BitMEX co-founder Arthur Hayes says that a shift in policy from the central banks is about to boost crypto assets into a new bullish phase.

In a new essay, Hayes, now the CIO of crypto investment fund Maelstrom, notes that both the Bank of Canada (BOC) and the European Central Bank (ECB) have decided to lower interest rates.

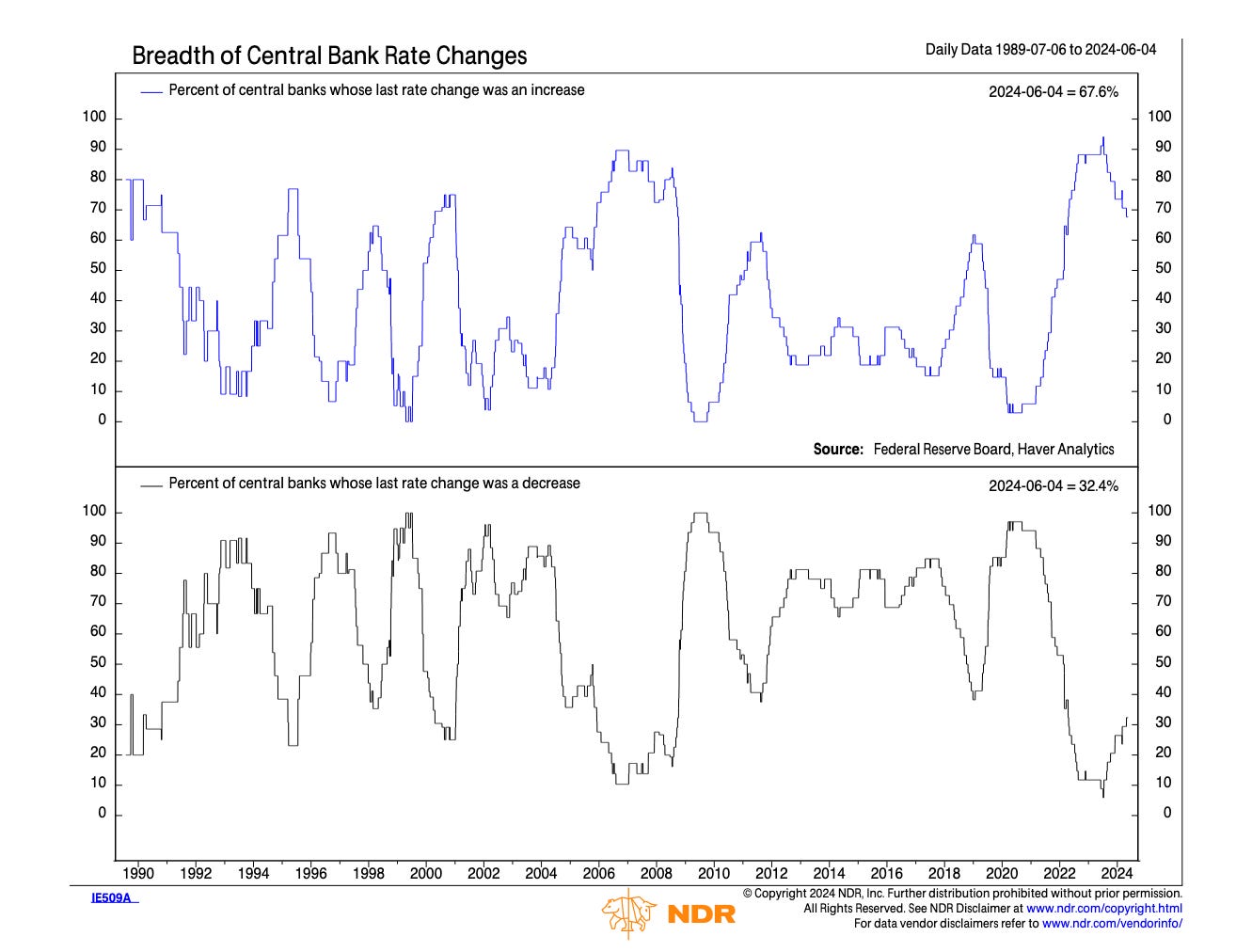

Hayes says the moves by Europe and Canada suggest that a global shift in looser monetary policy may be underway, and could therefore signal a bump in risk assets once the Federal Reserve in the US follows suit.

“The June central banking fireworks kicked off this week by the BOC and ECB rate cuts will catapult crypto out of the northern hemispheric summer doldrums. This was not my expected base case. I thought the fireworks would start in August, right around when the Fed hosts its Jackson Hole symposium. That is typically the venue where abrupt policy changes are announced going into autumn.

The trend is clear. Central banks at the margin are starting easing cycles.”

According to Hayes, the new chapter of monetary policy means it’s time to “go long Bitcoin and subsequently sh*tcoins.”

Says the crypto veteran,

“The macro landscape has changed vs. my baseline. Therefore, my strategy shall change as well. For the Maelstrom portfolio projects, who asked for my opinion on whether to launch their tokens now or later. I say, Let’s F***ing Go!

For my excess liquid crypto synthetic-dollar cash, a.k.a. Ethena’s USD (USDe) that’s earning some phat APYs (annual percentage yields), it is time to deploy it again on conviction shitcoins. Of course, I’ll tell readers what those are after I have purchased them. But suffice it to say, the crypto bull is reawakening and is about to gore the hides of profligate central bankers.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/prodigital art