From Magic Eden’s degen yacht party to Forbes’ multichain mixer, NFT.NYC offered a spectacle of excess and elitism, and then some more in another episode of #hearsay, a weekly gossip column looking into the sultry underbelly of crypto.

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Every week, crypto.news brings you #hashtag hearsay, a gossip column of scoops and stories shaping the crypto world. If you have a tip, email Dorian Batycka at [email protected]

In the wild west of cryptocurrencies, trends come and go faster than a junkie in a trap house. Just when pundits were ready to write off non-fungible tokens (NFTs) as dead, the digital collectibles born, and sometimes burned, on the blockchain may—instead—be undergoing a renaissance.

In 2023, as headlines screamed “NFT Bubble Burst” from the rafters, a split began to emerge in the NFT community—one of which saw the medium slowly beginning to separate from the message. A shift that many argued was more towards utility. The promise that blockchain once gave to digital artists—royalties ad infinitum—was soon, thanks to Blur, revealed to be a lie.

According to recent data, NFT sales in the past quarter have dipped, leading many to proclaim the demise of the digital art craze. However, a closer inspection reveals a more nuanced reality.

Take the recent edition of NFT.NYC (which ended April 5). Founded in 2018, the event exploded in 2021 on the heels of a major bull market that saw sales of NFTs reach $17.6 billion, thanks in part to the confluence of cryptocurrency prices, celebrity endorsements, and the recognition of NFTs as fine art rubber-stamped by major auction houses like Sotheby’s and Christie’s. Such events paved the way for a meteoric rise in cultural recognition and awareness of NFTs (thanks to Beeple), which again followed a massive boom/bust cycle that critics of cryptocurrency used to paint the entire industry as one giant casino.

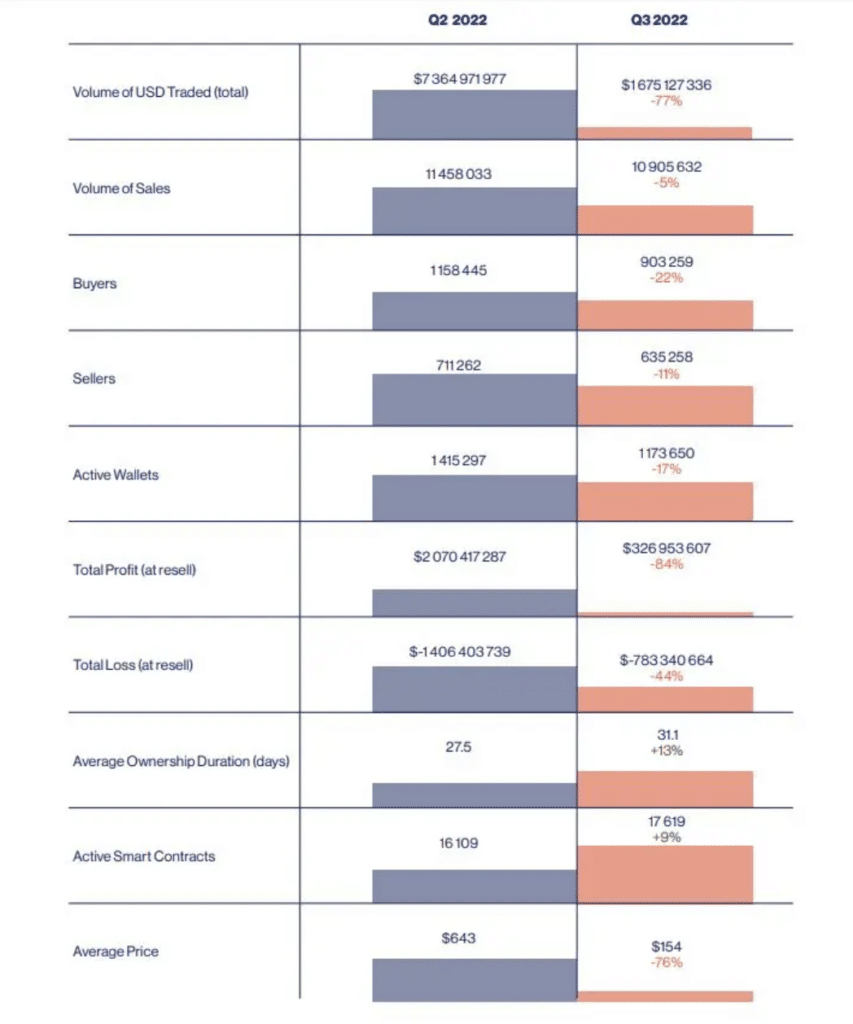

Indeed, in 2022, with the crash in cryptocurrency prices and turmoil in financial markets after Russia’s invasion of Ukraine, digital assets also took a big hit. Gone were the days of minting a pixelated punk or a bored ape on Ethereum and flipping it for 10 or event 100x profit, in came real world assets, big brands and e-commerce. According to the industry watchdog NonFungible report, the third quarter of 2022 saw a 77% drop in transaction volume, followed by net losses reaching $450 million from the year before.

Yet, by the end of 2023, the NFT market appeared far from dead. Rather, more mature. At last week’s NFT.NYC co-founder Jodee Rich admitted as much, stating emphatically that “the speculative burn has passed.”

That speculative burn, it should be noted, began in earnest last year as two popular NFT trading platforms, OpenSea and Blur, began what many now see as the ‘race to the bottom’ after Blur offered a zero-fee marketplace with tools designed to also get rid of royalties for creators. In response, Yuga Labs and Magic Edgen established the Creator’s Alliance, which they argued was a way of enshrining royalty rights, only supporting marketplaces and projects that promised to honor them.

During last week’s NFT.NYC, the new digital divide could not be clearer. The hype jocks in hoodies seem to have been replaced with serious technologists, nerds, and boring talks about file storage. Over at the Museum of Moving Image, Art Blocks’ Erc Calderon gave a talk with the generative artist Tyler Hobbes held on the sidelines of NFT.NYC. At the Museum of Modern Art’s sister venue, PS1, NFT.storage, which utilizes Filecoin’s decentralized storage and IPFS’s content addressing, held an event called “The Moment: Art, NFTs and Cultural Preservation,” which brought together representatives from FileCoin and Protocol Labs.

Over at the Javits Center, the official venue for NFT.NYC, the focus seemed to be less on technology or art and rather on sales, merchandising and marketing. Pudgy Penguins, the NFT collection that launched a line of dolls at Walmart last year, has since raised $10 million selling these digital-turned-physical cuddly artifacts.

What’s happening is not so much the death of NFTs but rather their rebranding. So, are NFTs dead? Far from it. Like a phoenix rising from the ashes, they’re undergoing a metamorphosis. What we’re witnessing is not the end of NFTs but rather a recalibration of the market. As investors and collectors sift through the rubble of the recent downturn, they’re discerning the gems from the crap. The froth may have subsided, but the underlying fundamentals remain strong.