The derivatives liquidity protocol Synthetix (SNX) witnessed more development activity than any other project in the decentralized finance (DeFi) sector in the past 30 days, according to the crypto analytics firm Santiment.

Synthetix aims to serve as a backend liquidity tool for user-facing DeFi projects, according to the protocol’s whitepaper.

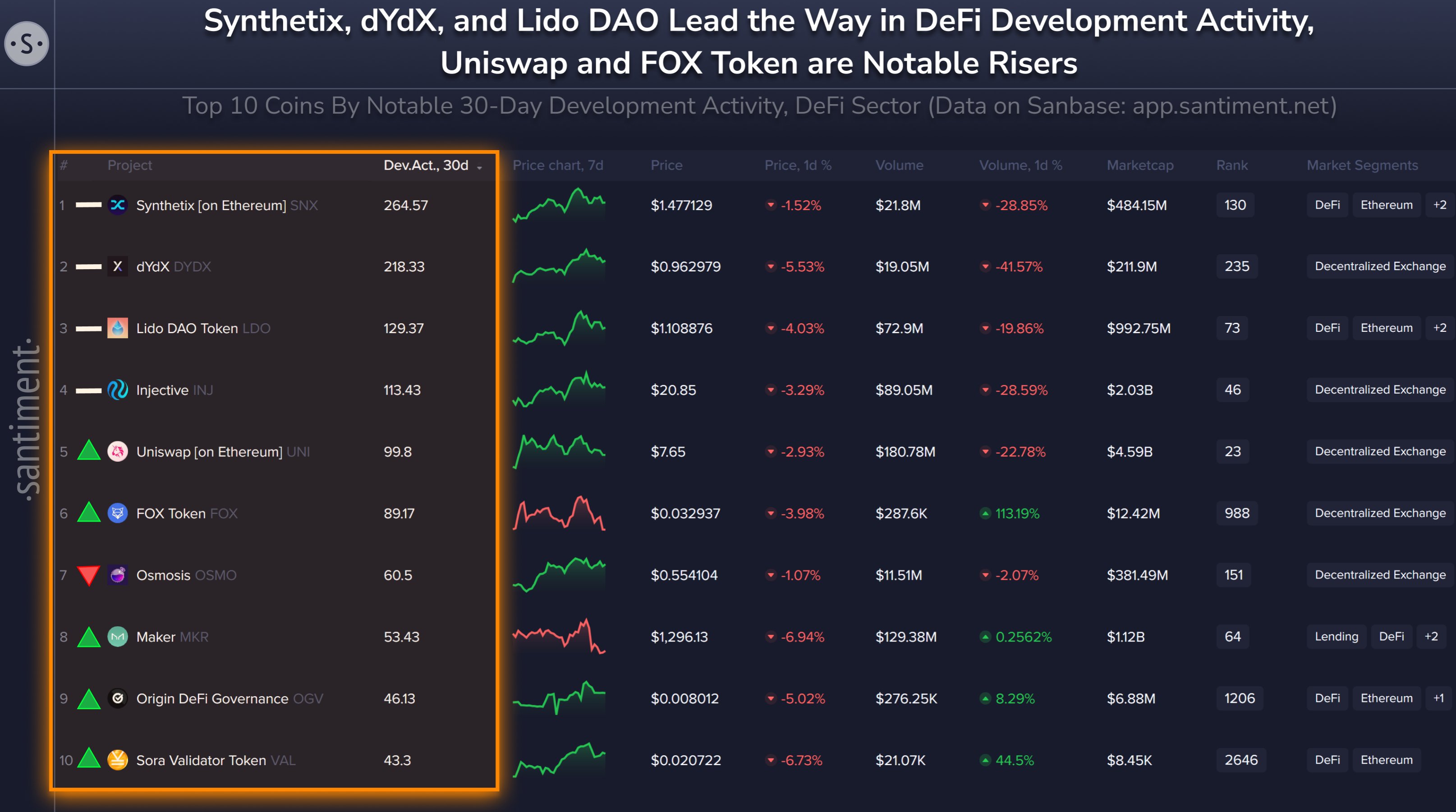

Santiment notes that Synthetix clocked 264.57 notable GitHub events in the past 30 days, compared to 218.33 events for the second-most-developed project, the decentralized exchange (DEX) dYdX.

A distant third on the analytics firm’s list is Lido DAO, a liquid staking service for the Ethereum (ETH) ecosystem. The project registered 129.37 notable GitHub events.

Source: Sentiment/X

Synthetix, dYdX and Lido DAO also occupied the first, second and third spots on Santiment’s list last month.

The analytics firm notes that it does not count routine updates and utilizes a “better methodology” to collect data for GitHub events based on a “backtested process.”

Santiment has previously said that heavy development activity centered around a crypto project indicates developers believe in the protocol. Development activity also suggests that the project is less likely to be an exit scam.

The Synthetix network token, SNX, is trading at $1.43 at time of writing. The 160th-ranked crypto asset by market cap is down more than 3% in the past 24 hours.

Generated Image: Midjourney