- Bitcoin miners faced selling pressure as revenues declined.

- Inflows for Bitcoin ETFs grew significantly.

Bitcoin [BTC] has remained stagnant at the $62,000 price level for quite some time. However, things could take a turn for the worse for the king coin going forward.

Miners face the heat

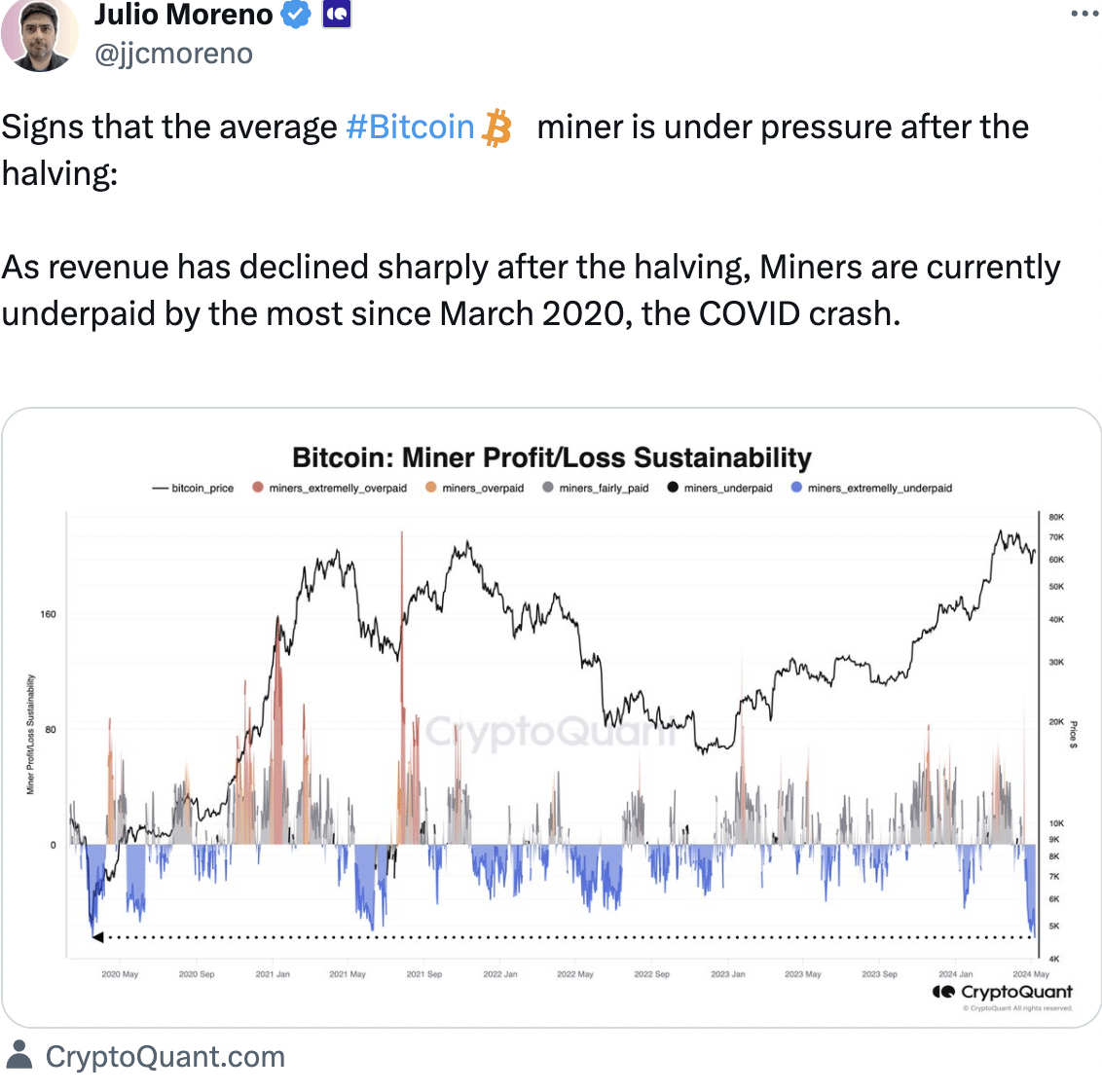

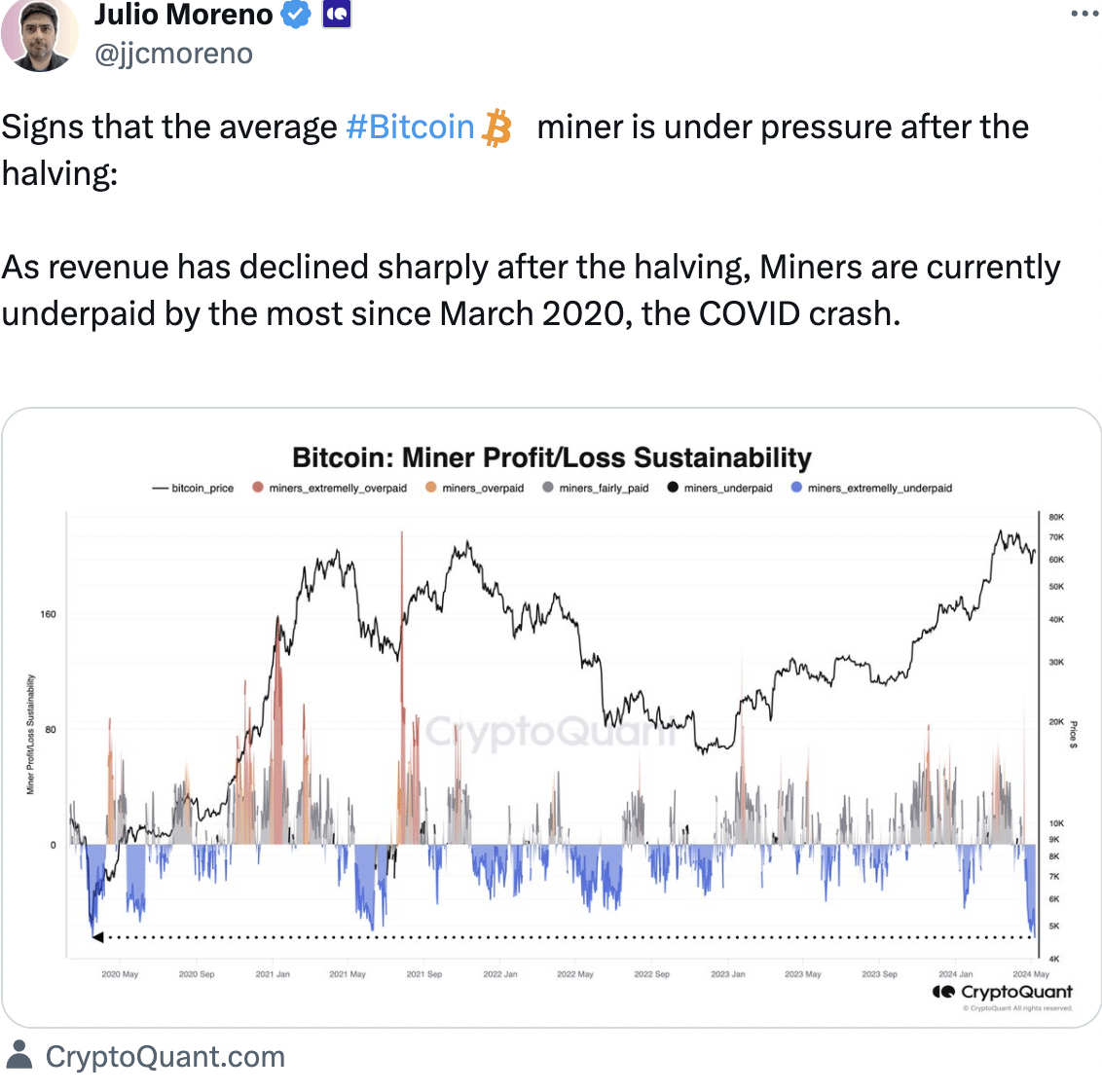

According to recent data, there were clear indications that the average Bitcoin miner is feeling the strain post-halving.

With a significant drop in revenue since the halving, miners are currently facing the most challenging conditions they’ve encountered since March 2020, during the COVID-19 crash.

This pressure is evident in the declining hashrate, which has prompted the network to undergo its fourth negative difficulty adjustment of the year.

The latest adjustment, standing at -5.6%, marks the largest negative change since November 2022, following the FTX collapse.

If things continue to get worse, miners will be forced to sell their BTC holdings to remain profitable.

Source: X

Inflows on the rise

Even though the state of BTC looks dire due to the state of miners, things looked better for Bitcoin on Wall Street.

Recent data revealed that US Spot Bitcoin ETFs experienced a total net inflow of $11.78 billion, with a daily net inflow of $12 million recorded on the 8th of May.

Among these ETFs, Bitwise’s BITB stood out as the sole ETF with a net inflow, whereas both Blackrock’s IBIT and Grayscale’s GBTC saw no net flow during the same period.

Moreover, the Grayscale Bitcoin Trust ETF (GBTC) registered zero net flow on the 8th of May and recorded a total net outflow of $17.5 billion.

In Asia, the latest statistics indicate that HK Spot Bitcoin ETFs have garnered a total net inflow of $273.6 million since their launch on the 30th of April, with a daily net inflow of $6.3 million reported on the 8th of May.

On the other hand, HK Spot Ether ETFs saw a total net inflow of $50.6 million since their launch on the 30th of April, but they experienced a daily net outflow of $1.9 million on the 8th of May.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

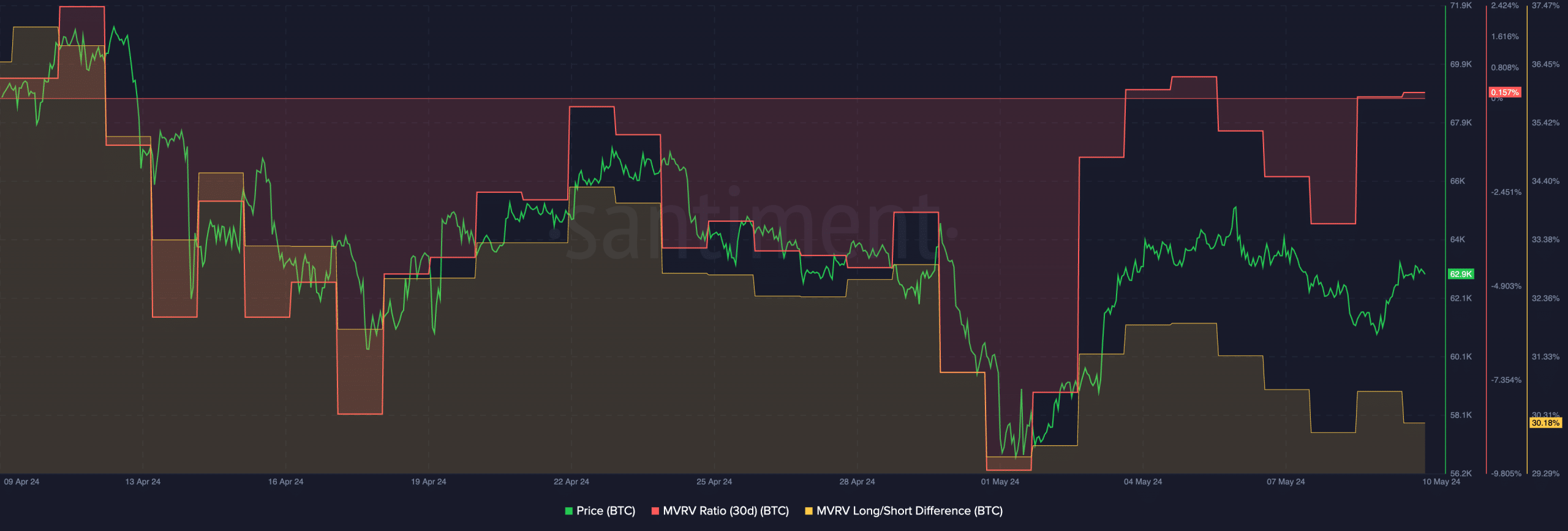

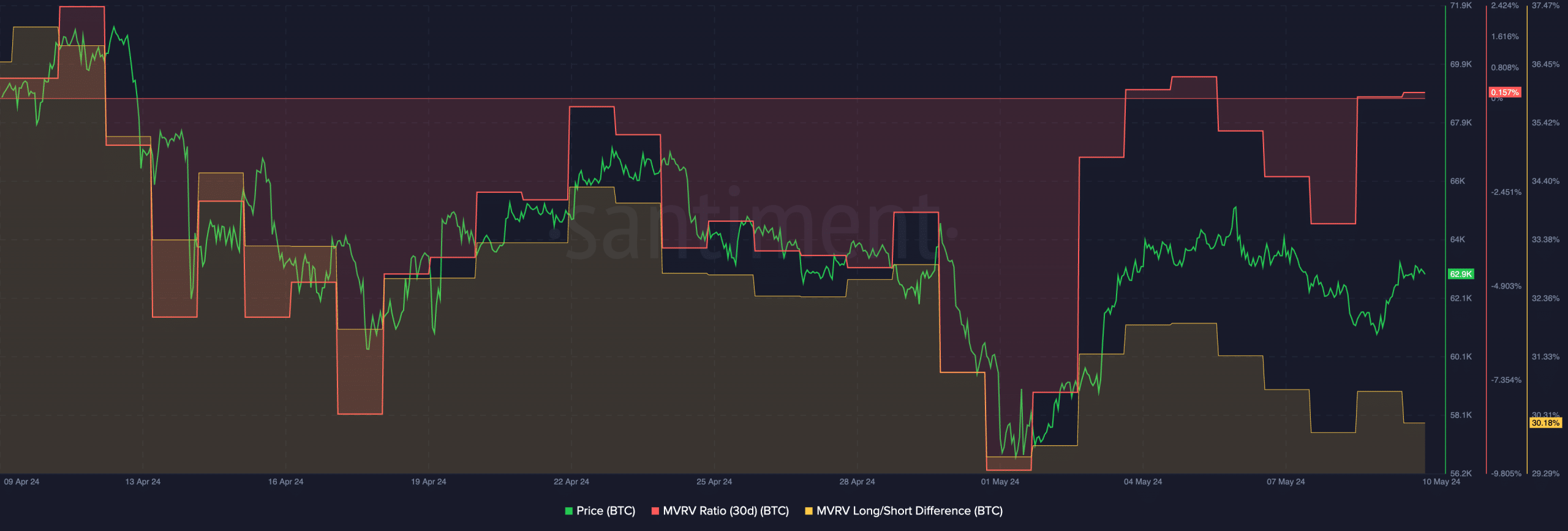

At press time, BTC was trading at $62,945.16 and its price had grown by 3.40% in the last 24 hours. The MVRV ratio for BTC had grown due to the surge in price.

This meant that most addresses holding BTC had turned profitable. As profitability for addresses increases, so does the incentive for holders to sell and indulge in profit-taking.

Source: Santiment