- Cardano reflected a positive outlook on-chain, but the price action differed.

- The short-term downtrend has not halted despite the recent bounce.

Cardano [ADA] retested a support level at $0.58 on 20th March and bounced higher. This pushed ADA to retest the $0.63 resistance zone, which had served as support just a few days earlier.

AMBCrypto reported that Cardano’s development activity eclipsed that of Ethereum’s [ETH] in March. Recently, its active addresses also saw a large uptick, and transaction fees reached a two-year high.

The 4-hour order block was problematic

Source: ADA/USDT on TradingView

Earlier this month, ADA broke out of a 3-month range (purple) whose highs were at $0.68. The $0.63-$0.68 region was a resistance zone from the 4-hour chart’s price action back then. When retested as support a few days earlier, the bulls failed to defend it.

Hope is not lost for the bulls. This breakdown saw the 61.8% Fibonacci retracement level retested. The $0.586 and $0.525 levels were crucial support levels. A drop below $0.447 would indicate a downtrend was in play on the 12-hour and daily timeframe.

The OBV trended downward over the past ten days. The RSI has been below neutral 50 since the 15th of March when ADA dropped below $0.7. This signaled that further drops in price were likely.

Examining the closest pocket of liquidity

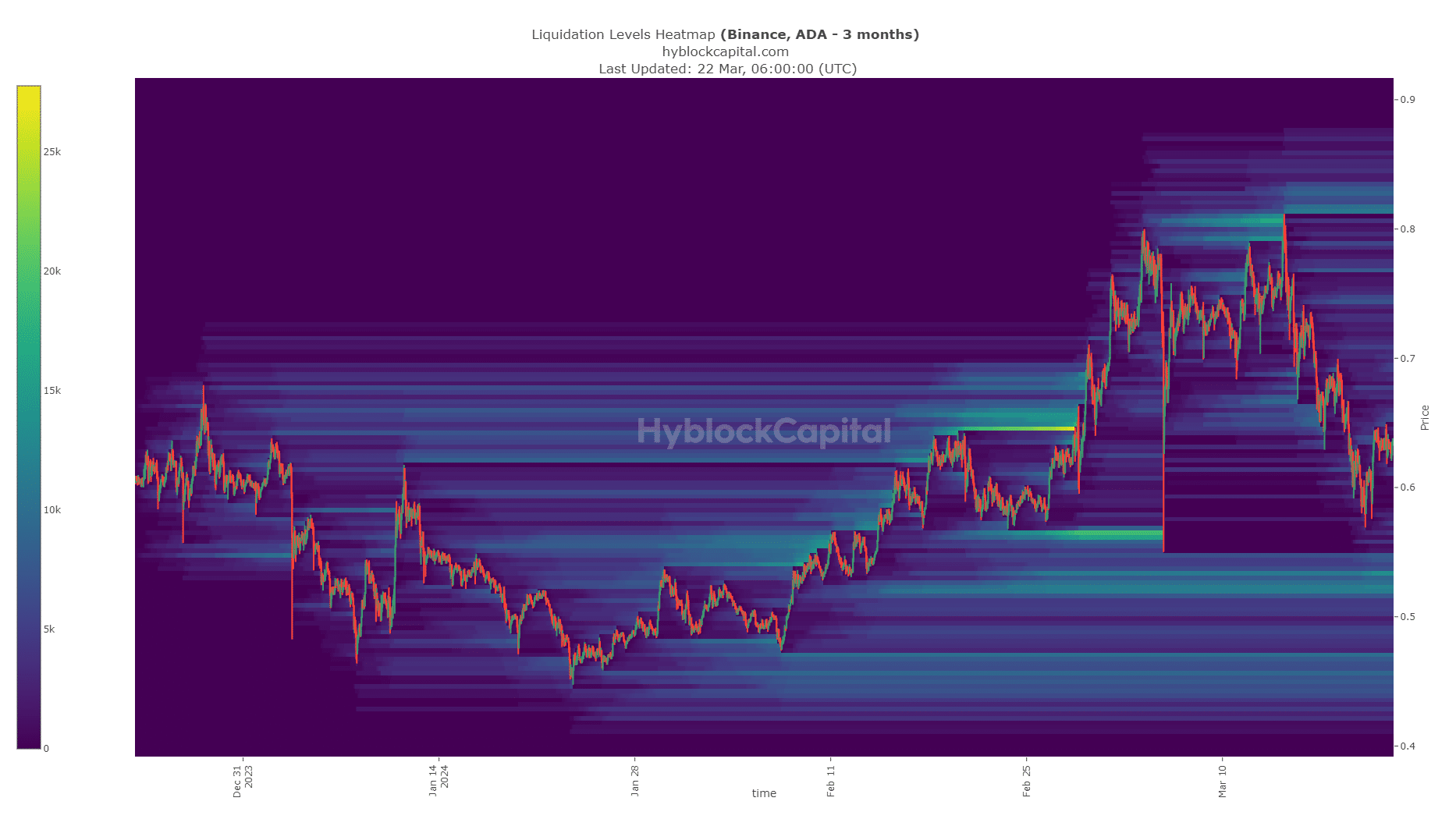

AMBCrypto’s analysis of the liquidation levels heatmap data showed that there were two regions of interest. The $0.52-$0.54 area and the $0.81-$0.835 area could prove pivotal for ADA in the long run.

How much are 1, 10, or 100 ADA worth today?

The liquidity pocket near $0.5 was closer, and Bitcoin [BTC] has still not finished its lower timeframe pullback.

Therefore, a drop to $0.52 to collect this liquidity was expected. It would present an ideal long-term buying opportunity. On the other hand, if ADA climbs above $0.7, it could be headed to the $0.83 zone next.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.