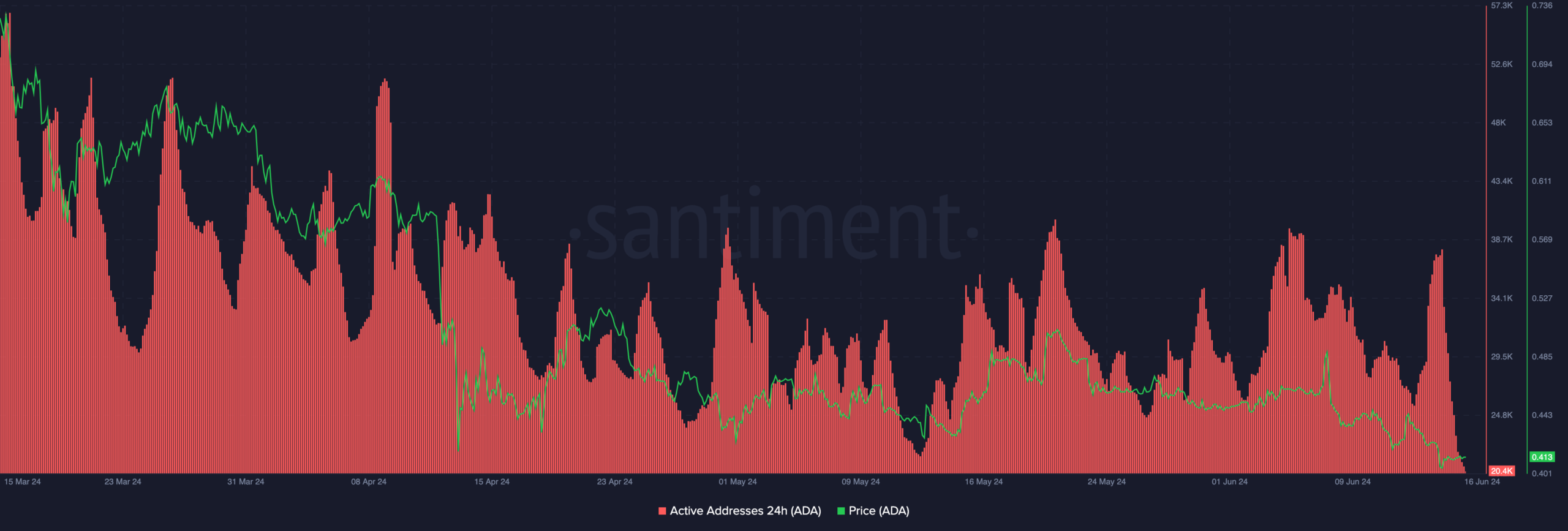

- The number of active addresses dropped to the lowest figure in the last 90 days.

- Amid bearish sentiment, technical analysis indicated that ADA could fall to $0.40.

Activity on Cardano [ADA] has plummeted to a three-month low, according to on-chain data. Before coming to this conclusion, AMBCrypto evaluated the 24-hour active addresses on the network.

Active addresses represent the total number of users interacting with a blockchain. On a 24-hour timeframe, this metric counts the number of unique users that either sent or received a cryptocurrency on a network.

At press time, the 24-hour active addresses on Cardano was 20,400. In the last three months, the metric did not reach this figure.

Cardano’s future hangs in the balance

Therefore, this decline indicates that market participants were choosing to engage with other blockchain over Cardano. A few days back, we disclosed how activity had improved.

However, this recent data implies that the earlier increase only lasted a short period. Furthermore, this decrease could affect ADA’s price.

A look at the data provided by Santiment showed that ADA’s price and network activity seem to have a strong correlation. At press time, ADA changed hands at $0.41. This was a 14.25% decrease in the last 30 days.

Source: Santiment

Should the number continue to drop, then the value of ADA might decline to $0.40. In a highly bearish condition, the price of the token might fall to $0.38.

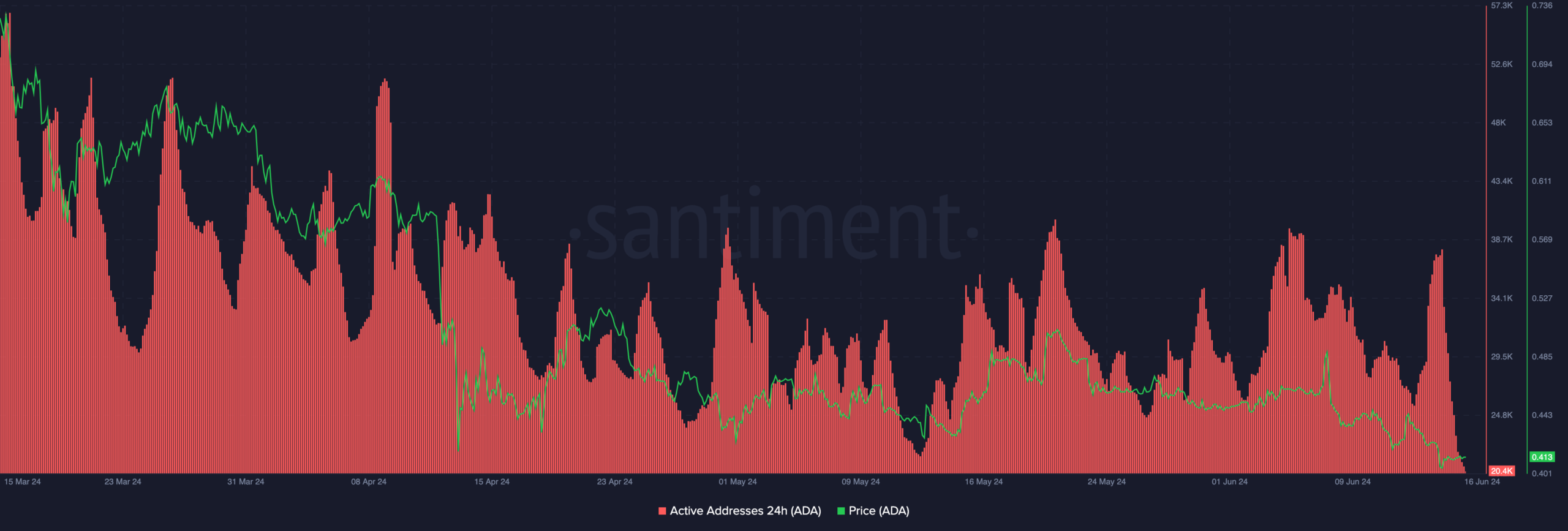

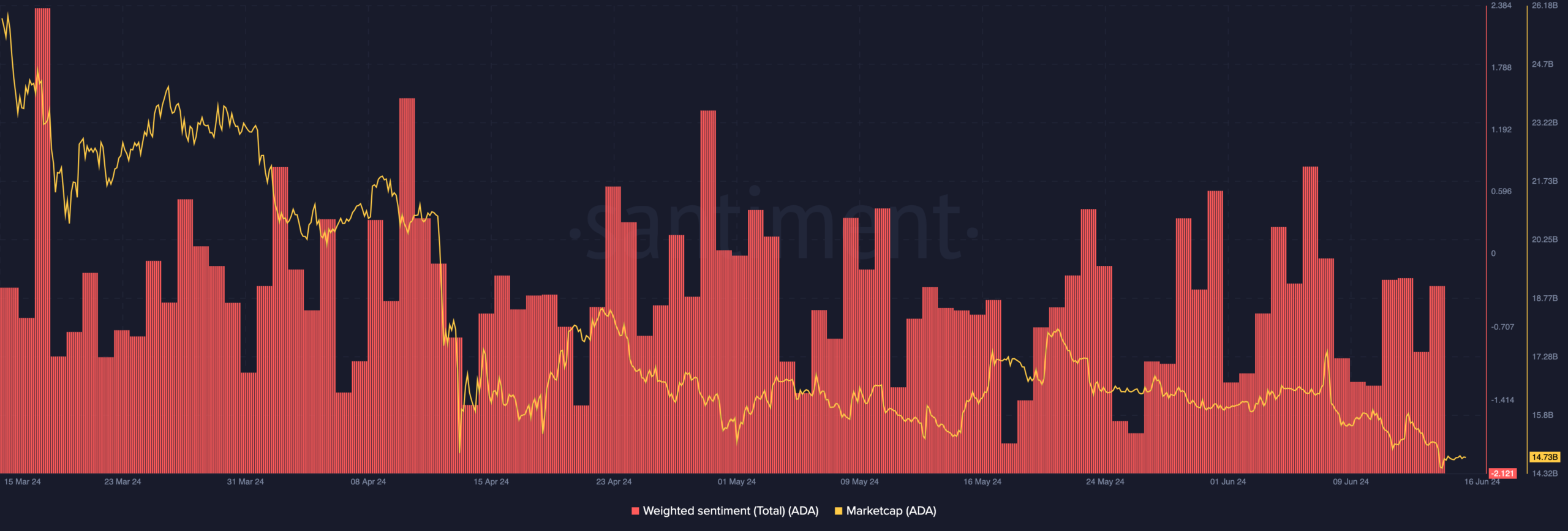

Apart from the metric above, the Weighted Sentiment is another indicator that could affect the token’s price. Weighted Sentiment shows the perception market participants have about a project online.

If the reading is positive, then it means most conversations are bullish. However, a negative value of the sentiment implies that a lot of comments are bearish. For Cardano, it was the latter.

One thing we also noticed was that the sentiment reading was at its three-month low, just like the active addresses. If respite does not appear, it could be concerning for ADA.

Source: Santiment

ADA’s price may not escape $0.40

A possible consequence could be a fall off the top 10 per market cap. As of this writing, Cardano’s market cap was down to $14.73 billion.

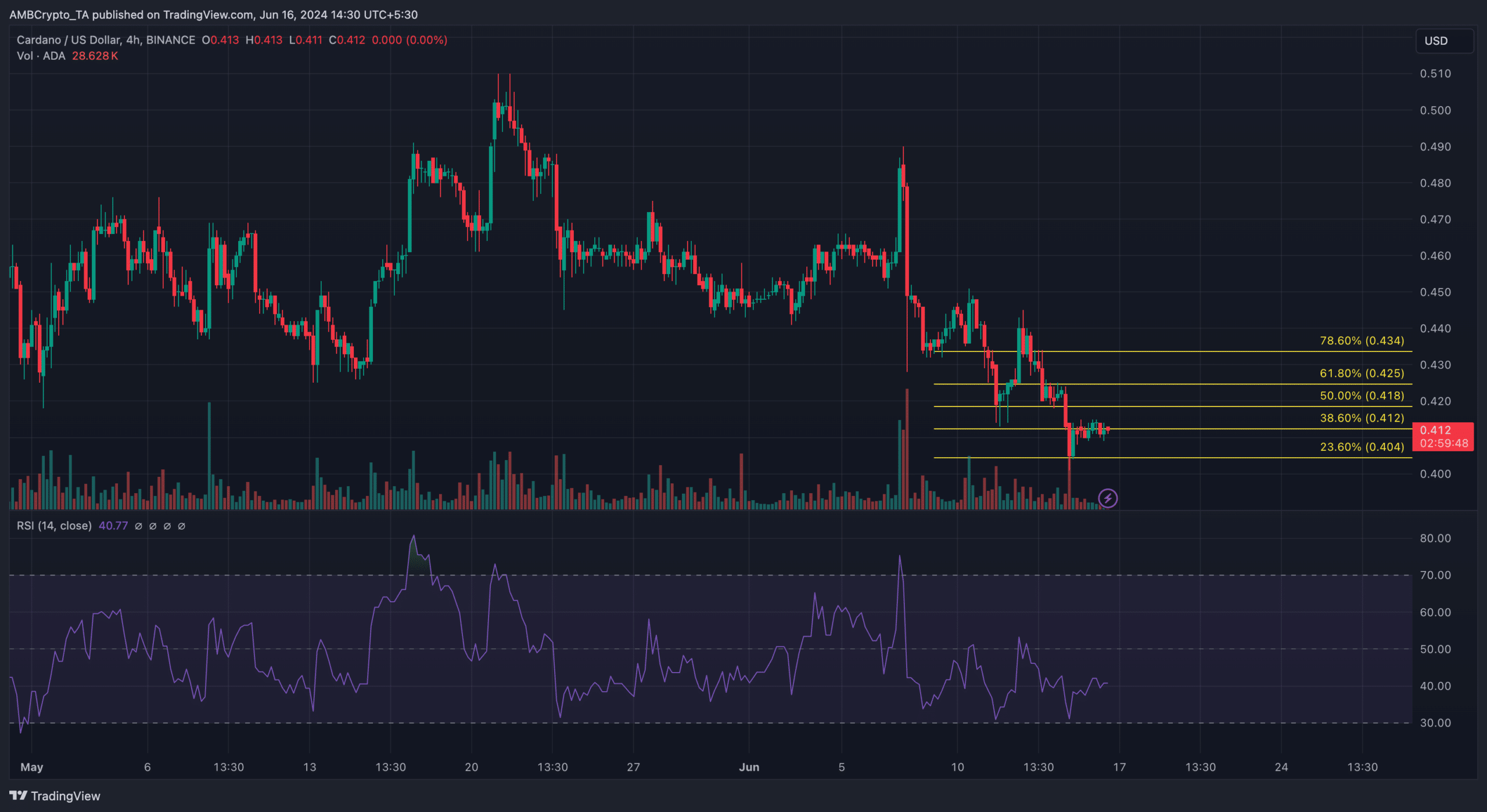

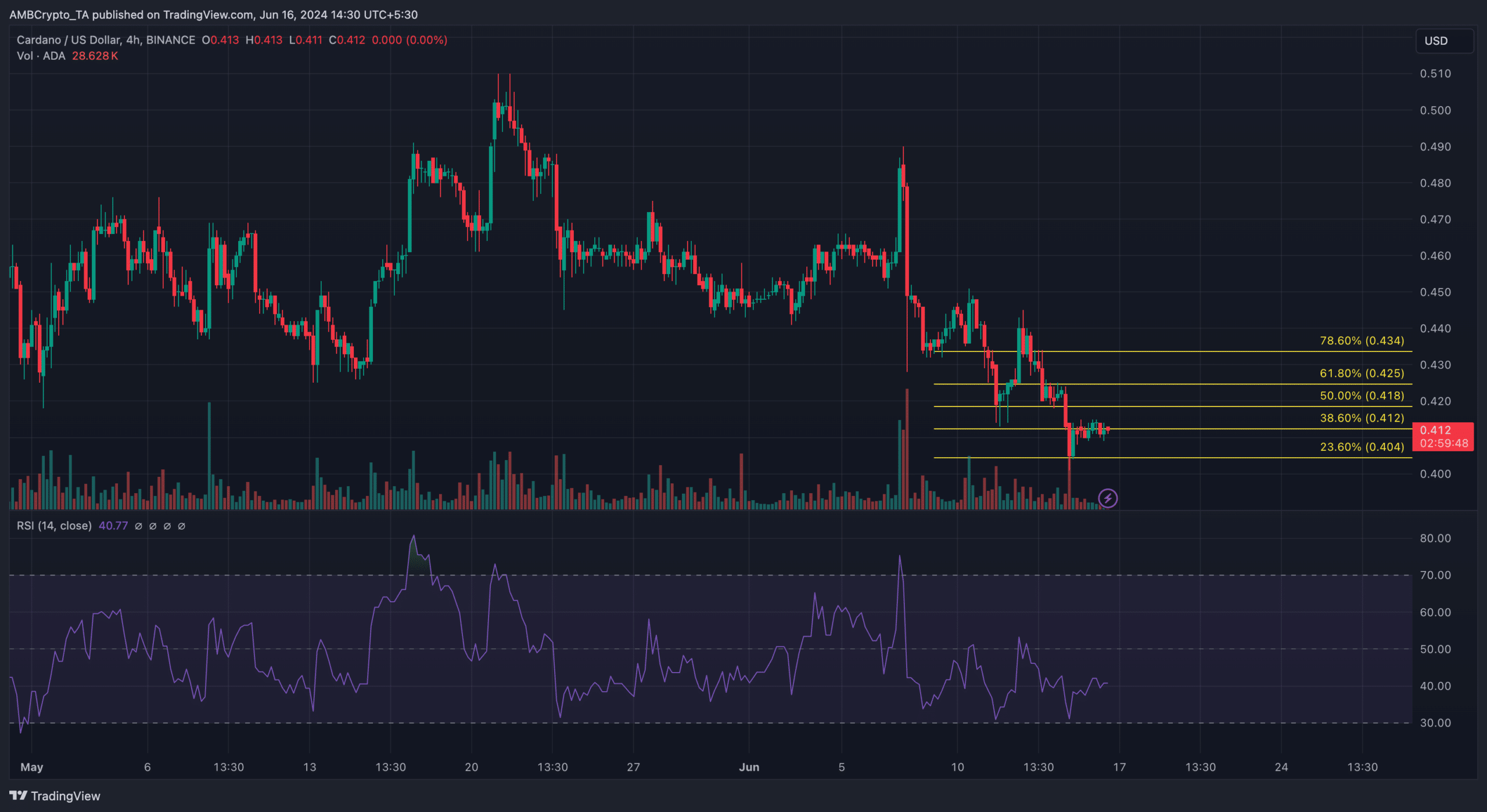

In addition, the technical perspective provided insights into how ADA might perform going forward. First off, AMBCrypto looked at the Relative Strength Index (RSI).

The RSI measures momentum. Values above 30 indicate that an asset is overbought. On the other hand, readings lower than 30 indicate that an asset is oversold.

At press time, the RSI on the ADA/USD chart 40.77. Since it was below the 50.00 midpoint, it meant that the momentum was bearish. Reinforcing this assertion was the Fibonacci retracement levels.

Source: TradingView

Is your portfolio green? Check the Cardano Profit Calculator

This indicator shows specific price points which can act as support or resistance for a token. At press time, the 23.6% Fib level was at $0.40. This indicates that ADA could pull back to the level in the short term.

However, if the price rebounds, the next target could be $0.43 where the 78.6% Fib level resided.