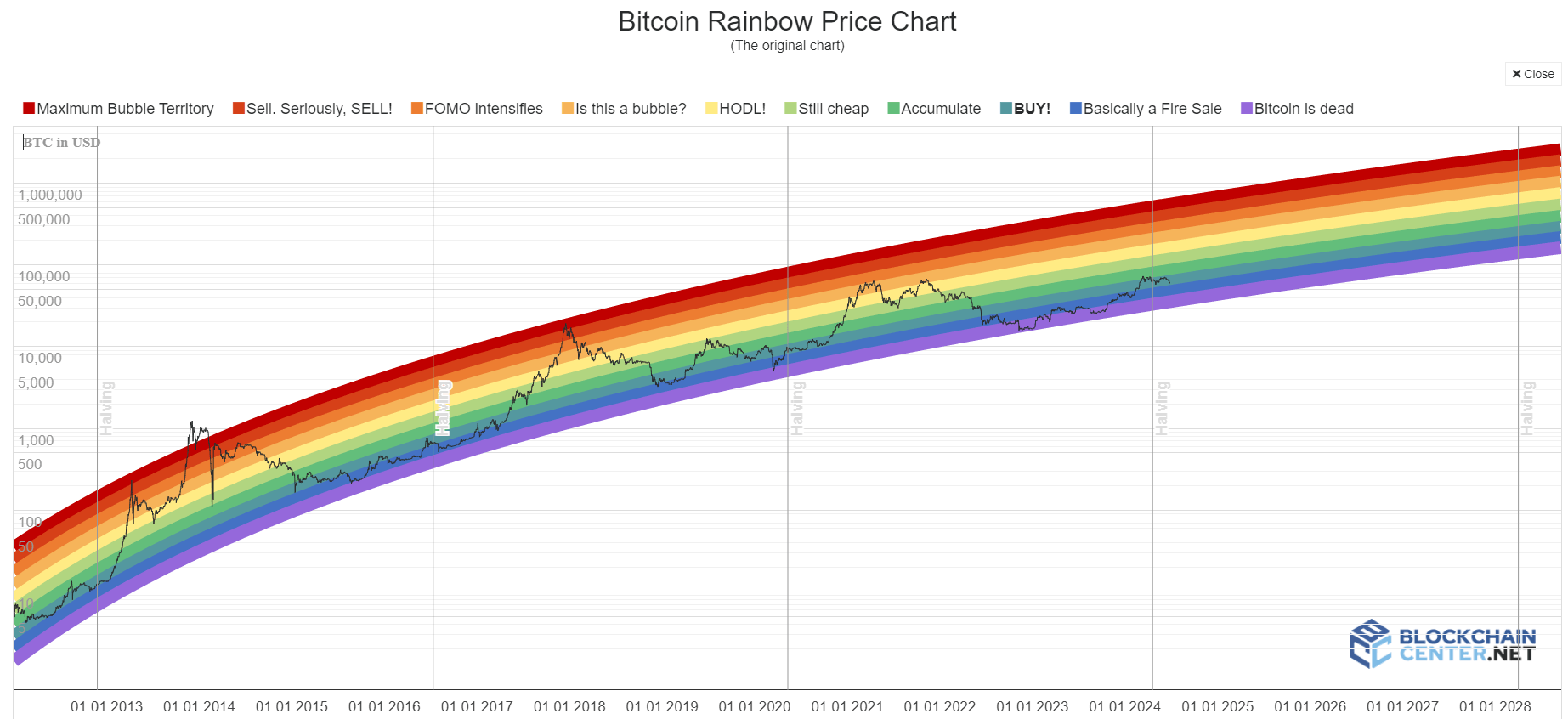

- The Bitcoin Rainbow Chart showed that investors must “BUY!” more BTC.

- The sentiment has been bearish in the past two weeks, and further price drops are possible.

Bitcoin [BTC] was trading near the $60k support zone once again. Nearly two months ago, the same $60k support zone was retested as support after a sharp price plunge to $56k.

Back then, the sentiment was fearful and investors were cautious. Now, too, a similar sentiment prevailed.

While the short-term price action showed bearishness, the higher timeframe price trend was strongly bullish. In the past six months, measured from the late January lows at $38.5k, Bitcoin has gained close to 55%.

It has set a higher low at $56.5k, marking it as the critical support level for buyers to defend in the coming weeks.

The Bitcoin Rainbow Chart showed that it is still a great time to buy Bitcoin. This chart represented Bitcoin’s price movement on a logarithmic scale and can be useful for investors to predict potential cycle tops.

Gauging the cycle top from the Bitcoin Rainbow Chart

The multicolored chart highlights different zones from “Bitcoin is dead” to “Maximum bubble territory”. At press time, BTC was in the rather aggressively “BUY!” marked zone.

At press time, the chart was confident that there is a long way yet for this cycle’s price discovery to stretch.

AMBCrypto observed that the past two cycle maximums occurred 17–18 months after the halving. Extrapolating that to the current cycle, a maximum could be reached in September or October 2025.

In 2021, BTC was unable to ascend past “Is this a bubble?” territory. AMBCrypto chose to be more conservative this time and assumed Bitcoin might not cross the “HODL” territory this time.

Even this conservative bet puts Bitcoin at a $260k value, with $373k being the estimate should Bitcoin spill into the “Is this a bubble?” territory.

So, there you have it, something to mark on your calendars — sell Bitcoin above $250k in September 2025.

Of course, this is not an accurate prediction and is based solely on the Bitcoin Rainbow Chart and the previous cycle’s halvings and top timings.

Investor prudence and a closer study of price action and on-chain metrics would be necessary to more keenly gauge the cycle top.

Buyer weakness was highlighted

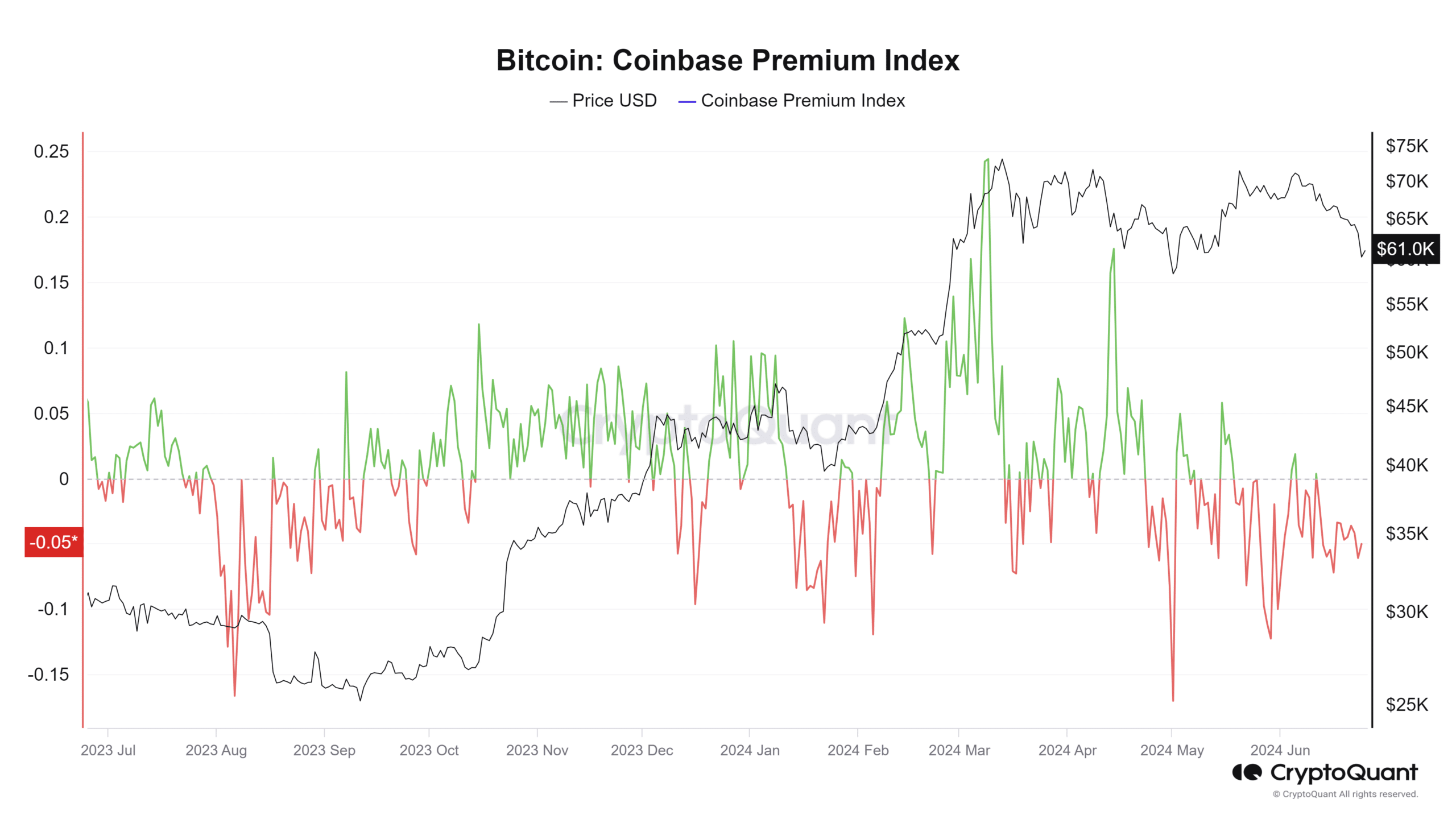

The Coinbase Premium Index has been negative for the past month. It signaled that the price on the Coinbase market was lower than the Binance USDT Bitcoin pair by just under 0.1%.

This implied that the U.S. investor interest in Bitcoin has waned considerably over the past six weeks. In March and April 2024, the Index was mostly positive, but the sentiment has shifted considerably since then.

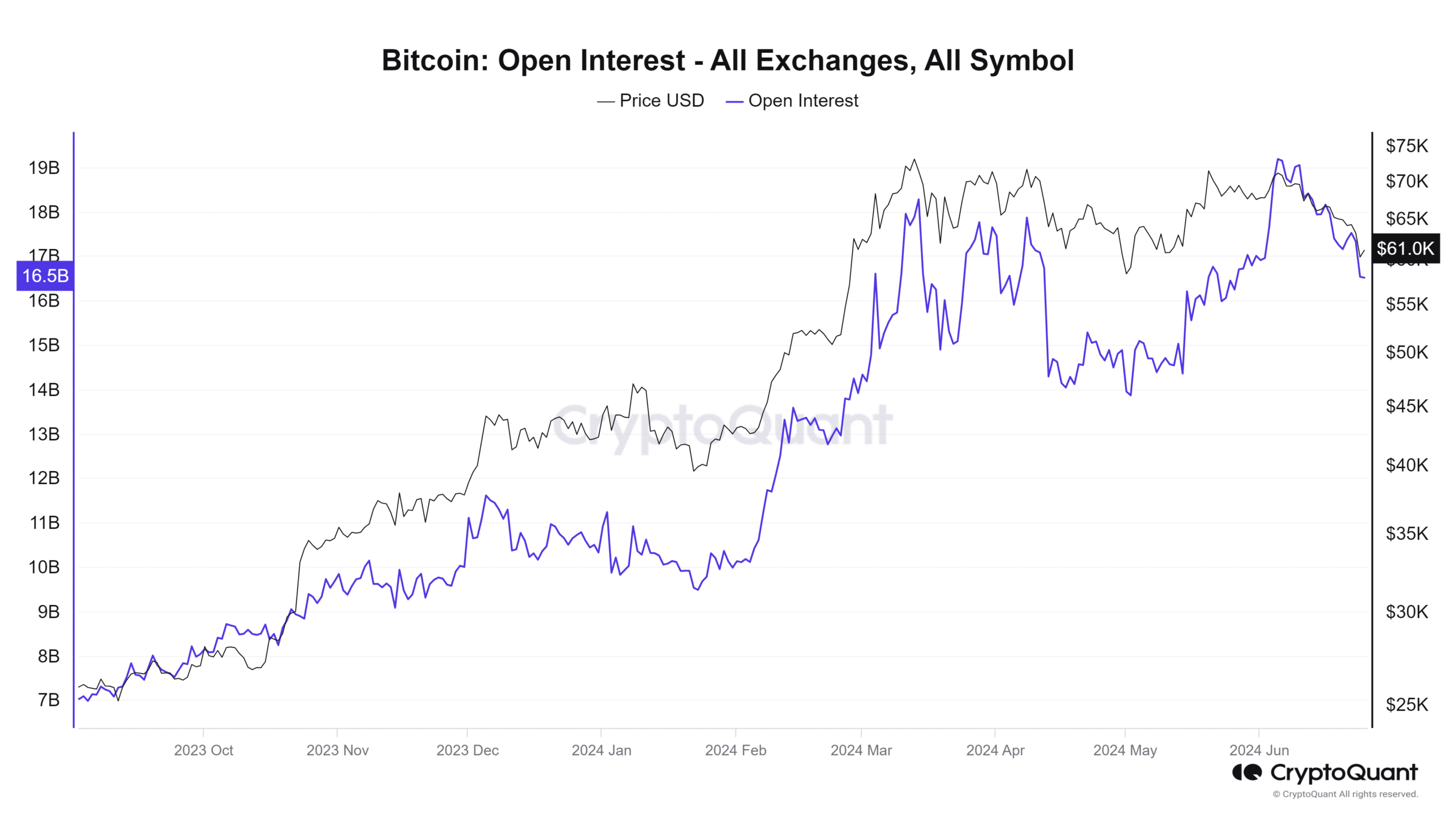

Another sign of bearish market sentiment was the sharp drop in Open Interest. On the 6th of June, OI was at $19.1 billion. At press time, with prices down by 14.6%, the OI stood at $16.5 billion.

It indicated that futures market participants preferred to remain sidelined and were unwilling to long BTC due to the consistent decline in recent weeks.

This can be a good thing in the long run as it wipes out overleveraged bulls, guiding the price development toward a more stable, spot-driven route.

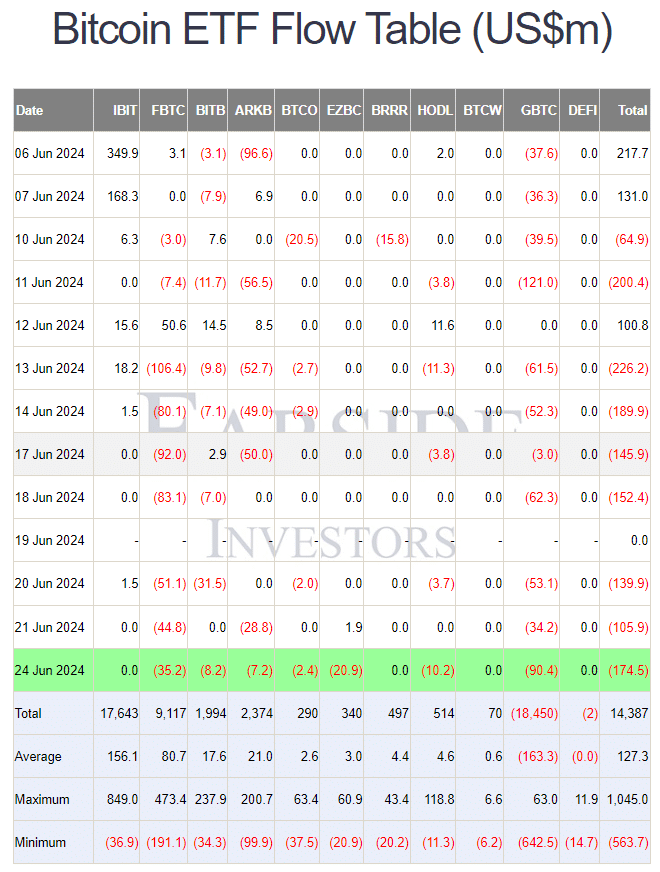

AMBCrypto also noted that the data from Farside Investors on Bitcoin ETF inflows has been negative over the past week. This was quite different from the first week of June, and once again reflected the shift in sentiment.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In a recent report, AMBCrypto highlighted that the current price dip might go deeper south.

News of Mt. Gox and repayments to clients whose assets were stolen a decade ago meant there’s a range of reasons why the crypto market sentiment is in a tough spot.