Source: Santiment

Is your portfolio green? Check the Dogecoin Profit Calculator

Concerning the price, this fall in activity could stop DOGE from exponential growth on the charts. However, if things change for the better, DOGE might make a move towards $0.12.