Bitwise’s BITB spot bitcoin exchange-traded fund witnessed daily net outflows of $7.3 million on Wednesday for the first time since trading began on Jan. 11.

BlackRock’s IBIT registered net inflows of $18.1 million yesterday — a fraction of its historical daily average of around $230 million. However, it was the only spot bitcoin ETF to do so, with Grayscale’s converted GBTC fund and Ark Invest’s ARKB recording substantial net outflows of $133.1 million and $42.7 million, respectively. The remaining funds recorded zero net flows on Wednesday — leading to $165 million in total net outflows, according to CoinGlass data.

The combined U.S. spot bitcoin ETFs have now registered net outflows totaling $314.8 million for four consecutive trading days — the longest outflow streak for a month.

Overall flows for the spot bitcoin ETFs have slowed significantly since peaking at a net daily inflow of $1.05 billion on March 12, with bitcoin subsequently dropping 17% from its latest all-time high of $73,836, according to The Block’s data dashboard.

BlackRock, Fidelity, Franklin Templeton and Valkyrie’s spot bitcoin ETFs are the only funds yet to experience daily net outflows. The overall picture is much stronger, with net inflows since the U.S. spot bitcoin ETFs launched totaling $12.27 billion.

Spot ETF trading volume declines as bitcoin slumps ahead of the halving

The spot bitcoin ETFs generated $3.5 billion in trading volume on Wednesday, led by BlackRock’s IBIT at $1.8 billion. Grayscale’s GBTC and Fidelity’s FBTC generated $764 million and $525 million, respectively, according to The Block’s data dashboard.

However, daily trading volume declined significantly after reaching a record $9.9 billion on March 5 — as bitcoin first broke past its prior cycle peak of around $69,000.

Bitcoin  BTC

BTC

+3.62%

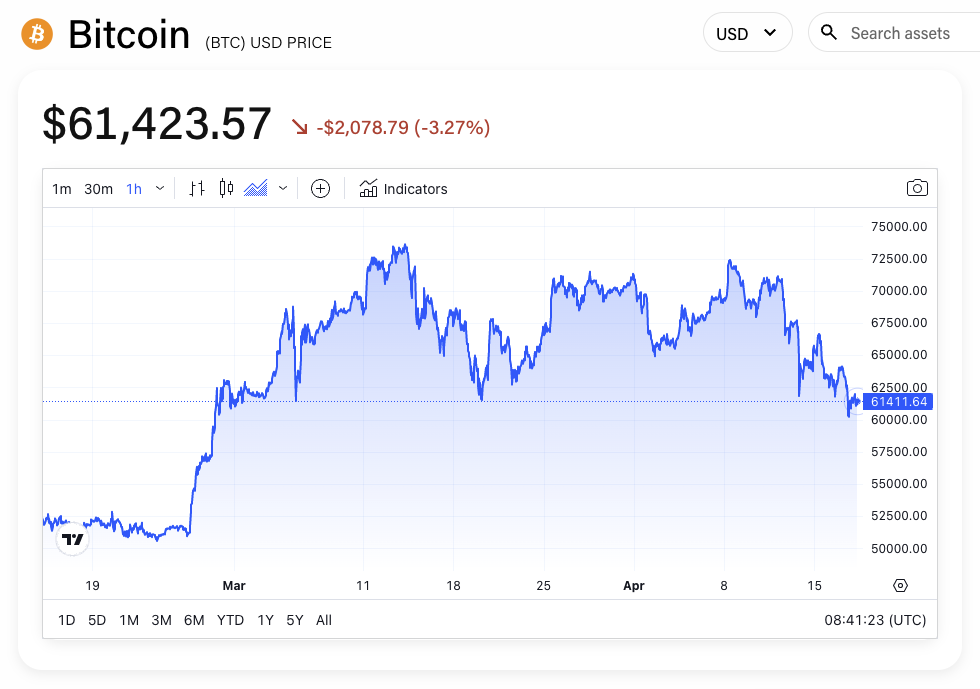

is currently trading for $61,424 — down 3% in the last 24 hours and 14% over the past week, according to The Block’s price page — with its fourth halving rapidly approaching.

BTC/USD price chart. Image: The Block/TradingView.

Bitcoin’s next halving event is now less than two days or 250 blocks away, according to The Block’s Bitcoin Halving Countdown page — setting a potential date of April 20 at around 3 a.m. UTC (11 p.m. ET on April 19), as things stand.

Bitcoin halvings are programmed to occur automatically every 210,000 blocks — roughly every four years. Once a halving event occurs, miners receive 50% fewer bitcoins as a subsidy reward for every block of transactions they mine and add to the blockchain. Bitcoin’s next halving event will see the subsidy reward for miners on the network drop from 6.25 BTC to 3.125 BTC per block. However, they continue to earn additional transaction fee rewards for each block mined as normal.

“I find the halving bullish,” Bitwise CIO Matt Hougan wrote in a note to clients on Monday. “I think the market has underestimated the long-term demand for bitcoin, for a number of reasons. For instance, I don’t think the market fully appreciates the size of the opportunity in the ETF market once wirehouses and the rest of the roughly $60 trillion U.S. wealth management industry are able to allocate to bitcoin ETFs, which could start to happen as early as Q3.”

“I also don’t believe the market has fully factored in the extent to which rising concerns about inflation will drive significant allocations,” he added.

On Wednesday, analysts at research and brokerage firm Bernstein agreed, saying they expect bitcoin to resume its bullish trajectory post-halving, reiterating a target of $150,000 by the end of 2025. On the other hand, Coinify CEO Rikke Staer suggested the halving is a “sell the news” event as less efficient miners may be forced to sell their existing bitcoin holdings, potentially overwhelming demand.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.