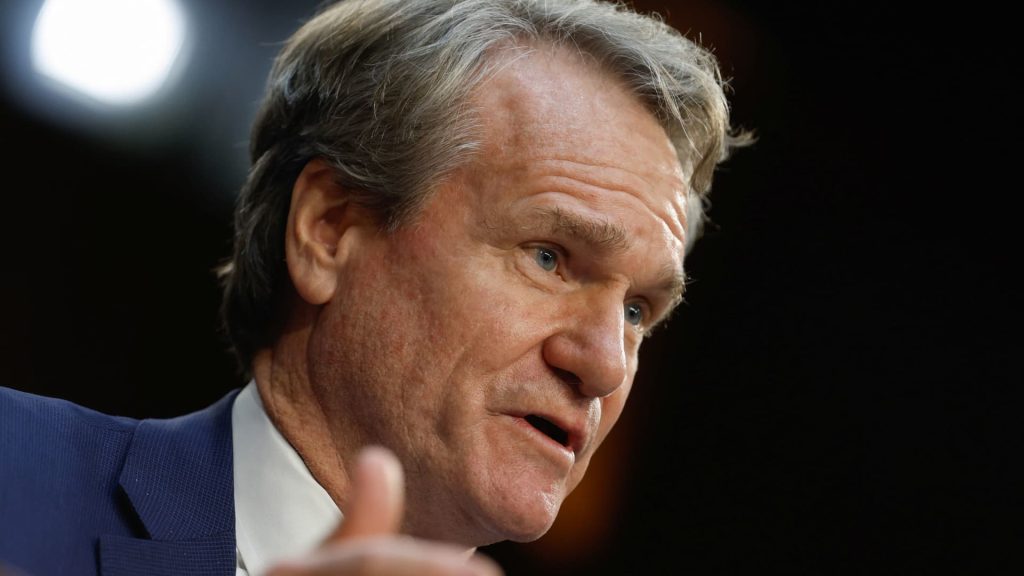

Bank of America Chairman and CEO Brian Thomas Moynihan speaks during a hearing of the US Senate Banking, Housing and Urban Affairs Committee on oversight of Wall Street firms on Capitol Hill in Washington, US, December 6, 2023.

Evelyn Hockstein | Reuters

Both U.S. consumers and businesses have become cautious in spending this year due to higher inflation and interest rates, analysts said. Bank of America CEO Brian Moynihan.

Bank of America customers, whether households or small and medium-sized businesses, are slowing the pace of purchases of everything from consumer goods to software, Moynihan said Thursday at a financial conference in New York.

Consumer spending through card payments, checks and ATM withdrawals grew about 3.5% this year to about $4 trillion, Moynihan said. This is a sharp slowdown from the nearly 10 percent growth rate seen in May 2023, he said.

Speaking about consumers and businesses, Moynihan said: “Both of our customer bases, which have a lot to do with the way the American economy works, are saying, ‘You know what? I’m careful, I’m slowing things down.”

The slowdown began last summer and is consistent with “very low growth” conditions between 2016 and 2018, he said.

Nearly a year after the Federal Reserve’s last rate hike, consumers and businesses are grappling with inflation and borrowing costs that remain higher than they are used to. The Fed began efforts to curb inflation by raising its benchmark rate starting in March 2022, hoping it could slow the economy without plunging it into recession.

Many economists believe the Fed is on track for that success, which has helped the stock market reach new highs this year. But consumers are still struggling with rising prices for goods and services, and this has impacted U.S. companies with McDonald’s discount retailers as Americans adjust their behavior.

According to Moynihan, grocery shoppers are visiting more stores in search of deals: “They’re going to three grocery stores instead of two, that’s one of the statistics we’re seeing,” he added.

For now, moderate growth in overall spending is supported by travel and entertainment, while “other things have slowed, except for insurance claims,” Moynihan said. Rent growth has slowed, he noted.

“We need to keep the consumer in the game in the US economy because [they’re] such a big part of it,” Moynihan said. “They become a little weaker and it has to do with everything that’s going on around them.”

The same applies to small and medium-sized businesses, the Bank of America CEO said. His company is the second largest US bank by assets, after JP Morgan Chase. Moynihan and other bank executives are taking a bird’s-eye view of the economy, with a reach to households and businesses around the world.

Business owners say, “I’m still happy with my business overall, but I don’t hire as many employees; I don’t buy hardware that fast, I don’t buy software that fast,” Moynihan said.

The bank’s economists believe it will take until the end of next year to bring inflation under control and that the Fed will begin cutting interest rates later this year, Moynihan said. The US economy is likely to grow by about 2%, avoiding a recession, he added.