- DOGE’s price surged by more than 7% in the last 24 hours.

- Most metrics and market indicators supported the uptrend.

The crypto market somewhat turned bearish over the last 24 hours, but Dogecoin [DOGE] managed to paint its daily chart green.

Though there might be multiple factors at play, a possible reason could be attributed to Elon Musk.

Dogecoin remains bullish

The last 24 hours were not very volatile for top coins like Bitcoin [BTC] and Ethereum [ETH], as their prices only moved marginally.

On the other hand, Dogecoin defied the market trend as its value rose by more than 7% in the last 24 hours.

According to CoinMarketCap, at the time of writing, DOGE was trading at $0.1616 with a market capitalization of over $23 billion, making it the eighth-largest crypto.

DOGE’s trading volume also surged along with its price, acting as a foundation for the bull rally.

A possible reason behind this trend could be Tesla’s recent announcement. The firm recently updated the FAQ section on its website and stated that DOGE may now be used to purchase even more Tesla products.

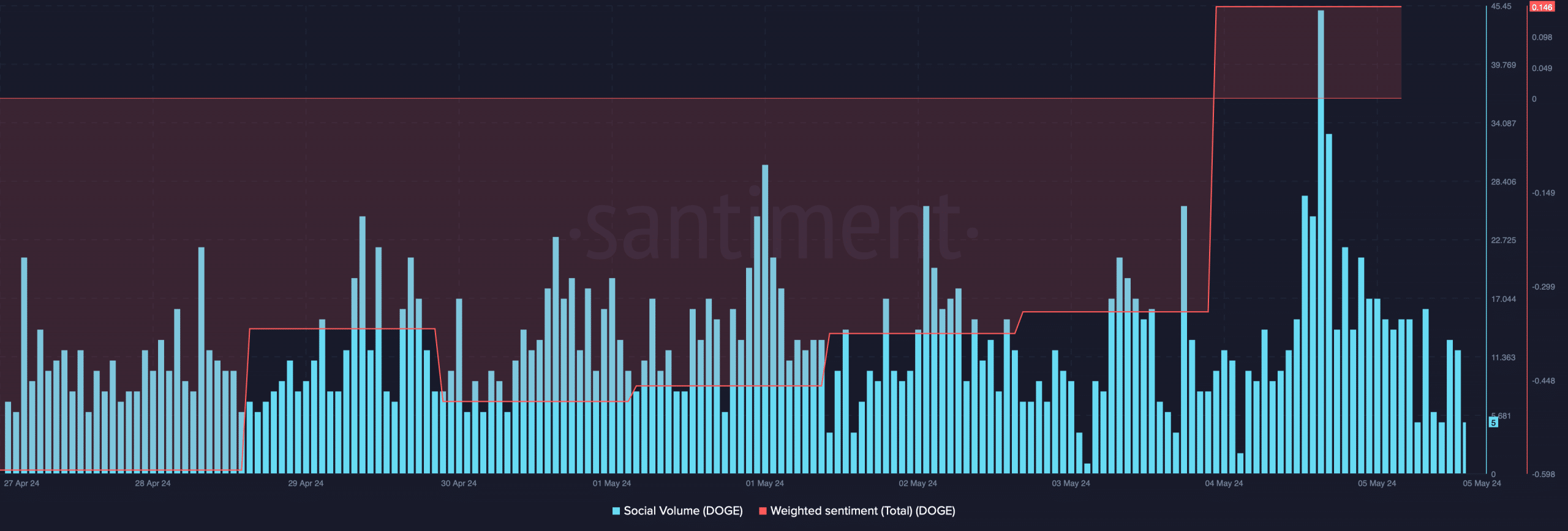

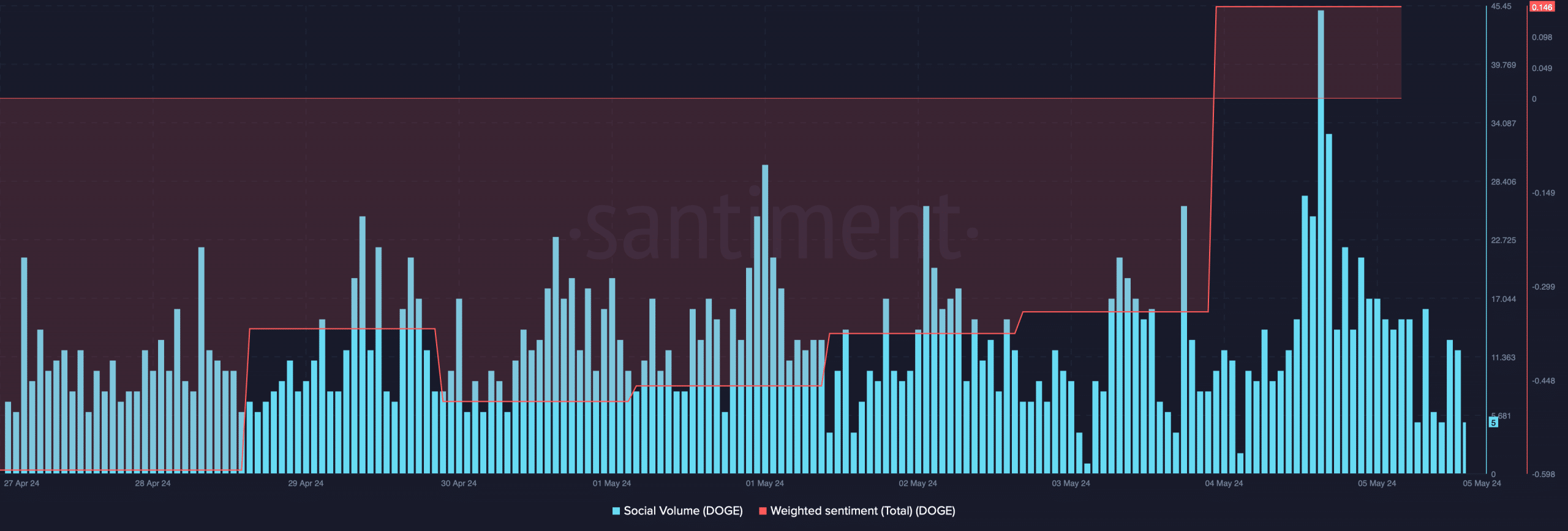

Soon after this, Dogecoin’s social metrics increased.

AMBCrypto’s look at Santiment’s data revealed that DOGE’s Social Volume spiked. Its Weighted Sentiment also improved, meaning that bullish sentiment around the coin was dominant in the market.

Elon Musk has a history of influencing Dogecoin’s price on multiple occasions in the past. Therefore, DOGE’s latest bull rally might as well be an outcome of Tesla’s action.

Source: Santiment

Will this bull rally last?

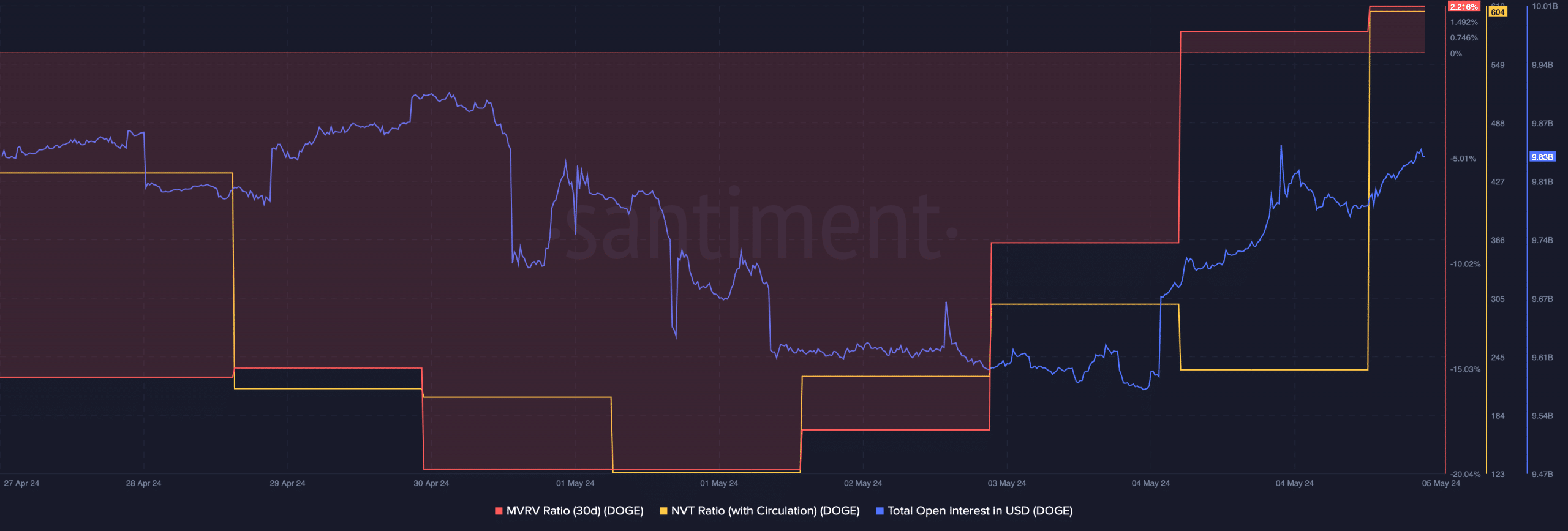

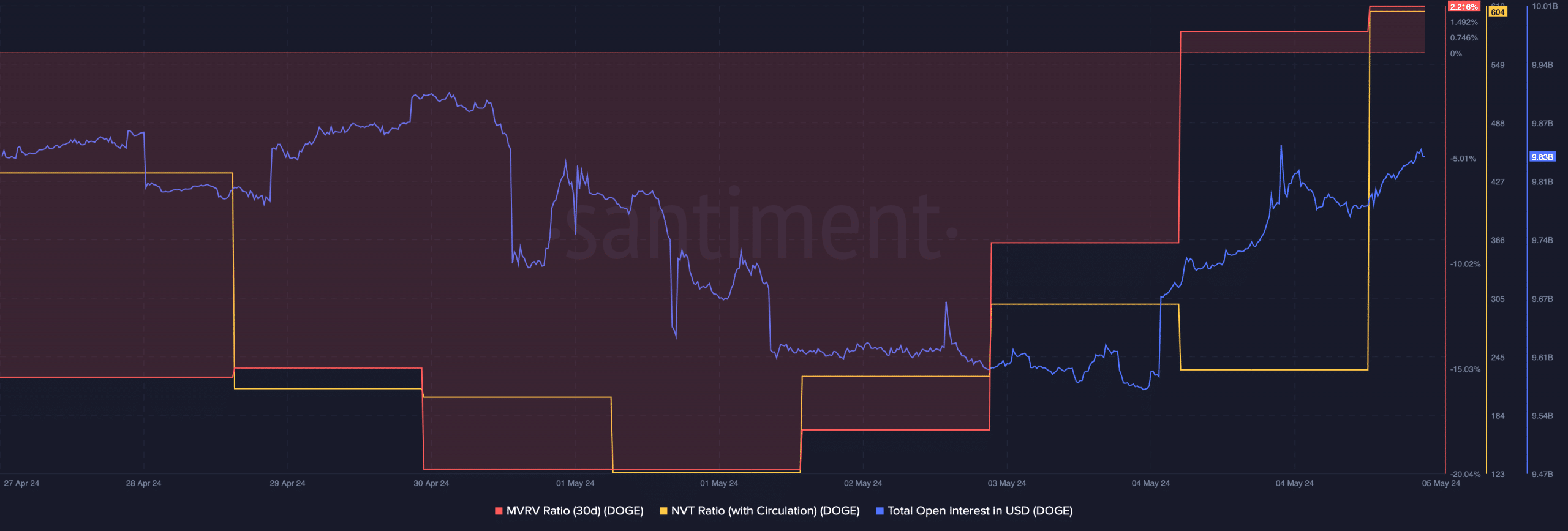

Since the bull rally might have occurred because of the Tesla-related hype, AMBCrypto checked DOGE’s metrics to find whether metrics backed this uptrend.

As per our analysis, DOGE’s Open Interest increased along with its price. A rise in the metric indicates that the chances of the current trend continuing are high.

The meme coin’s MVRV ratio also went into the positive zone. At the time of writing, DOGE’s MVRV ratio had a value of 2.22%, indicating a further price rise.

In fact, AMBCrypto reported that DOGE’s demand was rising. On the 2nd of May, 28,000 new addresses were created to trade DOGE, marking a 102% hike from the monthly low.

However, its NVT ratio also spiked, meaning that DOGE was overvalued. This hinted at a possible price correction.

Source: Santiment

Realistic or not, here’s DOGE’s market cap in BTC’s terms

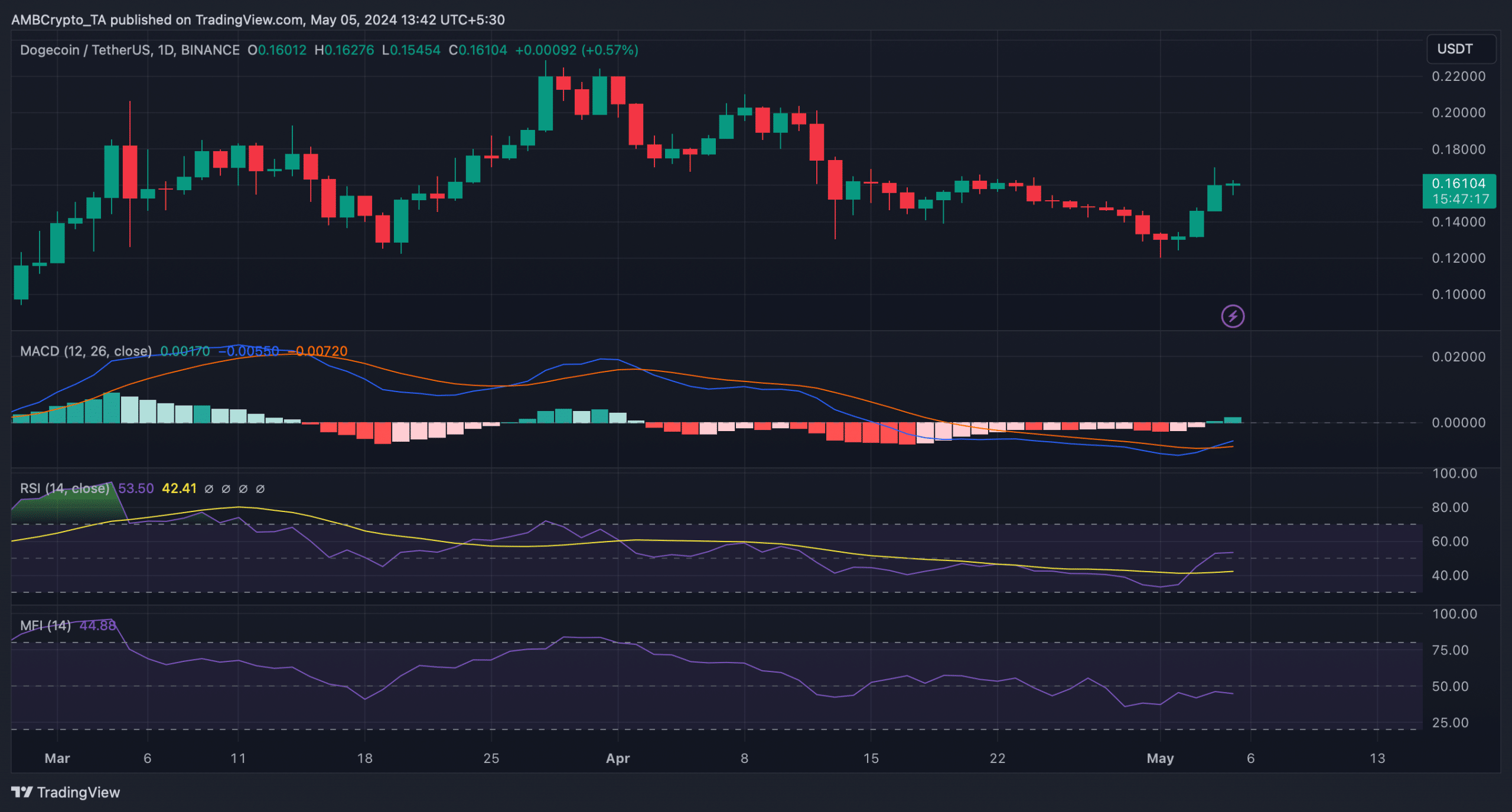

To see whether a price correction is on its way, AMBCrypto checked Dogecoin’s daily chart. We found that the coin’s Relative Strength Index (RSI) registered an uptick.

Its MACD also displayed a bullish crossover, hinting at a continued price rise. Nonetheless, the Money Flow Index (MFI) remained bearish as it was resting below the neutral mark.

Source: TradingView

![Dogecoin [DOGE] decouples: Does Elon Musk have a role to play?](https://chartdogs.app/wp-content/uploads/2024/05/Dogecoin-remains-bullish-1000x600.webp)