- The positive reading of the bulls and bears indicator suggests that the price might increase.

- Ethereum’s network was overvalued and could hinder the potential upswing.

The price of Ethereum [ETH] might have decreased by 7.30% in the last 24 hours, but an assessment of a key indicator suggested that the decline might soon end.

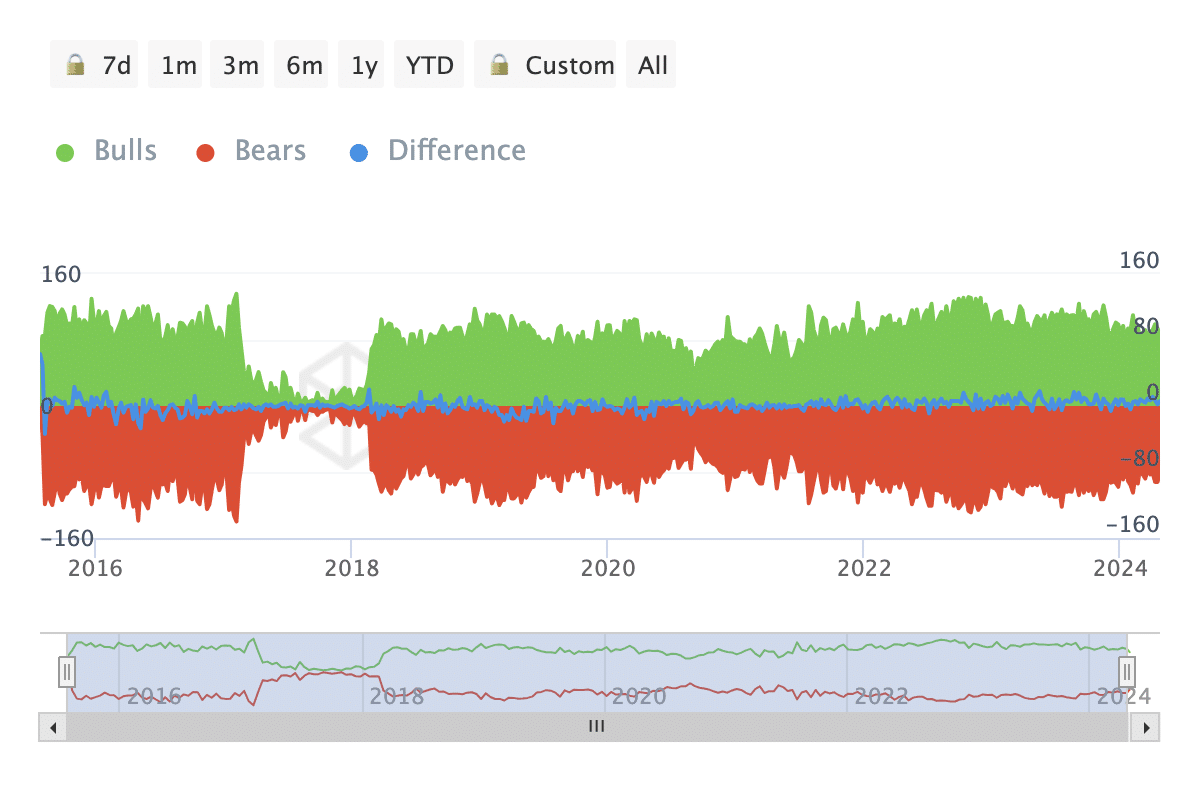

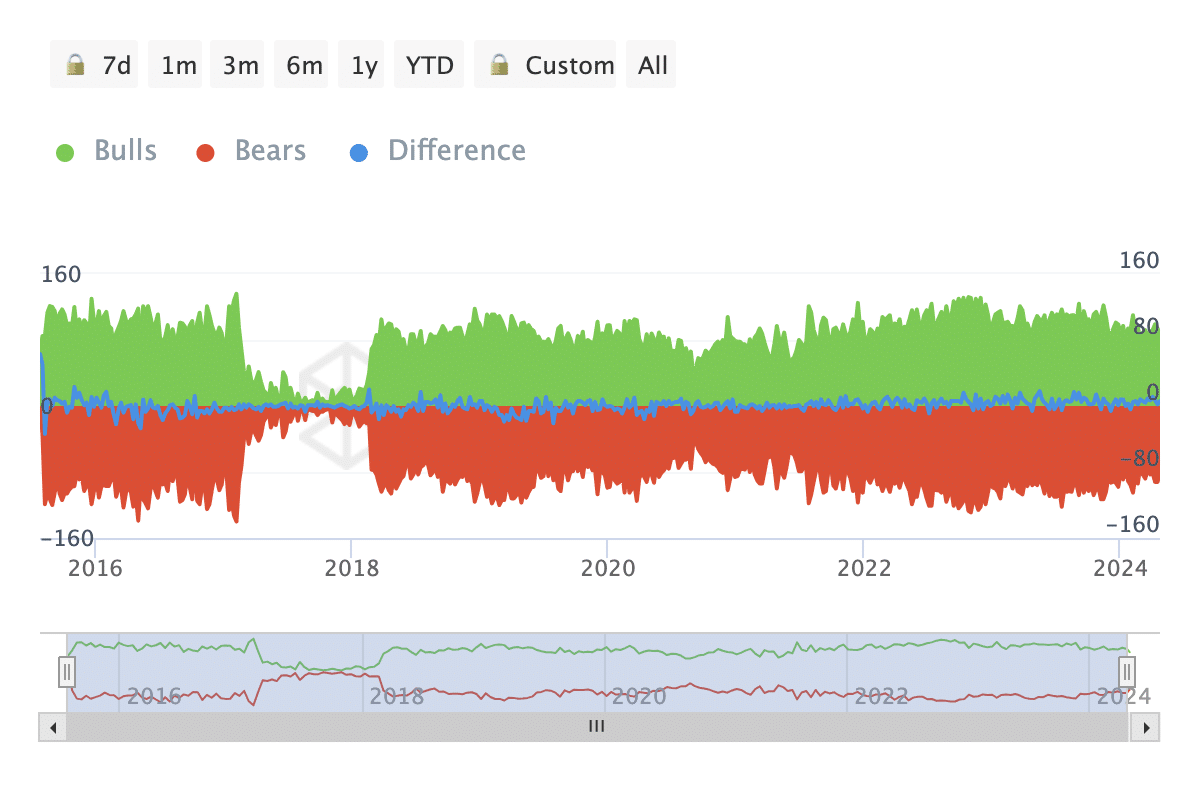

The indicator talked about here is the Bulls And Bears metric provided by IntoTheBlock. This indicator can be measured in addresses or volume.

However, the focus is usually on large buyers or sellers, as they have a big influence on price movements.

The 1% want to keep the faith

A net negative of the Bulls and Bears indicator suggests more large sell orders than buys. In this instance, the price of the asset involved might decrease.

But for Ethereum, data showed that the reading was positive, indicating bullish confidence in the price trend. Should this metric maintain its position over the coming days, then ETH might be able to rise toward $3,100.

Source: IntoTheBlock

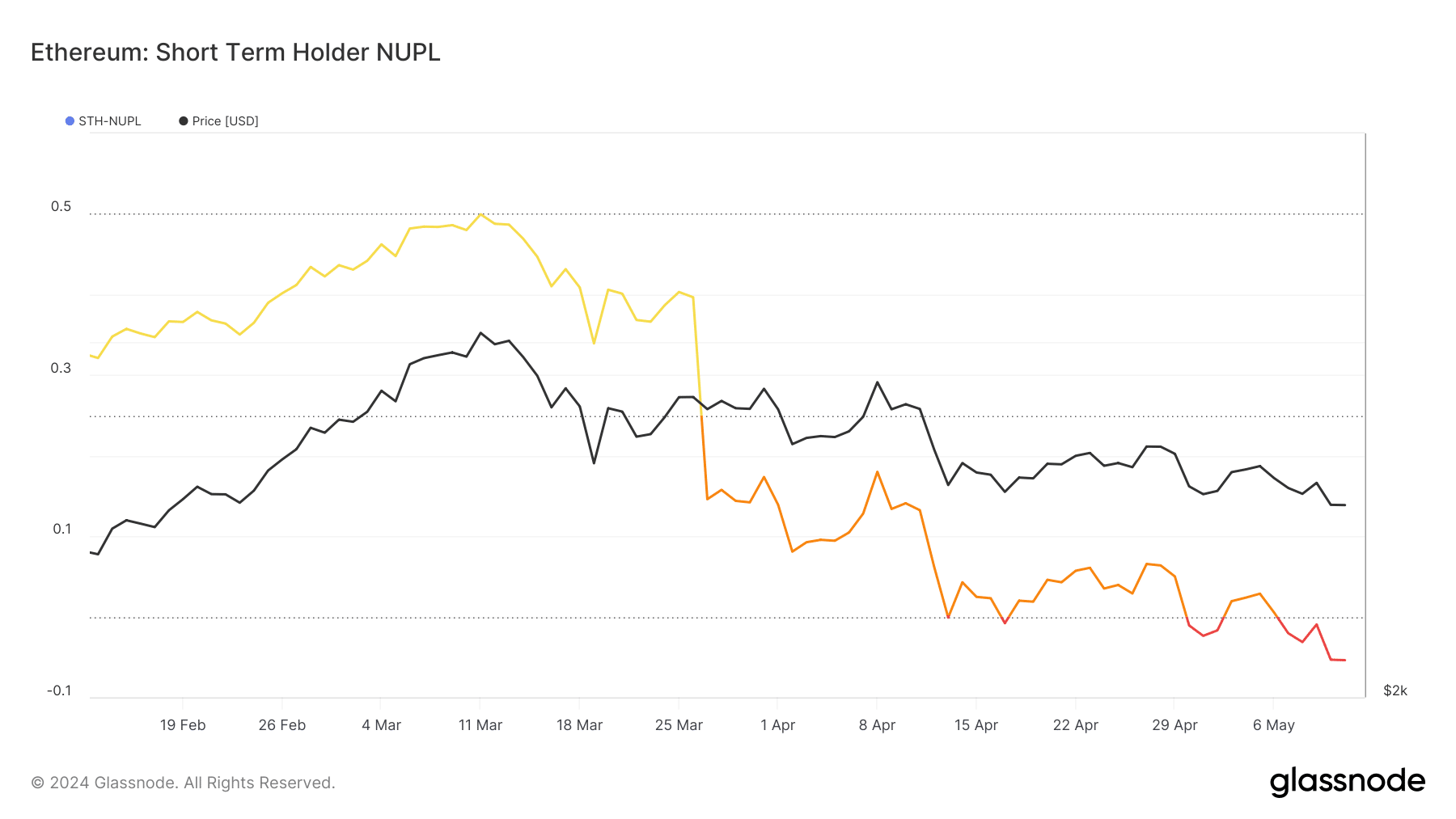

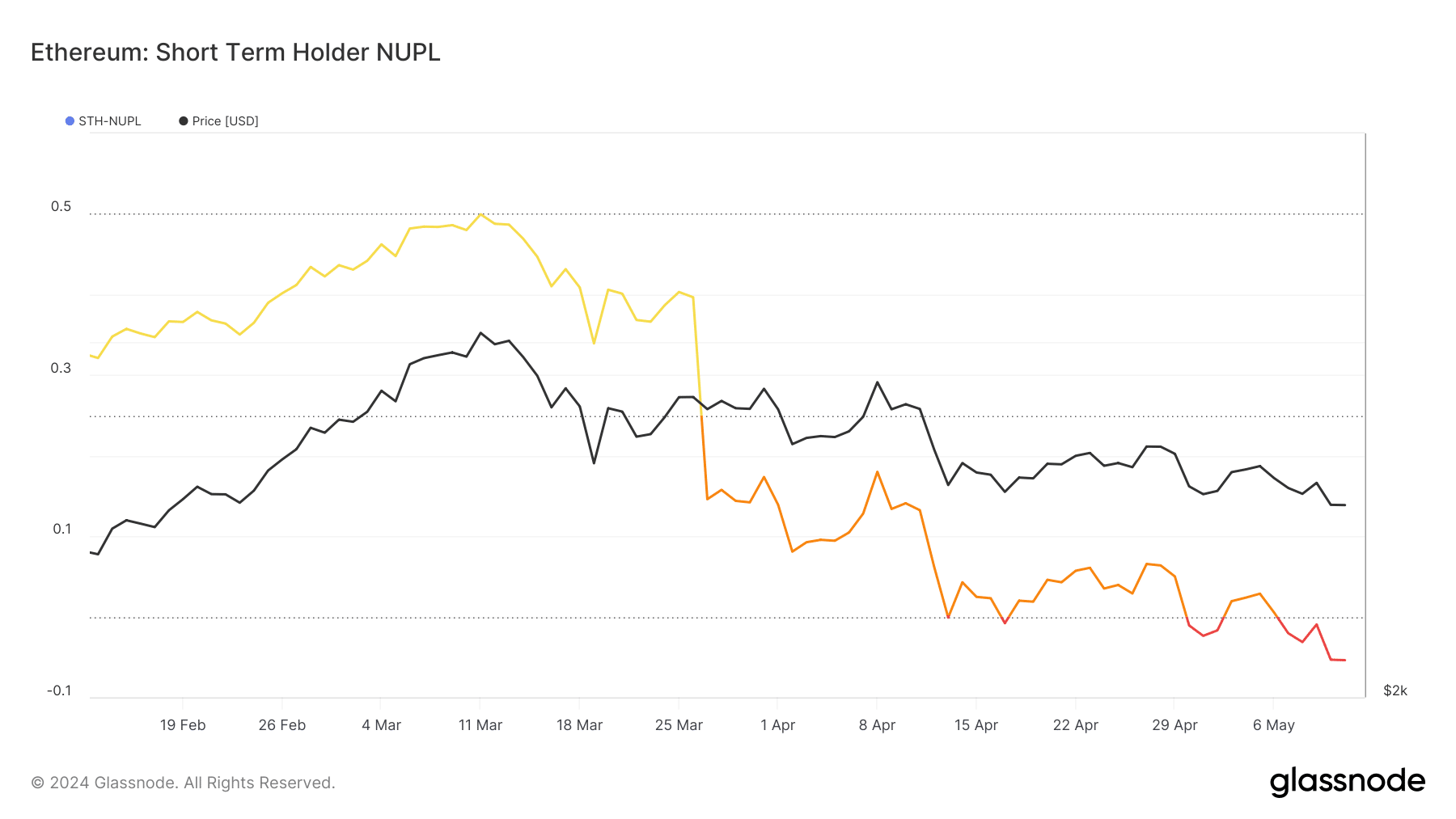

However, failure to sustain the status quo or improve on it could send the price of the altcoin below $2,800. When AMBCrypto looked at Ethereum’s STH-NUPL, we observed that market participants were not exactly confident in the cryptocurrency.

STH-NUPL stands for Short Term Holder — Net Unrealized Profit/Loss. With this metric, one can have an idea of the behavior of short-term investors.

Investors panic, but ETH may come to their aid

From our analysis, ETH’s underwhelming price action has changed the sentiment investors have toward the coin. In March, the metric was in the optimism (yellow) region.

At that point, holders were confident in ETH’s price action. But as of this writing, that reading has reached the capitulation (red) region, indicating that market participants are in fear.

Source: Glassnode

However, fear can act as fuel for a bounce. If the STH-NUPL continues to fall, ETH’s price might also decrease.

Moving, on, a turnaround might occur as intense fear could trigger a harder upswing if buying pressure increases.

In this instance, Ethereum might target a rise toward $3,500. Besides this metric, AMBCrypto found another indicator suggesting that ETH might soon recover.

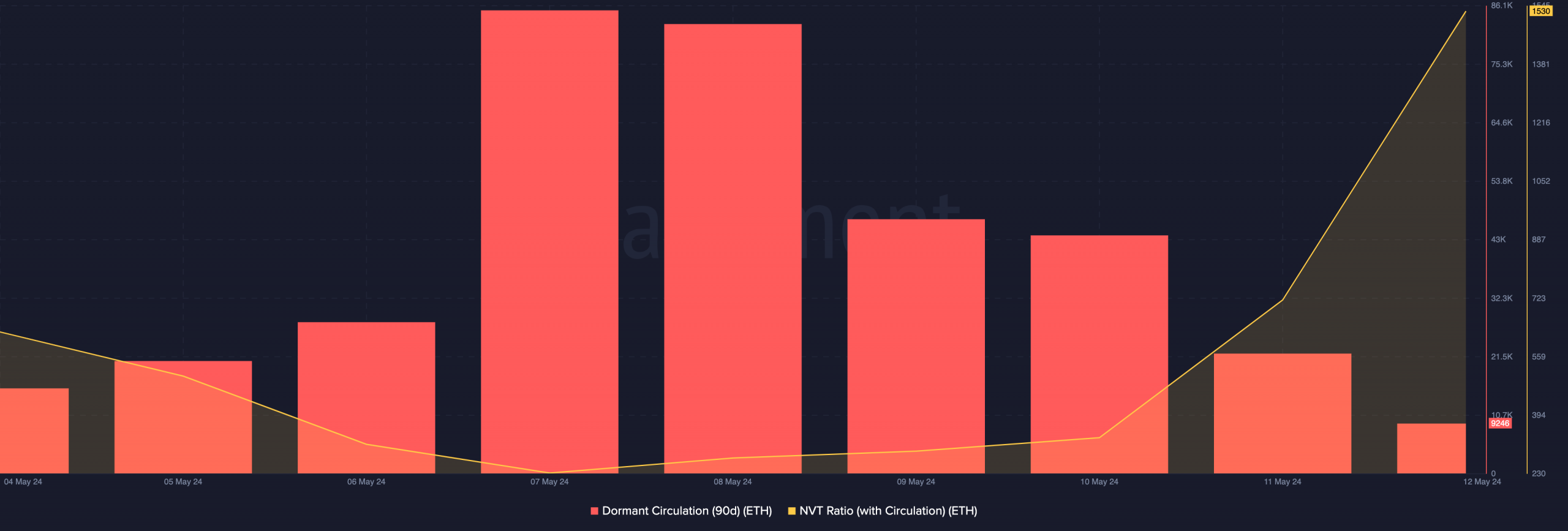

This time, we looked to the dormant circulation. According to on-chain data from Santiment, the 90-day dormant circulation had dropped to 9246.

If the metric increases, it means that coins that have not moved for a long while are starting to change wallets. Sometimes, this means old hands are selling.

Source: Santiment

Thus, the recent decline implied that long-term Ethereum investors were not selling as much as they did around the 7th and 8th of May.

Read Ethereum’s [ETH] Price Prediction 2024-25

However, the Network Value to Transaction (NVT) ratio suggested that ETH might still be overvalued. Low values of the NVT suggest undervalued.

But for Ethereum, the metric spiked, indicating that the network is overvalued relative to transactions.