- Cardano’s latest report highlighted the work done by different teams last week.

- ADA was down by 1.7% in the last 24 hours, and indicators suggested a few slow-moving days.

Cardano [ADA] developers pushed hard last week as the blockchain’s development activity went up. The blockchain recently posted its weekly report, highlighting the efforts made by different teams. Meanwhile, ADA’s price action turned bearish.

Cardano’s development activity is rising

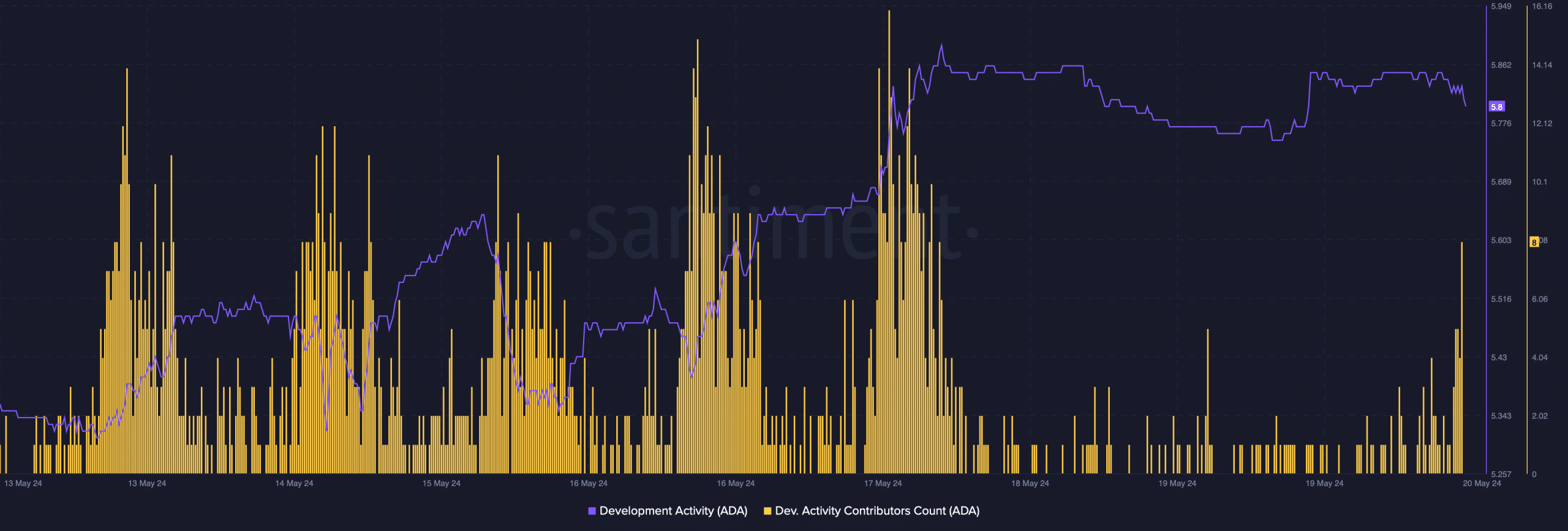

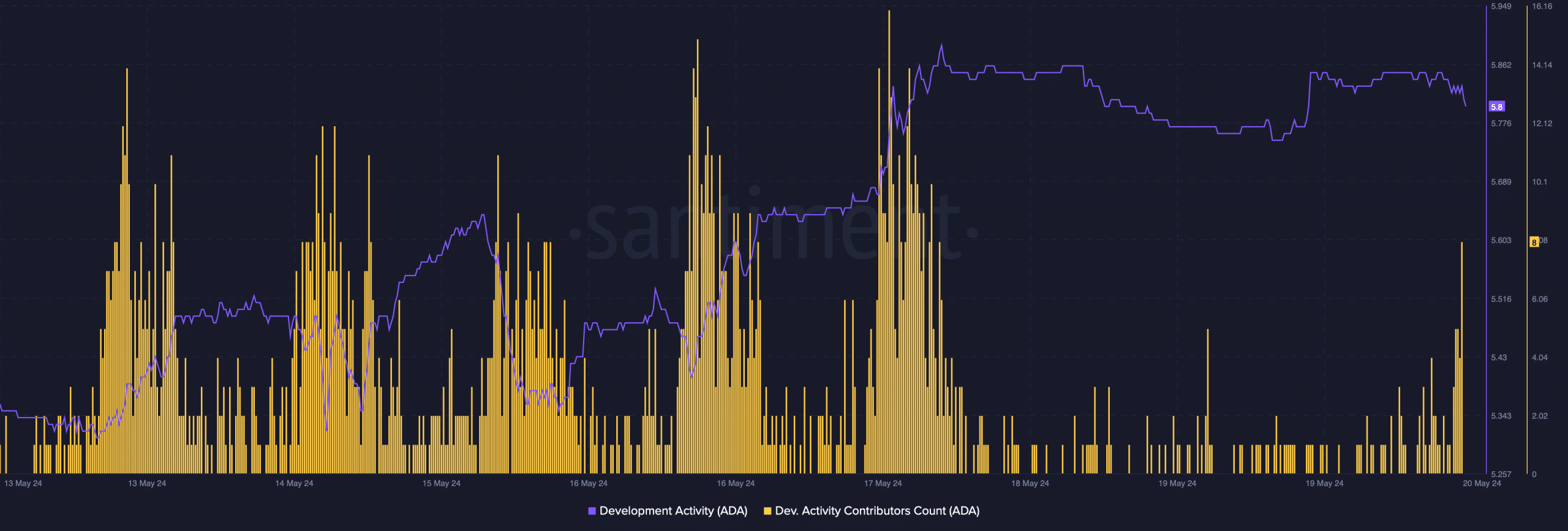

AMBCrypto’s analysis of Santiment’s data revealed that after a drop, ADA’s development activity graph has risen sharply over the past week.

Additionally, its development activity contributor count also remained high last week. These are inferred to be positive updates, as high development means more efforts were made to improve the blockchain.

Source: Santiment

Input Output Global recently posted its weekly report that mentioned what new developments happened in the Cardano ecosystem over the last seven days.

To begin with, the Lace team launched Lace v.1.11, a new update that comes with improved NFT functionality. The update introduced the ability to set a wallet avatar for the user’s favorite NFT and many more.

The Mithril team, which is a division of ADA’s scaling team, released the new distribution 2418.1. The update was aimed at preventing memory fragmentation.

Apart from these, the weekly development report also mentioned the updated statistics of the Cardno blockchain. As per the report, ADA’s total number of native tokens reached 10 million.

The blockchain’s total number of transactions also exceeded 90 million, which looked promising.

ADA’s bull rally is ending

While developers pushed their efforts last week, ADA bulls also stepped in as the token’s value increased by nearly 4% in the last seven days.

However, the trend changed in the last 24 hours as ADA dropped by 1.7%. According to CoinMarketCap, at the time of writing, ADA was trading at $0.4676 with a market capitalization of over $16.6 billion.

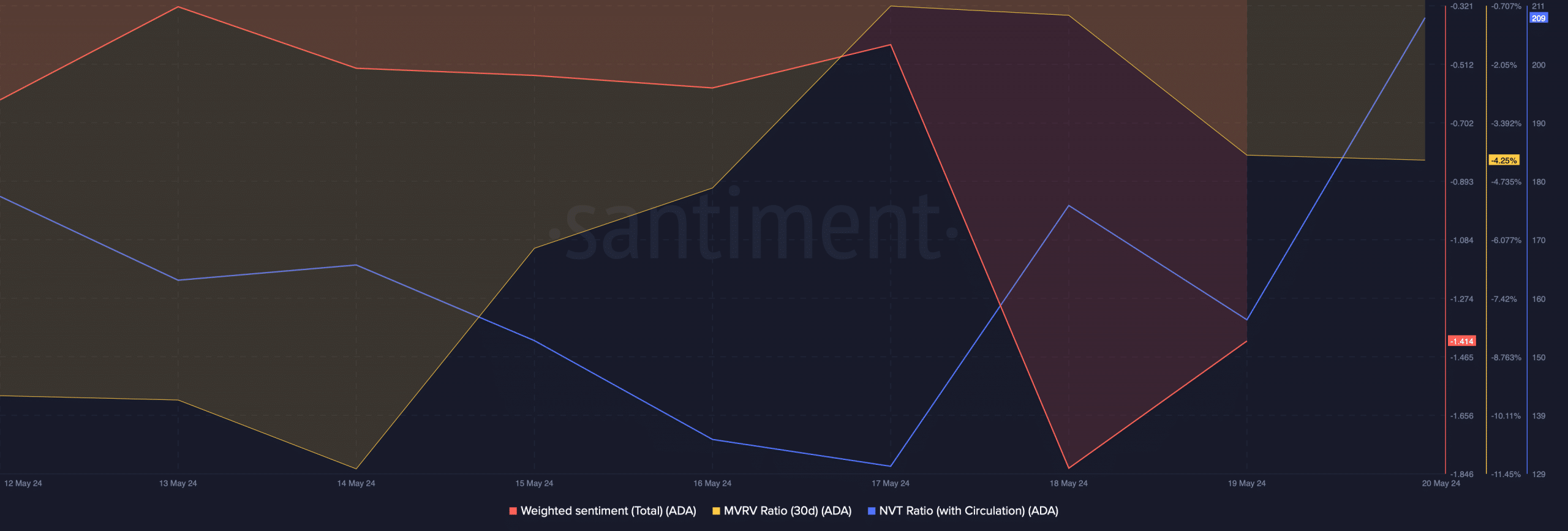

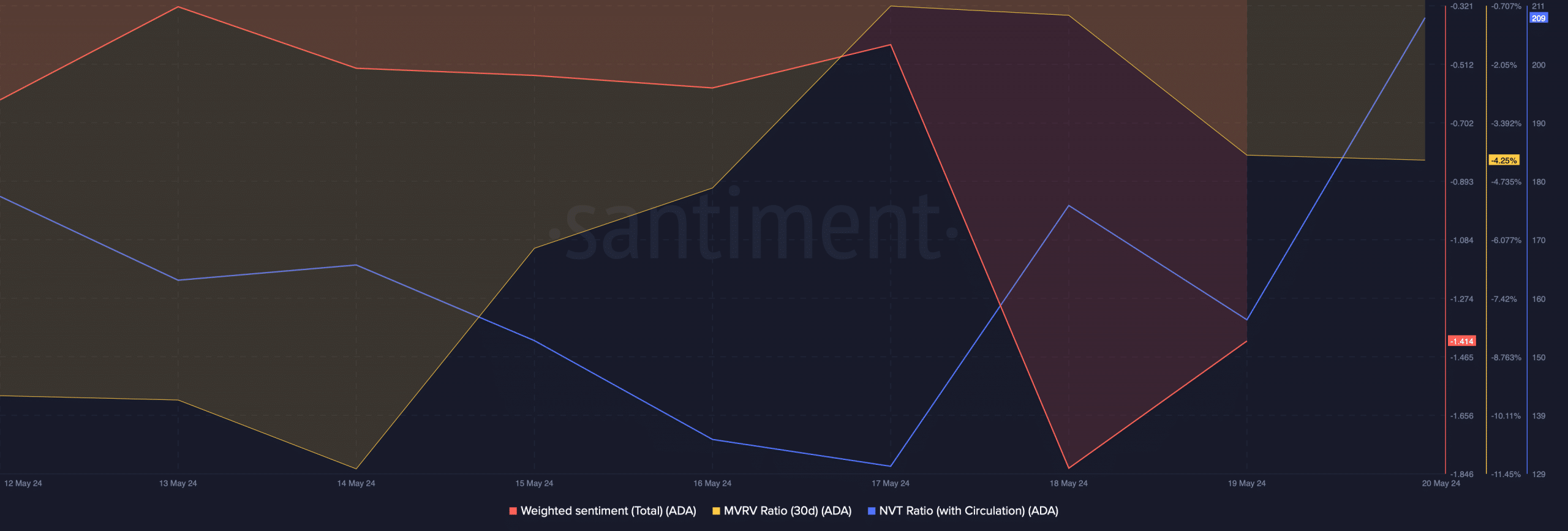

The NVT ratio pointed out a possible reason behind this price correction as the metric shot up. Whenever the metric goes up, it indicates that an asset is overvalued, indicating a possible price decline.

ADA’s weighted sentiment also dropped, meaning that bearish sentiment around the token was dominant in the market. Another bearish metric was the MVRV ratio, which also went down on the 19th of May.

Source: Santiment

Read Cardano (ADA) Price Prediction 2024-25

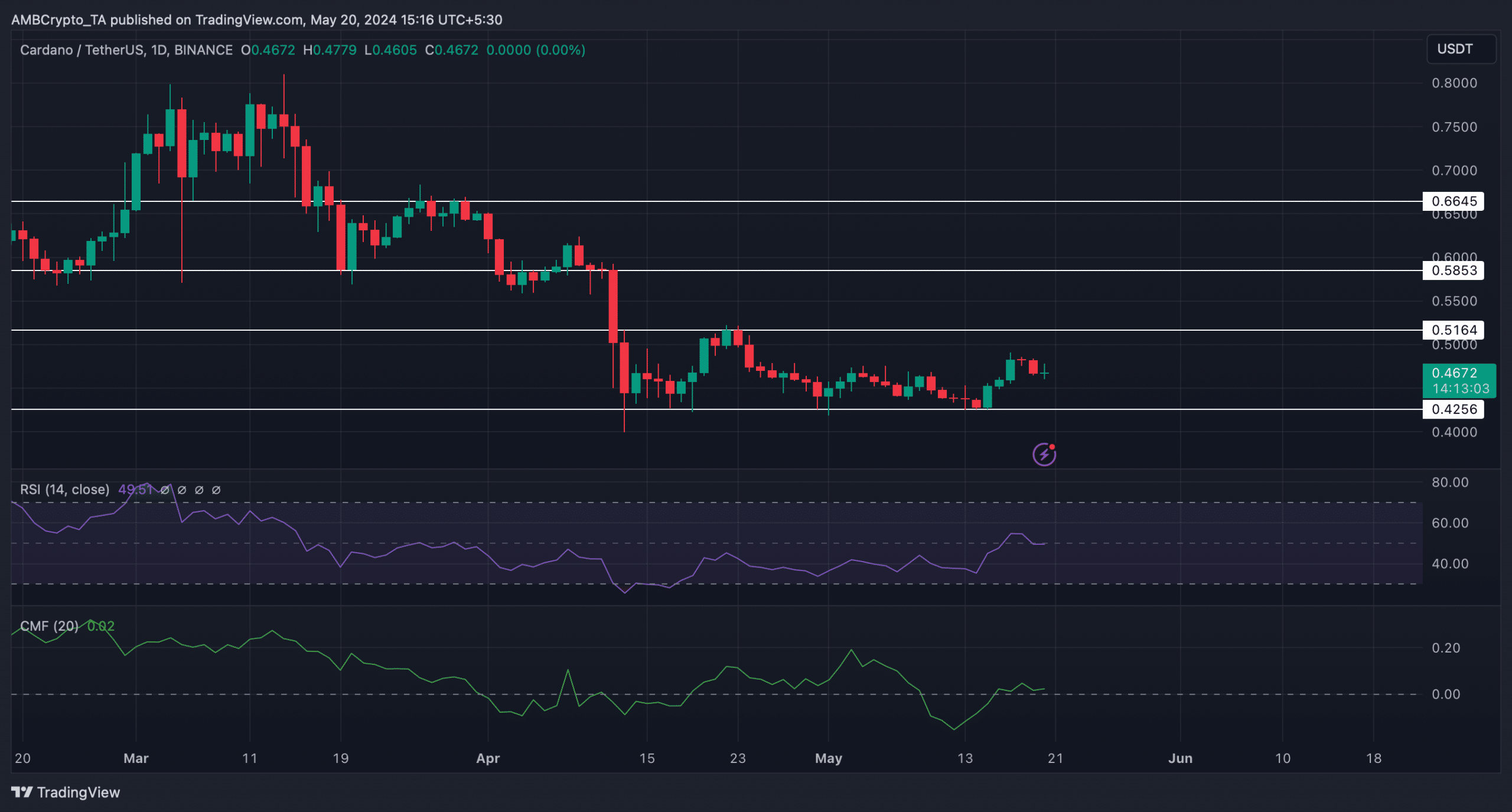

To see whether this meant an end to ADA’s bull rally, AMBCrypto analyzed its daily chart. We found that its Relative Strength Index (RSI) went sideways near the neutral mark.

The Chaikin Money Flow (CMF) also followed a similar trend. These indicated that investors might have to witness a few slow-moving days before ADA turns volatile again.

Source: TradingView